What's happening with the coin flows on Binance?

Binance has run into some new challenges in 2023: Paxos stopped minting BUSD and a lawsuit from the Commodity Futures Trading Commission (CFTC). Glassnode has studied coin flows to assess the state of Binance's balance sheets and the degree of customer confidence.

Stablecoins are the focal point in crypto exchange operations, being both base payment currency and a link between fiat money and crypto. Some users keep their savings in stablecoins, avoiding being stressed by high volatility.

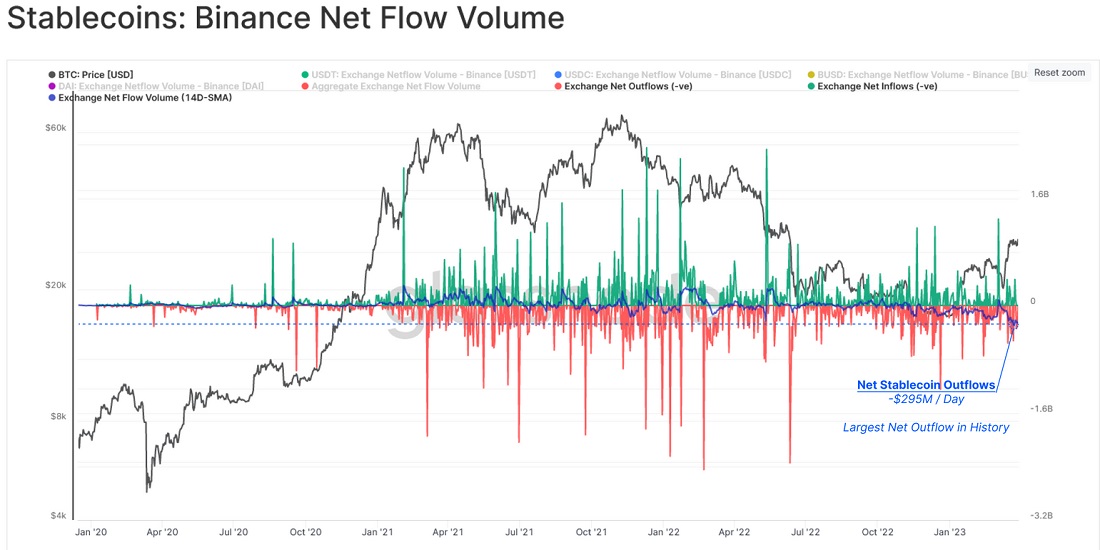

But after a bunch of grim news for Binance, the net stablecoins outflow set a new all-time high, reaching $295 million in a day.

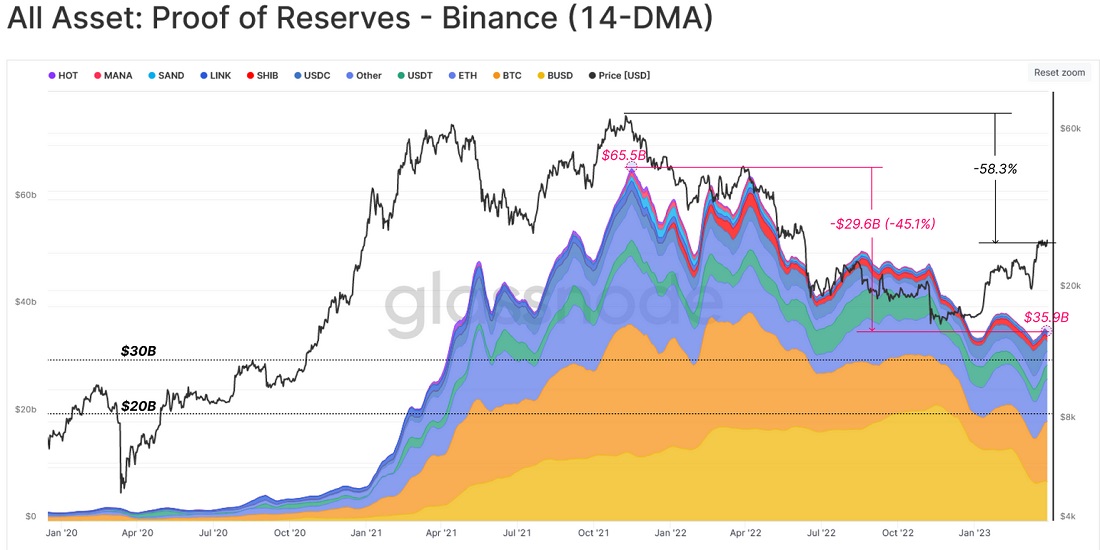

The total amount of client funds, referred to as reserves under the proof of reserve standard, hasn't changed significantly this year. And when assessing their decline from the highs, it turns out that Bitcoin alone has dropped by 45.1% versus 58.3%, respectively.

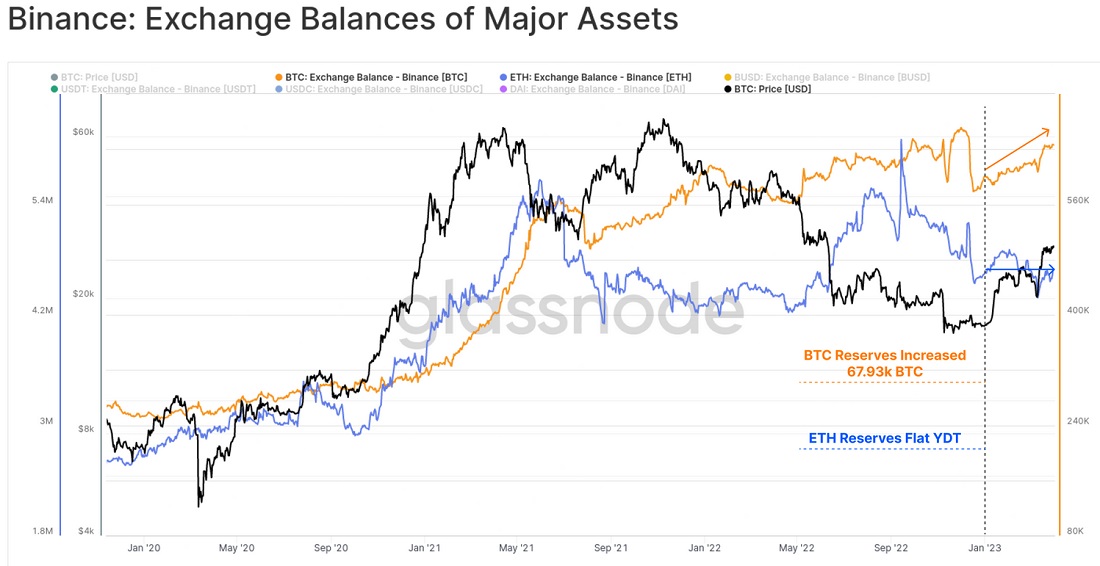

The comparison in dollars isn't quite right, given both the changing market conditions and the gradual withdrawal of BUSD from circulation. Looking at the balances in the major coins, the reserves in ETH remained unchanged in 2023, while in BTC, they increased by 68,000. This shows users' confidence in Binance's credibility, despite regulators' actions.

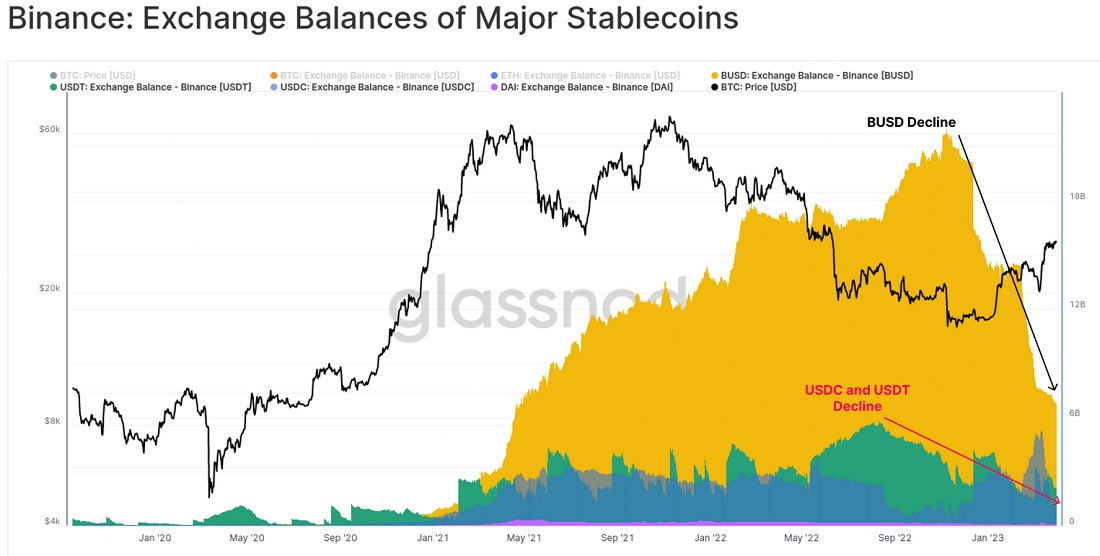

In terms of flows, the real drama unfolded behind the scenes as Binance's attempt to make BUSD a top stablecoin failed. Users have barely noticed that, as only 15% of the issued coins were located outside the crypto exchange on the best of days. To compare, the USDT share on Binance averages less than 4% of the circulating supply.

Despite the severity of the legal claims and BUSD's gradual withdrawal, confidence in the crypto exchange remains high.

StormGain Analytical Group

(platform for trading, exchanging and storing cryptocurrency)

Tags

Try our Bitcoin Cloud Miner and get additional crypto rewards based on your trading volume. It's immediately available upon registration.

Try our Bitcoin Cloud Miner and get additional crypto rewards based on your trading volume. It's immediately available upon registration.