Bitcoin: One of the best weeks in the history

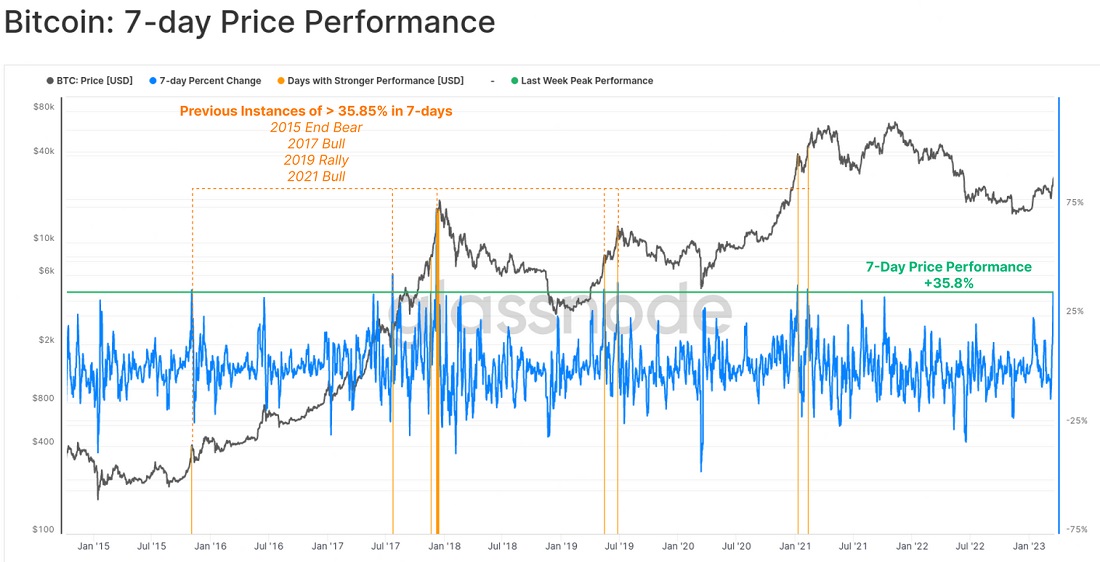

The past week ended with a 36% increase, which is typical for the last stage of a bullish market. There have been only 16 such skyrocketing jumps since 2015.

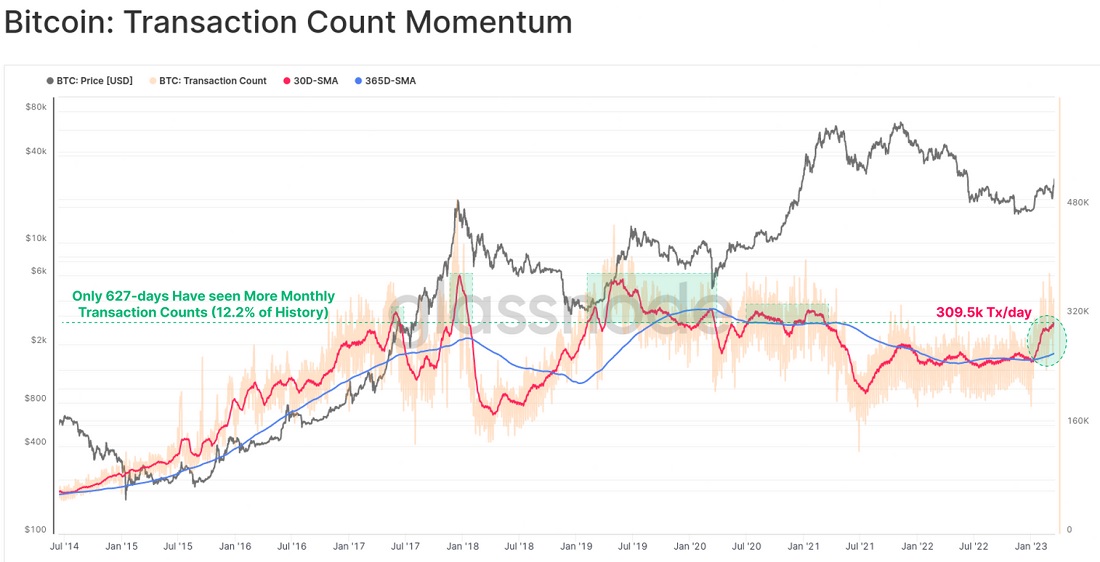

Wide interest in the network, not speculation, is what's behind this momentum. The number of transactions, which jumped to 309,500 a day, is an excellent indicator of this. A significant gap from the monthly average is also common in a bullish market when there's a growing influx of new users.

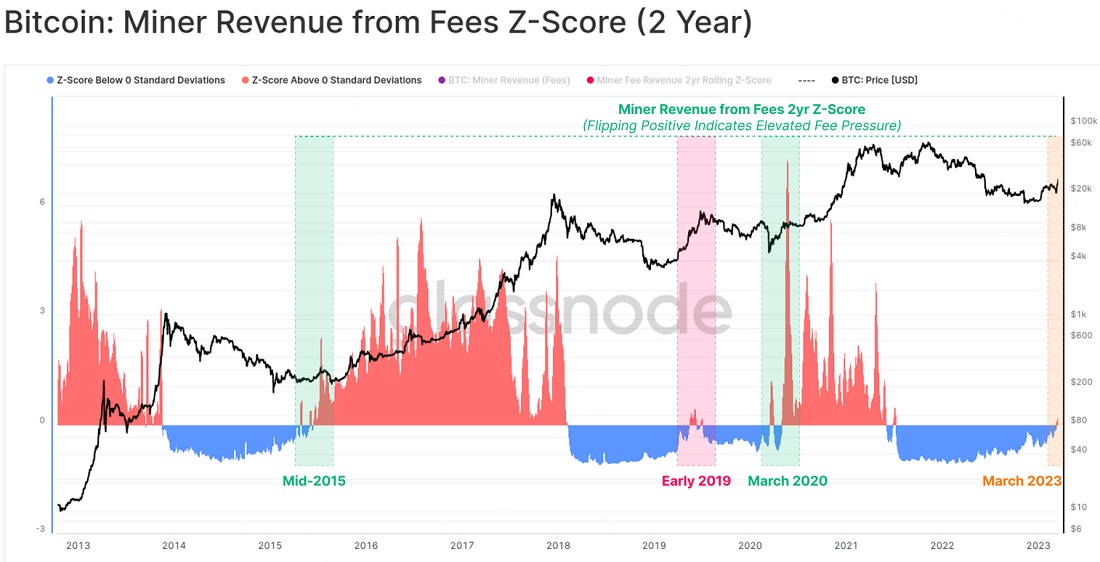

The transition to a new bullish cycle is clearly demonstrated by the Z-score of miner revenue, which emerged from underwater. Their total income now exceeds $22 million a day, the highest level since June 2022. Increased online transaction fees, also driven by widespread interest in cryptocurrency, are contributing to the growth in revenue.

Behind the increased interest in Bitcoin is a new financial crisis that regulators worldwide are trying to extinguish with new monetary injections. This will inevitably lead to another round of inflation, making Bitcoin — a deflationary cryptocurrency with a limited issuance and regular halving events — an attractive asset for savings.

Bitcoin looks even more appealing against bank failures and modest amounts of deposit insurance. In the US, for example, this insurance is limited to $250,000, putting both small- and medium-sized businesses and citizens with a decent financial cushion at risk. Amid a total loss of funds, investing in the highly volatile Bitcoin no longer seems as bizarre an idea as crypto critics make it out to be.

StormGain Analytical Group

(platform for trading, exchanging and storing cryptocurrency)

Tags

Try our Bitcoin Cloud Miner and get additional crypto rewards based on your trading volume. It's immediately available upon registration.

Try our Bitcoin Cloud Miner and get additional crypto rewards based on your trading volume. It's immediately available upon registration.