Former Coinbase director: Bitcoin will be worth $1 million in 90 days

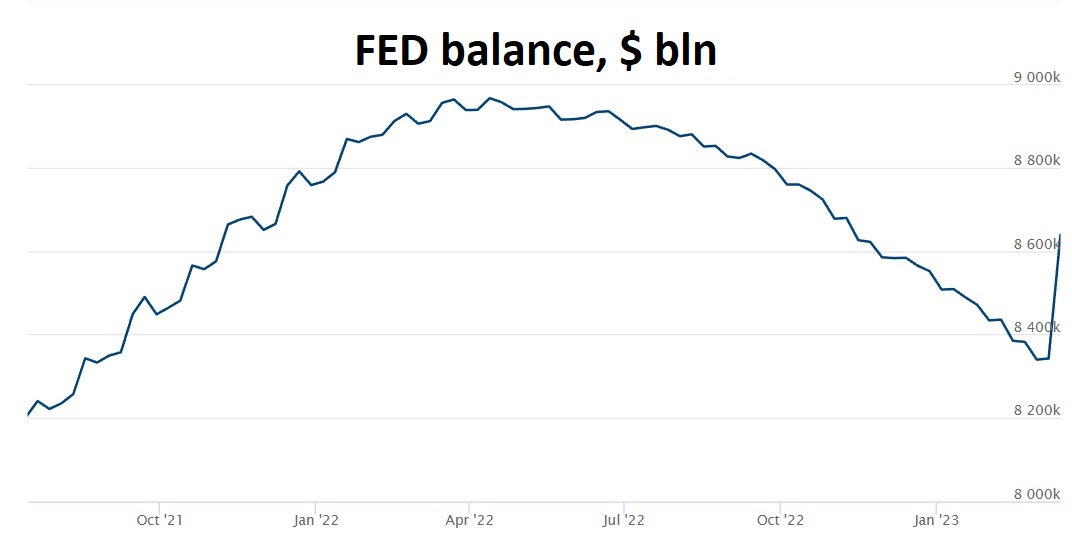

Some experts are sounding the alarm bells that the Fed is pushing the world economy into the worst crisis in modern history. The regulator has already flushed down the drain four months of efforts to shrink its balance sheet after it bought $300 billion worth of assets in just one week. This and other circumstances hint at a move towards hyperinflation, despite the relatively high key interest rate.

The Fed's balance sheet grows when the regulator supports the economy by buying bonds and other debt securities. Simply put, in the case of a shortage of funds, Bank N issues and sells bonds to the regulator and receives dollars in return. Bank N needs the money because panic has caused its depositors to flee (such as with SVB, for example, in our story).

This directly increases the money supply, which goes against raising the key rate and efforts to combat inflation. This is why economists call what is now happening hidden QE (quantitative easing).

The American fire has already spread to other parts of the world, such as Switzerland. Over the weekend, an emergency decision was made that UBS (with support from the Swiss Central Bank) would buy Credit Suisse, the second-largest regional bank. Both are among the world's top 30 financial banks, with combined assets of $1.7 trillion.

Credit Suisse shareholders lose 60% of their investment from the share swap, while AT1 bond buyers are left with no money at all (read more in this Bloomberg article). Such a move clearly doesn't add to investors' confidence in the future. The Swiss National Bank provided UBS with a $108 billion credit line to support liquidity.

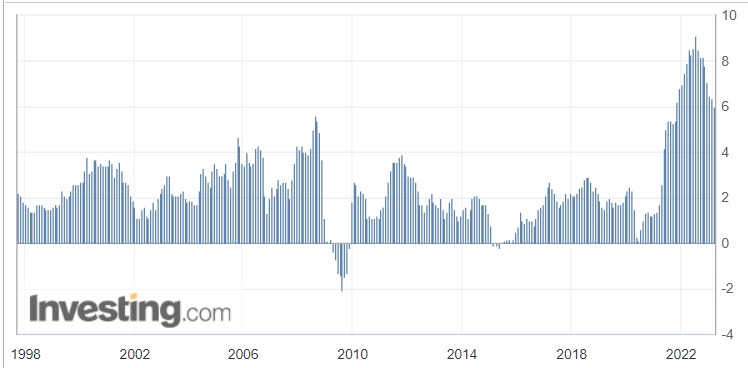

So, let's summarise. The fight against inflation is over, and the world's leading regulators are either already injecting additional funds into the economy or preparing to take this step. Economist Peter Schiff thinks the Fed should just step aside and let the crisis do its thing. Further rate hikes, however, are pointless because the ongoing QE offsets any effect.

U.S. inflation, % (y/y)

Former Coinbase CTO Balaji Srinivasan went even further in his assessment, posting on social media about the imminent arrival of hyperinflation and urging everyone to buy Bitcoin.

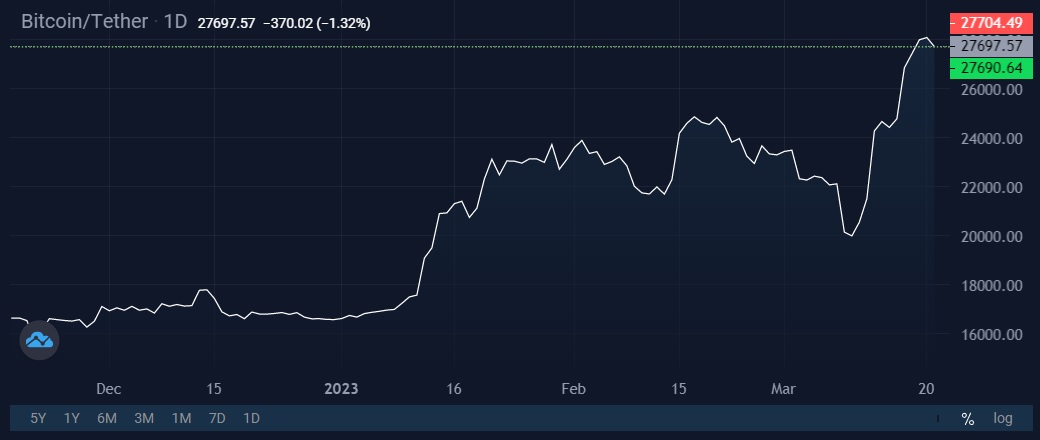

He was debated by James Medlock, who spoke of his willingness to bet $1 million that the US wouldn't face hyperinflation. Balaji responded by raising the stakes, promising Bitcoin's rise to $1 million within 90 days. Balaji has also agreed to accept 1 BTC from Medlock in the event of a win versus paying Medlock $1 million, which at the current exchange rate is equivalent to 40:1.

The chances of Srinivasan winning the argument are slim to none. Bitcoin, on the other hand, is likely to benefit from the recent shocks. In a time when printing presses worldwide will run with renewed energy and a number of bank customers will lose money due to excess deposit insurance, interest in cryptocurrency will grow.

StormGain Analytical Group

(platform for trading, exchanging and storing cryptocurrency)

Tags

Try our Bitcoin Cloud Miner and get additional crypto rewards based on your trading volume. It's immediately available upon registration.

Try our Bitcoin Cloud Miner and get additional crypto rewards based on your trading volume. It's immediately available upon registration.