Bitcoin: premature optimism

The cryptocurrency market has seen a resurgence, leading to significant losses among bears in recent months. However, the leading investment force institutional investors remain inactive while the blue whales are selling off their coins.

Uptober expectations (October is statistically a growth month for Bitcoin) and a technical correction in the US dollar index led to a surge in the price of the coin, which crossed the USD 20,000 mark, with cumulative bear losses on short positions exceeding USD 800m for the week.

The purchase of Twitter by Ilon Musk and the pending introduction of crypto-payments give traders cause for optimism. Dogecoin doubled in a week to 12 cents a coin, with veteran trader Peter Brandt claiming the bear market has ended for the meme coin.

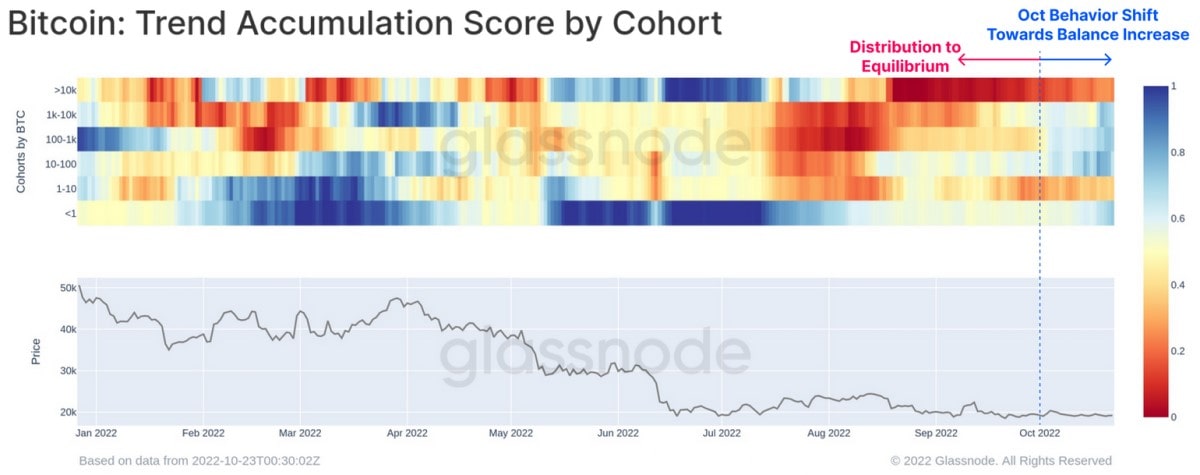

However, overall market sentiment is rarely the dominant factor in pricing. For example, blue whales (>10k BTC), which own 15% of the Dogecoin, have been selling off their coins in the last two months.

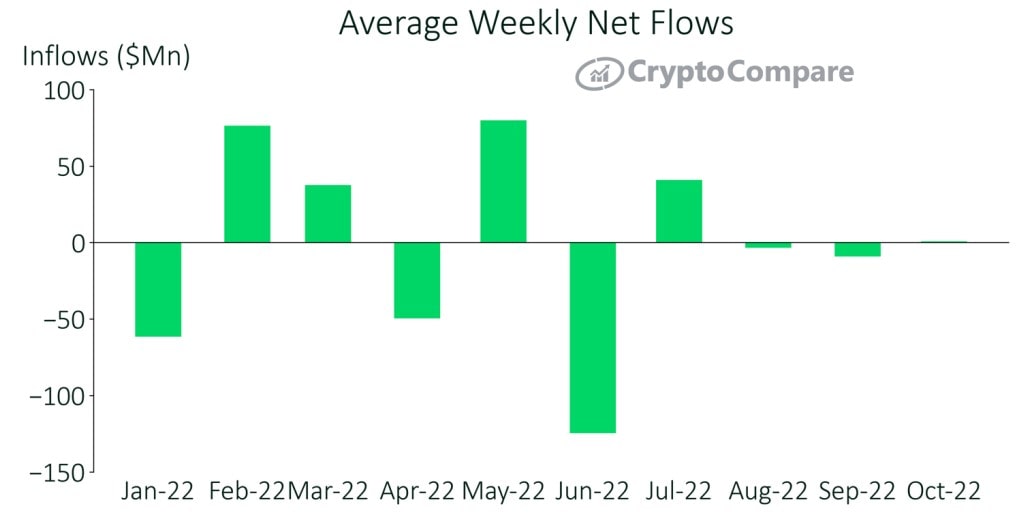

Since 2020, institutional investors have been the leading investment force in the cryptocurrency market (companies with investments of USD 1m or more). Looking at their behaviour through the lens of cryptocurrency funds, there has been little movement since August.

The weekly net inflows in October averaged at a paltry USD 730,000. And at only USD 22.9bn, the total amount of funds under management is half that of in March.

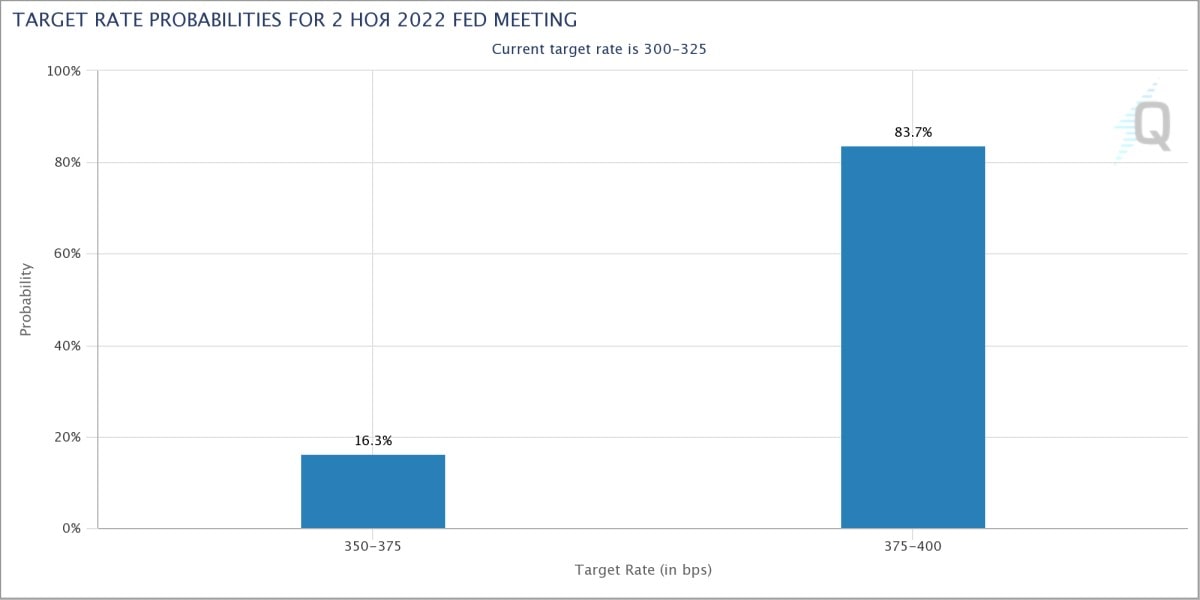

The coin sell-off by whales and the low level of interest on the part of institutional investors in cryptocurrency is associated with the Fed's upcoming key rate decision. According to the CME's FedWatch tool, there is an 83.7% probability that the regulator will again raise the key rate by 0.75%. The Fed will meet on 2 November.

The Fed is increasing interest rates to fight inflation, which broke a 40-year record this year. Following the rate hike, US bond yields are climbing, which in the context of global economic stagnation and the devaluation of several national currencies has led to the flow of capital into the US dollar. In the event of another 0.75% hike in the key interest rate, there is a high probability that this inflow will intensify, making it hard to see Bitcoin consolidating above USD 20,000.

StormGain analytics team

(a platform to trade, exchange and store cryptocurrency)

Tags

Try our Bitcoin Cloud Miner and get additional crypto rewards based on your trading volume. It's immediately available upon registration.

Try our Bitcoin Cloud Miner and get additional crypto rewards based on your trading volume. It's immediately available upon registration.