Bitcoin to hit $120,000 due to reduced supply

Bitcoin's minting rate halves every four years, with demand for the coins far outstripping supply. This leads to a long-term price increase in spite of macroeconomic headwinds, such as China's ban on companies conducting cryptocurrency transactions or the attempt to cut off the crypto industry from the banking industry in the US.

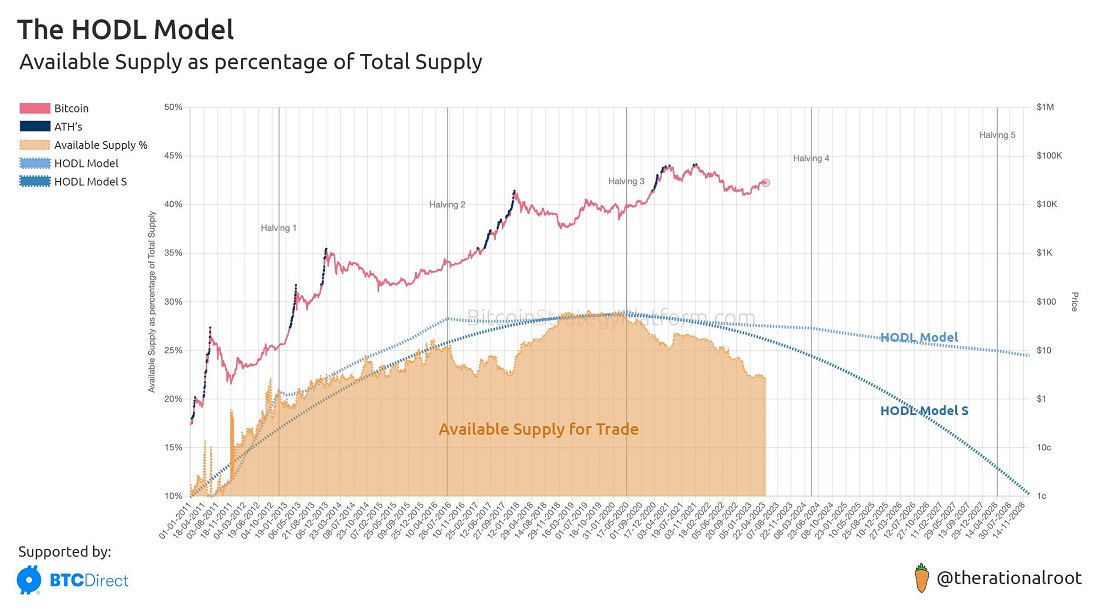

Since March 2020, the circulating supply has continued to dwindle. In other words, more and more coins are being saved in wallets, and market participants are opting for a holding strategy (HODL).

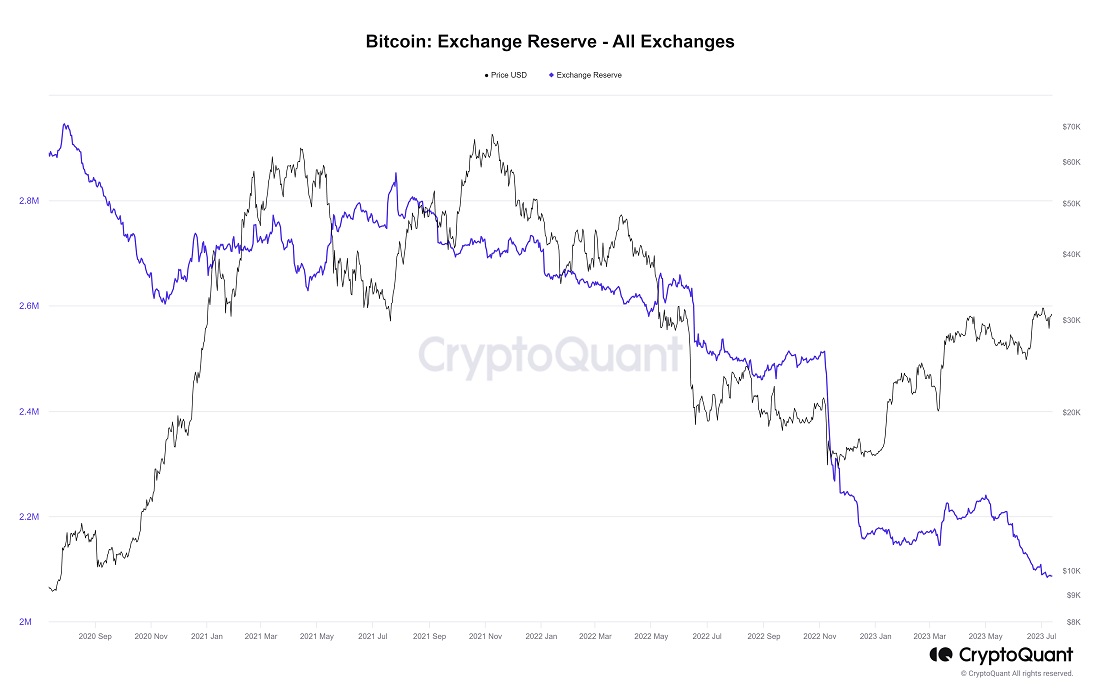

The third halving was the tipping point for Bitcoin to gain scarcity status after cryptocurrencies experienced widespread adoption and acceptance. This is also evidenced by a 28% drop to 2.09 million BTC held in cryptocurrency exchange reserves.

The expected halving in April 2024 will only serve to reinforce the trends that have been observed so far. Standard Chartered's head of crypto research, Geoff Kendrick, believes the supply cut will drive the price up to $50,000 by the end of this year and $120,000 by the end of next year.

According to Kendrick, as the value of Bitcoin grows, miners will return to their accumulation strategy. Due to high operating costs, miners are currently selling off everything they mine, sending 900 BTC to the market every day. However, the increased price will allow some coins to be saved for the future. When Bitcoin reaches $50,000, daily miner sales will drop to 180–270 BTC.

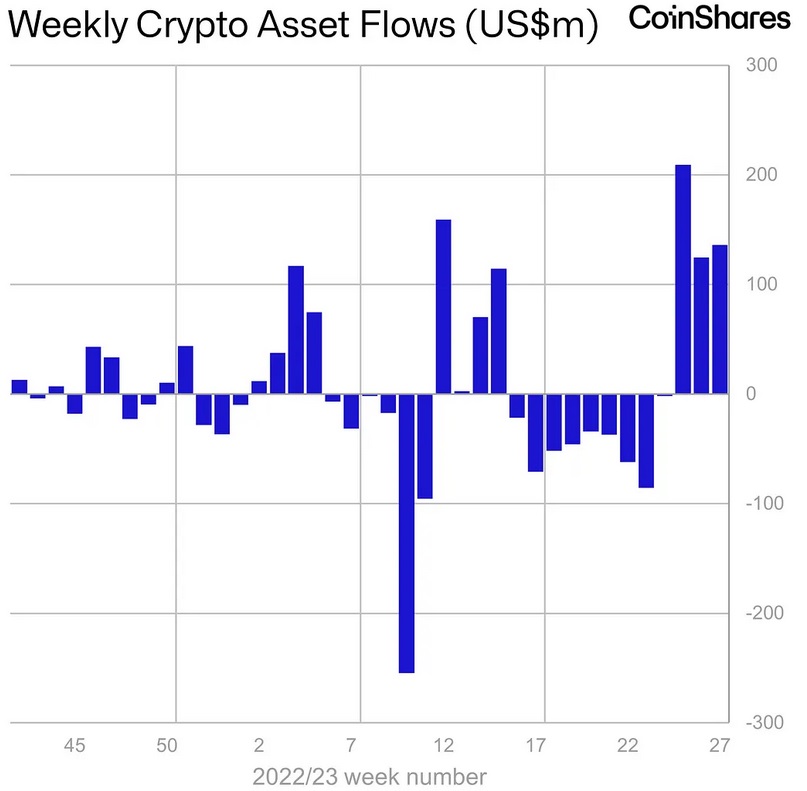

Miners aren't the only ones who will be interested in hoarding. Institutional investors have invested in cryptocurrency funds for the third week in a row in anticipation of a reversal in the Fed's monetary policy over the next 12 months, a weaker US dollar and the upcoming Bitcoin halving.

Over the past three weeks, crypto funds have seen inflows of $470 million, completely offsetting the outflows of the previous nine weeks. Of the investments directed into cryptocurrencies, Bitcoin accounted for 94% or $443.4 million.

StormGain Analytical Group

(platform for trading, exchanging and storing cryptocurrency)

Tags

Try our Bitcoin Cloud Miner and get additional crypto rewards based on your trading volume. It's immediately available upon registration.

Try our Bitcoin Cloud Miner and get additional crypto rewards based on your trading volume. It's immediately available upon registration.