Bitcoin's likelihood of a post-halving crash

When assessing the impact of the halving event on Bitcoin, most analysts rely on the emergence of scarcity that will unquestionably lead to a price increase. However, here, we'll list a few reasons why the first reaction may be negative.

Statistic

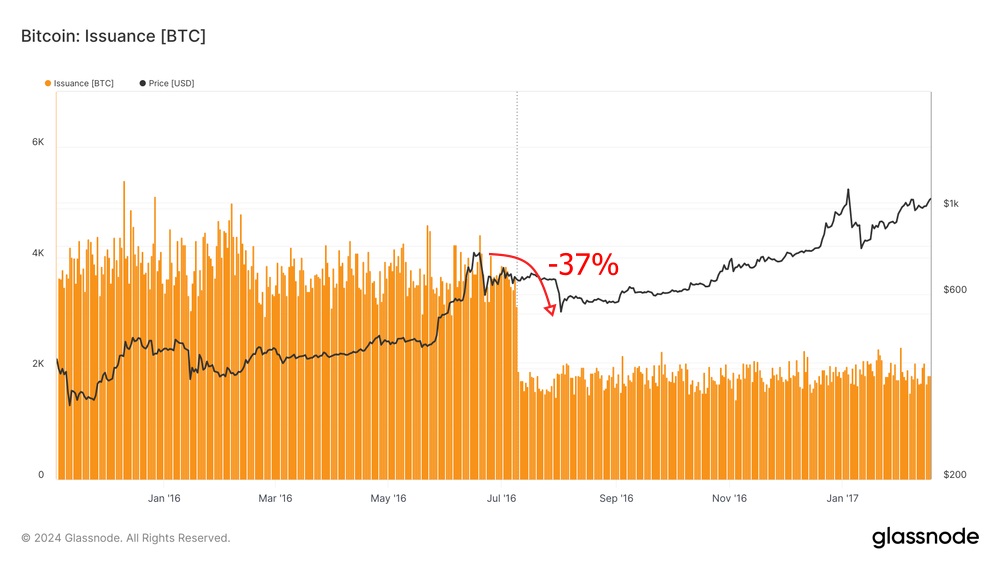

A third of the time, Bitcoin has corrected by more than 30% since the 2016 halving. There were no significant factors for a major sell-off, and the correction was an example of the old adage "buy the rumour, sell the news". The price has risen 75% since early 2016, and after the halving, it fell by 37% from the local high to $470 in two months.

The price is up 74% this year, similarly encouraging a number of players to sell in order to lock in profits. The last time the "buy the rumour, sell the news" principle was put into action was on the approval of spot Bitcoin ETFs, with the price correcting 21% to $38,500.

Halving compensation

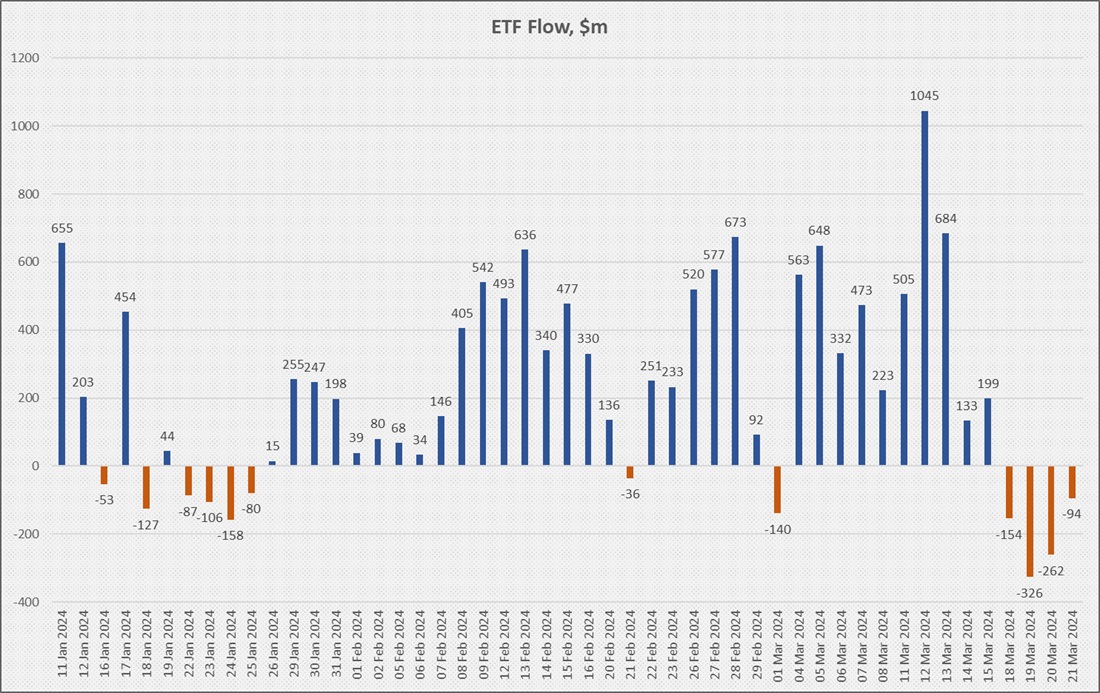

What makes this fourth halving different from previous ones is that, firstly, Bitcoin has reached an all-time high ahead of the event, and, secondly, a 'Bitcoin hoover' has appeared in the form of ETFs. The halving represents an ultimate reduction in incoming supply, but ETF investors are just as subject to emotion as other market participants.

They have now accumulated $11.3 billion worth of Bitcoin, thus anticipating the upcoming deficit and ensuring the coin's rise to a new high. But what happens to the price if funds start actively unloading reserves? If that happens, they would offset almost all of the good momentum from the halving in the short to medium term.

The price is already under pressure as whales, miners and long-term holders lock in profits. Meanwhile, spot ETFs have seen net outflows for the fourth day in a row now. These are excellent prerequisites for the correction to continue.

The impact of miners

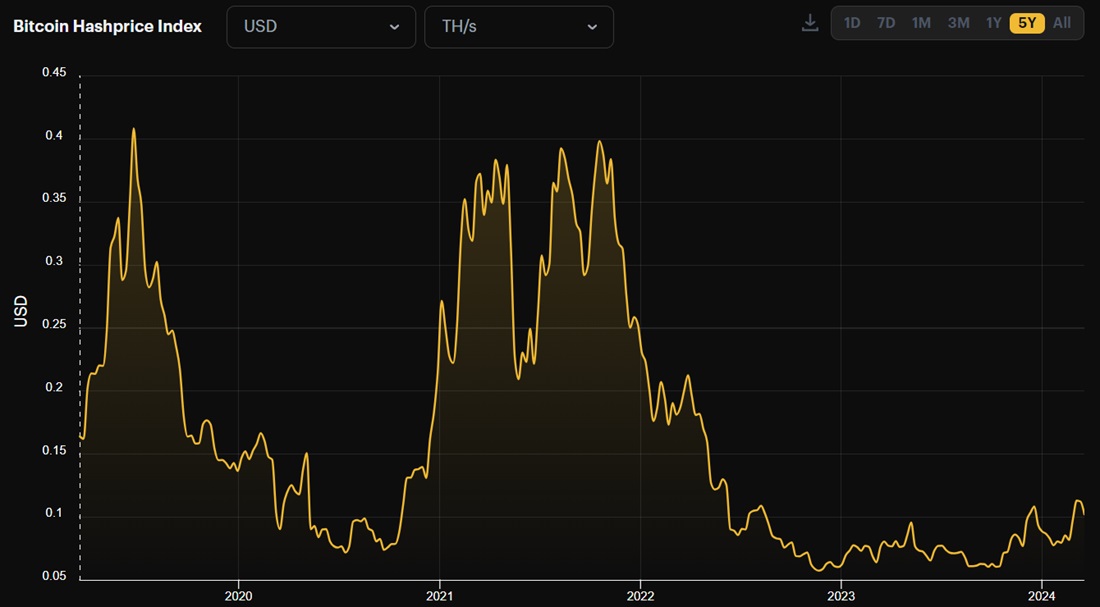

This time around, competition among miners is at an unprecedentedly fierce level, with almost a third of the network hashrate being provided by publicly traded mining companies. To appreciate the gravity of the situation, one only needs to look at the yields from a terahash of power, which are increasingly lagging behind the price.

If the correction drags on, most miners will ramp up the sell-off of their resolves due to falling revenues as a result of the halving, which CryptoQuant analysts estimate at 1.8 million BTC or $119 billion. Even if only a tenth is sent to market, it would have a significant negative impact.

Conclusion

Halving certainly has the long-term positive effect of reducing the flow of fresh supply, but in the first few months after it occurs, the market reaction may be negative. If all of these risks take place, the price may roll back to $45,000.

StormGain Analytical Group

(platform for trading, exchanging and storing cryptocurrency)

Tags

Try our Bitcoin Cloud Miner and get additional crypto rewards based on your trading volume. It's immediately available upon registration.

Try our Bitcoin Cloud Miner and get additional crypto rewards based on your trading volume. It's immediately available upon registration.