SEC will seek to label Ethereum a security

The latest news suggests that the SEC's intention to designate Ethereum as a security remains unwavering, despite previously approved ETFs on Ethereum futures, potential multi-million dollar losses for companies that work with the altcoin, and disagreements with the Commodity Futures Trading Commission (CFTC).

Fortune magazine reported yesterday that several US companies have received a subpoena from the SEC demanding details of their interactions with the Ethereum Foundation. By implication, the crypto community has speculated that the Ethereum Foundation has also received a "chain letter" with various demands and an order not to disclose its contents. Firstly, this is evidenced by the text deleted from the official website in late February:

The Ethereum Foundation (Stiftung Ethereum) has never been contacted by any agency anywhere in the world in a way which requires that contact not to be disclosed. Stiftung Ethereum will publicly disclose any sort of inquiry from government agencies that falls outside the scope of regular business operations.

Second, gone is the yellow canary logo that many companies use to mark the absence of confidential subpoenas from judicial or government agencies. Web developer Pablo Pettinari later confirmed the foundation's receipt of the letter from the government agency.

For Ethereum investors, this is a bad sign as the realisation of risks will lead to Ethereum further lagging behind Bitcoin.

Most were counting on the emergence of spot Ethereum ETFs in May when the deadline for a number of filings comes due. The probability of approval is now estimated to be less than 30%. But that's not the most unpleasant part. The security status will force most US companies to decline to work with the altcoin since the level of requirements will increase by an order of magnitude.

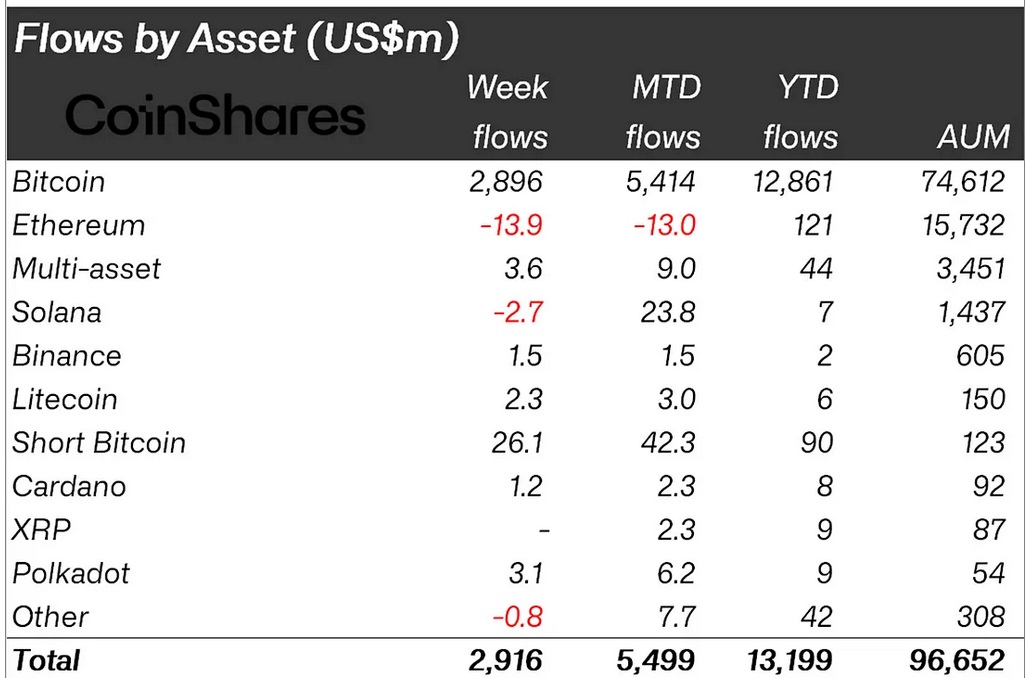

Anticipating that something would happen, institutional investors increased investment outflows from Ethereum ETFs to $14 million last week. The trend is likely to gain even more momentum this week.

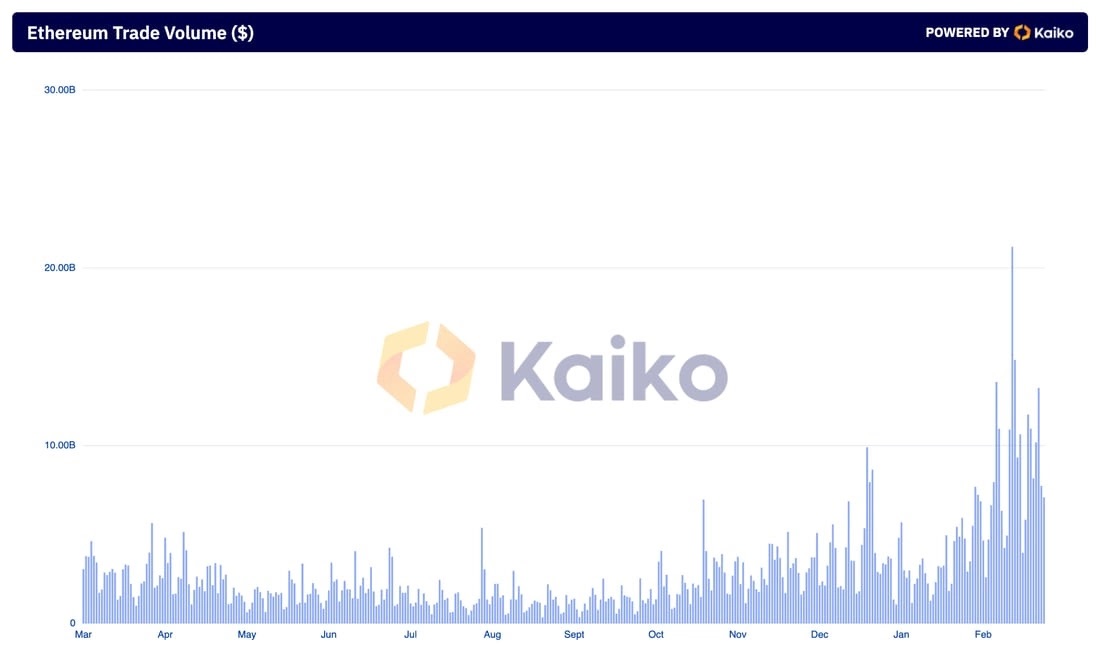

Pressure from the SEC is also overshadowing the positives from last week's successful Dencun hardfork, which made it possible to significantly reduce fees in Layer-2 (L2) networks. After L2, trading volume in Ethereum rose to multi-year highs.

The last hope for American investors remains the intervention of Congress or the Supreme Court, which could more meaningfully divide crypto assets into commodities and securities. The SEC, on the other hand, has yet to outline clear criteria, instead relying on The Howey Test from 1946 for its reasoning.

StormGain Analytical Group

(platform for trading, exchanging and storing cryptocurrency)

Tags

Try our Bitcoin Cloud Miner and get additional crypto rewards based on your trading volume. It's immediately available upon registration.

Try our Bitcoin Cloud Miner and get additional crypto rewards based on your trading volume. It's immediately available upon registration.