Celsius' sell-off will hurt altcoins

By early 2022, Celsius was one of the largest lenders in the cryptocurrency market, operating with $12 billion in assets under management and $8 billion in loans. Investors were attracted to Celsius by the promised yield of 6% when investing in Bitcoin and up to 17% in other cryptocurrencies.

Problems emerged with the crash of Terra in May 2022, the project responsible for issuing LUNA and the UST stablecoin (at the time, the third-largest stablecoin, with a capitalisation of $20 billion). UST was an algorithmic stablecoin (with little or no backup collateral) directly linked to LUNA's price. Staking in UST was encouraged by yields of up to 20%. The decline in new customer inflows in the spring couldn't ensure consistency of payouts. And so UST and LUNA went into a deep downward dive.

It turned out that Celsius was linked through investments with Terra and a bunch of other collapsed projects, like the hedge fund 3AC. It later emerged that management was trying to win back the cryptocurrency market using client funds and margin trading. But it only got worse. The company filed for bankruptcy on 13 July, with an estimated $1.2 billion deficit and owing a total of $4.7 billion to its customers.

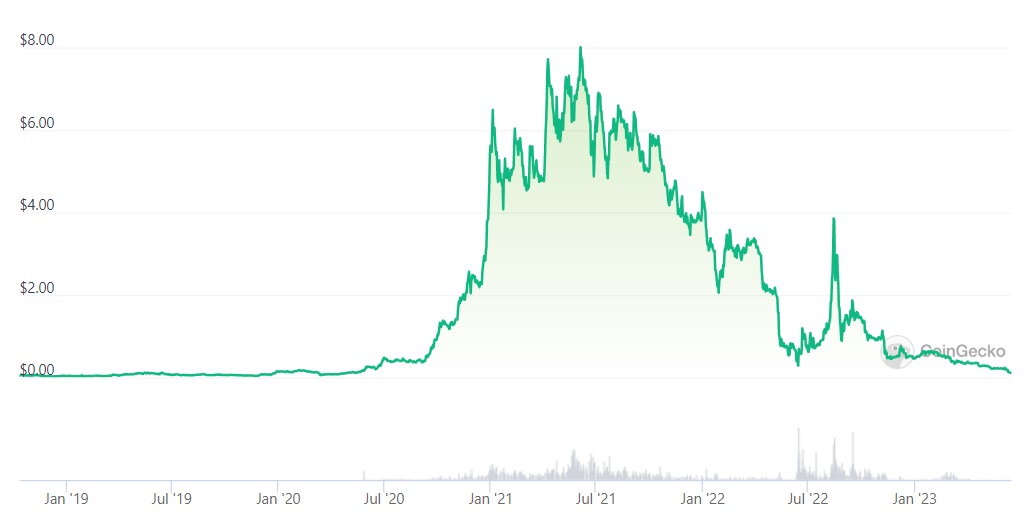

Investors' problems are further complicated by the fact that the bulk of the assets were denominated in CEL's token, which collapsed from $4 in early 2022 to the current $0.10.

In addition to CEL, its assets still contain various other altcoins worth $220 million. Polygon's MATIC is second to CEL in terms of volume, coming in at $52 million.

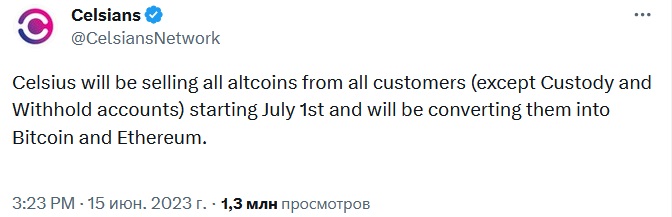

On 1 July, the company planned to convert all available altcoins to Bitcoin and Ethereum, supposedly because of the SEC tightening its grip.

The plan must be approved during a bankruptcy court hearing, and not everyone involved in the process agrees with it. If the decision is affirmative, altcoins will face renewed pressure in July.

StormGain Analytical Group

(platform for trading, exchanging and storing cryptocurrency)

Tags

Try our Bitcoin Cloud Miner and get additional crypto rewards based on your trading volume. It's immediately available upon registration.

Try our Bitcoin Cloud Miner and get additional crypto rewards based on your trading volume. It's immediately available upon registration.