Companies have sold $5.5 billion worth of Bitcoin in two months

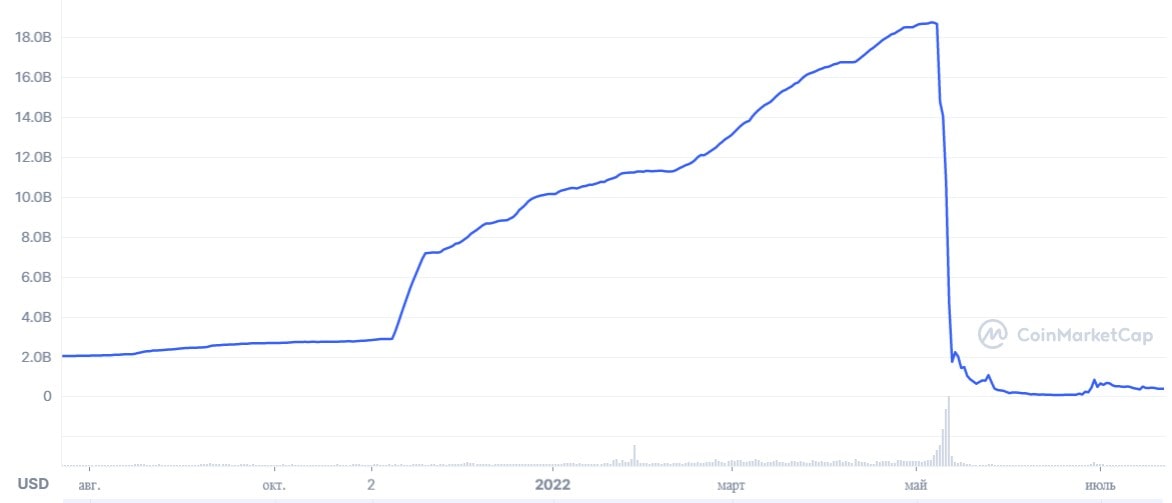

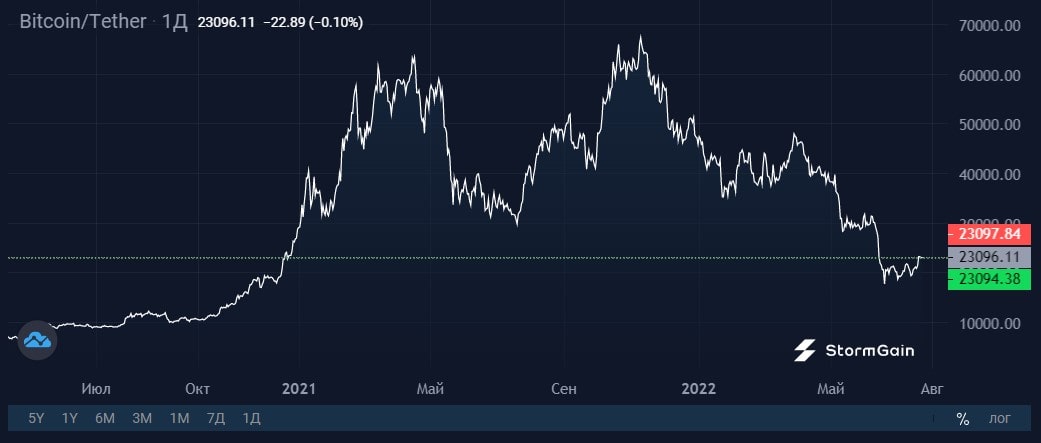

In addition to macroeconomic factors, such as the Fed tightening its monetary policy and the global economic slowdown, panic has put significant pressure on Bitcoin. The catalyst for the process was the collapse of the third-largest stablecoin, UST, which had a capitalisation of $19 billion. It lost its peg to the US dollar on 9 May.

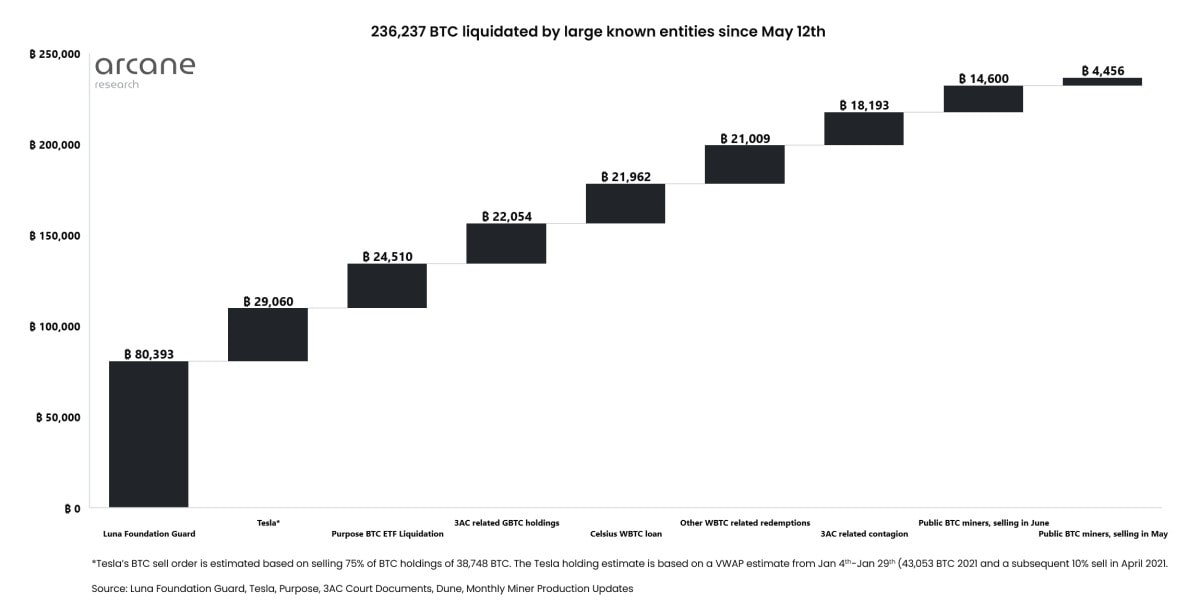

In an attempt to maintain the stablecoin's exchange rate, Terraform Labs sold 80,000 BTC from its reserve in the amount of $2.5 billion, but this did not help. In just a few days, the Terra project lost $40 billion in capitalisation, and the internal LUNA coin dropped out of the Top 10 coins by market capitalisation.

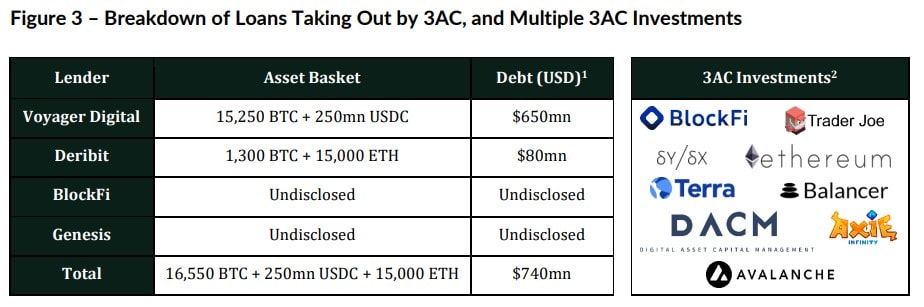

Because Terra was a significant market player, various companies invested in it. One of the largest crypto funds, Three Arrows Capital (3AC), invested over half a billion dollars in LUNA. In turn, other crypto players invested in 3AC. For example, the broker Voyager Digital put in over $600 million.

Terra's collapse led to the collapse of a number of projects, many of which have either already faced bankruptcy proceedings or are close to it. In order to pay off liabilities, companies began to offload coins. Among them was Tesla because Elon Musk failed to realise the potential of the idea (read more about this in the article). In just two months, the companies got rid of 236,000 BTC, worth a total of $5.5 billion.

In addition to unlucky investors, the list also included public miners who were actively increasing production capacity on credit, including using equipment as collateral. In May, this group sold more Bitcoin than it mined in a month. And in June, the largest of them, Core Scientific, sold 7,202 BTC for a total of $167 million.

A large share of borrowed funds plays a significant role in Bitcoin's rapid decline. However, the cryptocurrency's fall in the current environment is not a one-off event, and Bitcoin proved to be stronger than a number of famous names in the stock market.

Bitcoin is now regaining its position, but pressure from a number of participants will continue. The troubled companies have yet to repay their liabilities to creditors, and public miners will continue to get sell off assets if there is prolonged consolidation. According to various estimates, their reserves range from 50,000 BTC to up to 70,000 BTC.

StormGain Analysis Team

(crypto trading, exchange and storage platform)

Tags

Try our Bitcoin Cloud Miner and get additional crypto rewards based on your trading volume. It's immediately available upon registration.

Try our Bitcoin Cloud Miner and get additional crypto rewards based on your trading volume. It's immediately available upon registration.