Complexity has eaten away at miners' profits from Bitcoin's rise

Bitcoin's return to growth in 2023 has been met with enthusiasm by miners actively building up their computing power. In the past five months, the complexity has increased by the same 45% as for the whole of 2022.

The computational complexity increases or decreases in response to the amount of power involved, with the expectation that it takes 10 minutes to mine one block. Adjustments are made automatically every 2016 blocks, which is about once every fortnight.

Complexity has no direct connection to Bitcoin's price. However, a price increase increases the profitability of mining and attracts new entrants or encourages old ones to increase their capacity. In the pursuit of profit, miners are causing complexity to increase.

As a result of the new equipment being connected at a rapid clip, mining yields have rolled back to the level last seen on 13 January, when Bitcoin was trading at $19,000.

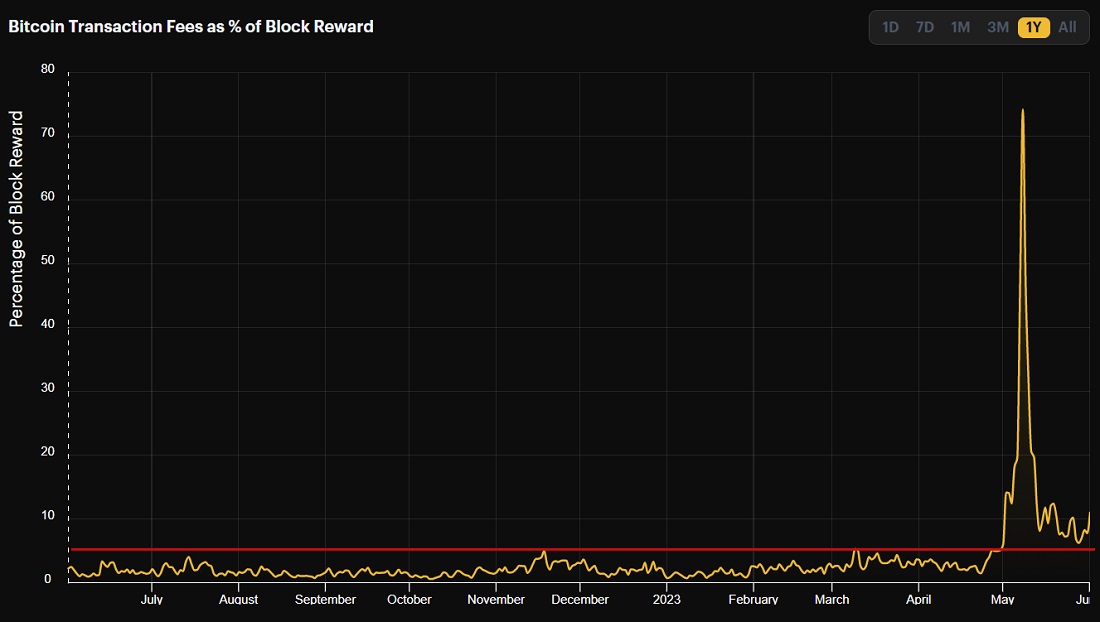

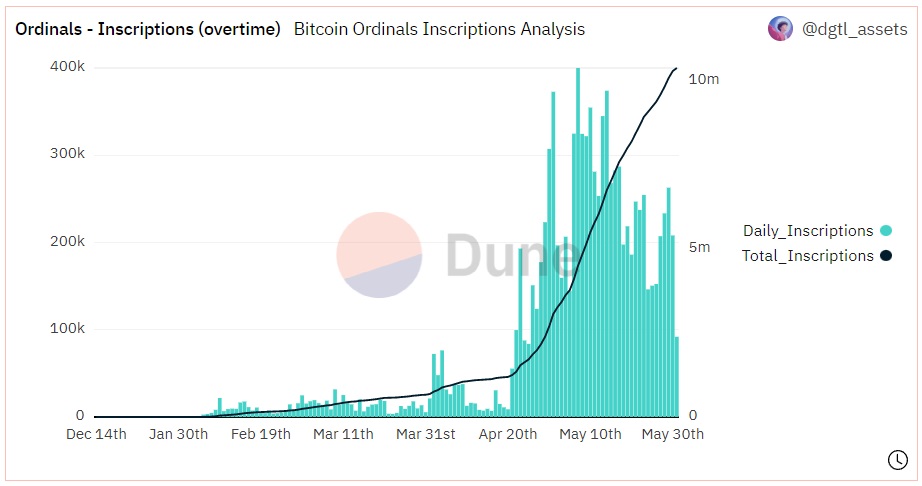

The only thing holding yields relatively high and that caused a surge in yields in May is the hype around ordinals. The Ordinals protocol allows digital objects (similar to NFTs) to be exchanged on the Bitcoin network. Due to some crypto enthusiasts' excitement about the innovation, network congestion has skyrocketed, resulting in higher fees.

On 8 May, commissions exceeded the award for block production for the first time since 2017. We can see on the following chart that the percentage of income from fees remains high. The peak on the chart doesn't reach 100% due to the averaging of values.

Once interest in ordinals subsides, miners' revenues will drop even more if all other things are equal. Some cooling to minting digital objects compared to early May can already be observed.

As we've previously described, the hash rate has become hopelessly detached from Bitcoin's price due to fierce competition between mining companies' expansion by raising investments from third parties. For example, Core Scientific, the company with the highest capacity and level of debt, filed for Chapter 11 bankruptcy late last year. But this hasn't affected the network's hash rate. Despite the business being restructured and ownership potentially changing, most ASICs continue to mine Bitcoin.

StormGain Analytical Group

(platform for trading, exchanging and storing cryptocurrency)

Tags

Try our Bitcoin Cloud Miner and get additional crypto rewards based on your trading volume. It's immediately available upon registration.

Try our Bitcoin Cloud Miner and get additional crypto rewards based on your trading volume. It's immediately available upon registration.