How to create your own cryptocurrency: a fast guide

Everyone is talking about cryptocurrency now. With the growing advancement of blockchain technology, merchants can often pay for their products and services using cryptocurrency. Mining can bring you monthly income without requiring too much effort. While searching for opportunities to become full-stack players in the blockchain world and generate thousands of dollars in income, more and more people have started to wonder how to create their own cryptocurrency. There are several ways to do this and a bunch of factors that you should consider before launching your crypto coin or token.

In this article, I'll guide you through what cryptocurrency really is, what differentiates a coin from a token, the key benefits of cryptocurrency, and, finally, how to create your own crypto.

What is a cryptocurrency?

I don't think anybody would argue that cryptocurrency is an unavoidable topic these days. Blogs, forums, social media platforms, online magazines and newspapers strive to keep you informed on the latest changes and releases of new tokens and coins that are worthy of your attention.

Forewarned is forearmed. If you're looking for a great business idea and feel that you're ready to embrace something new, you can't miss out on the opportunity to create your own cryptocurrency.

Cryptocurrencies were introduced to the world over 10 years ago. Yet, despite the time that's passed, the topic is still misunderstood and underestimated by many people. While some individuals think of it as a new form of money, others consider it to be just a buzzword. There is so much more to learn about this concept, its benefits and its usage. So, before we dig deeper into the guidelines on how to create your own cryptocurrency coin, let's look at the definition of cryptocurrencies.

A cryptocurrency is a digital currency that is not tracked by governments, banks or any digital authority. It uses encryption to generate currency and transfer funds. Anonymity and security are among the main factors that differentiate cryptocurrency from other currencies available in the modern world. There are different types of cryptocurrencies that you may come across on the web today. Most of them are decentralised networks running on blockchain technology, which is an integral part of cryptocurrencies. Essentially, a blockchain is a peer-to-peer network made of data blocks that are used to store information related to every transaction and follow the protocol of validating new blocks and managing the inter-node communication. Whenever any changes need to be made to one block, a series of consecutive changes should be applied to all subsequent blocks.

Bitcoin was the first decentralised cryptocurrency to be launched back in 2009. When writing this guide, the total number of cryptocurrencies available in the world has reached more than 5,000. Although competition is getting tougher as the number of virtual currencies grows daily, Bitcoin still holds the leading position in the cryptocurrency world in terms of market capitalisation and name recognition.

Largest cryptocurrencies by market cap

Although Bitcoin was the first cryptocurrency to debut on the market in 2009, many other virtual currencies have been released since then. Still, none has become as large as the original. With that said, let's look at the top 12 cryptocurrencies by market capitalisation. The following data are from CoinMarketCap as of 16 October 2021.

- Price: $60,761.77

- Market cap: $1,145,088,413,739

For many people worldwide, BTC is often synonymous with cryptocurrency. Since it was launched by its mysterious creator, Satoshi Nakamoto, the virtual currency has taken the world by storm. To this day, Bitcoin is at the top of the game, with a market share of 40% of the entire cryptocurrency market. The coin's value continues to grow and hit record numbers every once in a while. There's no indication that it will stop growing and strengthening its positions in the years to come.

- Price: $3,862.07

- Market cap: $455,561,964,350

Ethereum is the second-most-popular cryptocurrency after Bitcoin. In fact, Ethereum and Bitcoin match each other in terms of popularity and recognition in the cryptocurrency world. ETH lets you perform different actions using ether (the currency). Just like BTC, ETH is a cryptocurrency with a promising future, and it's one of the best options for trading today.

Since its launch in 2015, Ethereum has shown steady growth and is often used to create new tokens. The currency's market share is over 11%.

- Price: $466.84

- Market cap: $78,492,865,308

Binance (one of the largest cryptocurrency exchanges in the world) uses Binance Coin. The token was originally launched in June 2017. It was primarily intended to be used as a virtual currency to pay for different products and services online.

- Price: $2.19

- Market cap: $72,055,489,349

Cardano is a blockchain platform created by Ethereum's co-founder. It's the ultimate choice for innovators and changemakers looking for technology to make a positive global change. The cryptocurrency adopts smart contracts that make identity management a reality.

- Price: $0.99

- Market cap: $68,754,826,527

The price of the coin is anchored at $1, which makes Tether a stablecoin in the cryptocurrency world. Traders often use it as a medium to go from one currency to another instead of dollars.

- Price: $1.15

- Market cap: $53,701,481,161

XRP was previously known as Ripple. Its launch in 2012 made it possible to complete cross-border transactions in various fiat currencies. XRP is more than just a cryptocurrency; it's an international payment system preferred by small businesses and large corporations thanks to its fast, secure transactions. Big names in the world of finance are using it, such as American Express, JP Morgan and Santander.

- Price: $158.65

- Market cap: $47,603,057,324

Solana is a new player in the cryptocurrency world. It launched in March 2020 and stands out in the cryptocurrency world for the speed at which transactions are performed and its overall reliability.

- Price: $41.84

- Market cap: $41,469,967,996

Polkadot is another example of a newly released cryptocurrency in the digital world. It was launched in 2020 and is predicted to become more popular than ETH someday.

USD Coin (USDC)

- Price: $1.00

- Market cap: $32,797,666,226

Similar to Tether, USDC is a stablecoin whose value is fixed at $1. It launched in September 2018 and runs on the Ethereum, Stellar, Algorand, Solana, Tron and Hedera Hashgraph systems.

- Price: $0.2373

- Market cap: $31,204,190,245

This cryptocurrency was launched in December 2013 as a joke after the global rise in demand for Bitcoin. Its name originates from a meme featuring a Shiba Inu dog. What makes Dogecoin different from other digital currencies is that there's no limit to the total number of coins that can be issued. DOGE can be safely used to send money and process payments.

- Price: $196.80

- Market cap: $2,041,003,342

Dash offers a supreme level of anonymity to all crypto holders. It uses a decentralised mastercode network that makes all Dash transactions untraceable.

- Price: $147.88

- Market cap: $1,909,041,183

Zcash is another cryptocurrency that looks rather promising and can be a handy alternative to Bitcoin and Ethereum. Thanks to its zero-knowledge proofs, all transactions within the network are kept anonymous. Information about the sender, receiver and the amount of money moving within the network is kept secret.

With this information in mind, let's highlight the key takeaways that one should know about crypto:

- A cryptocurrency is a digital asset featuring a decentralised structure based on a network distributed across many computers. Digital coins exist outside the centralised control of banks or governments.

- Many cryptocurrencies use blockchains as an essential component for completing transactions.

- The number of digital currencies is constantly growing, with more than 5,000 available in the cryptocurrency world today.

Summarising the information above, it's safe to conclude that blockchain networks are a hot topic in the market. Individuals and businesses find value in using decentralised currencies that offer anonymity, transparency and security when it comes to sending and receiving transactions.

How does cryptocurrency work?

Digital currencies are an integral part of the blockchain, a form of the digital database of transactions that uses consensus algorithms to create new blocks. In a peer-to-peer network, all participants need to accept blocks to have them registered in the blockchain. Some of the most popular types of consensus requiring proof-of-work (PoW) include:

- Proof-of-stake (PoS)

- Delegated proof-of-stake (DPoS)

- Proof-of-authority (PoA)

- And others.

The digital database (or ledger) is distributed across a network of computer systems, none of which takes control of the ledger. Since all cryptocurrencies work on a blockchain, everyone who invests in digital currencies bets on the resiliency of that blockchain. Because blockchains run on a decentralised network of computers, they keep transactions and the identity of crypto holders private.

All cryptocurrency transactions are recorded on the underlying blockchain. The owners of digital currency can transfer it between wallets and blockchain addresses. Groups of transactions are added to the chain in the form of blocks, an action that validates transactions and keeps the network up and running.

Cryptocurrency can be used for trading and exchanged for fiat money. Everyone in the same network can view transactions, but crypto holders' identities are encrypted by unique keys used to connect a person to an account, thus keeping individuals' data absolutely anonymous.

The main reason why people apply extra effort to validate blockchain transactions is that they get rewards with the underlying cryptocurrency. The system bears the name proof-of-work (PoW), meaning that computers prove that blockchain transactions are authentic. As part of this system, the computers are called miners. Miners earn crypto assets for the energy they spend to validate transactions.

In the cryptocurrency world, investors use digital addresses instead of holding their assets in traditional bank accounts. Every digital address comes with private and public keys, which enable crypto holders to send and receive digital currencies. Private keys let individuals unlock and send currencies, whereas public keys let crypto holders receive digital currencies from any sender.

Do you want to launch a coin or token?

Before moving to the guideline on how to create your own cryptocurrency coin, let's clarify what the words' coin' and 'token' mean and why they shouldn't be confused. The reason why I'm focusing on this point is because the two terms are often considered to be interchangeable, but they're not.

The industry is changing and growing at a fast clip, which results in the introduction of new words and terms that should be interpreted to avoid misunderstanding and misuse. So, let's highlight the major differences between coins and tokens.

All coins and tokens are cryptocurrencies. However, some aren't intended to circulate like digital currencies. If we look at the definition of a currency, it's a medium of exchange or store of value that can be exchanged, sent and received. Bitcoin is a vivid example of a cryptocurrency that possesses all of these features. Following the global success of their predecessor, all coins and tokens that came to market after Bitcoin were called cryptocurrencies by default. But as I've already mentioned, tokens and coins are two absolutely different types of units. Calling them cryptocurrencies is misleading for people taking their first steps in the industry and those looking to create their own crypto.

Coins

Coins are often called digital money or alternative cryptocurrency coins (altcoins) that store value over time and are made using encryption. Coins are digital equivalents of real money. Bitcoin is one of the most vivid examples of a coin that runs on a blockchain where all blockchain network participants can see all transactions. Following the successful release of Bitcoin, there have been several more coins that operate on Bitcoin's original protocol, including Litecoin and Namecoin. There are also coins that run on blockchains made specifically for those coins, such as Ripple and Monero.

Coins share similar features with the money we use in the offline world, known as fiat currency. Coins are portable, durable, divisible and acceptable. On top of that, most have a limited supply. Avid cryptocurrency fans predict that digital coins will totally replace fiat currency. Only time will tell.

Here's a brief overview of coins' main characteristics:

- They can be sent, received and mined.

- They aren't intended to be used for anything other than as money.

- They're based on a public open blockchain network that anyone can join.

Tokens

Generally speaking, tokens perform similar functions to coins but with certain peculiarities. Tokens are digital assets issued by different projects to be used as payment methods in each project's ecosystem. Unlike coins, tokens allow their holders to join the network.

The main functions that tokens can perform include:

- Acting as digital assets

- Representing shares of the projects where tokens were issued

- Providing access to the project's features

- Introducing new features upon the release of new projects.

Digital tokens are created to be used only within a certain project. For example, you can compare using a token to cinema tickets. You can't use the tickets to pay for items at a supermarket; they only have value at the cinema. The same rule applies to tokens.

You should bear this in mind when you decide to create your own crypto because tokens are easier to create than coins. There's no need to create a new code or change an existing one. When creating tokens, you can use standard templates like Ethereum, which is based on a blockchain and allows everyone to create a new token with a few steps. In fact, Ethereum was the first digital currency that made creating tokens simpler for everyone interested in the topic.

There are two types of tokens:

- Security tokens, like DAO, are intended to be a share in a project.

- Utility tokens like BON Token are intended to have a certain use case inside a particular project.

Summing up the difference between coins and tokens, we see that:

- Coins perform independently and are used as payment methods. They're used to buy different things, including tokens.

- Tokens represent a share in a company and can be used to buy and sell within the project to which the tokens belong.

The benefits of creating your own cryptocurrency

There are thousands of cryptocurrencies in circulation today. However, there are only around 40 with a market capitalisation of $1 billion. With a growing number of businesses creating their own coins and tokens, it's important to understand if it's really worth having your own cryptocurrency.

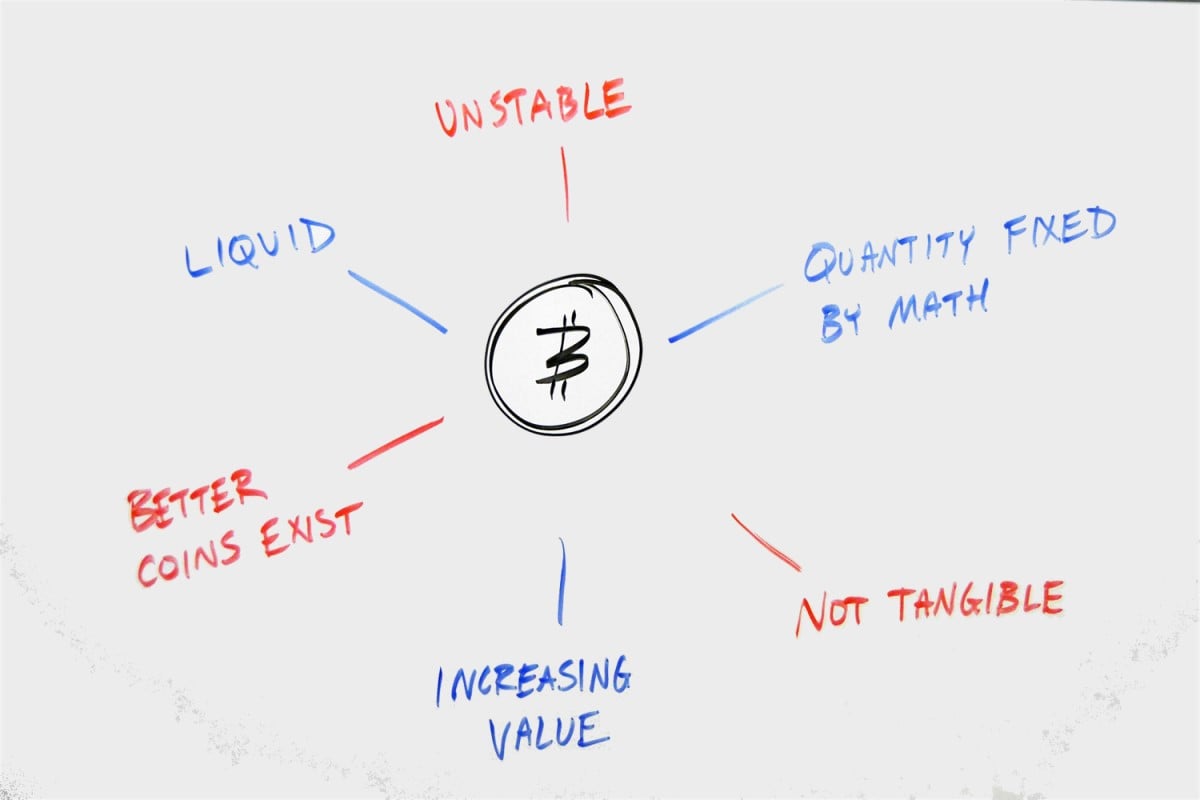

Before you create your own crypto, you first need to know the major advantages and disadvantages of digital currencies. Let's take a look at the main reasons why cryptocurrencies are so popular around the world and what major drawbacks you should beware of when owning one.

Cryptocurrencies' main pros include:

- Being the currency of the future. Given how fast blockchain technology is evolving and how many businesses have already adopted it, it's not surprising that digital money will soon become mainstream globally.

- Existing as a digital currency that banks, governments and other institutions can't control. It gives individuals the freedom to create their own currencies based on the needs of their personal projects or businesses. When you create your own crypto, you can define its functionality to cater to your specific needs. For example, Burger King released its own token in Russia that customers can use to pay for burgers. On top of that, if you run an international business, using cryptocurrency lets you facilitate the way you manage financial flow with your clients, partners, and investors. You can send and accept crypto regardless of your geographical location.

- Adding value to your brand. By creating your own crypto, your company can catch up with the trend that such big names as Microsoft have implemented with the release of their coins. When you create your own crypto coin or token, you present your company as a futuristic and technologically advanced organisation that stands out from the competition. With your own coin or token, your business can give customers more freedom to choose their preferred payment method when ordering products or services from your company. You can also appeal to a wider range of clients and boost your company's appeal.

- Offering usefulness for businesses in need of financial funding. By creating your own coin or token, you can forget dealing with lots of paperwork, opting instead to support your preferred projects while simply sending digital currency. You can also welcome more investors to support your brand without sharing your business's ownership with investors when you launch your own cryptocurrency.

- Having a dedicated digital currency exclusively created for your company. This makes it easier and safer for your brand to work internationally. Companies often send and receive funds internationally. Whenever an international transaction hits your bank account, you need to pay taxes and transaction fees that vary depending on the country where a business operates and the bank it uses. You can change that with cryptocurrency. Blockchain technology makes cryptocurrencies decentralised, meaning it's nearly impossible for a financial authority or governmental institution to track your funds.

- Receiving unlimited funds fast and worry-free. Unlike fiat money, which takes time to get processed until it hits your banking account, cryptocurrencies are sent immediately to any crypto wallet owner. You can create an unlimited number of transactions and send them anywhere in the world without any limits or restrictions. Cryptocurrency transaction costs are relatively small and can't be compared to the high fees you pay for international transactions completed through your local bank.

- Completing transactions anonymously and transparently. All transitions that take place in blockchain networks are recorded and can't be changed. At the same time, it's almost impossible for someone to discover the addresses from and to which transactions were sent because crypto addresses are not confirmed publicly.

There are always two sides to a coin. In addition to the numerous remarkable advantages of using cryptocurrency, you should also beware of certain drawbacks. These include:

- The very limited number of countries that support digital coins. Despite growing interest in creating cryptocurrencies and enjoying the ability to send and receive funds freely, it will take time until more countries have the infrastructure, legally and otherwise, to use digital currencies.

- The cryptocurrency market's riskiness for big investments due to high volatility. Because of crypto's frequent ups and downs, this niche isn't very stable. Deciding to invest in crypto is a gambit because you never know how high its price may rise or how low it may fall.

- The chance of losing money due to a typo. Cryptocurrency transactions aren't reversible, so you need to double-check the cryptocurrency address you're sending funds to before you hit the confirm button. You can send a refund request, but you'll lose your money forever if it's declined.

- Permanently lost access to crypto funds due to a lost device or forgotten storage key. You may have already heard about horrible situations when crypto holders lose all of their funds because they simply lost or forgot their login credentials. It can happen to anyone. Play it safe when you change passwords; keep a copy of your login information in a secure place.

As you can see, the advantages of creating and using cryptocurrencies significantly outnumber the drawbacks. Unlike fiat money, which can be monitored and tracked by governmental and financial institutions, cryptocurrencies offer levels of anonymity every step of your way.

As a growing number of businesses adopt digital money, more people will be able to use crypto in more countries around the world. Moreover, more individuals and start-ups can create their own currencies to use within their projects or conduct international transactions. The best part is that everyone can create their own coin or token to match their business's needs with the required features.

Wrapping up this section, anyone thinking about creating their own crypto to reach their business goals should consider the advantages and disadvantages of cryptocurrency. Decide why your brand needs crypto, then proceed to the following guidelines on how to create your own crypto.

Ways to create your own crypto

Whether you want to create a coin or a token, there are several ways to create a cryptocurrency that you should be aware of. If you want to create a coin on an entirely new blockchain, you should develop the blockchain first. If you want to begin with a token, you can start off by forking an existing blockchain network.

Creating a coin won't likely be a suitable option for you if you're looking for a fast and simple way to create your own crypto. You'll need at least some basic coding skills or an experienced professional who's previously worked with decentralised technologies. The entire process of creating a coin doesn't take much time. You can even finish creating your coin in as little as five minutes, provided that you understand the code and know where to apply the needed modifications. The approach that many businesses opt for is copying Bitcoin's code and adding a new variable to it. More experienced users can modify the value. And that's it. You have a blockchain and coin ready to use.

One more issue you'll have to deal with using this method is maintaining, promoting and supporting the coin after you launch it. Many users prefer not to manage the whole blockchain's logic by themselves, instead choosing to hire a team of professionals who can provide them with the needed custom software development services. That costs more money but can save a lot of time at the end of the day.

Creating a token takes less development time and doesn't require as much spending as creating a new coin does. This is thought to be a more feasible way of creating your own currency, though it doesn't provide you with complete control over the blockchain.

Token creation involves less time and money because you build it on top of an existing blockchain while using the underlying technology's trust, popularity and consensus mechanism. One of the most popular examples of a strong, reliable blockchain is Ethereum, which lets your token run in a secure network that is protected from fraud and malware attacks.

Now, let's move to a comparison of the two most popular solutions for creating a cryptocurrency in a chart:

Creating your own crypto coin | Creating your own crypto token |

You need to create a new blockchain. | You can use an existing blockchain. |

You need to have specific coding skills or hire a professional blockchain expert. | You can independently create your own token using open-source code. |

The process of creating a new coin takes more time and money. | Token creation is more affordable and doesn't require huge investments. |

If creating your own token is what you're looking for, you should know that there are several blockchains that let you create tokens. The most popular solutions include Ethereum, NEO and EOS. These are relatively easy to use and don't require advanced coding skills to create their own cryptocurrency. Let's discuss and compare them in more detail.

Ethereum was the first blockchain in history to start offering the ability to create tokens. It's one of the most reliable and well-established solutions in the cryptocurrency market. When using Ethereum, you're supposed to create tokens based on the ERC-20 standard. The token creation process should be quick and worry-free, thanks to well-written documentation that is always at your disposal. Another thing worth mentioning is that a token based on Ethereum can only be written in Solidity programming language. You still have the option to use HTTP API to create decentralised applications in any programming language you choose.

NEO, on the other hand, lets you create your own token using the programming language of your choice. You can use Java, Python, C#, Kotlin, etc. NEO's blockchain is based on the NEP-5 standard and uses HTTP API for interactions.

The third option, EOS, is a highly scalable blockchain that can handle a vast number of transactions per second. It's one of the most preferred solutions for many individuals and businesses because of its affordable cost and the lack of truncation fees. To create tokens with EOS, you need to use the EOSIO.Token standard. Tokens can be created with C++ or other languages that comply with WebAssembly.

Here's a comparison of how to create a new currency with Ethereum, NEO and EOS.

Ethereum | NEO | EOS | |

Programming language | Solidity | Almost any high-level programming language, including C#, Java, VB.Net, F#, Kotlin, Python and others | C++ and other languages that comply with WebAssembly |

Token standard | ERC-20 | NEP-5 | EOSIO.Token |

Consensus | PoW before the switch to PoS | dBFT | DPoS |

Areas of application | Smart contracts | Smart economy, digital identity, digital assets | Smart contracts |

Number of transactions per second | 15 | 10,000 | 3,000+ |

Getting ready for the launch

Here's the focal point of this guide. When you decide to create your own cryptocurrency, you need to carefully think through the process from A to Z to achieve success with the efforts you apply. Make a mental plan and stick to it when you get to business. Jot down some notes on your phone to make sure that you don't miss any of the following steps.

- What's the value? In addition to the steps highlighted above and deciding on whether to create a coin or a token, your own cryptocurrency has to have a deeper meaning. For example, you may decide to create a decentralised application that would help individuals solve specific sorts of problems or target a selected audience. To appeal to your potential customers and get them interested in your cryptocurrency, you need to create a value proposition. If there's no value for your audience, the greatest idea will remain just an idea, and the time and money you spend creating your own crypto will all be for naught.

- Whom can you rely on? Hiring a development team is the most popular solution for individuals and businesses that don't want to get in the weeds with programming and coding matters. It'll take you less time but more investments to get started with your own crypto. Choosing a reliable development team matters the most in this case. Take your time to select the right software vendor with sufficient experience in blockchains and the cryptocurrency industry. It's always worth the investment if you find a reliable team of experts that lets you reap the rewards of their work in the shortest time possible.

- Is your project legit? Because fraudulent coin offerings have started to pop up more frequently on the web, investors have become more cautious and pickier when it comes to selecting projects worthy of their funds. To ensure that your project is legit, it's always a wise move to hire a trusted independent audit company to run an ICO or STO security audit.

- What are the rules for smart contracts? Most of the cryptocurrencies we've discussed were created to be used for smart contracts. You can create your own rules for smart contracts that will operate on the blockchain and feature pre-established rules representing the main idea behind the ICO/STO that can't be changed.

- Take the time to create a white paper. Besides showing that your web project is legitimate, a well-written white paper can appeal to potential investors while providing clear answers to such questions as:

- When will your cryptocurrency be released, and what problems will it solve?

- Who are your target audience and business niche?

- What makes your new crypto solution better than what's already available in the market?

- How are you going to spend the ICO/STO funds?

- How many coins/tokens will you issue?

- Who's on your team? What value can they bring to your project?

- ICO/STO marketing. Smart ICO promotion using social media, guest blogging, e-mail marketing and other digital advertising tricks can help you achieve broader exposure for your project, attract more investors and reach the right audiences that will derive the maximum value from using your coin or token.

- Create a strong online community and manage it 24/7. What Bitcoin, Ethereum, NEO and other top-rated cryptocurrencies have in common is their strong, active communities with whom they communicate and provide regular updates whenever something worthy of attention happens. Managing and growing a strong online community is a must if you want your crypto to become as popular as the previously mentioned solutions.

Now, let's move further and see how to create your own coin and token that will be trusted and supported in the cryptocurrency world.

How to create your own cryptocurrency

Step 1. Choose a consensus mechanism

A consensus mechanism is a fundamental protocol that regulates whether a particular transaction can be considered valid. All the nodes in the mechanism need to achieve a consensus, meaning they need to confirm if a transaction can go through. So, to get your blockchain operating smoothly, all the participating nodes should be verified as legitimate ones and added to the block.

There are different types of available consensus mechanisms for blockchains. Let's discuss the most popular options.

PoW

Proof-of-work (PoW) is the consensus mechanism that Bitcoin initially used. It's one of the most expensive options and requires a lot of energy and computer power to reach a consensus. The key idea behind the PoW consensus mechanism is that miners should prove the transactions in the blockchain network. Meanwhile, it makes the network more protected against hackers and malicious behaviour.

PoS

The proof-of-stake (PoS) consensus mechanism uses a random algorithm for consensus building. It gives mining power based on the number of tokens a miner has. The more tokens a miner owns, the more likely he/she will be selected to extract the next block. The main objective of the PoS consensus mechanism is that miners support the projects for the long term. Some of the most vivid examples of blockchain protocols using the PoS mechanism include Dash and NEO.

DPoS

With the delegated proof-of-stake mechanism, transactions are validated by groups of delegates selected by token owners. It's still a decentralised network since all users have the freedom to select miners who will be responsible for confirming transactions. Compared to PoS consensus mechanisms, DPoS has one major advantage: it's a more scalable solution that offers faster transaction verifications. Projects like EOS and Lisk are good examples of DPoS at work.

PoA

The proof-of-authority mechanism shares many similarities with PoS and DPoS. With PoA, new blocks in the chain are created only when groups of pre-selected reputable authorities (validators) produce blocks, thus adding computational power to the blockchain network. The identities of all validators are public and can be easily checked by any third party. The PoA mechanism is used primarily by newer blockchain start-ups and private organisations looking to build their own closed chains and that don't intend to invite a wider audience to participate.

Because of the predetermined nature of the PoA trust system, there have been some concerns regarding the centralised element of the algorithm. However, it can be appropriate for private blockchains such as Ethereum testnets like Rinkeby and Kovan.

Raft

Raft is a modern and less complicated distributed consensus algorithm that you can often find being used in RabbitMQ, Consul and other software. It was created to be easy to understand, making it available for wider audiences that are expected to develop consensus-based systems of higher quality than those available today.

The consensus protocol works by electing a leader in the cluster. The leader is responsible for accepting client requests and sending logs to the server. As part of the mechanism, the data flows in just one direction: from the cluster leader to the server.

Proceed to the next step once you decide which consensus mechanism you'd like to use for your blockchain.

Step 2. Choose a blockchain platform

The choice of the blockchain platform will depend on the consensus mechanism you picked. Take a look at the list of the most popular blockchain platforms and the consensus mechanisms each one uses:

- Ethereum uses proof-of-work (PoW).

- Waves use leased proof-of-stake (LPoS), which is a variation of proof-of-stake (PoS).

- EOSIO employs its advanced BFT-DPoS.

- BitShares uses DPoS.

- CoinList uses PoW.

- Hyperledger Fabric deploys Raft.

- HydraChain uses PoS.

Step 3. Design nodes

To understand what nodes are, think of a brick wall, where each brick represents a node that should provide support and security to the entire blockchain mechanism. A node is an Internet-connected device that is used to perform a wide range of tasks, including storing data, verifying transactions, completing transactions, etc.

When choosing the right nodes for the blockchain mechanism, you may consider choosing solutions that match the following criteria:

- In terms of permissions, you can choose from private, public and hybrid nodes.

- In terms of the hosting location, there are cloud-based nodes, on-premise nodes or a combined approach.

- Which operating system does the node use? The most common solutions include Windows, Ubuntu, Debian, CentOS, Fedora and Red Hat.

Step 4. Manage the internal architecture

Pay special attention to completing this step. If you make a mistake and set the wrong parameters, you won't be able to go back to make changes when the blockchain platform is up and running. Take your time and carefully consider the following factors:

- Define permissions by specifying who can access the data, send and validate transactions, create new blocks, etc.

- Determine what blockchain addresses will look like.

- Specify the format of the keys that will generate transaction signatures.

- Keep private keys protected while developing the system where they'll be stored and protected.

- Specify the number of keys the blockchain will need for transaction validation.

- Clearly set the rules that need to be followed when asset units are created and listed.

- Set the rules that should be followed when you need to create open asset units.

- Establish the maximum block size, the rewards that will be granted for block mining, the transaction limit, etc.

- Specify the procedure for blockchain participants to follow when signing the blocks they've created.

- Create the rules for a native digital currency used in the blockchain.

- Set the rules for how nodes in the blockchain will identify each other before connecting.

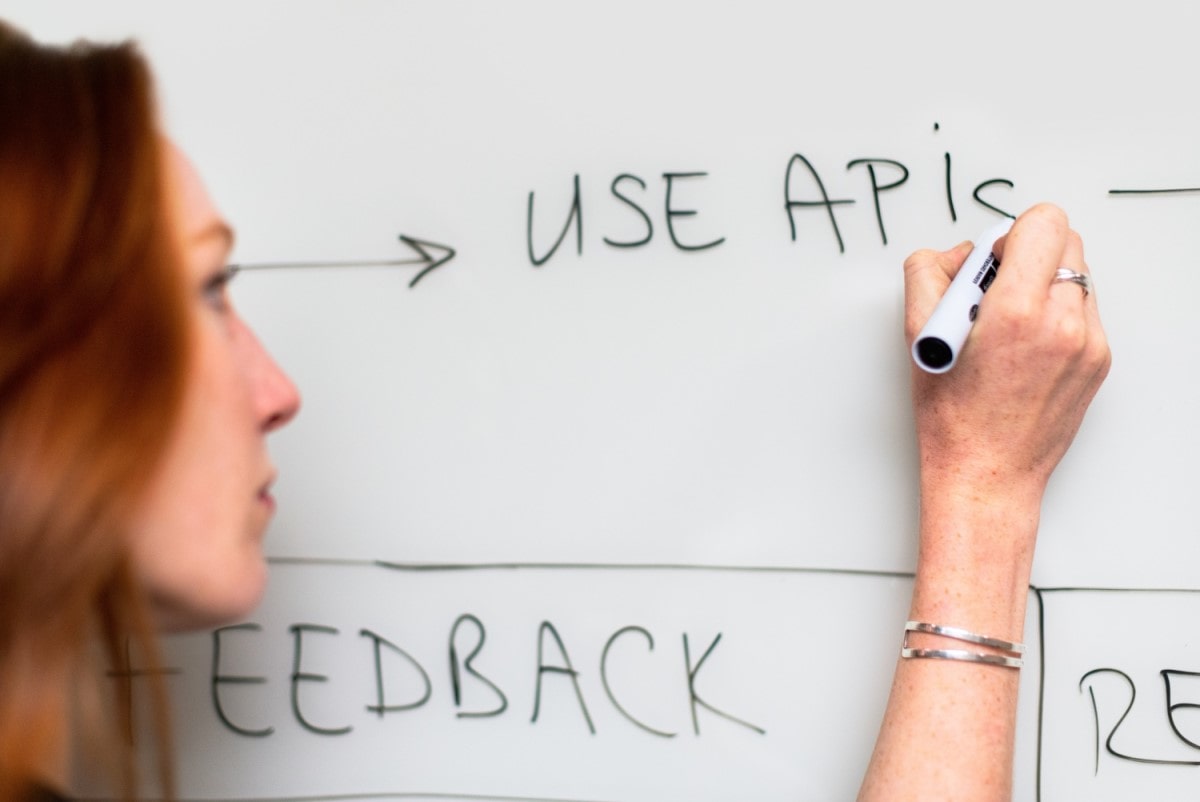

Step 5. Manage blockchain APIs

Not all blockchain platforms feature pre-built APIs. Pay attention to this factor when selecting your cryptocurrency's platform. If you find out that the chosen platform doesn't come with one, don't worry. There are many blockchain API providers you can choose from. We'll give you suggestions on the top five solutions that have proven to be the most useful for those creating their own crypto.

AN API (application programming interface) works as a connection between different user apps. For example, when you need to book tickets or a hotel room online, the API sends your request to the server that manages the necessary data and returns the result to you. APIs are widely used in developing mobile and web apps.

A blockchain API is an interface that manages communication between a blockchain node and a client network directly or by means of another service. For example, we can consider the way Bitcoin's exchange works and how the user app collects its data.

There are different API types in the cryptocurrency industry that handle transactions, analytics, security, account management, etc. Security APIs became especially important after the catastrophic hack of the Binance crypto exchange that resulted in $42M being stolen. After the incident, Binance and other crypto companies took immediate actions to keep their clients and funds more protected against hacks and malware attacks. Security means a lot in the crypto world, especially when it comes to APIs. Having said that, let's proceed to the list of the top five blockchain API providers you can totally rely on.

- NOWNodes is a blockchain-as-a-service solution that provides high-quality connections to more than 40 blockchains in a fast, reliable infrastructure.

- Coinbase API is one of the most reliable and secure solutions in the industry. Bitcoin, Litecoin and Ethereum use it. The blockchain API provider sends notifications on every transaction that takes place within the network. Both free and premium versions of the API technology are available. Coinbase's free tools have an hourly limit of 10,000 transactions. The Pro version offers a set of handy features like the ability to add programmatic trading to your network.

- BitCore features a toolset that fits almost any Bitcoin-related enterprise app. It's a native interface for Bitcoin that was developed by BitPay, a popular Bitcoin payment processor. The API provider runs on JavaScript and includes nodes, a Bitcoin chain explorer and a wallet. It also provides access to popular libraries. The modular structure lets you expand BitCore's features the way you want.

- Blockchain API features a community of over 25,000 developers. It's one of the oldest and most popular blockchain API technologies available in the market. It features APIs for payment processing, wallets, blockchain exploration and text queries.

- Factom is an innovative solution that hasn't been in the industry for long but has every chance of becoming more popular in the future. Their API seamlessly integrates with existing software and offers a handy tokenisation feature. With it, you can create tokens that represent real-world assets to trade over the network.

Step 6: Design the interface

To make sure that communication between the blockchain and its participants runs smoothly, you need to ensure that every network element is well-thought-out. That means the interface design, which covers such aspects as:

- The web, mail and FTP servers that your blockchain network uses

- The selected external databases

- The front-end programming languages that you use. They may be HTML5, CSS, Python, PHP, ava, C#, Java or Ruby.

Step 7. Cryptocurrency legalisation

When you go through all of the previously mentioned steps, it's vital to ensure your coin or token meets modern cryptocurrency regulations.

Step 8: Boost your blockchain

Don't stop once your crypto is all set up and launched. Take further efforts to promote it online and boost the blockchain by implementing it in the last-generation technologies like IoT, machine learning, cloud technologies, bots, biometrics and more.

How to create your own Bitcoin fork

Building your own blockchain from scratch normally requires a lot of time, skills and resources to get everything set up correctly and up and running smoothly immediately after its launch. That's why many individuals start looking for alternative ways of building their own blockchain. One of the most popular solutions is to create a Bitcoin fork.

A blockchain fork is essentially a software update. To get all elements of the blockchain network to work just the way it's supposed to, all blockchain nodes need to run the same software version. Otherwise, it'll be difficult or impossible to access the shared ledger to verify transactions and ensure the highest security level for the blockchain network. So, every time you decide to add new features, you should create a new fork.

There are two types of forks available:

- For hard forks, 90-95% of blockchain nodes must be updated. Otherwise, non-updated nodes won't be accepted by the system.

- The situation is not as critical for soft forks. To get the system operating, they require that the majority of nodes use the latest version. Nodes that aren't updated can continue operating on the old version of the software.

Following the same logic, Bitcoin forks are changes applied to the Bitcoin network protocol. Creating Bitcoin forks is the ultimate choice for users and businesses who don't want to build crypto from scratch because they can use the open-source protocol and add new features.

There are two options that you can choose from when you decide to create a Bitcoin fork.

The first solution is to use a fork coin generator like Forkgen. It's the simplest and fastest method for creating a new fork coin when generating a unique Bitcoin fork offshoot by simply adjusting the rules and network parameters.

The second option takes more time because you have to create a Bitcoin fork yourself. The following steps are required:

- Download Bitcoin code from GitHub and compile it on your PC.

- Customise Bitcoin's code doing a reconfiguration job.

- Publish the results of your programming efforts back to GitHub.

- Attach a white paper and success stories of the Bitcoin fork.

Creating Bitcoin forks is the right choice for you if you're looking to create your own crypto while leveraging the demand and social capital around Bitcoin's name. Some of the most popular examples of Bitcoin forks include Litecoin, Bitcoin and Gold Mine, among many others.

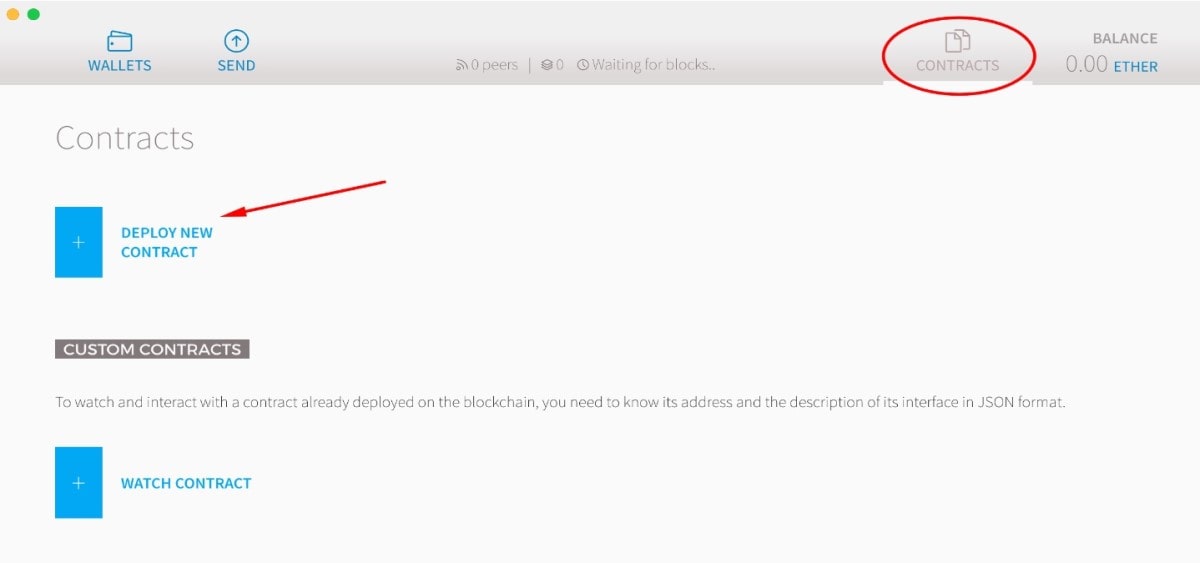

How to create your own Ethereum token

Another solution you can use to create your own crypto is building an Ethereum token. To get started, you need to use the ETH wallet app, which can be downloaded from GitHub. When you open the wallet, you'll see the 'Contracts' icon at the top of the app. Click or tap it to find the 'Deploy new contract' option. Click/tap it.

In the 'Solidity contract source code' field, copy and paste the following code:

contract MyToken { /* This creates an array with all balances */ mapping (address => uint256) public balanceOf; function MyToken() { balanceOf[msg.sender] = 21000000; } |

Here, "mapping" means an associative array that associates balances with addresses (all addresses use the hexadecimal format). "Public" means that everyone within the network can see your balance.

When adding the piece of code above in the 'Solidity' field, your initial token supply is set at 21 million. You can change this amount to any number you want.

Next, select the 'Contract byte code' option to see a drop-down window. You'll see 'My Token' there. Select it.

By completing all of these aforementioned steps, you'll get a smart contract linked to a token. However, you can't move it yet. Copy and paste the following lines of code in the 'Solidity' field to be able to move the token. (You can probably make out what this code does, even if you don't have special coding skills.)

/* Send coins */ function transfer(address _to, uint256 _value) { /* Add and subtract new balances */ balanceOf[msg.sender] -= _value; balanceOf[_to] += _value; } |

Now, you can send tokens, and the suggested values will be added where necessary.

There are also scenarios when users try to send more tokens than they possess. To stop the smart contract from executing when that happens, copy and paste the following lines of codes to the 'Solidity' field.

function transfer(address _to, uint256 _value) { /* Check if sender has balance and for overflows */ require(balanceOf[msg.sender] >= _value && balanceOf[_to] + _value >= balanceOf[_to]); /* Add and subtract new balances */ balanceOf[msg.sender] -= _value; balanceOf[_to] += _value; } |

Next, we need to add some basic information related to our smart contract. You can add the following lines to the 'Solidity' field:

/* Initialises contract with initial supply tokens to the creator of the contract */ function MyToken(uint256 initialSupply, string tokenName, string tokenSymbol, uint8 decimalUnits) { balanceOf[msg.sender] = initialSupply; // Give the creator all initial tokens name = tokenName; // Set the name for display purposes symbol = tokenSymbol; // Set the symbol for display purposes decimals = decimalUnits; // Amount of decimals for display purposes } |

After completing all of these steps, we need to create 'Events' for the token. These are empty functions that enable Ethereum wallets to track smart contract activities. The title of every event should begin with a capital letter. To add an event, copy and paste the following code:

| event Transfer(address indexed from, address indexed to, uint256 value); |

Also, add the following lines within the 'Transfer' function:

/* Notify anyone listening that this transfer took place */ Transfer(msg.sender, _to, _value); |

That's pretty much it. Now, all you need to do is deploy the token, and it's ready to go.

In your Ethereum wallet, navigate to 'Contracts' and click/tap 'Deploy new contract'. Copy and paste the token source from here. On the right side of the wallet app, there are such parameters as _supply, _name, _symbol, _decimals, which you can tweak however you like.

The cost of creating your own crypto

Cryptocurrency is synonymous with money. You can create your own crypto to support your own app or support an ICO project. The purposes of creating your own coin or token may vary. However, there is one thing that all such initiatives have in common: money matters.

Did you decide to create your own cryptocurrency all alone, or will you use the help of a professional team of experts? Whatever road you choose, you should know how much money it will cost to achieve the goal.

The cost of creating your crypto depends on many factors, including whether you're building a new coin from scratch or using an existing blockchain network as the underlying technology for your token. It's up to you to decide which option you choose. Keep in mind that creating your own cryptocurrency from scratch is always more costly than building one on an existing blockchain. You should also be ready to pay more if you're working with a team of cryptocurrency experts who take care of everything for you. This option will come in handy for companies and well-established businesses rather than individuals that want to play around with their own form of digital money.

Anyway, regardless of the option you choose, let's see how much it may cost you to create your own crypto.

Stage | Time | Money |

Development | Depends on the project: it normally takes from 15 minutes to 5-6 months | $1,000-$100,000+ |

ICO Security Audit | 30 days on average | $3,000-$10,000 |

White Paper and Documentation | 24-50 hours | $5,000 to $7,000 (~$500 per page) |

Promotion | 1 week - 30 days | $10,000 per week |

Coin Listing | 1-2 weeks | $5,000+ |

What can I do with my cryptocurrency?

It's a logical question that should come to a crypto developer's mind before completing all the aforementioned steps and getting their currency up and running. How do you store it? Where can users spend it? Which payment processors will accept it? Let's take a look at the answers to these questions.

Using digital money is similar to using fiat money. You can store it in a bank or your crypto wallet. You can send, receive or exchange it whenever you wish. You can also use a credit or debit card to spend your digital money.

You can use a crypto wallet on your smartphone, laptop or desktop and access your money whenever and wherever you wish. You can also store your cryptocurrency electronically while using a portable hardware device or a compact USB device. A mobile wallet lets you transfer and spend your cryptocurrency on the go from your smartphone.

You may also come across some paper wallet outlets that work similarly to regular cash. These options provide you with a piece of paper that has a couple of QR codes on it. One QR code is intended to be used for receiving crypto, while the other is used for spending your digital money.

Spend cryptocurrency using debit cards

One of the most common ways to spend cryptocurrency is to connect it to your Visa or Mastercard and use that card wherever it's accepted. Be careful when deciding to spend your crypto this way because different cryptocurrencies are supported by different debit cards. Here are some of the cards that support Bitcoin:

- BitPay is a Visa debit card that lets you upload bitcoins to its balance from your virtual wallet. The card lets you spend bitcoins just like you spend regular money at local retail stores.

- Bitstamp provides you with a plastic prepaid debit card that you can fund with bitcoins.

- CoinsBank provides you with four different types of cards, each of which comes with its own fees and features. When you choose it to spend bitcoins, the chosen card will automatically convert Bitcoin into US dollars and British pounds.

- Coinizy is a virtual Visa card that you can load with bitcoins and use for online payments or PayPal.

- Cryptopay.me offers prepaid cards. It's an appealing option to many crypto holders because of its low commission fees. Both plastic and virtual cards work with GBP, USD and EUR.

- SatoshiTango allows you to buy bitcoins and then transfer them to debit cards.

- Shift Card offers a Visa card that lets you spend crypto online and offline by connecting the card to Coinbase.

- SpectroCoin provides a prepaid debit card that can be used in USD, EUR or GBP. It lets you cash in bitcoins at any cash machine in the world.

- TenX offers a virtual wallet that you can use to spend bitcoins.

- Uquid cards are available to users who have created a Uquid account. The card works with GBP, EUR and USD.

- Wirex offers an online banking app specifically created for Bitcoin. You can store bitcoins in the virtual wallet and use the debit card to spend bitcoins in dollars.

- Xapo users can connect their Xapo accounts to debit cards that can then be used to complete transactions online or withdraw bitcoins as fiat money.

Places to spend cryptocurrency directly

Using credit and debit cards to spend crypto is one of the most convenient ways to use your digital currency. However, it involves extra expenses since you need to pay fees for every transaction. These fees may vary depending on the bank and debit card you choose.

Another solution you can opt for is spending your crypto online. Several retailers have already started to accept digital money as a form of payment. They also have fees, but in many cases, the charges are lower than what you would pay to withdraw money from debit cards.

- eGifter is a website where users can buy gift cards and use bitcoins to pay for their purchases.

- Expedia is a travel booking company that lets you book hotels and pay in Bitcoin.

- Fancy.com works similarly to dropshipping sites. It's an intermediary between a customer and a seller that features an enjoyable Pinterest-meets-Facebook-inspired feed, where customers can pay with bitcoins.

- Microsoft lets you deposit bitcoins to your account and use them in the Windows and Xbox stores.

- NameCheap services will come in handy for individuals and business owners looking to launch new websites or set up a new domain name. You can pay for the service with bitcoins.

- NewEgg features an impressive collection of the most innovative tech gear. You can use your digital wallet to pay for gadgets with bitcoins.

- Overstock was one of the first online retail stores to start accepting bitcoins. It uses Coinbase to process digital currency payments.

- PizzaforCoins allows you to pay for pizza from your preferred pizza joint while paying with digital money.

- Shopify, one of the leading eCommerce platforms used by businesses of any scale, lets companies accept Bitcoin payments for the products and services they sell.

- The Square payment app has rolled out the option for customers to purchase products and services with cryptocurrencies.

- Streetwise lets you invest in property with Bitcoin and Ethereum. Streetwise's escrow agent Prime Trust allows you to easily process your payment to the seller. You can also use the iOS app that allows you to invest your funds and view your investment in real-time.

- One of the leading payment processors, Stripe, also lets companies integrate Bitcoin as a payment method on their websites.

- Save the Children lets you support and help at-risk kids around the world while making donations in bitcoins.

- Wikimedia lets you send donations in Bitcoin to support the company behind Wikipedia.

With the growing demand and adoption of cryptocurrencies worldwide, the list of companies and websites where digital currencies can be spent online is growing bigger every day. More and more modern businesses are supporting the trend of letting users pay with digital money like Bitcoin and Ethereum, a phenomenon that's extending to not-for-profits, small businesses and large retailers.

As more online payment processors adopt cryptocurrency as a payment option, paying for goods and services with cryptocurrency is becoming increasingly easier. There's no more need to exchange digital currencies because dedicated apps can handle this procedure for you.

Creating your own crypto: Is it worth it?

There are many factors involved in the process of creating your own cryptocurrency. Coding is the most time-consuming and laborious part. It requires special knowledge, skills and experience to be done properly.

The process may take as little as half an hour to create your cryptocurrency from scratch, provided that you have certain experience in this field. If you don't not, you can opt to create a new token based on an existing blockchain network like Ethereum. This takes less time and is a more cost-effective solution for users of all skill levels.

You can also hire a dedicated team of crypto specialists to set up the digital currency for you. It'll cost more than creating the crypto on your own, but it's a great option for businesses that don't want to get their hands dirty with coding.

Ultimately, you decide which way to go. Whichever way you go, the results are worth the effort.

Tags

Try our Bitcoin Cloud Miner and get additional crypto rewards based on your trading volume. It's immediately available upon registration.

Try our Bitcoin Cloud Miner and get additional crypto rewards based on your trading volume. It's immediately available upon registration.