The 2023 crypto market in five charts

The crypto industry saw plenty of events this past year. We've selected five of the most illustrative charts to show what the year looked like.

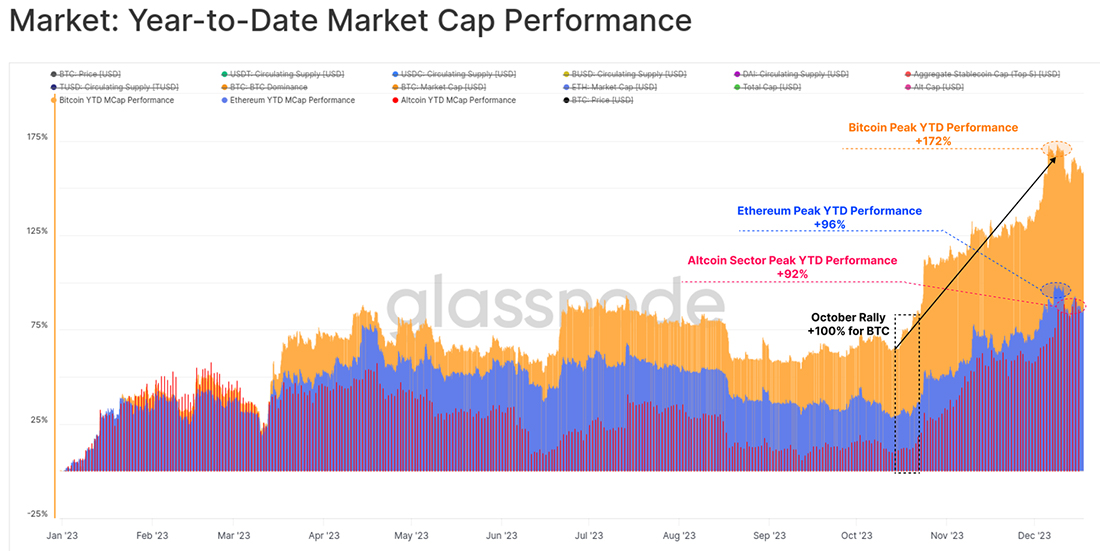

The rise of Bitcoin. This year, Bitcoin's market capitalisation jumped 172%, outpacing altcoins by almost double in terms of growth rates. The autumn saw strong momentum when the last arguable obstacle to approving spot ETFs in the US collapsed. On 13 October, the deadline for the SEC to appeal Grayscale's decision to convert the Bitcoin trust fund into a spot ETF expired.

Institutional capital inflows. October saw another turning point in the futures market when open interest on the CME exceeded open interest on Binance for the first time. The Chicago Exchange is now headed towards breaking the all-time high of $5.5 billion set in October 2021. All of this shows the genuine interest of institutional capital in cryptocurrency.

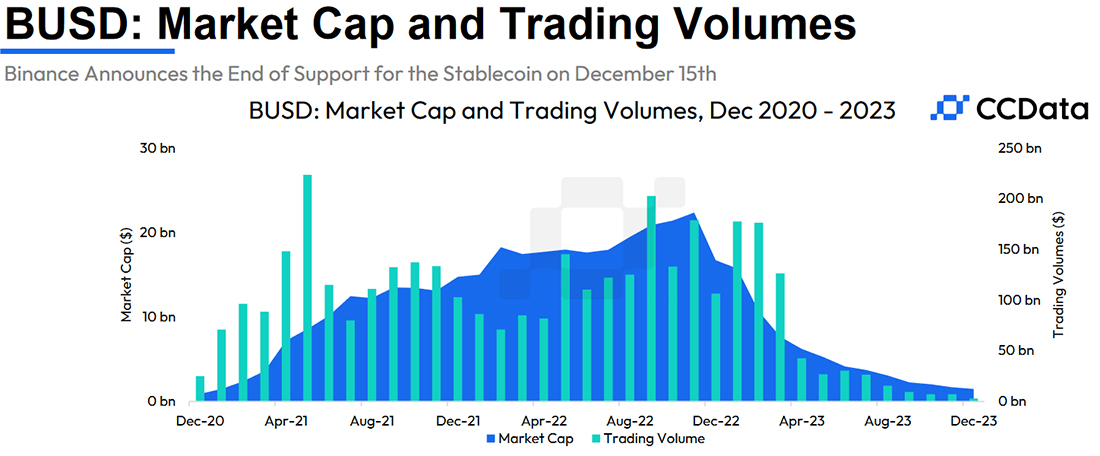

BUSD's decline. US regulators' displeasure with Binance resulted in claims against the issuer, Paxos, for minting the third-largest stablecoin. It was the most stable coin of all, according to S&P Global. At its peak, BUSD's capitalisation exceeded $20 billion, and its monthly turnover was $200 billion. Binance has already stopped supporting the coin, and Paxos will halt operations in February 2024.

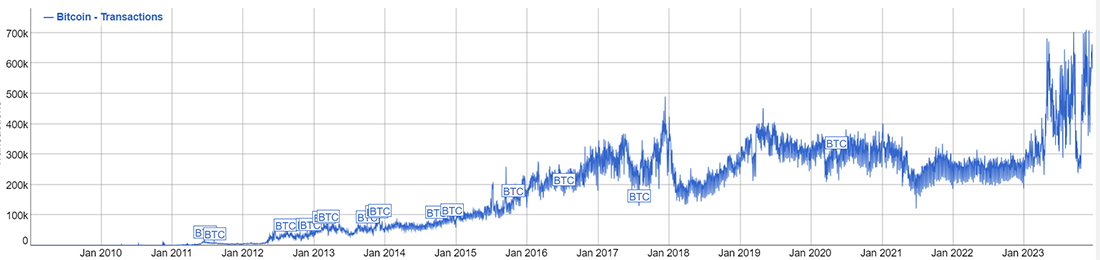

Ordinals. In February, Casey Rodarmor presented the Ordinals protocol, which allowed digital objects to be exchanged over the Bitcoin network. The innovation later spread to other networks. At first, users were interested in images, but since May, interest has shifted towards quasi-tokens. There are now between 180,000 and 360,000 transfers per day involving Ordinals. As a result, the total number of transactions in Bitcoin (and not only in this network) has reached all-time highs.

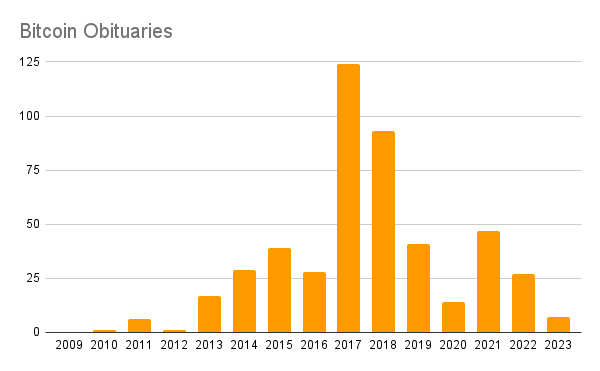

Growing acceptance of Bitcoin in 2023. Over the past 10 years, the cryptocurrency has been deemed dead in the media and labelled a pyramid scheme or a scam the least number of times. Delving into the details, Bitcoin has increasingly fewer obvious opponents.

Recognising Bitcoin as an investment asset, prominent financiers such as Larry Fink, head of the world's largest investment company BlackRock, and Stanley Druckenmiller, one of the world's most effective money managers, have spoken out in its defence this year.

This year turned out to see a host of events that, for the most part, were positive for cryptocurrencies. The new year, 2024, is expected to be no less exciting.

StormGain Analytical Group

(platform for trading, exchanging and storing cryptocurrency)

Tags

Try our Bitcoin Cloud Miner and get additional crypto rewards based on your trading volume. It's immediately available upon registration.

Try our Bitcoin Cloud Miner and get additional crypto rewards based on your trading volume. It's immediately available upon registration.