Escalation of the Binance vs SEC conflict

The SEC sued the crypto exchange and its CEO Changpeng Zhao for violating a number of US laws. These include the parent company (Binance Ltd) accessing American clients' funds, mixing client funds with company funds, violating the Securities Act (the SEC recognises a number of cryptocurrencies as securities) and misleading investors.

The regulator requested an extensive list of documents to conduct its investigation and received 220 documents that "consist of unintelligible screenshots and documents without dates or signatures", the SEC claimed. In response to a request from the SEC for some documents, the crypto exchange's subsidiary, BAM Trading, refused to provide them, saying that they simply didn't exist. However, the regulator managed to receive over 6,500 documents from the company that audited BAM.

The regulator has also called Binance US executives as witnesses and is particularly interested in the testimony of CEO Brian Schroeder. Instead of top executives, the crypto exchange provided mid-level managers and stated that the whereabouts of Schroeder, who abruptly resigned on 12 September, were unknown.

Since filing the lawsuit in June 2023, 10 top executives have resigned from the crypto exchange:

- Senior Director of Investigations Matthew Price

- Global Vice President of Marketing & Communications Steve Milton

- General Counsel Han Ng

- Chief Strategy Officer Patrick Hillmann

- Senior Vice President Stephen Christie

- Head of Asia and the Pacific Region Leon Fung

- Head of Product Mayur Kamat

- Vice President for Eastern Europe, Turkey, CIS, Australia and New Zealand Gleb Kostarev

- Executive Vice President Helen Hai

- US division CEO Brian Schroeder

On 15 September, the SEC accused the cryptocurrency exchange and CEO Changpeng Zhao of withholding information and obstructing the investigation. The regulator petitioned the court to conduct a forensic audit, subpoena key witnesses, and issue a court order to provide all requested documents.

A major hitch for the regulator is the link between Binance US and Ceffu. Binance US claims that it only used Ceffu as a software provider. However, prior to February 2023, Ceffu was called Binance Custody (legal name: Bifinity). In financial reports, Changpeng Zhao is listed as the sole shareholder.

The SEC claims that US funds could flow out through Ceffu and that the company plays a much larger role than just that of an "equipment provider". The regulator needs the requested documents and testimony that Binance has persistently refused to provide in order to confirm the ties between the two entities.

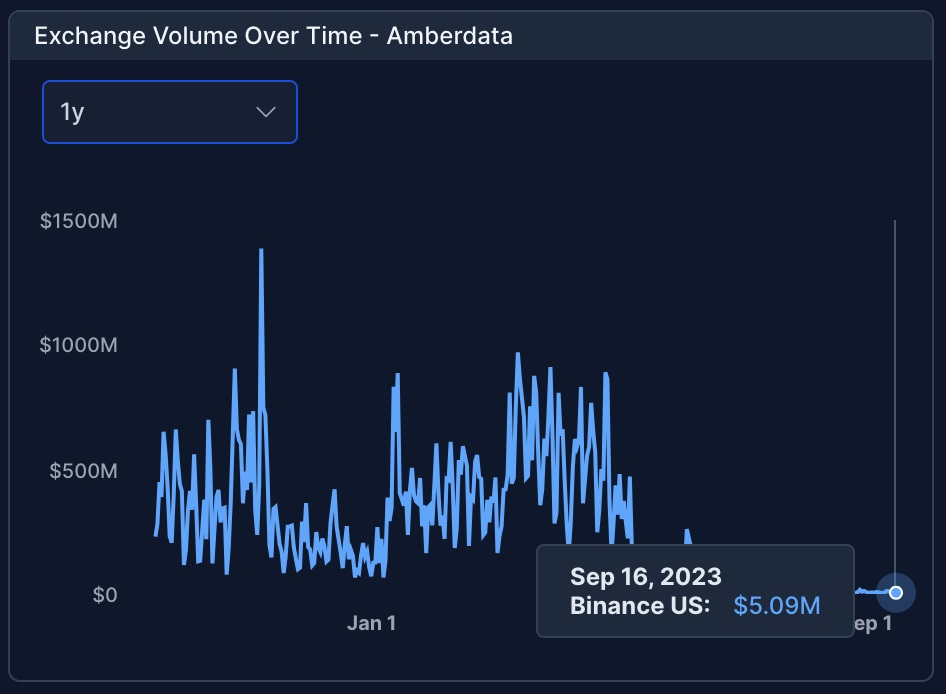

Due to the controversy and some restrictions imposed, there has been a significant outflow of employees and clients from Binance US. In one year's time, the exchange's turnover dropped 50-fold from $230 million to $5 million.

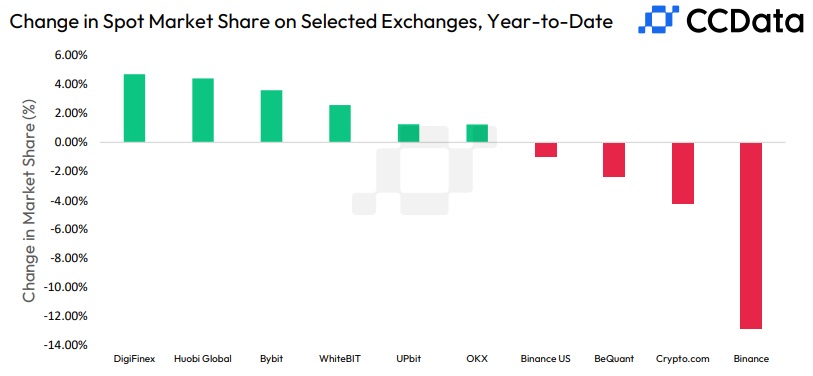

The problems also affected the international division, which saw the largest decline in market share among major players.

Binance's own coin, BNB, also went underwater this year and is trading at a 12% discount.

For its defence strategy, Binance decided to drag the trial out and failed to provide the requested documents, calling the SEC's requirements "unduly burdensome".

StormGain Analytical Group

(platform for trading, exchanging and storing cryptocurrency)

Tags

Try our Bitcoin Cloud Miner and get additional crypto rewards based on your trading volume. It's immediately available upon registration.

Try our Bitcoin Cloud Miner and get additional crypto rewards based on your trading volume. It's immediately available upon registration.