Ethereum developers raise the alarm about too many validators

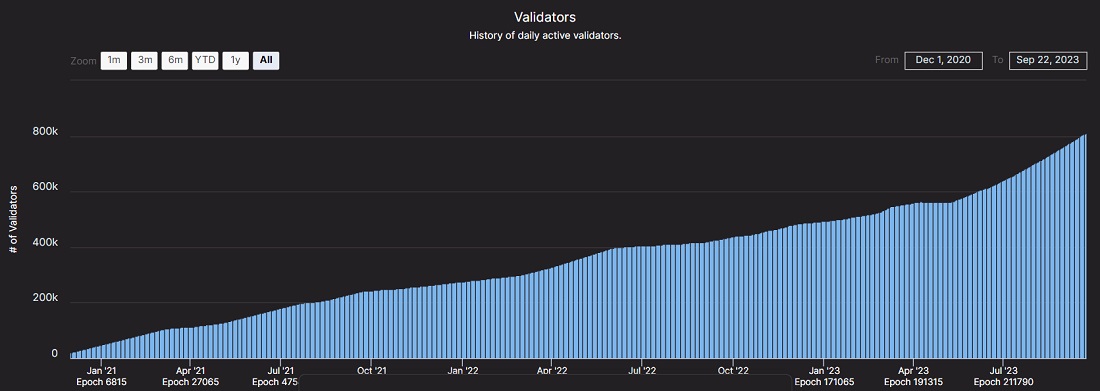

After the switch to PoS, the network began to rely on validators instead of miners, and users were happy with the opportunities to make passive income. Ethereum staking became so attractive that even pressure on the staking programme in the US and its rejection by some crypto exchanges didn't affect the increase in the number of validators. There are now over 800,000 validators, and the number is expected to reach 1 million in November and 2 million by mid-2024.

On the one hand, a large number of validators provide a high degree of decentralisation and network security. It also supports ETH's value since the reduction in the coin's circulating supply increases deflationary pressure.

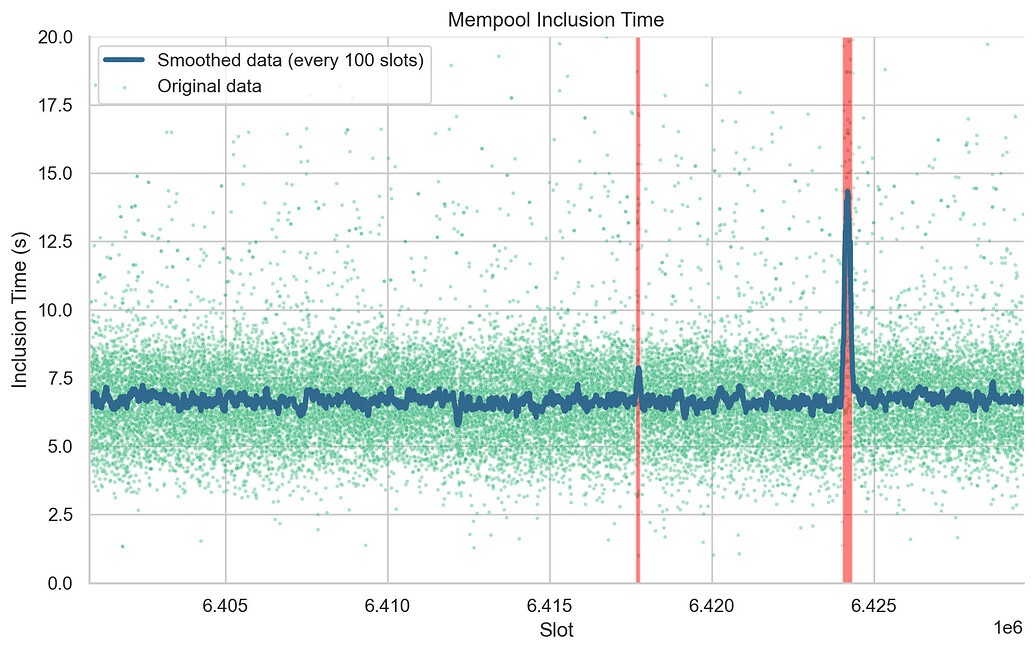

On the other hand, the load on the network is increasing since participants have to exchange messages to validate blocks. Sometimes, this causes full-scale failures and delays in completing transactions, just like what was seen in May 2023 (read more on the issue in the developers' forum).

ETH's developers are looking for ways to reduce the inflow of validators. The first method, which has already been included in the new update, is to limit validator activations to 8 per epoch. The current number is 12 and could be expanded dynamically. The update is due to arrive in late 2023 or early 2024.

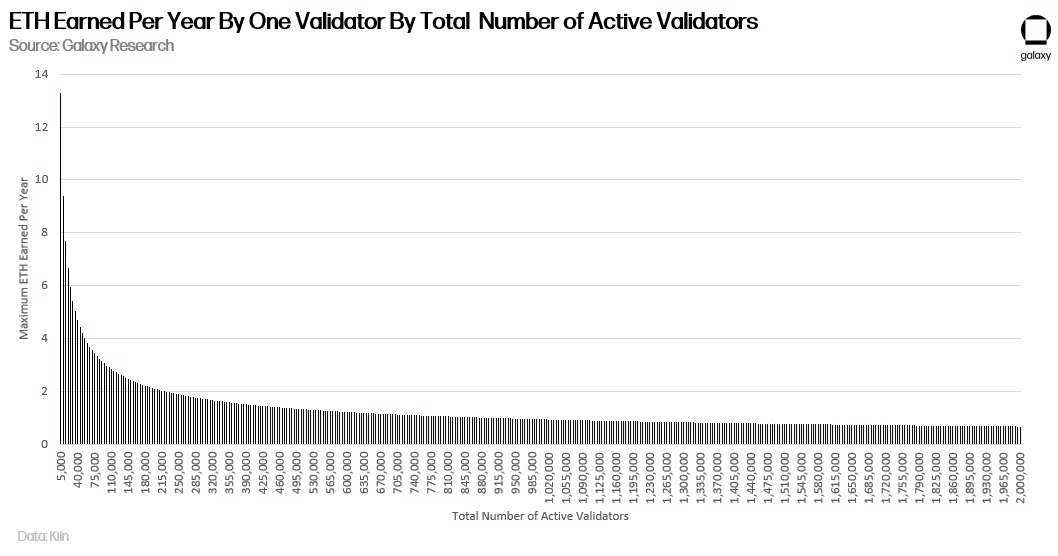

The limitation on the inflow of validators will give developers additional time to come up with a solution. One promising option is to cut the profitability of staking by limiting the number of coins staked as opposed to the number of validators (as is the current situation).

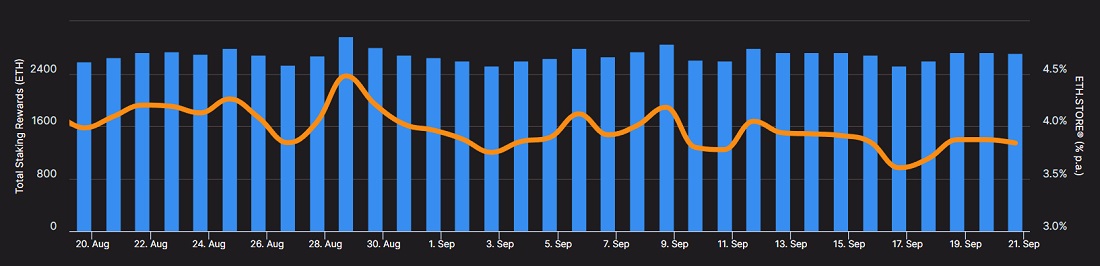

In other words, the more ETH is staked, the lower the profitability is. There are currently 27 million ETH, or 23% of the total supply, staked on the network, and the yield is 3.8% APY.

Another thing being considered is the introduction of a floating minimum balance with the exclusion of small players during periods of high network loads, the introduction of fines when exceeding the maximum number of validators, and the differentiation of remuneration depending on the amount each validator stakes.

Some methods are difficult to implement, while others lead to increased centralisation. This is exactly why developers need a delay to make an informed decision.

StormGain Analytical Group

(platform for trading, exchanging and storing cryptocurrency)

Tags

Try our Bitcoin Cloud Miner and get additional crypto rewards based on your trading volume. It's immediately available upon registration.

Try our Bitcoin Cloud Miner and get additional crypto rewards based on your trading volume. It's immediately available upon registration.