Ethereum is losing influence in the stablecoin market

Many have high hopes for Ethereum in response to the launch of spot ETFs, but the list of the network's internal problems continues to grow. In addition to increased centralisation, excessive MEV influence, high fees and excessive validators, the network is now seeing lower practical use.

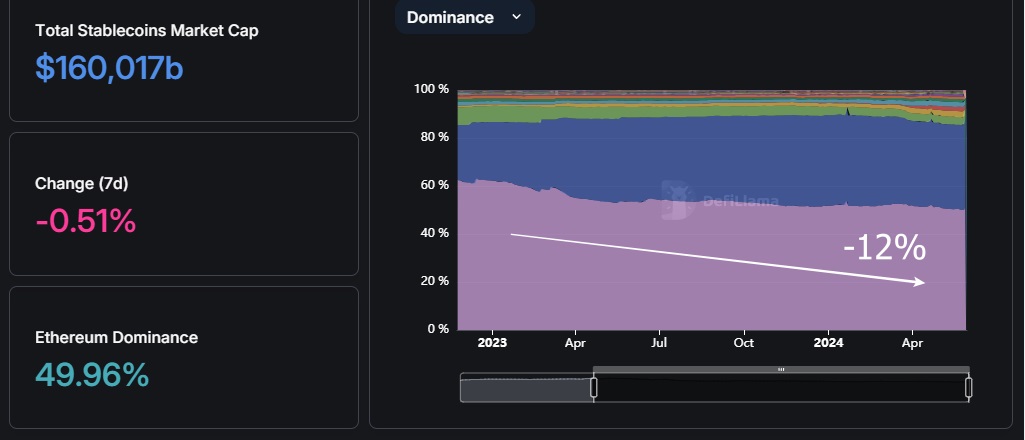

One of the key uses of smart contract-enabled blockchains is for stablecoin transactions. At first glance, Ethereum is doing well since the network's stablecoin capitalisation increased by 17.8% to $80 billion in 2024.

However, at the same time, the segment's total capitalisation jumped 23.1%, while Ethereum's price jumped 65.4%. In fact, the network is losing the weight of its share, especially in terms of ETH.

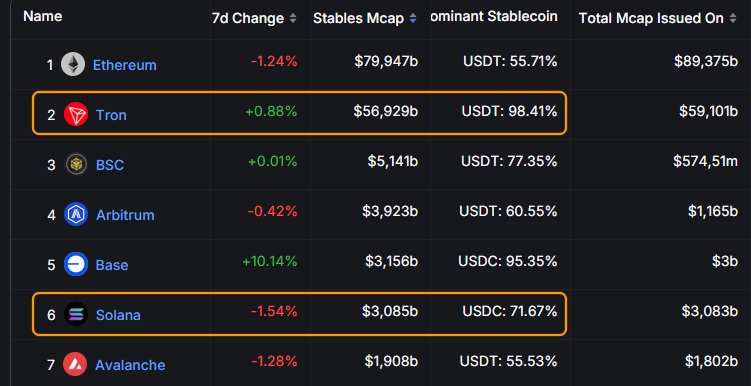

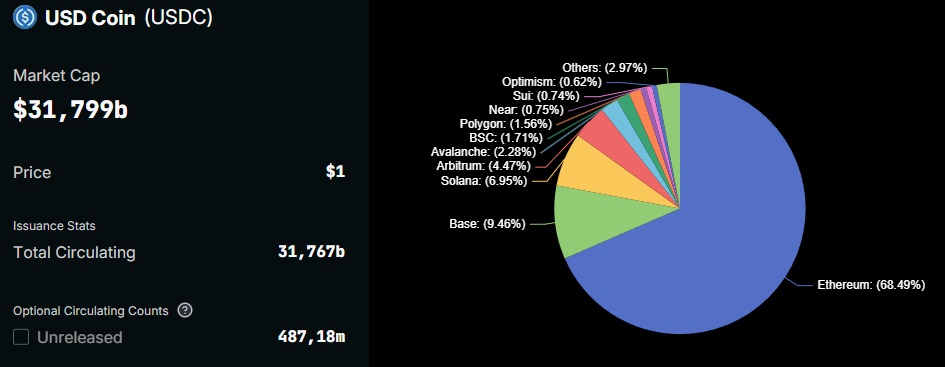

Two trends led to this. In terms of Tether (USDT), interest shifted to Tron. For Circle (USDC), interest shifted to Solana. These networks beat Ethereum in terms of fees and transaction speed but are inferior in security and uptime. The latter applies more to Solana.

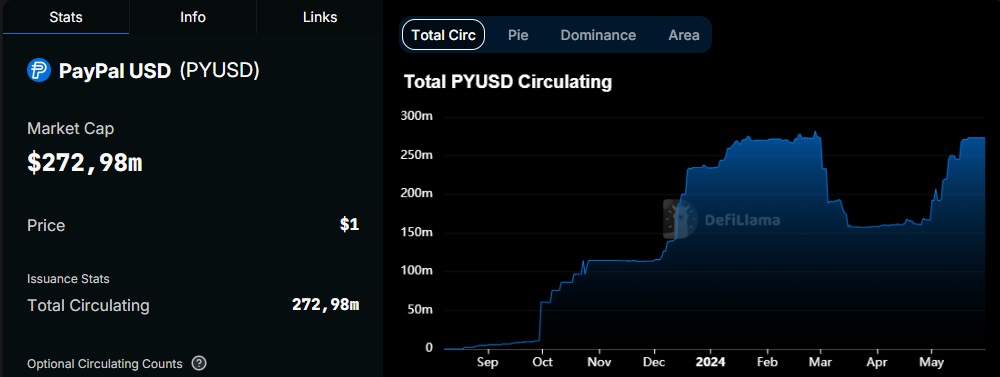

However, over time, more and more projects are turning a blind eye to technical risks in favour of low fees. The other day, PayPal announced the upcoming minting of the PYUSD stablecoin on Solana. The same coin debuted a year ago on Ethereum. This is another breakthrough for PayPal after it launched an interbank exchange pilot project with Visa.

Ethereum's decreasing relevance as a stablecoin operator led to a decline in its share of the relevant segment, going from 62% to 50% in a year and a half.

Competition is growing, and Ethereum's developers aren't managing to resolve old problems before new ones pile up. If the trends continue, it will be increasingly difficult for the altcoin to maintain its leadership and move the way investors would like to see it move every year.

The only caveat to the conclusion is the development of Layer-2 (L2) networks, which conduct fast and cheap transactions, with Ethereum (L1) used as a security guarantor.

For example, Base's share of USDC's capitalisation has risen from 0.6% to 9.5% over the past five months, pushing Solana into third place. However, in this case, Ethereum's relevance becomes dependent on the success and loyalty of third-party projects.

StormGain Analytical Group

(platform for trading, exchanging and storing cryptocurrency)

Tags

Try our Bitcoin Cloud Miner and get additional crypto rewards based on your trading volume. It's immediately available upon registration.

Try our Bitcoin Cloud Miner and get additional crypto rewards based on your trading volume. It's immediately available upon registration.