Ethereum lags behind Bitcoin because of the Shanghai threat

Bitcoin was up 40% in January, while Ethereum rose by just 32%. The lag of the largest altcoin is due to the upcoming Shanghai hardfork, an event that will see 16 million ETH (~$27 billion) unlocked for withdrawal.

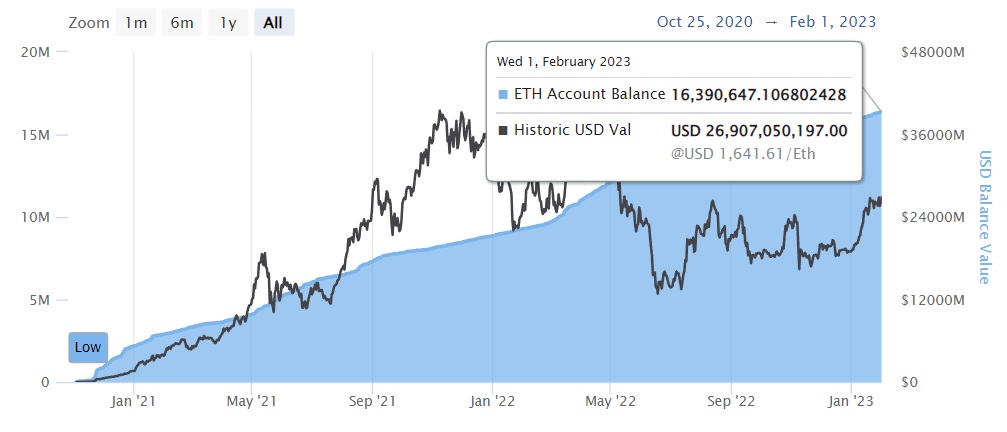

In November 2020, a deposit contract was launched to attract validators and switch to PoS when the necessary liquidity is reached. Ethereum has since attracted 16.4 million ETH, or 13. 8% of the total supply.

Staking yields were declining with the influx of validators and are now no more than 5%, and deposited funds are still staked. It'll only be possible to queue up for withdrawal after the Shanghai hardfork.

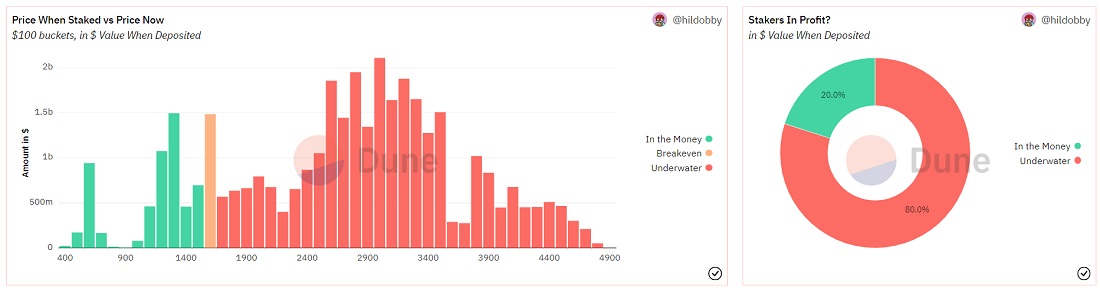

Despite a good start in 2023, 80% of validators are still suffering unrealised losses. Meanwhile, Ethereum lags behind Bitcoin and other promising altcoins. The annual return of 5% doesn't cover the difference, which may be disappointing for some investors.

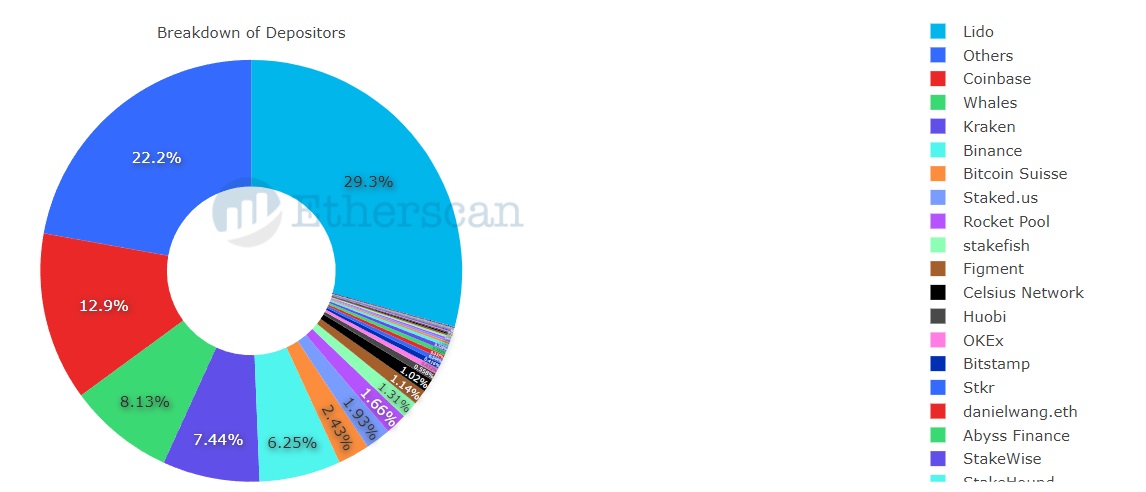

To make matters worse, the external backdrop for Ethereum hasn't changed for the better since the switch to PoS. First, the requirement for validators to deposit funds in blocks of 32 ETH led to the development of pooling services. As a result, the top four participants (Lido, Coinbase, Kraken and Binance) hold a 56.2% share.

Increased centralisation has led to increased censorship. Since last October, the percentage of transactions approved by the US Treasury Department's Office of Foreign Assets Control (OFAC) has exceeded 60%. One of the largest pools, AntPool, has refused to support ETH 2.0, citing the risk of transaction censorship.

Second, on the day of the move to the new protocol, the SEC chairman announced that he would seek security status for Ethereum as users had the opportunity to generate a passive income via staking. Regulatory pressure on Ethereum will increase if the SEC wins its court case against Ripple about whether the coin is actually a security. The judge is due to deliver the verdict this year.

Summing up the risks involved, some investors can't wait for the restrictions to be lifted to get out of ETH. The impact of unlocking on its price will be stretched over time, as validators will need to queue up to avoid both a collapse in price and a liquidity crisis. The Shanghai hardfork is scheduled to take place in March 2023.

StormGain Analytics Team

(a cryptocurrency trading, exchange and storage platform)

Tags

Try our Bitcoin Cloud Miner and get additional crypto rewards based on your trading volume. It's immediately available upon registration.

Try our Bitcoin Cloud Miner and get additional crypto rewards based on your trading volume. It's immediately available upon registration.