Ethereum outflow hits four-year high

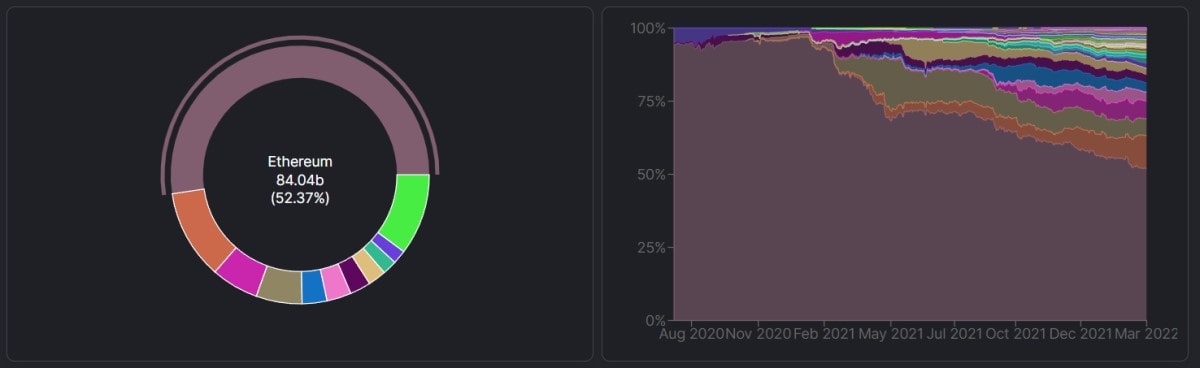

Crypto investors hope that Ethereum's long-awaited transition to the proof-of-stake protocol will take place this year. This will save the network from expensive fees and allow it to compete with faster blockchains. Ethereum has already reduced its share in DeFi from 96% in January 2021 to the current 52%, and if Vitalik Buterin delays the move again, the network risks losing leadership in key areas.

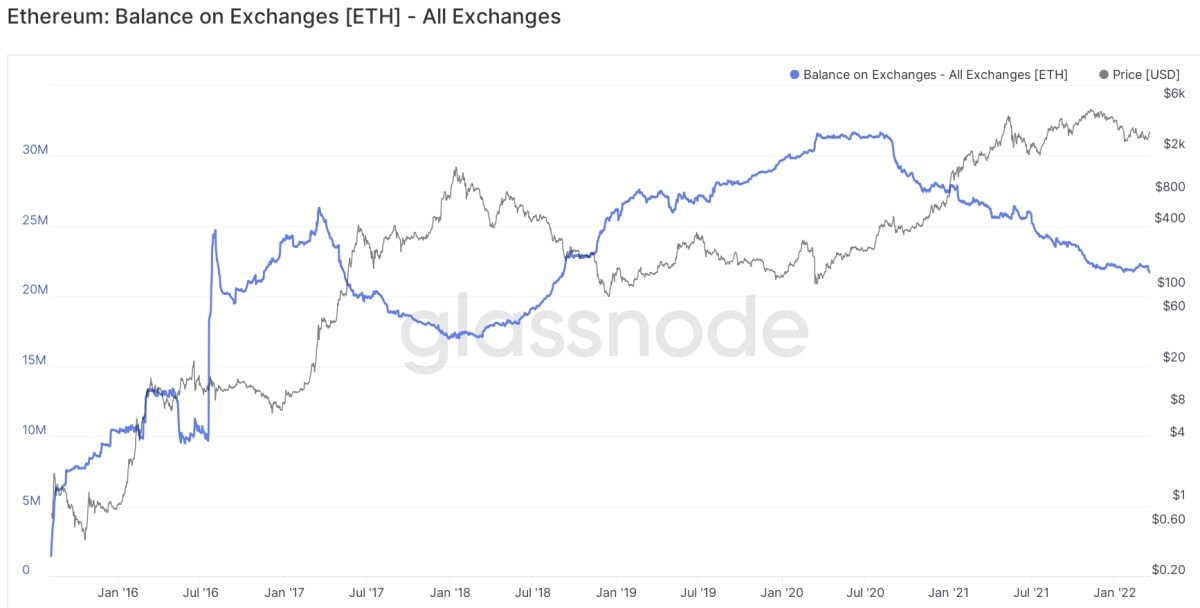

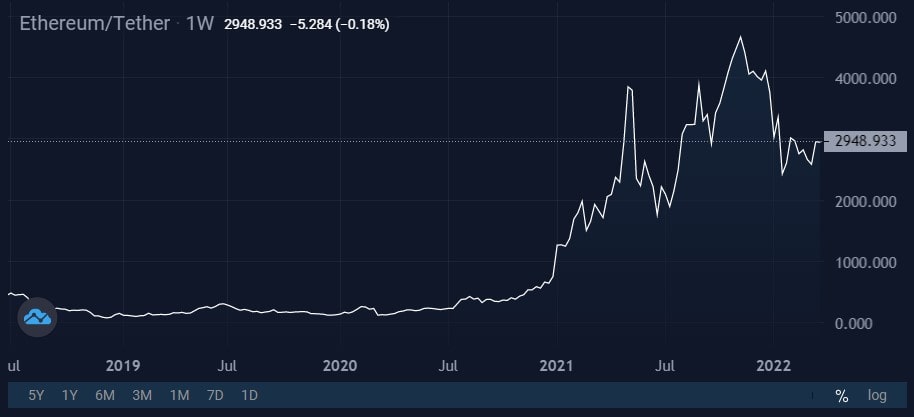

Based on the roadmap, Ethereum has passed through all of the stages on the way to merging the two branches, ETH and ETH 2.0, with the date listed on the official website for the event to take place in Q2 2022. In anticipation of the upcoming changes, crypto users increased their rate of Ethereum withdrawal to cold wallets, reducing the total balance held by crypto exchanges to 21.7 million ETH. This is the lowest value since September 2018. At the same time, a further acceleration has been observed in March: the weekly outflow exceeded 180,000 ETH ($512 million).

Despite the London hard fork and transaction fee burning, the network remains inflationary. In other words, more coins are mined than burned. However, with the transition to proof-of-stake, it can become completely deflationary, which will increase the value of Ethereum.

The price is also supported by a general reduction in supply caused by the transfer of ETH to a deposit contract. Users currently have 10.6 million ETH (worth $30bn) locked up, with about one million ETH added in the last 30 days. The total locked up amount is 9% of the entire ETH network capitalisation. It'll become available for withdrawal no earlier than the merger date between the two branches.

Locked up funds allow receiving passive income from staking. The only restriction is that you need to deposit in blocks of 32 ETH. But there are a number of services that allow you to pool smaller investments. For example, Lido provides staking with a current yield of 3.8%, and the total amount under its management exceeds 2.7 million ETH.

Interest in ETH 2.0 is on the rise – this is evidenced by both the outflow of funds from crypto exchanges and the growing deposit contract. The only question is: when is all of this going to happen?

StormGain analysis group

(a platform for trading, exchanging and storing cryptocurrencies)

Tags

Try our Bitcoin Cloud Miner and get additional crypto rewards based on your trading volume. It's immediately available upon registration.

Try our Bitcoin Cloud Miner and get additional crypto rewards based on your trading volume. It's immediately available upon registration.