Ethereum staking hits DeFi

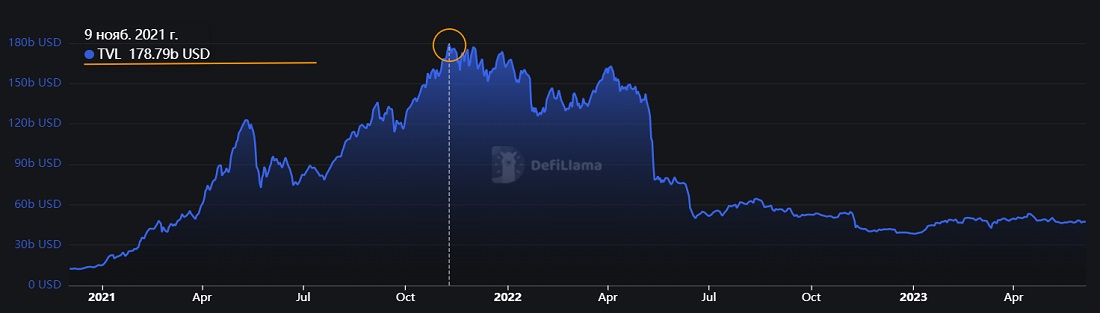

On 9 November 2021, the decentralised finance (DeFi) sector peaked at $179 billion in staked funds. Since then, it has fallen to nearly a quarter of that amount, $47 billion. It didn't receive much of a boost in 2023, adding only 26% total value locked (TVL).

The upheaval began with the collapse of UST (Terra), the third-largest stablecoin, which reached a market capitalisation of $20 billion at its peak. The coin experienced high demand in DeFi thanks to its high staking yield, which went as high as 20%. UST's fall caused a significant outflow of funds from other projects, as well, some of which encountered a liquidity crisis and went under as a result.

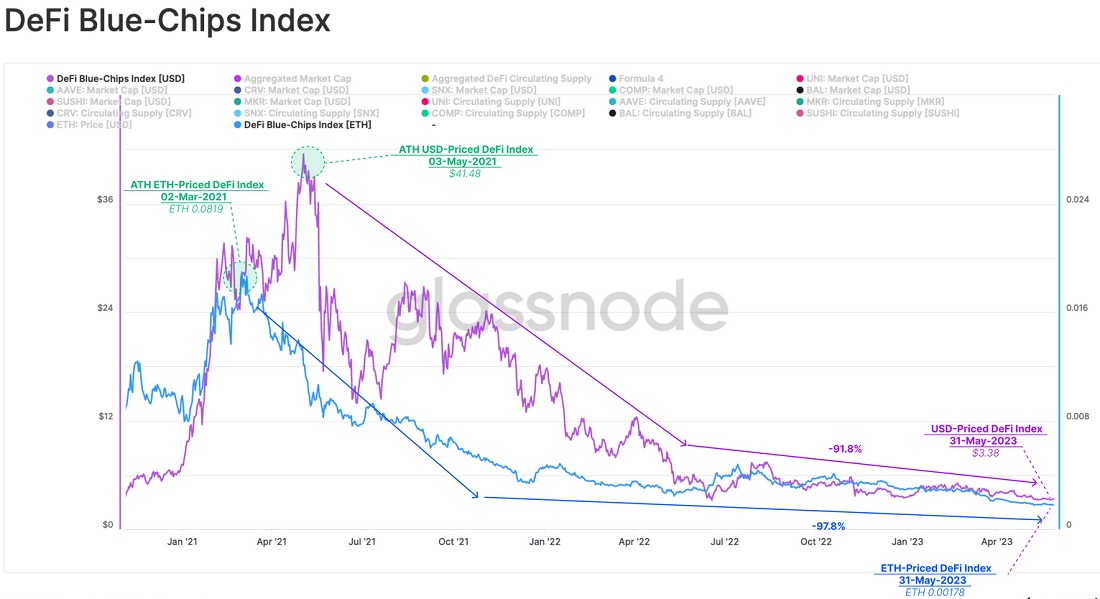

The sector's decline can be more clearly reflected through the capitalisation of leading tokens (excluding Ethereum) of projects such as Uniswap, AAVE, Maker and others. Analyst agency Glassnode has dubbed them DeFi 'blue chips'. When expressed in either ETH or USD terms, the index shows an over 90% drawdown.

Since Ethereum is most often staked for entry into DeFi (until 2021, its share exceeded 95%), project coins must provide a return that at least exceeds this cryptocurrency's growth.

"At least" because with the move to proof-of-staking (PoS), there is the possibility of a passive income. The staking yield is currently 4.6%, and in May, it was as high as 8%.

Another important aspect of tokenomics is inflation. Staking rewards are paid in the coins of the selected project. Therefore, the greater the offered yield is, the greater the inflation that increased coinage causes. This largely explains why DeFi project coins have fallen harder than Ethereum. This also includes funds that are staked at the start of projects and earmarked for future payments to developers or investors. Every infusion of liquidity undermines the value of the coin.

Unlike most competitors in the sector under review, Ethereum remains deflationary after its transition to PoS. More coins are burned through transactions than are minted to reward validators.

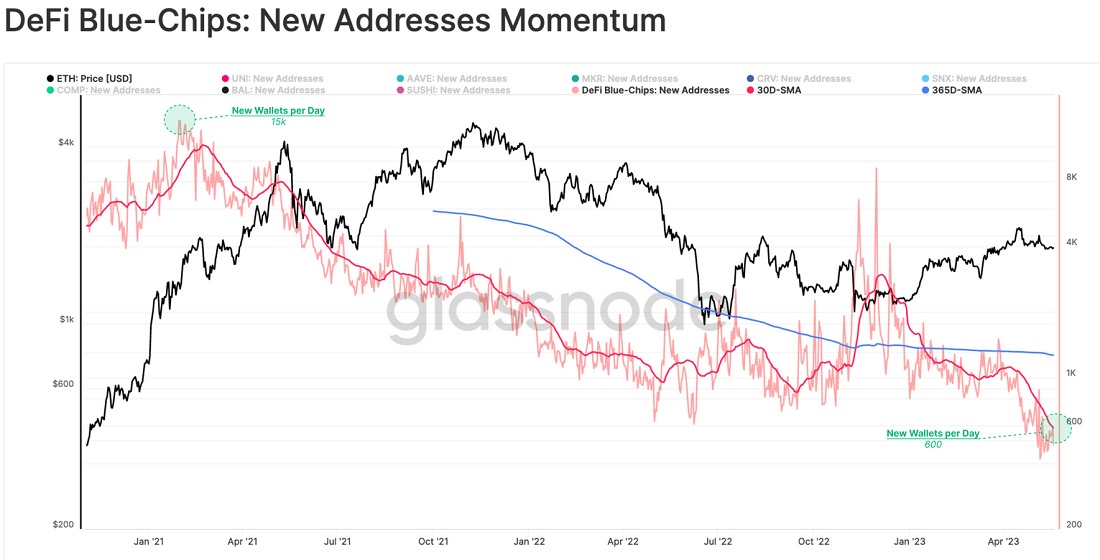

The last hurdle for investors was when staked funds were frozen. On 12 April, the Shanghai hardfork lifted this restriction. Since that date, the number of new addresses created in 'blue chip' DeFi has plummeted from 1,000 to 600 per day.

Following the decline in confidence in DeFi due to a series of crashes in 2022 and the introduction of full staking in Ethereum, other projects are finding it increasingly difficult to attract grassroots investment. Meanwhile, Ethereum has seen the number of its validators increase by 13% to 698,000 since 12 April.

StormGain Analytical Group

(platform for trading, exchanging and storing cryptocurrency)

Tags

Try our Bitcoin Cloud Miner and get additional crypto rewards based on your trading volume. It's immediately available upon registration.

Try our Bitcoin Cloud Miner and get additional crypto rewards based on your trading volume. It's immediately available upon registration.