Ethereum staking yields up 55% in a month

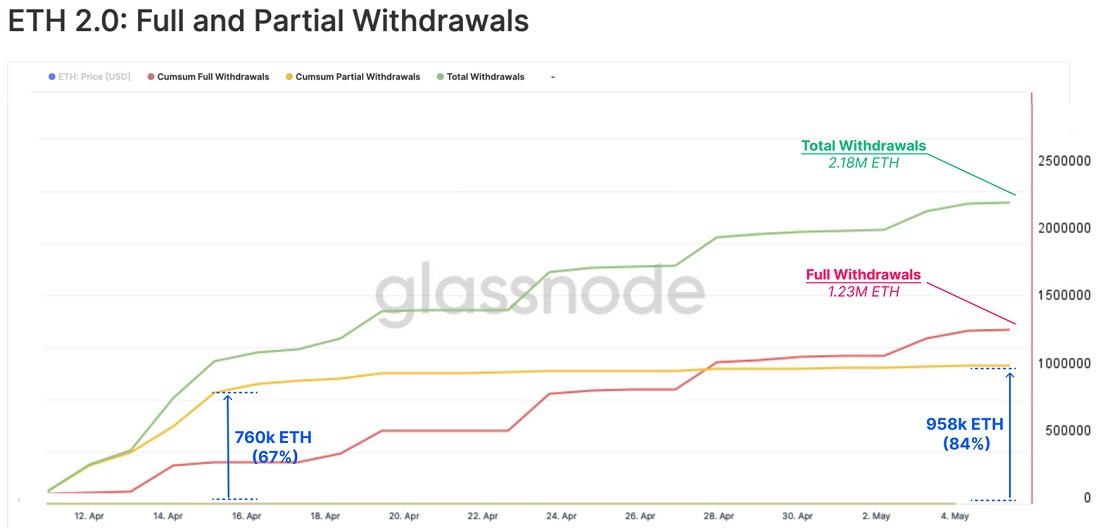

It's been a month since implementing the Shanghai hardfork and allowing validators to withdraw both rewards and staked deposits. During that time, users have withdrawn 1 million ETH in rewards and another 1.2 million ETH due to the full withdrawal of validators from staking.

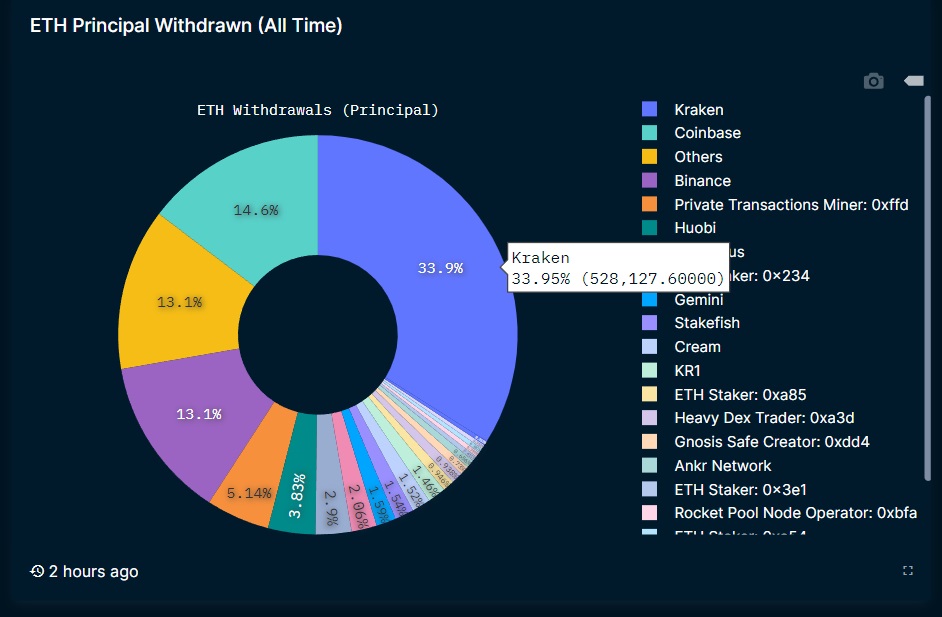

As expected, the main pressure came from US crypto exchanges, where the SEC is trying to get Ethereum labelled a security. Kraken has agreed to a pre-trial settlement, a $30 million fine and a gradual exit from staking. The crypto exchange has now withdrawn 528 million ETH worth $1 billion, with Coinbase coming in second at 228 million ETH worth $417 million withdrawn.

It's worth looking at the fortuitous decision by developers, who limited set a daily limit of 1800 validators for full withdrawals and up to a daily amount of around 58,000 ETH. While the exit queue is forming on the one hand, on the other hand, the inflow of those wishing to participate in the staking is increasing.

The inflow exceeds the outflow, increasing the number of validators and the amount staked. The recent surge in interest in meme cryptocurrencies also contributes to this, causing an increase in network congestion and fees. As a result, staking jumped from 4.4% to 6.8% in a month.

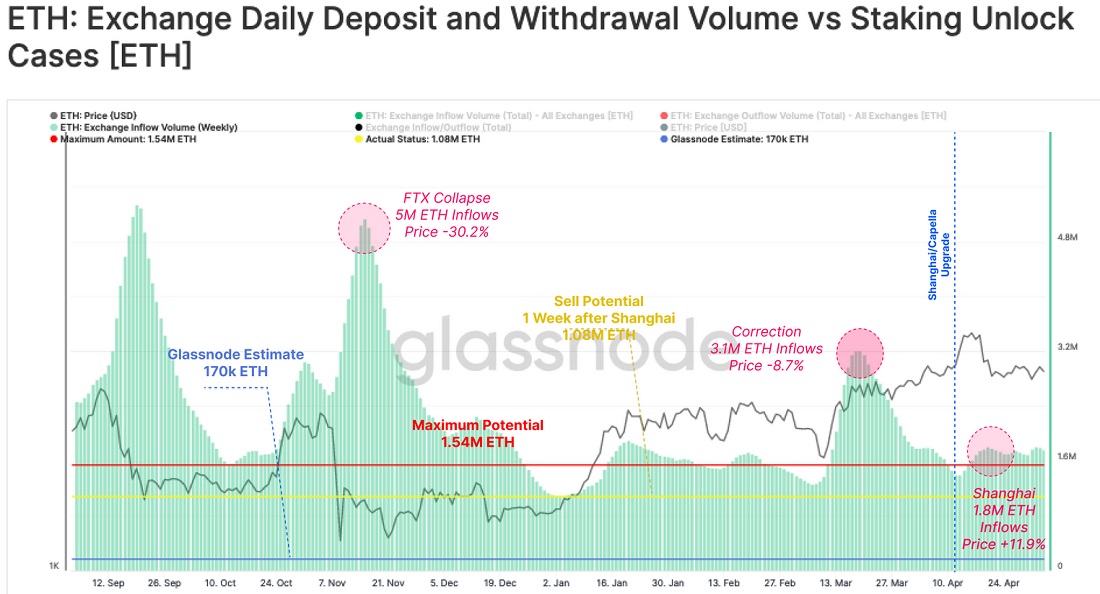

The fears caused by the expectation of an ETH influx to the exchanges didn't prove to be true. Having received their reward, most validators reinvested it in new staking. Some investors allocated coins to cryptocurrency exchanges for subsequent sale, but the 1.8 million ETH inflow doesn't look significant.

Increased pressure from US regulators and the potential exit of Coinbase from staking with a 12% share worth 2.5 million ETH are risk factors for Ethereum. The most significant damage would come from recognising cryptocurrency as a security.

It's worth noting that some congressmen are unhappy with SEC chairman Gary Gensler's policy, which is already leading to an outflow of investment from the country to freer economic zones. For example, in early May, Coinbase launched an international division registered in Bermuda. A change in SEC management would hint at liberalisation and a search for compromise, which would boost Ethereum.

StormGain Analytical Group

(platform for trading, exchanging and storing cryptocurrency)

Tags

Try our Bitcoin Cloud Miner and get additional crypto rewards based on your trading volume. It's immediately available upon registration.

Try our Bitcoin Cloud Miner and get additional crypto rewards based on your trading volume. It's immediately available upon registration.