Ethereum will reach $5,000 in 100 days

Last week, the SEC approved a 19b-4 filing format for a spot Ethereum ETF. Bloomberg analysts predict the regulator will approve the S-1 format by mid-June. This will lead to a surge in investment in Ethereum and an increase in its price.

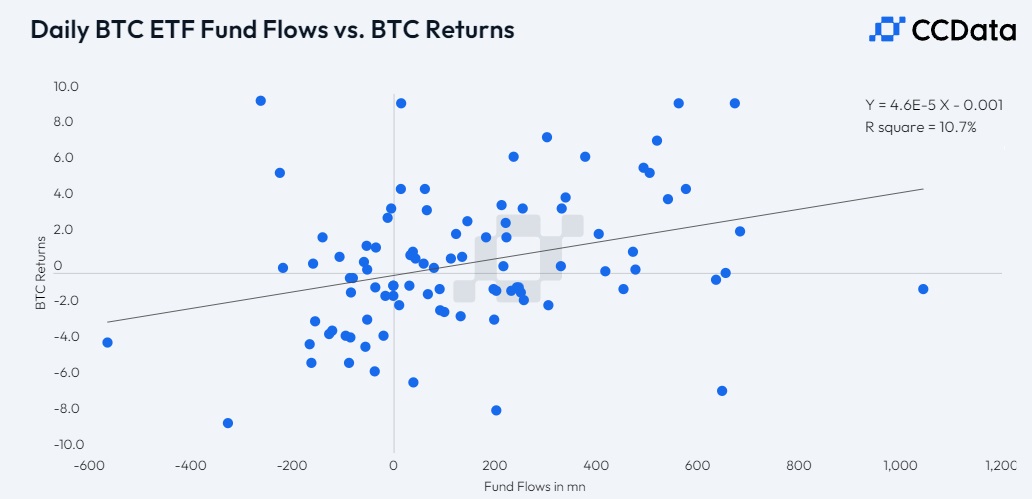

Analyst firm CCData used linear regression and the correlation of Bitcoin's price growth from inflows into spot ETFs to predict that Ethereum's price will rise to $5,000k 100 days after the funds launch. The analysis assumes that the Ethereum ETFs will see at least 50% of the inflows that Bitcoin ETFs saw and collect $3.9 billion in investments over the allotted time.

At the same time, it is highly probable that Ethereum will start to correct just as Bitcoin did immediately after the long-awaited funds are launched. Back then, Bitcoin was down 21% in 12 days.

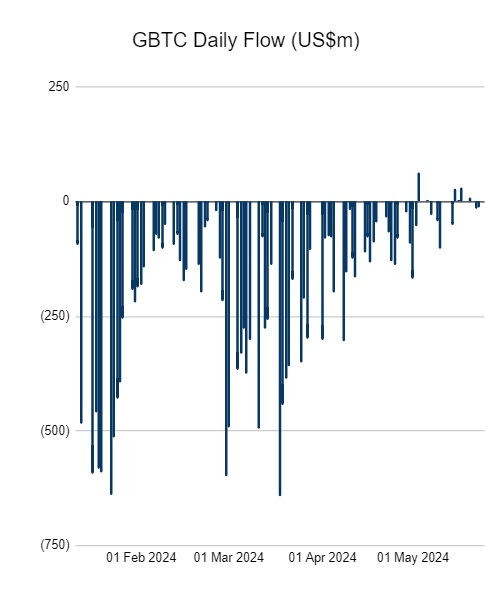

One of the key reasons for the drawdown was assets becoming unlocked, which was converted to a spot fund from a trust. It lost $500 million in reserves every day for the first 10 days, for a total of $17.6 billion in lost investments so far this year.

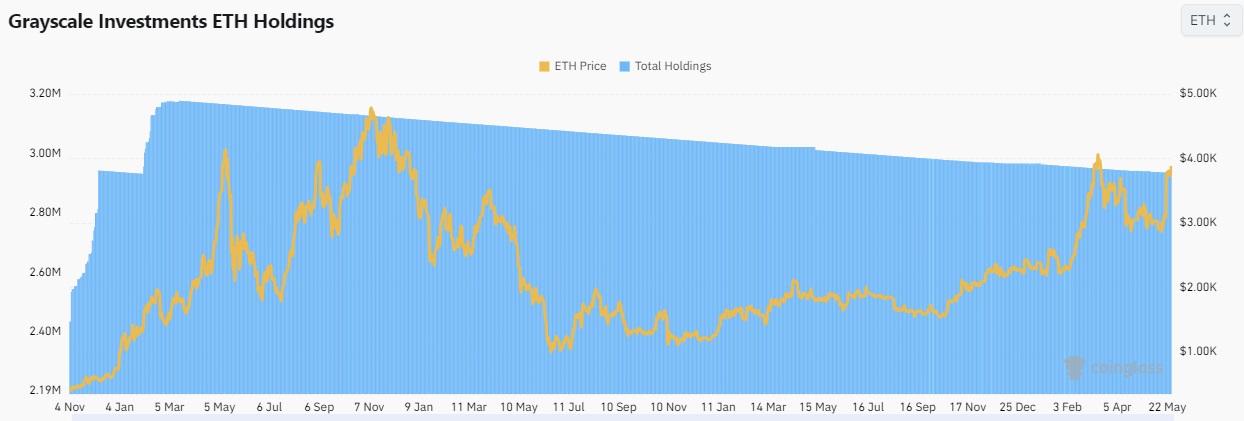

Ethereum is expected to see a similar picture with Ethereum, where Grayscale's ETHE fund (which had its 19b-4 approved) has accumulated $11 billion worth of coins.

On 20 May, the SEC reached out to applicants to adjust their applications, dramatically improving the chances of the spot ETFs being approved. Shrewd speculators rushed to buy up ETHE shares, causing the discount to the underlying asset to plummet from 22% to 7% in a matter of days. Once the exchange-traded fund is converted, assets will be unlocked, and investors who bought shares at a discount will start taking profits. The same pattern was seen when GBTC was converted.

It stands to reason, then, that selling pressure is already assured after the funds launch, while investment interest is questionable. On the one hand, the altcoin picks up more movement due to its smaller capitalisation. On the other hand, the fact that its legal status is up in the air (is it a commodity or a security?), the SEC's complaints about its staking programme and a host of internal contradictions (rising censorship, the impact of MEVs, the shift of interest from L1 to L2 and L3) hint at difficulties in raising capital more widely.

Mathematical models show that Ethereum has good prospects after the ETFs are launched, but investors should proceed with caution. Unless inflows into new funds can offset outflows from ETHE, as happened with Bitcoin, the $5,000 target will be out of reach this year.

StormGain Analytical Group

(platform for trading, exchanging and storing cryptocurrency)

Tags

Try our Bitcoin Cloud Miner and get additional crypto rewards based on your trading volume. It's immediately available upon registration.

Try our Bitcoin Cloud Miner and get additional crypto rewards based on your trading volume. It's immediately available upon registration.