FTX clients unhappy with upcoming 118% bankruptcy payouts

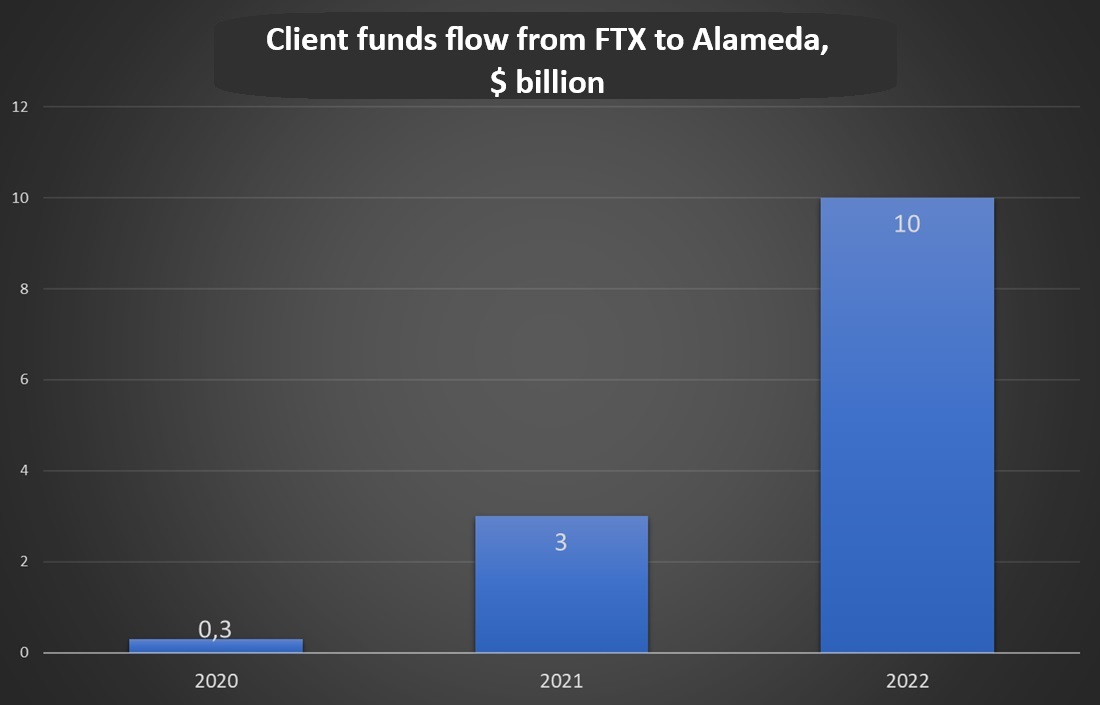

In November 2022, FTX, the third-largest crypto exchange, collapsed as a result of diverting customers' funds to its affiliate company, Alameda Research. Funds from the company it controlled were spent on political donations, purchasing luxury real estate and unwise investments. Each year, the hole got bigger and bigger, reaching $10 billion in 2022.

The debt was masked by issuing more of the FTT token, which was listed on Alameda's balance sheet as an asset and as collateral for loans issued to third parties. On 2 November, Coindesk published an article that triggered a massive outflow of client funds and a liquidity crisis at Sam Bankman-Fried's empire.

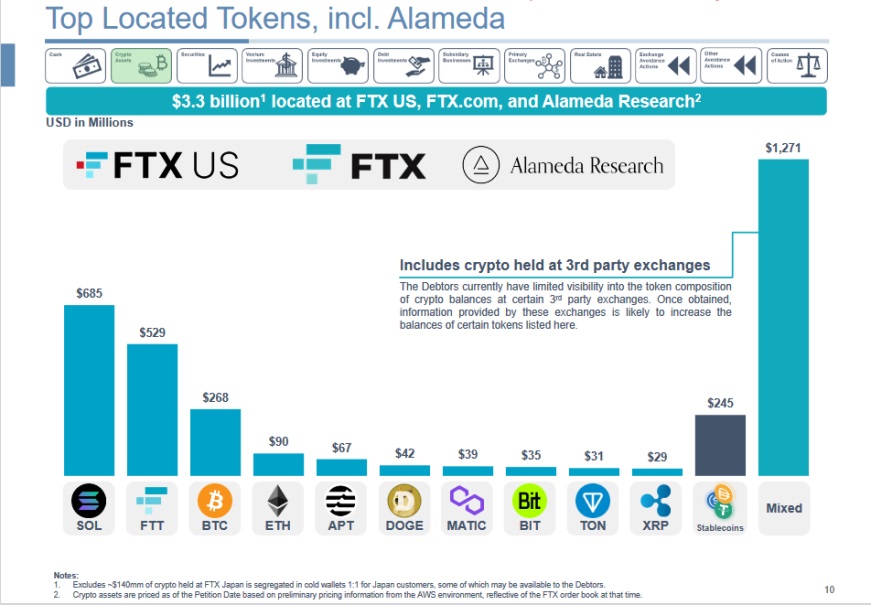

On 11 November, FTX declared bankruptcy, leaving over 2 million customers high and dry. The liquidation committee's first valuation showed that the total cryptocurrency held in all controlled accounts was worth only $3.3 billion, while the company had liabilities of $8 billion to customers.

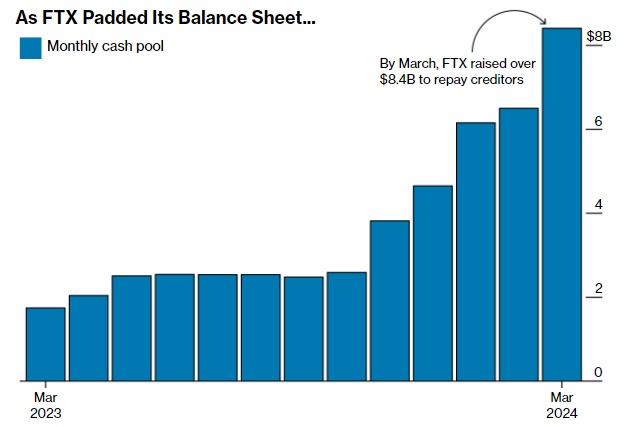

The first compensation announcement presupposed a payout to customers of just 10 cents on the dollar. However, as the values of assets have risen and the commission has succeeded in finding all the cryptocurrency wallets controlled by the company, the expected payout for most customers has risen to 118 cents on the dollar.

It's very rare for global jurisprudence to see clients recover more money than they had in their accounts as a result of a private company's bankruptcy. However, not all customers were happy with this result.

The reason for this is that payments are scheduled in US dollars, according to how things were on the day of the bankruptcy. Meanwhile, the value of Solana, which formed the backbone of assets held by FTX, has risen nine-fold to $162 during this period. Bitcoin's price, meanwhile, has quadrupled to $66,000.

Bloomberg reports that more than 80 petitions have been filed with the bankruptcy court by dissenting customers who want their cryptocurrency funds back. FTX's CEO, John Ray, responded to this by saying that he had the best interests of the majority of customers in mind. The cryptocurrency assets, on the other hand, are simply not enough to meet all requests in full.

In June, customers will be able to vote on the proposed reimbursement plan. If the majority favours a cryptocurrency payout, the judge may reject the bankruptcy commission's proposal and send it back for further review. If the majority of clients are satisfied with a payout in US dollars, they will receive the funds throughout 2024.

StormGain Analytical Group

(platform for trading, exchanging and storing cryptocurrency)

Tags

Try our Bitcoin Cloud Miner and get additional crypto rewards based on your trading volume. It's immediately available upon registration.

Try our Bitcoin Cloud Miner and get additional crypto rewards based on your trading volume. It's immediately available upon registration.