Rags to riches: MicroStrategy is about to make $1 billion in profits

MicroStrategy, the largest public Bitcoin holder, epitomises the buy-and-hold strategy in the cryptocurrency market. The company made its first purchase in September 2020 for $11,600 a coin and continued to add to its holdings once a quarter.

It held onto its subsequent purchases during both market rises and falls. The media began to bury MicroStrategy after the May 2022 crypto collapse, when the market price dropped way below the average value of Bitcoin in its reserves ($30,700 at the time).

Despite the difficult times and some forced measures to refinance part of the company's liabilities, MicroStrategy's Executive Chairman, Michael Saylor, held to the strategy. In a June 2022 interview, he called Bitcoin "a lifeboat in a storm", referring to rising inflation and an upcoming financial crisis.

After waiting for the drop in Bitcoin's price to slow, MicroStrategy returned to buying. This allowed it to reduce the average price of the BTC it held. The current average cost per coin is $29,870, which is way lower than Bitcoin's current price.

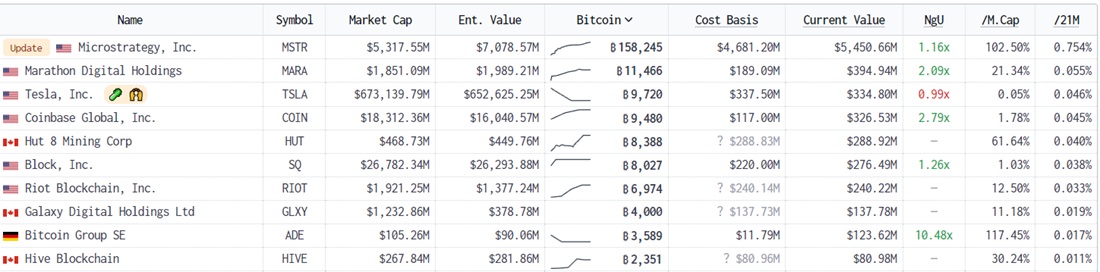

In terms of reserves among public market players, the company is the absolute leader, holding 158,245 BTC. It's spent a total of $4.7 billion on the cryptocurrency, while its portfolio value is currently worth $5.4 billion for an unrecorded profit of over $0.7 billion.

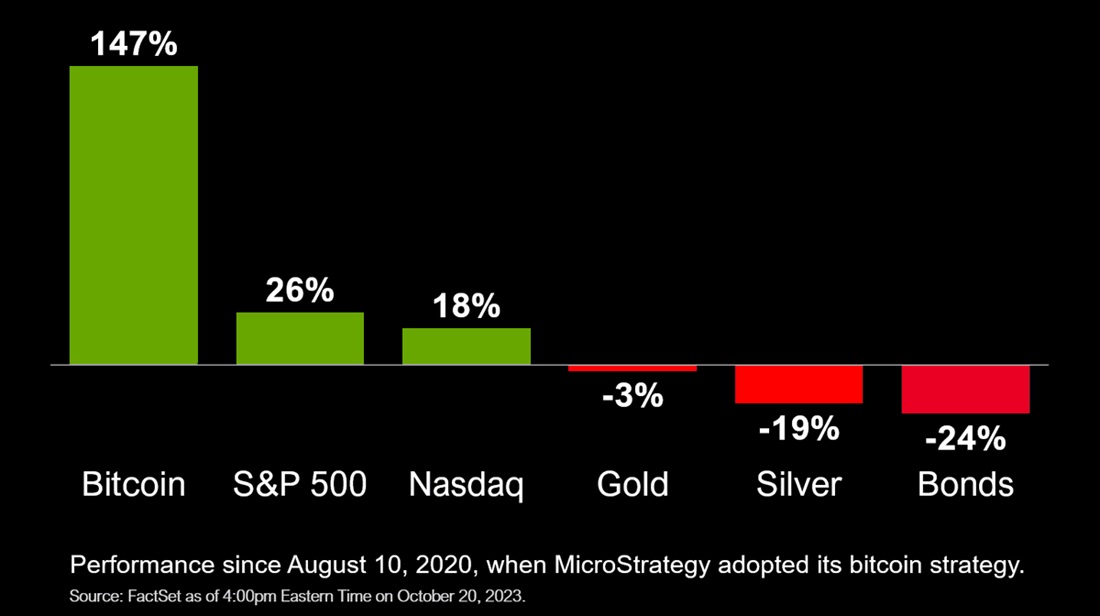

Michael Saylor has repeatedly stated that cryptocurrency is a more progressive asset than traditional financial instruments. In three years, Bitcoin's price increased by 147% (as of 20/10/2023), while the S&P 500 gained only 26%, and bonds and precious metals are showing negative trends.

Over the past 24 hours, Bitcoin skyrocketed by 10% to $34,500.

The breakthrough is due to a significantly increased chance that Bitcoin spot ETFs will be approved in the US in the next 10 weeks. If they are approved, it would pave the way for institutional capital to participate. The volume of subsequent investments in cryptocurrency in the first six months alone is estimated to be $100-$200 billion, leading to the asset undergoing significant strengthening.

StormGain Analytical Group

(platform for trading, exchanging and storing cryptocurrency)

Tags

Try our Bitcoin Cloud Miner and get additional crypto rewards based on your trading volume. It's immediately available upon registration.

Try our Bitcoin Cloud Miner and get additional crypto rewards based on your trading volume. It's immediately available upon registration.