Exodus of funds from Binance after deal with US government

Binance CEO Changpeng Zhao's guilty plea to violating US laws and striking a pre-trial settlement, which includes an industry-record $4bn fine, led to widely-anticipated turmoil in the markets. In the 24 hours that followed, nearly $200 million worth of long positions across all crypto instruments were liquidated, with BNB buyers accounting for $4.4 million of this total.

The flames were fanned by tongues wagging, proclaiming the imminent demise of Binance in the wake of an exorbitant fine. The negative backdrop caused BTC to fall by 6% in the first couple of hours and drove BNB down by 12% – to $235.

They based their argument on the significant net outflow of funds from the crypto exchange, which according to various estimates ranged from $700 million to $1.7 billion in just 24-hours. The large difference between the estimates lies in the difficulty of identifying all the wallets associated with Binance and also the different calculation methodologies employed.

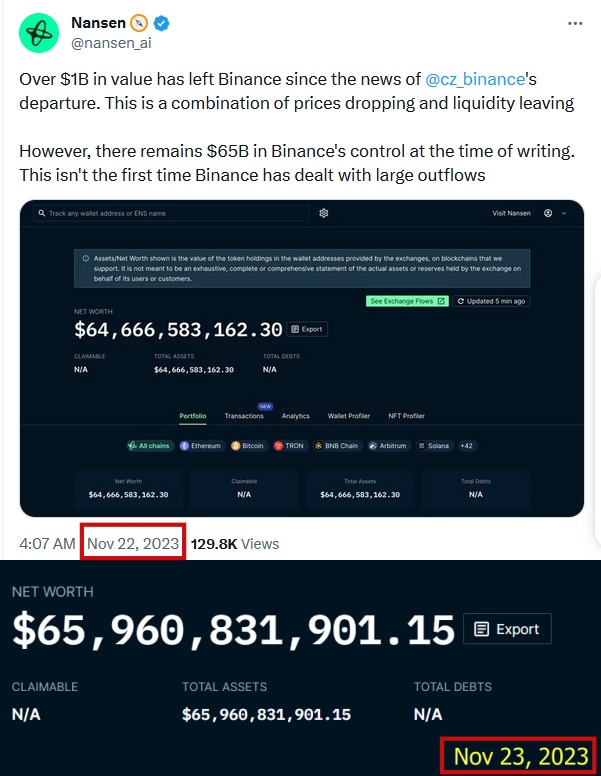

The largest negative result was found by Nansen, who calculated the $1.7bn figure on 21 November. However, this large figure is due to the overlapping of both asset outflows and the fall in the value of reserves due to the general correction on the crypto market. As a result, the reserve had grown by $1.3bn the very next day. In other words, the direct outflow of assets was much more modest.

A clearer picture is provided by the DeFiLlama service, according to which Binance's reserves decreased by $1.5bn over two days, while the outflow for the same period amounted to $710m.

However, the current rate of outflows is unremarkable from a historical standpoint. In June, after the SEC filed a lawsuit, it exceeded $1 billion within a single day, and in January, amid the scandal around the BUSD stablecoin, it hit a record high for the year – $4.3 billion.

All this shows that talk of a mass exodus of customer funds is simply invalid; the crypto exchange is only facing localised difficulties, as is the case in the USA or Australia.

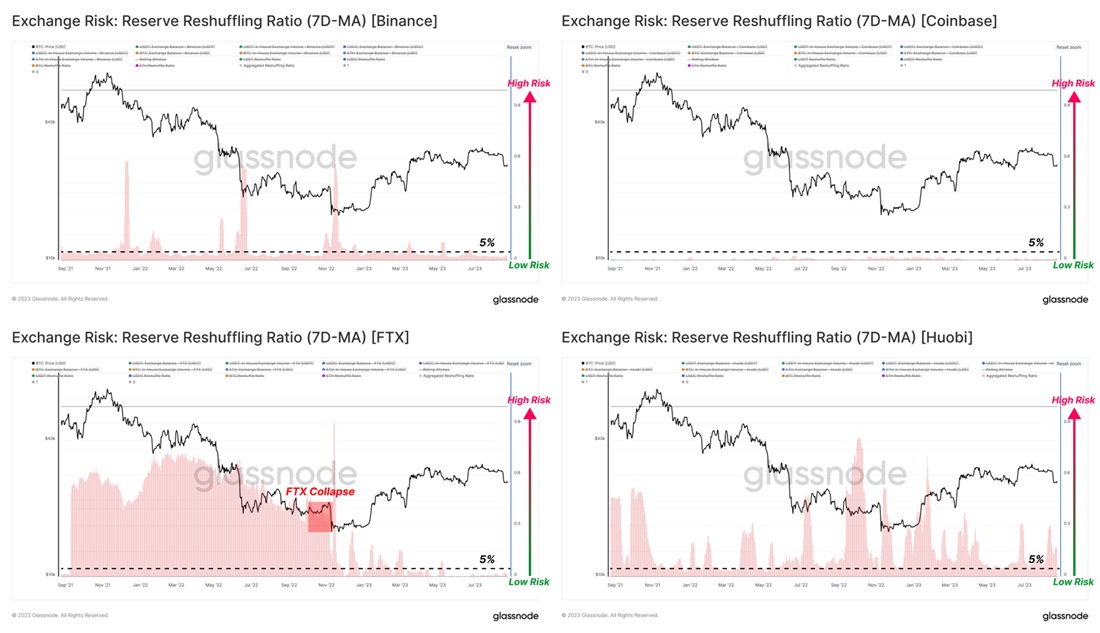

If we talk about objective indicators of the stability of reserves and the degree of customer confidence, we have previously cited the research by analytics agency Glassnode as an example.

Binance has demonstrated a high degree of reliability, second only to Coinbase by some metrics, and surpassing it in others.

StormGain Analytical Group

(platform for trading, exchanging and storing cryptocurrency)

Tags

Try our Bitcoin Cloud Miner and get additional crypto rewards based on your trading volume. It's immediately available upon registration.

Try our Bitcoin Cloud Miner and get additional crypto rewards based on your trading volume. It's immediately available upon registration.