Trust and stability metrics for Coinbase, Binance and HTX reserves

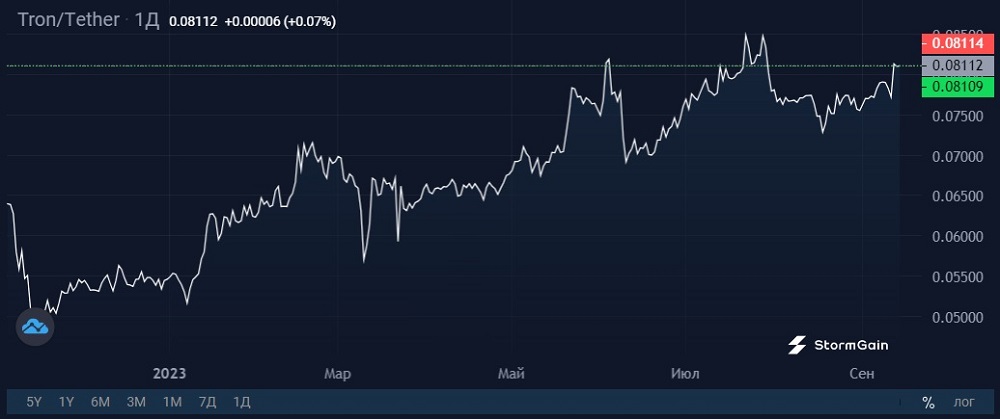

Yesterday, Huobi rebranded to HTX. The crypto exchange explained this 10th-anniversary decision: H stands for Huobi, T stands for its close link to the TRON blockchain, and X stands for the Roman numeral for 10 and symbolises the main function ('eXchange').

Many users didn't like the new naming, as it reminded them of the failed FTX.

Justin Sun, officially recognised as the head of the crypto exchange only earlier this year after a number of uncomfortable questions from the community, is also controversial. Sun is also the founder of the TRON blockchain and the TRX coin, and he has been repeatedly accused by journalists of pumping the latter.

It's worth considering Glassnode's research to objectively assess the stability of the three major crypto exchanges, including Huobi. The agency analysed coin flows on Coinbase, Binance and HTX (Huobi) to find patterns similar to the bankrupt FTX.

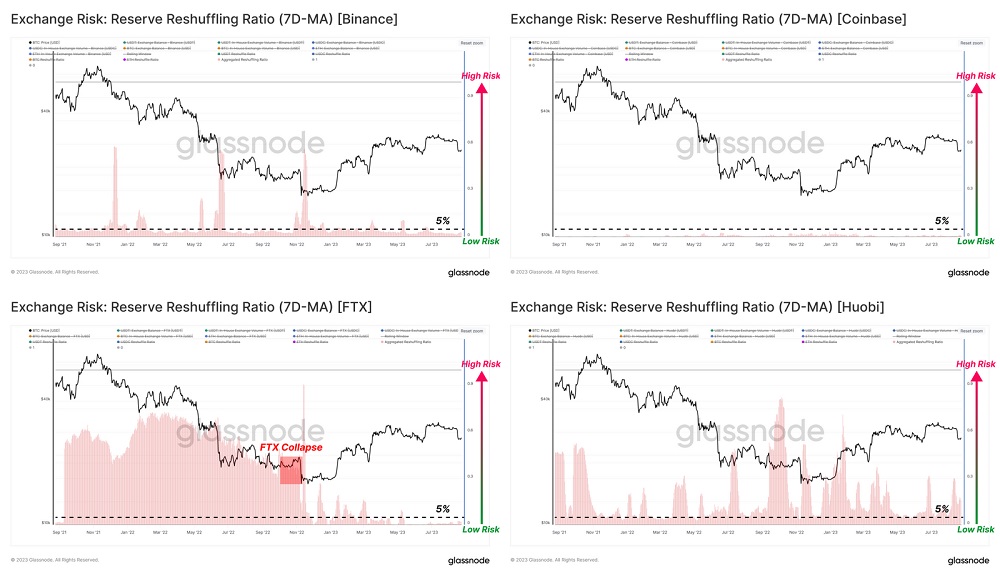

Reserve reshuffling ratio

This indicator compares the transaction volume ratio to total reserves and is given for each cryptocurrency exchange from 0 to 1. If the exchange balance exceeds reserves over a long period, this may signal poor money management.

Coinbase leads in terms of this indicator. Binance has seen spikes in response to major events, such as the FTX collapse, after which the ratio returns to the 5% threshold. The situation is worse for HTX (Huobi), as a reduction in the balance of assets accompanies it. For FTX, the ratio remained consistently in the red zone due to the misappropriation of client funds by Alameda.

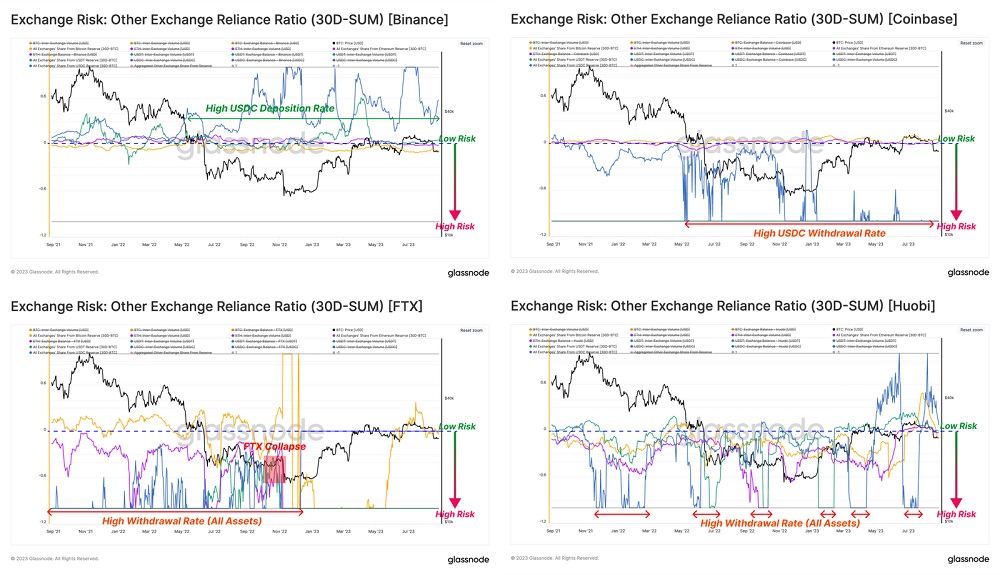

Trust rate

The indicator compares inflows/outflows from one crypto exchange to other exchange platforms across different asset groups.

Binance has the best numbers, showing mostly an inflow of funds. Coinbase has a strong USDC outflow to Binance. And HTX (Huobi) shows a strong outflow for all key assets.

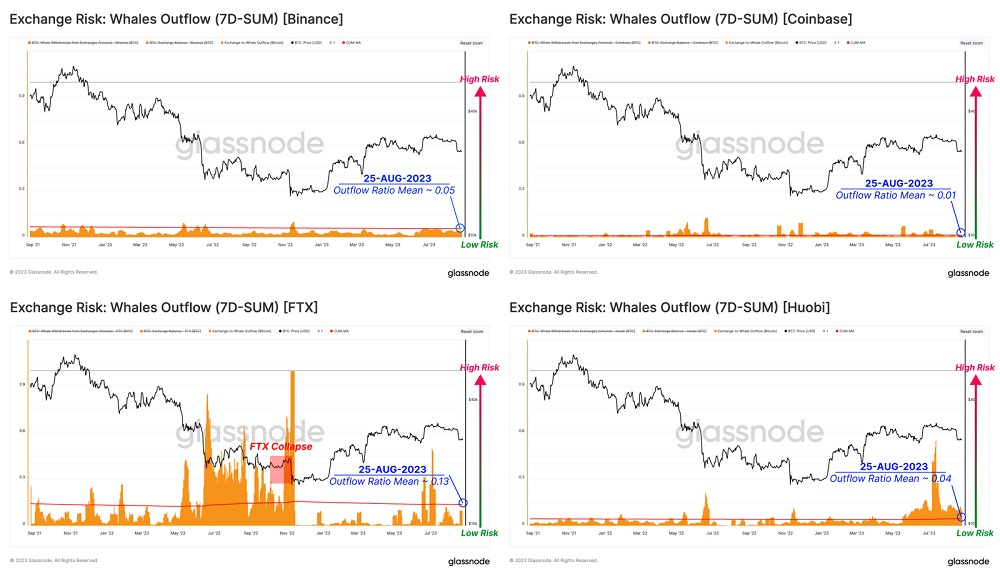

Whales outflow rate

This indicator captures the withdrawal rate of coins by major players, calculated as the ratio between the weekly outflow of whales and the Bitcoin balance on the exchange.

Coinbase and Binance are doing fine, but FTX saw an outflow of whales after Terra (LUNA) collapsed in May 2022. HTX (Huobi) faced a whales outflow in recent months amid spreading rumours regarding the crypto exchange's insolvency. This was written about by Adam Cochran, Managing Partner at Cinneamhain Ventures.

Conclusion

By comparing the risk metrics of the three major crypto exchanges to FTX, Glassnode highlights the stable position of Coinbase and Binance. For HTX (Huobi), analysts note that some caution may be justified.

StormGain Analytical Group

(platform for trading, exchanging and storing cryptocurrency)

Tags

Try our Bitcoin Cloud Miner and get additional crypto rewards based on your trading volume. It's immediately available upon registration.

Try our Bitcoin Cloud Miner and get additional crypto rewards based on your trading volume. It's immediately available upon registration.