What does HODL mean in crypto?

As with many other acronyms and cryptocurrency memes, the origin of HODL is traced back to a typo. It started in December 2013 with a post that a user named GameKyuubi published on the cryptocurrency platform Bitcointalk. It said, "I AM HODLING." Later, GameKyuubi explained that he planned to write "hold" instead of "hodl" when talking about Bitcoin investments. However, the digital community spread the term HODL throughout the cryptocurrency world in no time, making it more than a typo but an investment strategy crypto traders are actively using. What does HODL mean in crypto, and what's its value to an investor? Let's find it out.

What is HODL?

HODL stands for "hold on for dear life", the trendy term among cryptocurrency investors. Many would say it looks like nothing but a funny misspelt word. This is how it started but not how it goes. Today, HODL is related to the traditional buy-and-hold investment strategy as one of the ways to cope with the cryptocurrency's volatility.

Similar to other cryptocurrency words like FUD, Moon and Sats, HODL is one of the insider terms you can often see on crypto forums. All these memes originated as chat slang words and have become common terms.

Crypto investors use the acronym HODL to encourage others not to sell cryptocurrency when the prices fall. The meme also acknowledges novice crypto investors who need to be more skilled to profit from short-term trades in the highly volatile crypto market. Besides, the HODL approach helped long-term investors in Bitcoin, Ethereum, etc., navigate extreme fluctuations in the crypto market.

What does HODL mean in cryptocurrency?

What is HODL, and how does the phrase "hold on for dear life" play into the deeper HODL meaning? For many investors, it's easier to understand what HODL means in the context of buying and holding. For example, if investors wonder whether to "HODL stock", they're talking about buy-and-hold strategies. That is buying stocks intending to hold them long-term, regardless of the market volatility.

The goal is to weather the crypto market's ups and downs and earn long-term profit. If we look back in history, the stock market commonly trends upward. Still, the past performance of any crypto asset doesn't guarantee its future returns. In other terms, you'll HODL the stock instead of selling it if the market gets volatile. This is a common tactic used by value investors.

But what does HODL mean in crypto?

- The first and basic HODL meaning applies to the buy-and-hold strategy when talking about cryptocurrency. It refers to "hold on for dear life" rather than selling off cryptocurrency in a panic if volatility increases.

- The second HODL crypto meaning refers to a specific type of community-driven token named hodl, operating on the Binance Smart Chain.

HODLer meaning

A HODLer is a true believer in cryptocurrency. The term originated from the bitcointalk.org community. It's one of the oldest public discussion forums focused on the Bitcoin ecosystem, blockchain technology and cryptocurrencies, very popular among developers, investors and technology enthusiasts.

HODLers buy and hold cryptocurrency for the long term regardless of price. They're confident in the long-term vision of the crypto assets they bought. Although HODLers may not necessarily understand the technical side of cryptocurrency, they believe in the long-term value of their investment.

"Never-sellers" is another term you can often meet in the crypto industry. These individuals never sell the assets they bought, regardless of the market volatility.

Some crypto market participants consider HODLers as plain crazy who miss the chance of making money by selling their crypto assets at market highs.

HODL as an investment strategy

The HODLing strategy is more complex than just holding cryptocurrency. HODL is especially useful when the market goes down. It helps investors resist the urge to panic sell. The HODL strategy is beneficial for amateur investors prone to impulsive behaviour.

Every investor can decide on their own if the HODL strategy fits them. Those who don't use it are similar to day traders attempting to buy low and sell high or to short sell and profit from small market movements instead of holding crypto assets for the long term.

HODL as an investment strategy can make sense. It's unlikely a downturn in the markets overall can result in the crypto market crash. There's always a rainbow after the rain. The recovery follows even the direst of downturns.

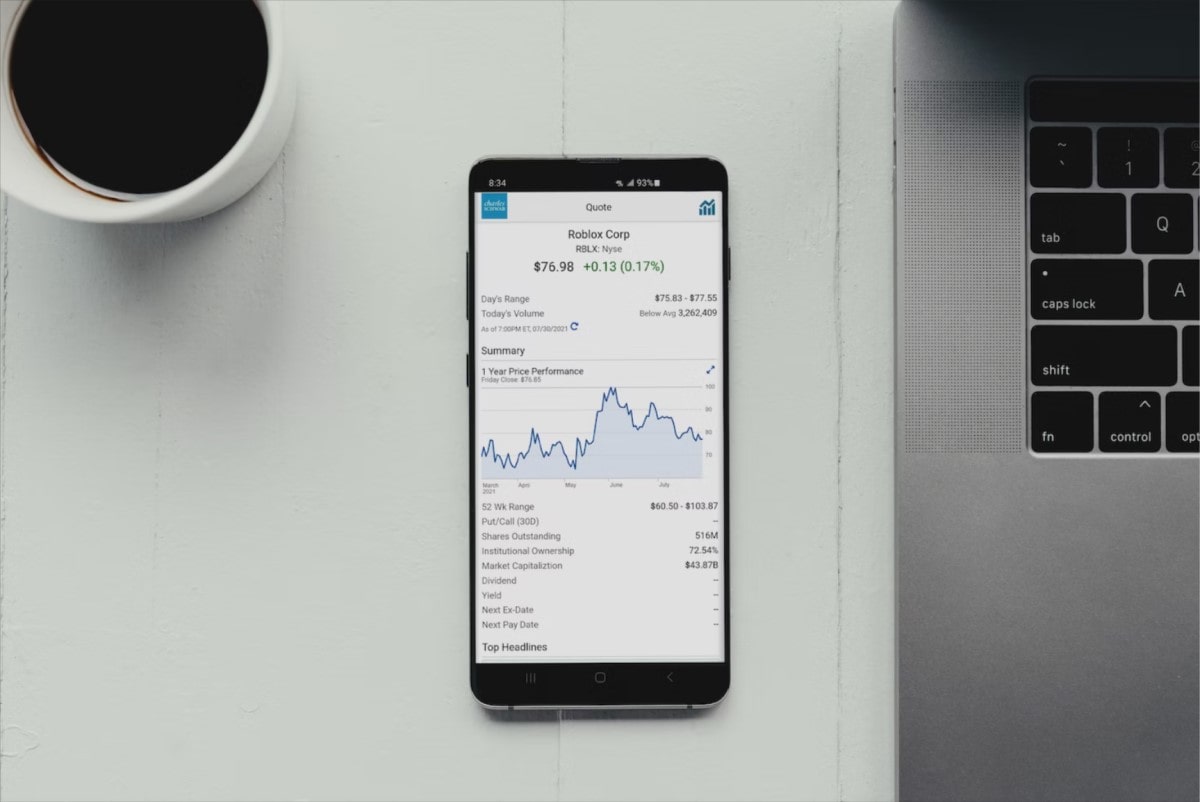

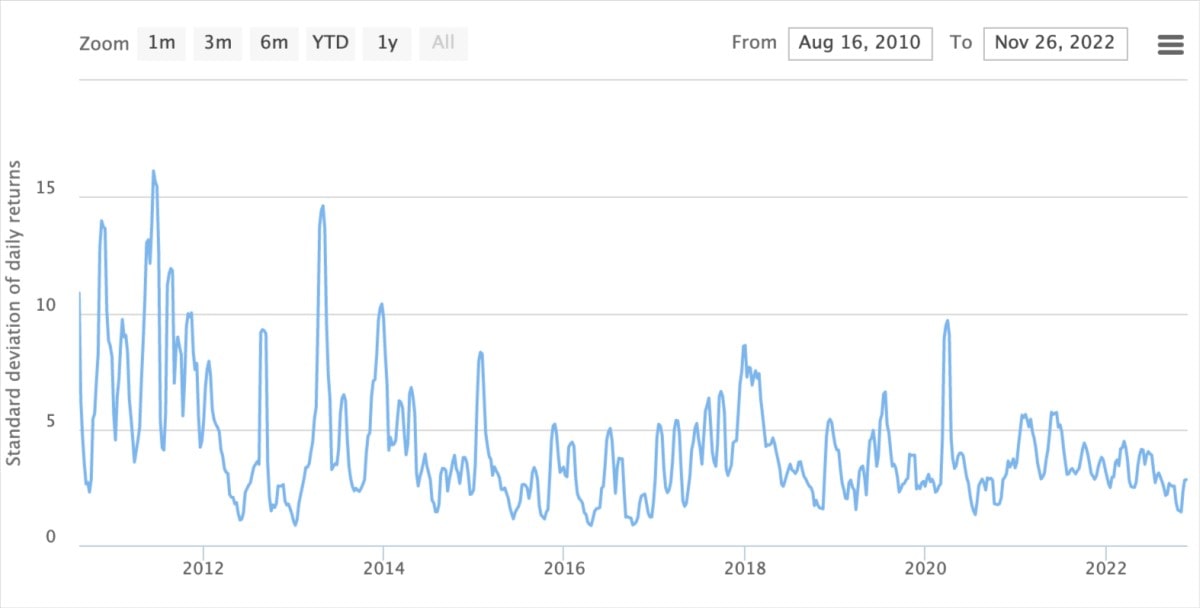

The image below shows Bitcoin's chart, with its dramatic highs and lows.

The idea of long-term investments instead of getting short-term gains is rather familiar. However, long-term cryptocurrency investors should be able to communicate their goals and monitor the emerging space for systemic risks. The main rule for investing in the stock market is to put money in only if you're ready to keep money there for a long time (say, for 5 years) rather than hunting for short-term peaks.

When mining cryptocurrency, it's essential to be patient and make decisions wisely. The cryptocurrency market is highly volatile. Long-term gains, though, can be way more appealing.

When is it better to HODL cryptocurrency?

Is it the trading or HODLing approach that works best for you? When investors need to decide what strategy works best for them, they should consider if they possess the right skills to venture into a risky business.

The choice of trading or HODLing strategy also depends on the investor's skills, the time they can afford to spend on one or another strategy, the risk level they're ready to take, and whether they're ready to handle stressful situations.

When is the best time to HODL? It's now and whenever you feel like you're ready. A true HODLer will always keep its digital assets even if the market gets highly volatile or crashes. At such moments, holding becomes an ideological belief about the long-term prospect of blockchain technology and cryptocurrency.

Is HODL right for me?

Whenever you ask yourself if HODLing is the right investment strategy, you need to think if you're ready to invest any money in the chosen crypto assets today and return to your investment in five years.

Another way to understand if HODLing is right for you is to weigh all pros and cons of this investment strategy.

Benefits of HODLing:

- A long-term investment strategy removes the need to check crypto prices continuously.

- HODLing removes the risk of dealing with short-term cryptocurrency volatility.

- It increases the chance of earning in the long term.

- HODLing can result in massive returns within the range of several years. For example, if you invested $5,500 to buy Bitcoin in spring 2020 and sold it in autumn 2021 for $65.000, the return would have approached 1100%. You'll hardly get such a big return on your investment within a few months.

- HODLing allows investors to increase their capital much faster if the value of the chosen cryptocurrency keeps rising.

Drawbacks of HODLing:

- When the crypto market is bearish, HODLing may be tough, and investors should resist the temptation to sell their assets.

- Investors should ensure they have enough capital in case of unexpected liquidity needs.

- It may be risky to HODL. Although the market possesses such well-established cryptocurrencies as Bitcoin and Ethereum, their history still needs to be improved to ensure investors of their long-term value.

- Security is another concern for HODLers. Investors should learn how to protect their digital assets to avoid cyber attacks.

- When HODLing, there's a high risk of losing access to private keys.

Having exposed the pros and cons of HODLing should help investors better understand what HODL means in crypto and decide if this is the right investment strategy they should go in for.

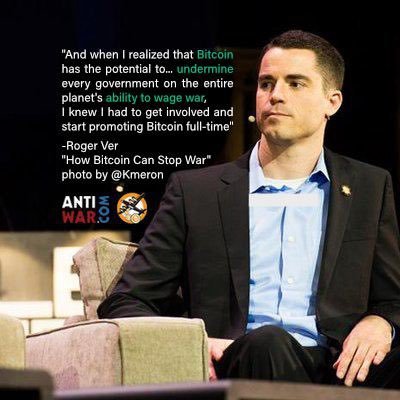

Most important crypto hodlers

With more than 700,000 Twitter followers, @rogerkver (Roger K Ver) from Tokyo is one of the most popular Bitcoin HODLers.

Roger K Ver always lays out plans for cryptocurrency for his followers. His opinion plays major importance to investors who may want to HODL.

Ver is often called "Bitcoin Jesus" because he was one of the early cryptocurrency investors and acted as an evangelist on behalf of Bitcoin. Roger not only adopted cryptocurrency for his companies but also advocated it tirelessly. In 2018, Ver switched his preference to Bitcoin Cash (BCH), which he claims is more accurate to the original Bitcoin ideals. Many startups and popular Bitcoin projects were launched with Ver's help.

Ver was one of the earliest adopters of the first digital currency. He integrated Bitcoin payments into Memorydealers.com, allowing customers to make cryptocurrency payments. Ver started to invest in Bitcoins in its earliest days when one asset was priced at about $1. This allowed the Bitcoin HODLer to amass a total collection of about 400,000 Bitcoins.

Roger K Ver is also known as an early investor in BitInstant, the company founded by Bitcoin, and an investor in many other blockchain-related projects, like Kraken, purse.io, Blockchain.com and Ripple.

Bottom line

When you want to understand what HODL means in stocks and crypto, it's important to point out that HODLing only works with well-established cryptocurrencies that can build value over time. When HODLing into one of the short-lived assets, you may be disappointed by not getting the desired results. HODLing as an investing strategy should be combined with serious research into the quality and long-term prospects of the chosen cryptocurrency.

Tags

Try our Bitcoin Cloud Miner and get additional crypto rewards based on your trading volume. It's immediately available upon registration.

Try our Bitcoin Cloud Miner and get additional crypto rewards based on your trading volume. It's immediately available upon registration.