It's hodlers' time. Short-term BTC holders' reserves are at a 12-year low

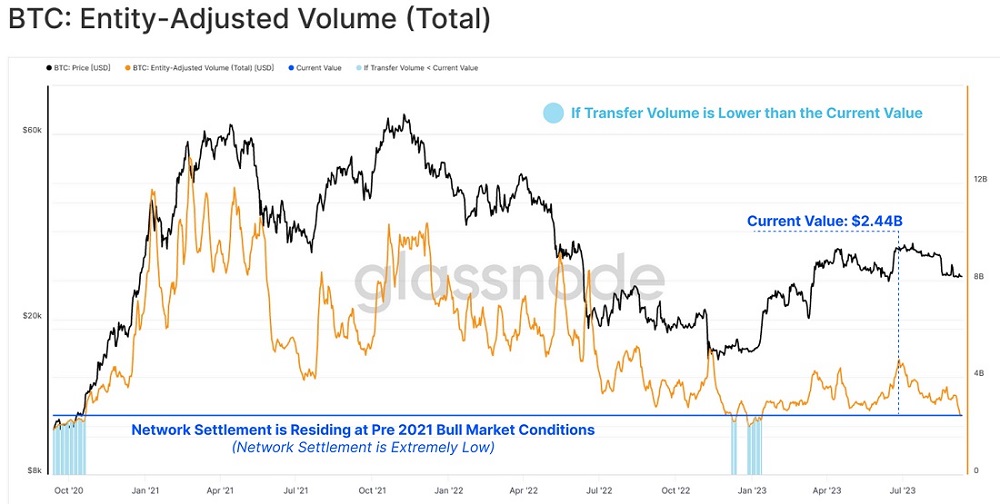

The cryptocurrency market continues to drift amid low liquidity and volatility. Even a slight revival due to Grayscale's interim victory over the SEC didn't affect the metrics. The volume of coins changing hands declined to $2.4 billion a day. These levels were last seen in October 2020.

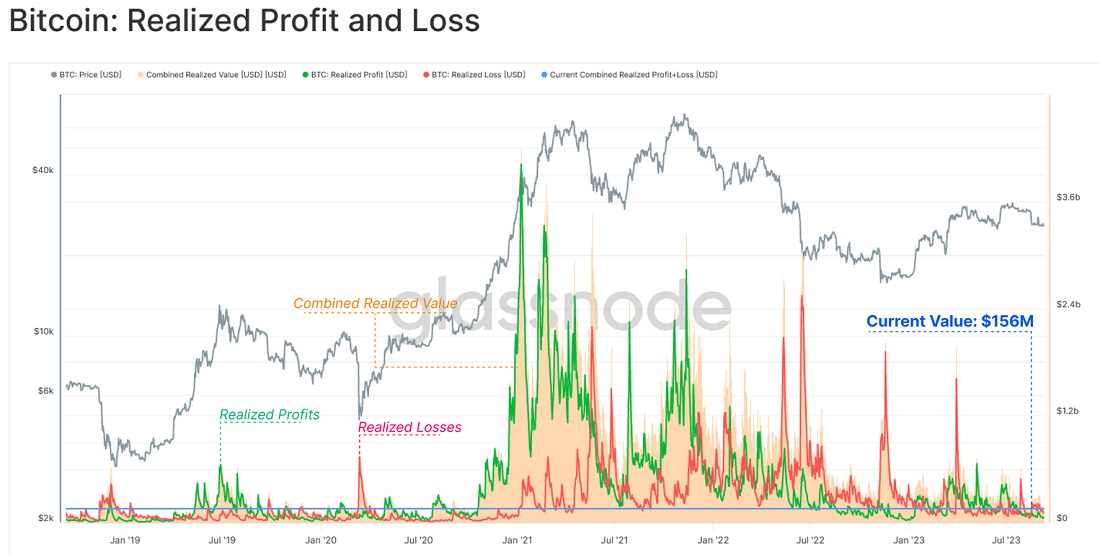

The realised profit and loss indicators have also dropped to three-year lows for both derivative and spot trading.

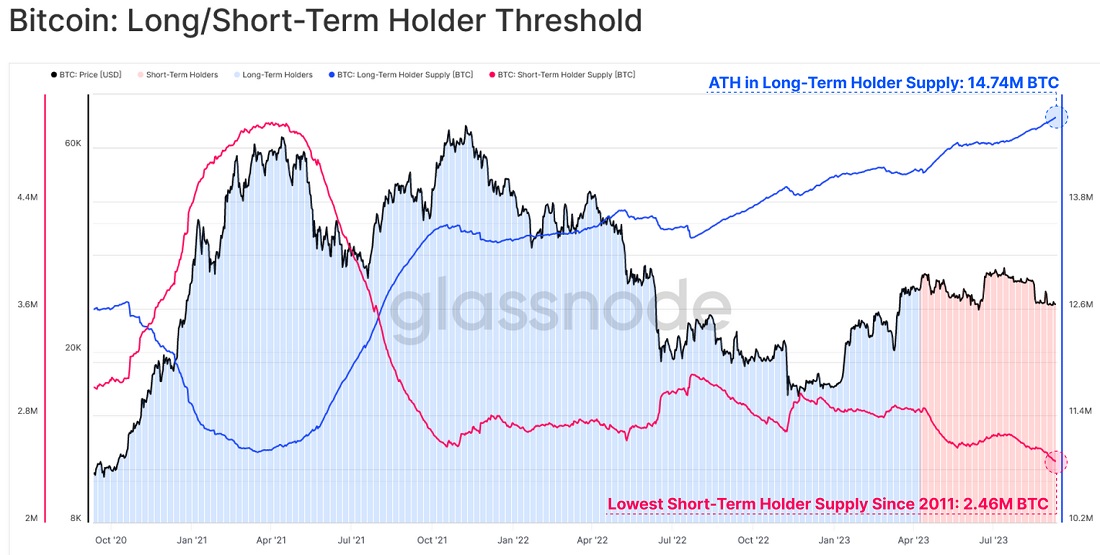

Prolonged calm and increased uncertainty have caused short-term holders to flee. A drop in interest in cryptocurrency trading resulted in this group's holdings dropping to 2.5 million BTC, the lowest level since 2011.

On the other end of the spectrum, long-term holders set a new record by accumulating 14.7 million BTC.

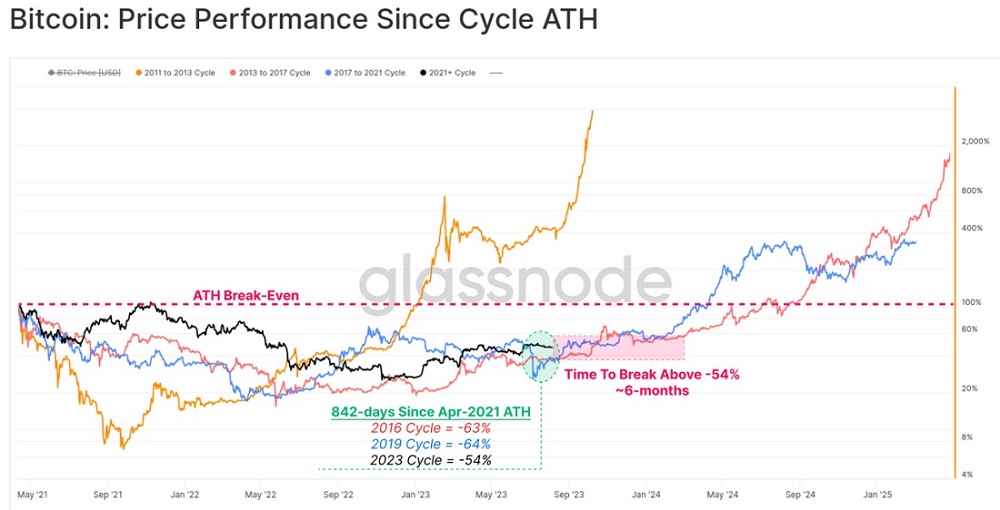

Periods of calmness are typical for the cryptocurrency market between the sell-off and bull rally phases. If we compare the cycles, starting from reaching major local highs, the current consolidation could last until early 2024.

This perfectly aligns with the Fed's monetary policy, which acts like a 'financial hoover' for regional markets and risky assets due to the regulator's high key interest rate. The Fed began its tightening cycle in March 2022, and in just two months, the Terra project (LUNA) collapsed because of a decline in investments. That triggered a wave of collapses of interconnected projects, and the market faced a massive coin sell-off.

Note: Terra's capitalisation growth was presumably due to a Ponzi scheme. The investigation is ongoing, and the founder of the project has been arrested.

The Fed is nearing the end of its hawkish monetary policy cycle as inflation in the US is near its 2% target level, and the banking sector is facing a crisis. Some experts assume that the regulator will stop at the 5.5% level it's already reached and start decreasing the key rate in early 2024.

StormGain Analytical Group

(platform for trading, exchanging and storing cryptocurrency)

Tags

Try our Bitcoin Cloud Miner and get additional crypto rewards based on your trading volume. It's immediately available upon registration.

Try our Bitcoin Cloud Miner and get additional crypto rewards based on your trading volume. It's immediately available upon registration.