Holders pour Bitcoin into exchanges to lock in profits

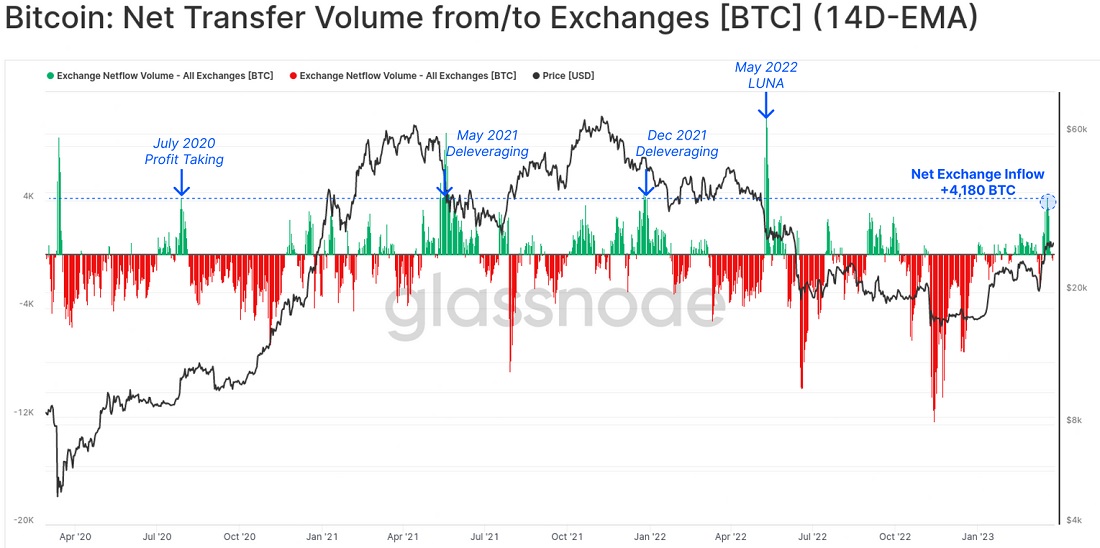

In March, Bitcoin had one of the best weekly runs in history, nearly hitting the $30,000 mark. A number of investors hurriedly sent coins to cryptocurrency exchanges to lock in profits, and as a result last week's net inflows jumped to 42,000 BTC. This is the best market recovery since the May crash caused by the collapse of the Terra project (LUNA).

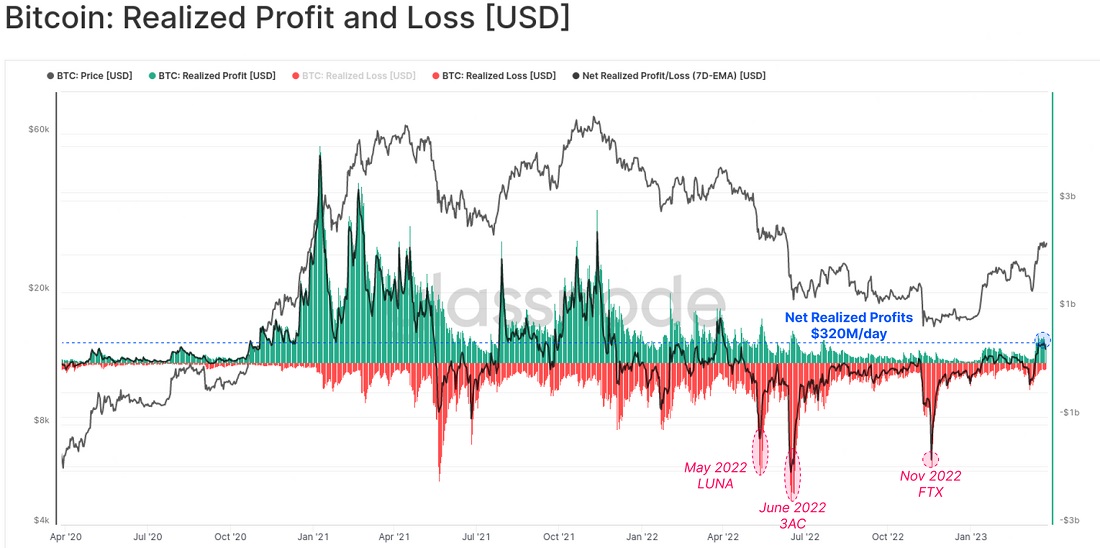

In contrast to the events of last May, the influx of coins was not caused by panic selling, but the desire to lock in profits. Thanks to the growth of recent weeks, investors are locking in $320 million a day in profits. Short-term holders (STH) are most active, accounting for 92.5% of total inflow volumes.

The selloff of coins should lead to a natural fall of Bitcoin. In the first graph, you can see how a significant increase in inflows led to a drop in price time after time.

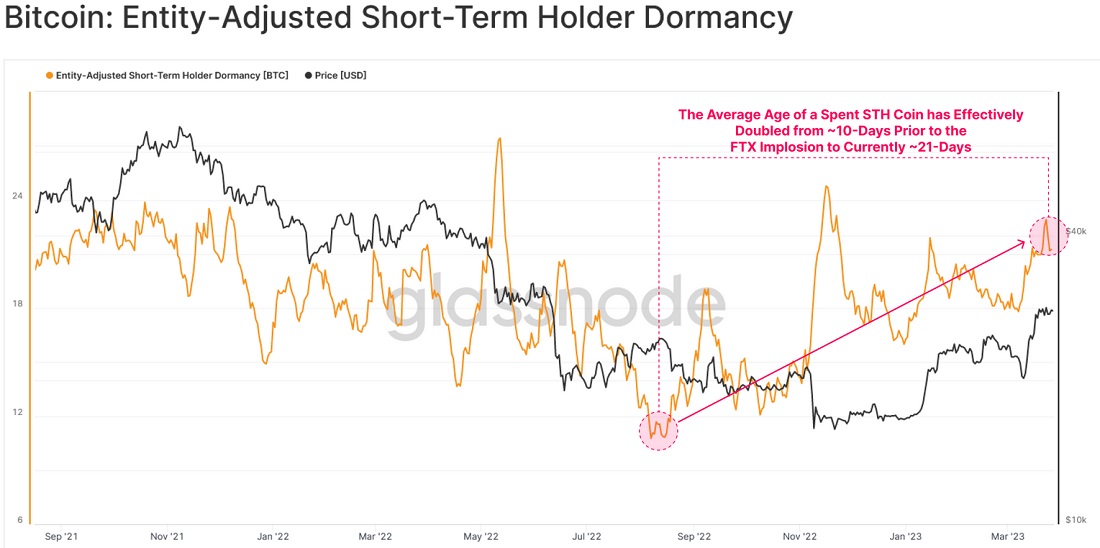

To predict the likelihood of a fall in the current market, we need to consider investor commitment to holding coins. To this end, Glassnode uses a parameter called liveliness, which calculates the time between buying and selling a coin. As we can see, holder accumulation is still strong.

Even more telling is the increase in the average time coins are held in the STH cohort – from 10 days in mid-2022 to the current 21 days. Despite the desire to lock in some profits, even short-term holders are increasingly holding onto coins. This shows that Bitcoin maintains a positive outlook.

On the one hand, investors are trying to lock in some profits, and this increasing supply creates a downward pressure. But this is counterbalanced by the current accumulation phase, as the outlook has improved considerably since the FTX collapse.

On top of this, the largest public holder has resumed Bitcoin purchases: in the past 40 days, MicroStrategy has bought another 6,455 BTC for $150 million. The company now holds 138,955 BTC, at an average of $29,817 per coin. Its current portfolio is valued at $3.7 billion.

StormGain Analytics Group

(an all-in-one cryptocurrency platform)

Tags

Try our Bitcoin Cloud Miner and get additional crypto rewards based on your trading volume. It's immediately available upon registration.

Try our Bitcoin Cloud Miner and get additional crypto rewards based on your trading volume. It's immediately available upon registration.