How do I Invest in Ethereum (ETH)?

Thinking about whether to invest in Ethereum? Not sure whether to invest in Bitcoin or Ethereum? You've come to the right place. In this article, we discuss the Ethereum cryptocurrency, its trading and exchange price, whether to invest in ETH or not, how to invest in ETH, and whether to invest in BTC or ETH.

What is Ethereum (ETH)?

Strictly speaking, Ethereum can refer to two things:

- The Ethereum network, an open-source software platform based on blockchain technology that enables developers to create smart contracts and decentralised applications.

- Ethereum, a cryptocurrency built on the Ethereum platform. This currency is officially called Ether. In this article, we discuss Ether as an investment opportunity. When someone talks about buying, trading, investing in or paying with Ethereum, they mean the Ether currency.

The Ethereum crypto token has long been regarded as the second-best coin after Bitcoin, the original cryptocurrency. It's generally considered the best coin for trading. Ethereum has the second-largest market share after Bitcoin and the second-highest trading volume among cryptocurrencies, once again behind Bitcoin. As such, ETH is seen as an attractive investment for investors who are interested in the crypto space.

Make no mistake – Ethereum would never have existed without Bitcoin as a forerunner. That said, I think Ethereum is ahead of Bitcoin in many ways and represents the bleeding edge of digital currency. – Fred Ehrsam, Coinbase co-founder

Is Ethereum worth buying?

When deciding whether to invest in BTC or ETH, Ethereum's price makes it much more accessible than Bitcoin. At the same time, the potential profit is very high. Ethereum can be bought on the crypto market with the help of a cryptocurrency exchange. Top-rated crypto platform StormGain makes buying ETH easy by allowing clients to invest in ETH with a credit or debit card at the dollar price, according to the latest crypto market index.

Can I make money investing in Ethereum?

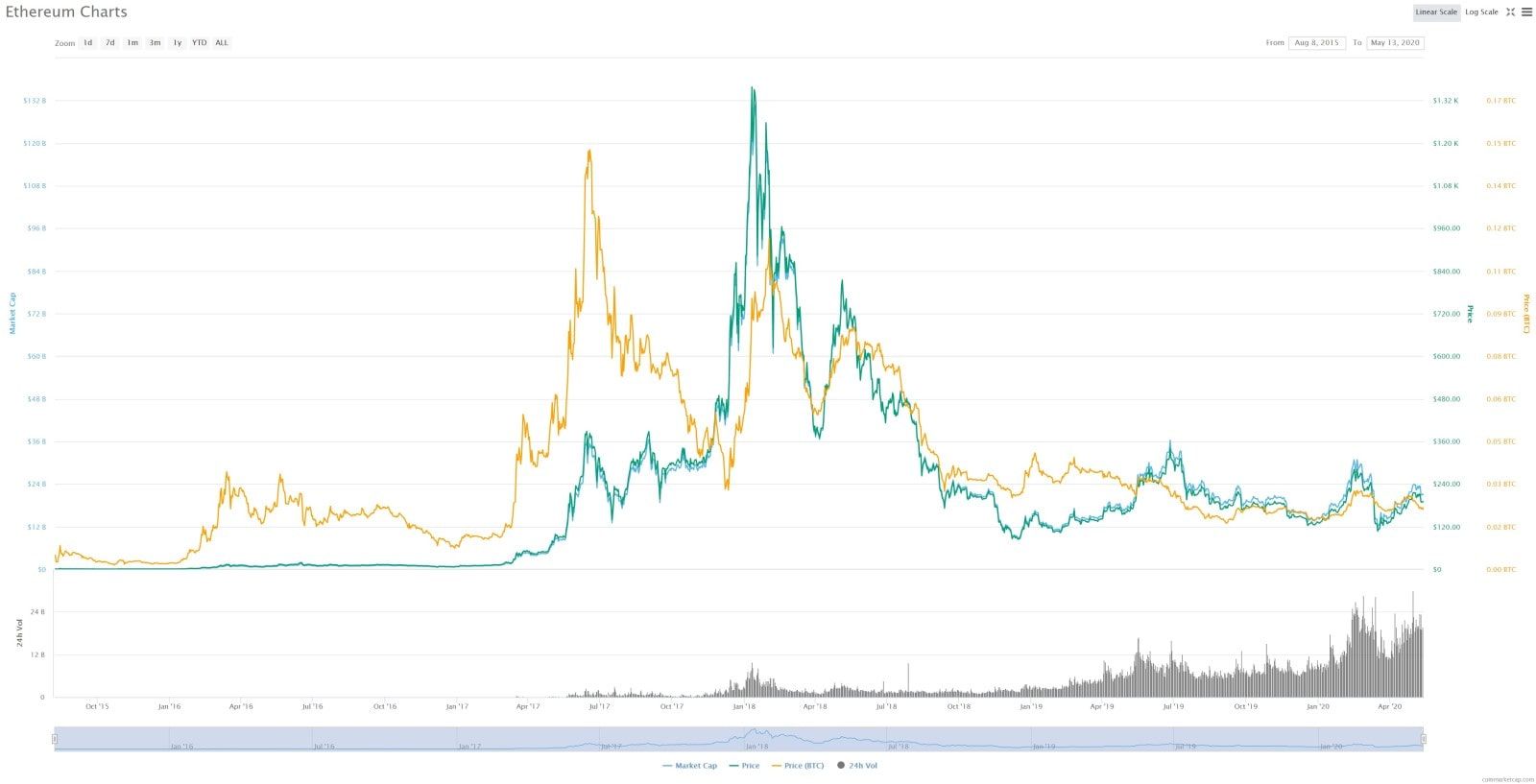

You can invest in crypto to make money. In fact, a lot of people already have. Like any investment, it's all about timing. At the time of its launch, early adopters could buy Ethereum for around one dollar. Ethereum's all-time high price in 2018 was over $1,400. That's quite a return.

Anyone who sold their Ethereum at the price peak in 2018 will have enjoyed a mind-boggling profit. However, there are still investors holding on for dear life who think that Ethereum's best days are still ahead. The current value of Ethereum is $188, but history has shown that any surge of interest in cryptocurrency is as likely to benefit Ethereum just as much as Bitcoin.

Financial analysts and veteran crypto investors predict that the price of Ethereum could reach around $320 per ETH, a prediction based on the most conservative opinions. The highest estimates from Ethereum evangelists predict that the ETH price could soar to over $11,000!

Of course, nothing is guaranteed, but an investor who takes the time to educate themselves on the historical behaviour of ETH, as well as the future predictions of cryptocurrency experts, can stand to make a lot of money investing in Ethereum.

Is it better to invest in Bitcoin or Ethereum?

Following the discussion of whether to invest in BTC or ETH, Bitcoin has a bigger market share than Ethereum, even though ETH is technically 'better'. That's just the advantage gained for getting there first. However, is ETH a better investment than BTC in the long run?

Let's take a look at a few key differences in the two cryptocurrencies:

Bitcoin | Ethereum | |

Ticker | BTC | ETH |

Current price | $41,594.26 (18/12/23) | $68,789.63 (18/12/23) |

All-time high | $68,789.63 (10/11/21) | $4,891.70 (16/11/21) |

Coin Limit | 21 Million | None |

Purpose | Digital money | Smart contracts |

Algorithm | SHA-256 | Ethash |

Mean block time | 10 minutes | 12 seconds |

As you can see, while Ethereum is cheaper to buy and has less value per token than Bitcoin, its algorithm is more technologically advanced than BTC, and it has the ability to process at much faster speeds.

Like Bitcoin, there is little stopping Ethereum from being an alternative currency to fiat and commodity currencies. You can conceivably trade anything using Ethereum, but this is not Ethereum's strength in comparison to other cryptocurrencies – they can all do this. It's rather the computing language that allows the smart contracts to exist that makes Ethereum more valuable than BTC. ― Jeff Reed, Investing in Ethereum: The Essential Guide to Profiting from Cryptocurrencies

An important difference between BTC and ETH is purpose. They are both digital currencies based on blockchain technology, but Bitcoin is only that: a kind of digital cash exchanged between people.

Bitcoin is exchanged manually. Person A sends 10 BTC to person B, for example. However, Ether is intended to form part of a smart contract.

A smart contract is a programme where the ETH currency is transferred automatically if certain conditions are met, for example, if work is submitted or a document is signed on a certain date or at a certain time. This allows Ethereum to handle much more complex financial agreements. Investing in Ethereum should be seen as investing in blockchain technology.

Is it safe to invest in Ethereum?

All investments involve some kind of risk. The typical investor's advice - only invest what you can afford to - applies just as much to cryptocurrency as to traditional investing, such as with gold, oil, or stocks. Bitcoin, Ethereum and other digital assets are still vulnerable to stock market performance, even if they are less volatile than they used to be.

Nonetheless, Ethereum's usefulness in creating smart contracts, along with the fact that many other cryptocurrencies are based on the Ethereum network, means the decision to invest in ETH could be a wiser one than Bitcoin in the long run when the crypto market has had time to mature.

Ethereum investment trust

Some companies decided to capitalise on the increased interest in Ethereum by offering trusts. Investors can buy shares in trusts, which are companies that conduct trading on the stock market with an aim to make their shares more valuable for investors.

While trusts that deal in ETH exist, we recommend that you invest in ETH directly. Cryptocurrency is about empowering the individual, and you will be in a better position to profit from your investment if you own your Ethereum.

A trustworthy crypto exchange will empower its users by providing education materials, webinars, demos and trading signals. StormGain's educational programme, which helps clients on their journey from beginner traders to crypto market experts, is backed up by a helpful support team and a fully functional demo programme to make sure users have everything they need to manage their investments successfully.

Is BTC or ETH a better investment?

So, should you invest in BTC or ETH? Ethereum and Bitcoin are both cryptocurrencies, but they have fundamentally different functions. Bitcoin is limited in capacity and function, behaving like a precious metal. Investing in Ethereum is making a bet on the future of blockchain applications. Neither is strictly better as an investment, but a savvy crypto investor will consider both BTC and ETH investment.

How do I invest in ETH?

To invest in ETH, you just need to buy some ETH. You will also need a crypto wallet to store it. The best quality crypto exchanges will offer free built-in crypto wallets to store your Ethereum and other coins.

Then, of course, you will want to be able to monitor the price of your Ethereum so that you can decide when to sell and cash in on your investment. A cryptocurrency exchange easily facilitates all this.

How to invest in ETH, step-by-step

- Choose a cryptocurrency exchange - we recommend StormGain for the best bonuses and the best online crypto trading platform.

- Register an account.

- Buy Ethereum via bank transfer, credit/debit card, or by exchanging Bitcoin or another cryptocurrency.

- The platform will exchange your funds for the chosen amount of Ethereum.

- Once Ethereum is in your wallet, monitor your investment by keeping up with ETH price and market trends.

- When you are ready to make a profit, sell or exchange your Ethereum.

Where can I invest in Ethereum?

The best place to invest in Ethereum is at a cryptocurrency exchange. Ideally, you want an exchange with a modern, easy-to-use design that you can access from your main computer or your smartphone. This way, you'll eliminate the need to hire a broker and save both time and money.

A good cryptocurrency exchange will offer bonuses for large deposits and active users. It never hurts to have a little more money, so make sure that you'll get something extra when you put money in.

How much do you need to invest in Ethereum?

To get the best returns on your Ethereum investment, you'll want to take full advantage of the bonuses and special rewards offered by the broker. Check any special offers from your crypto exchange - if you can make some extra money off your ETH deposit, why not do it?

Currently, the best possible returns on investment are offered by the StormGain loyalty programme. The maximum bonuses (15% deposit bonus and 10% annual interest) are available for users with a total balance greater than 9,999 USDT, but there are rewards for having a balance of over 499 USDT too.

How do I invest in Ethereum in the UK?

To invest in Ethereum in the UK, one just needs to find a crypto exchange that offers ETH and also accepts payments from a UK bank account. StormGain, for example, accepts payments from the UK.

Due to the nature of national legislation about the trading of cryptocurrencies, not every exchange will support every country. Most exchanges will have a list of countries that they accept payment from, or they list the ones that they do not service.

Cryptocurrency is based on an open philosophy that transcends national borders. In a way, the concept as a whole intends to weaken governmental control over people's money. Bitcoin, Ethereum, Ripple and other cryptocurrencies are all able to facilitate cross-border payments, and given the international interest in cryptocurrency all over the world, chances are you will find an exchange that supports your country.

Is Ethereum a long-term investment?

Ethereum is a good long-term investment plan because the price should go up the more the Ethereum blockchain technology is used. At the moment, Bitcoin dominates the market as a store of value. However, as blockchain technology becomes more mainstream, Ethereum should gain popularity because of its usefulness in smart contracts and the fact that other cryptocurrencies can be based on the Ethereum network.

ETH investment strategy

When buying Ethereum as an investment, the investor should ask themselves whether they want ETH as a long-term or short-term investment.

As a long-term investment, you'll want to hold on to your Ether for many years, hoping for the Ethereum network, smart contracts and decentralised applications to become mainstream. When that happens, whoever has heavily invested in Ethereum will be in a strong market position.

But the long-term strategy means that you miss out on the potential short-term gains of trading Ethereum on the market. We recommend actively trading ETH for profit, buying low and selling high. Not only will that gain you profit that you can actually use here and now, but traders will learn invaluable lessons about ETH's behaviour in the market and get a better idea of its long-term value.

A mixed approach, where you hold some ETH as a long-term investment and use some Ether for trading, should be the best path for investors to take.

Conclusions: Ethereum, buy or not?

Ethereum is absolutely worth buying. The success of the Ethereum network has proven that ETH won't be going away, and as blockchain technology becomes more mainstream, the importance of Ethereum in the finance world will only increase.

'It's clear to me now that Ethereum is the new currency of the Internet. It's way ahead of where PayPal was in its day, and it's much more exciting to its customers than PayPal ever was.'

– Gil Penchina, Angel Investor

Just make sure to buy Ethereum through a platform that will offer good bonuses for your investment and provide the tools you need to manage your assets effectively.

Benefits of investing with StormGain

StormGain is an award-winning platform for trading, exchanging and buying cryptocurrency. Available as a user-friendly smartphone app or on the web, StormGain's mission is to make the crypto market accessible to everyone. This makes it perfect for beginners who are looking to invest in Ethereum and other cryptocurrencies.

The key benefits of investing with StormGain include:

- The best rewards for trading and managing crypto assets, including discounts of up to 20% on trading commissions, up to 15% on deposits, and up to 10% APR interest bonus on holdings.

- The ability to trade cryptocurrency pairs with an up to 200x multiplier, higher than any competitor.

- Built-in secure crypto wallets for the 6 most popular cryptocurrencies, including ETH.

- A comprehensive educational programme, including webinars, guides and a fully functional demo account that lets you try the platform out before you deposit.

- A variety of payment options to easily buy Ethereum or other cryptocurrencies with fiat money.

In addition, StormGain offers free SWAPs for daily trades and integrated trading signals to keep you up to date with today's fast-moving international market.

StormGain's platform has attracted praise from finance industry publications, trading professionals and ordinary users alike for its ease of use and very low fees and commissions. If you're looking to invest in Ethereum and profit from its future price increase, then it's time to register with StormGain and benefit from the best perks and professional support in the crypto industry!

StormGain is an award-winning platform for trading, exchanging and buying cryptocurrency. Available as a user-friendly smartphone app or on the web, StormGain’s mission is to make the crypto market accessible to everyone. This makes it perfect for beginners who are looking to invest in Ethereum and other cryptocurrencies.

The key benefits of investing with StormGain include:

- The best rewards for trading and managing crypto assets, including discounts of up to 20% on trading commissions, up to 15% on deposits and up to 10% APR interest bonus on holdings

- The ability to trade cryptocurrency pairs with leverage of up to 200x, higher than any competitor

- Built-in secure crypto wallets for the 6 most popular cryptocurrencies, including ETH

- A comprehensive educational programme, including webinars, guides and a fully functional demo account that lets you try the platform out before you add funds

- A variety of payment options to easily buy Ethereum or other cryptocurrencies with fiat money.

In addition, StormGain offers free SWAPs for daily trades and integrated trading signals to keep you up to date with today’s fast-moving international market.

StormGain’s platform has attracted praise from finance industry publications, trading professionals and ordinary users alike for its ease of use and very low fees and commissions. If you’re looking to invest in Ethereum and profit from its future price increase, then it’s time to register with StormGain and benefit from the best perks and professional support in the crypto industry!

Tags

Try our Bitcoin Cloud Miner and get additional crypto rewards based on your trading volume. It's immediately available upon registration.

Try our Bitcoin Cloud Miner and get additional crypto rewards based on your trading volume. It's immediately available upon registration.

FAQ

Who invested in Ethereum?

Most of the largest Ethereum holders are exchanges, but some individuals and protocols hold large amounts of ETH. So, who made the largest ETH investment? Check them listed below.

- Vitalik Buterin, one of the founders of Ethereum, is one of the largest owners of Ethereum, with an ETH Investment of over 240,000 ETH held in his VB 3 address.

- The Beacon Chain contract, used during Ethereum's switch to proof of stake, is currently the largest holder of ETH with an ETH Investment of over 18 million ETH.

- Binance, one of the best online crypto trading platforms, is the second largest holder of ETH, with over 4.4 million ETH held across various addresses, including their Binance-Peg Tokens address.

- Kraken, another top exchange by trading volume, holds over 1.7 million ETH.

- Arbitrum Bridge, a popular Layer 2s, holds over 1 million ETH in its contract.

- Bitfinex, another top exchange to buy crypto quick, holds over 1 million ETH across three addresses.

Is investing in Ethereum worth it?

Whether to invest in ETH or not is a viable option for a long-term investment. Ranking the second largest cryptocurrency in the world, ETH is considered one of the best crypto for 2024. Nonetheless, it's crucial to acknowledge that Ethereum is highly unstable and can fluctuate rapidly in brief periods. Before making an ETH investment, it's imperative to grasp the associated risks, as there's a chance you could lose a significant proportion or the entirety of your investment.

Is it good to invest in Ethereum now?

There are several vital points to consider before deciding to invest in ETH:

- Ethereum's first-mover advantage has allowed it to become one of the best coins for trading and to establish a thriving ecosystem of developers, users, and investors before any other blockchain could. Maintaining this market position is crucial for Ethereum since it is vital to ETH's value.

- With "the Merge" set to introduce a PoS consensus protocol in 2022, Ethereum has become more scalable than it was using a PoW consensus mechanism. Further upgrades, like the highly-anticipated "Danksharding" system, will be vital to helping Ethereum stay ahead in this regard.

- Risks such as high gas fees and growing competition cannot be ignored. Rival chains often focus on delivering faster and cheaper transactions relative to Ethereum, which could negatively impact the ETH price if users migrate to these platforms.

- Regulatory developments will also impact Ethereum's price. With the SEC's stance on cryptocurrencies still unclear, new restrictions in the years ahead could introduce volatility into the market, causing severe price swings for ETH.

The decision to invest in ETH will come down to each investor's level of risk tolerance. While the rewards could be significant if Ethereum continues to grow, it will likely continue facing stiff competition in the years ahead.