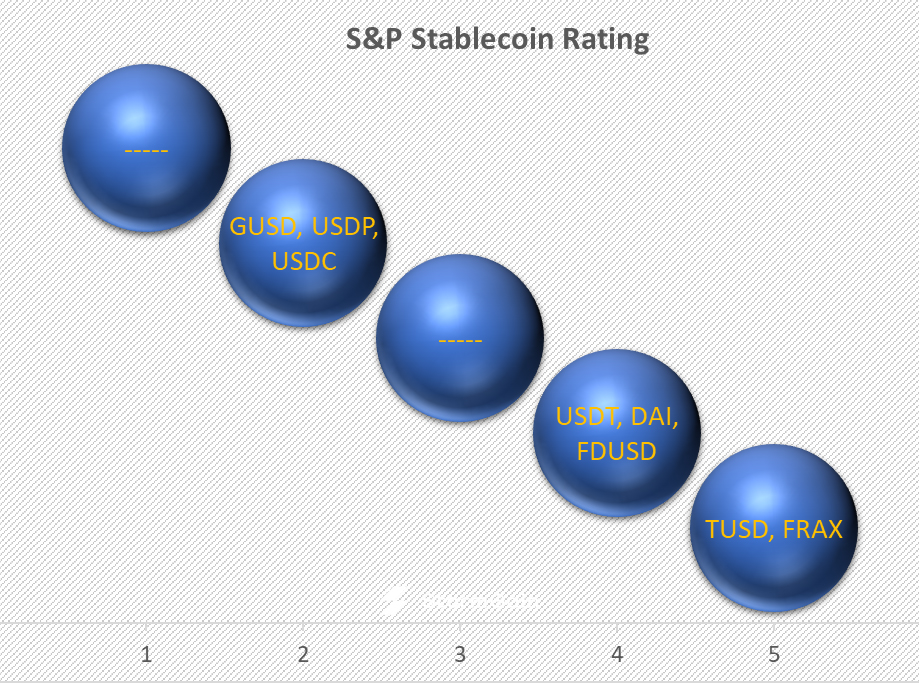

Tether is second to last in the S&P's stablecoin rating

S&P Global conducted a study of the stablecoin market on the ability to hold the US dollar peg, reserve quality, transparency and liquidity. Based on its findings, it compiled an overall rating system.

No stablecoin received the highest score of 1 or the middle-of-the-range score of 3. The scores were distributed as follows:

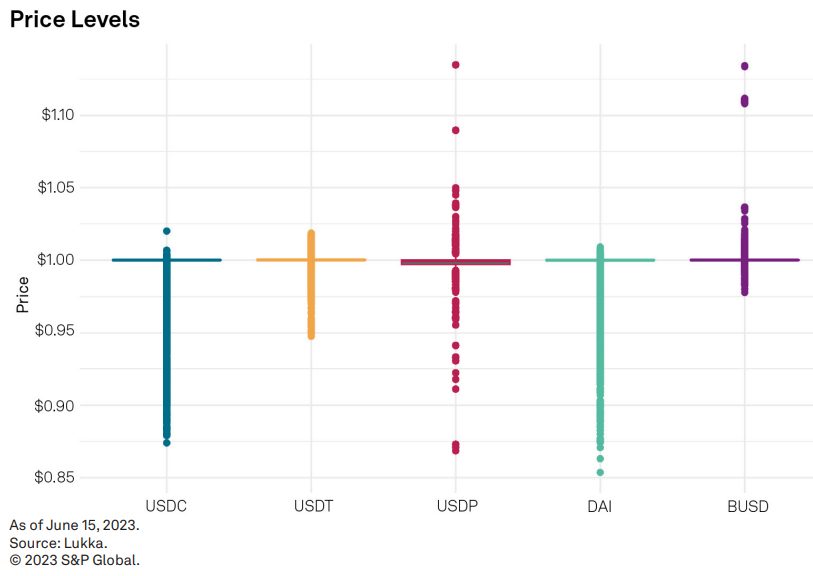

USDC took second place due to its high transparency and location in the US, but the coin traded at a 10% discount in March after some US banks collapsed. At that time, some reserves could only be saved through the government's and the Fed's intervention.

USDT, on the other hand, has done better with the dollar peg but is still criticised for its lack of transparency and the presence of all sorts of assets in reserves, including third-party debt securities. For the S&P, that's enough to give it a below-average score and place USDT next to FDUSD, which is based in Hong Kong and has only been around for six months.

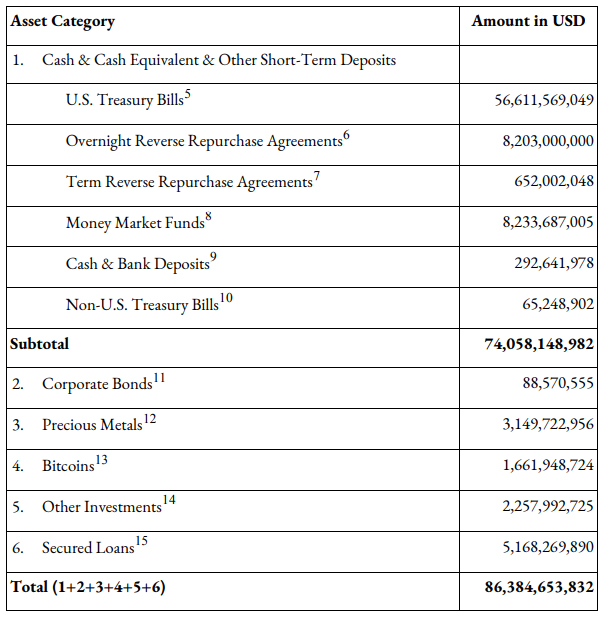

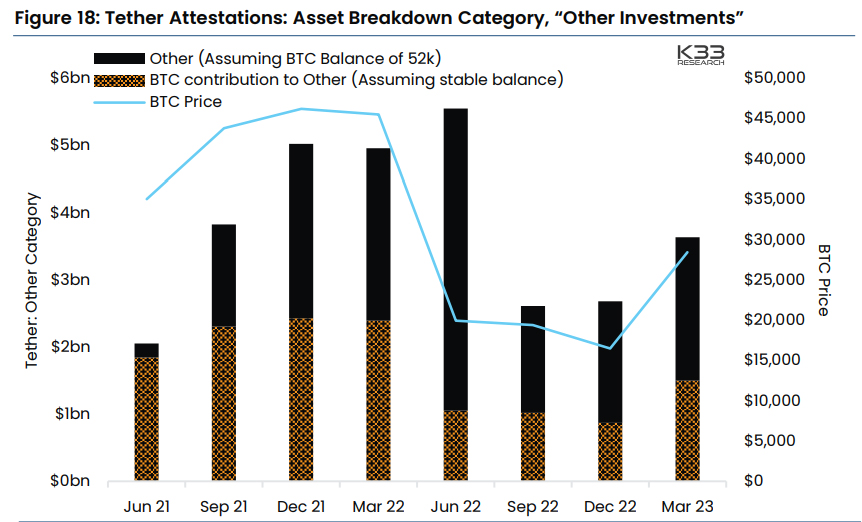

Criticism of Tether is justified, though, as the company initially promised to have $1 in the bank for every 1 USDT issued. It is still not meeting this condition. In the September reserves report, $2.3 billion is referred to as "other investments", and $5.2 billion is listed as "collateralised loans". Together, these two shady columns account for 10% of reserves.

Tether pulled a trick with listing Bitcoin as an asset.

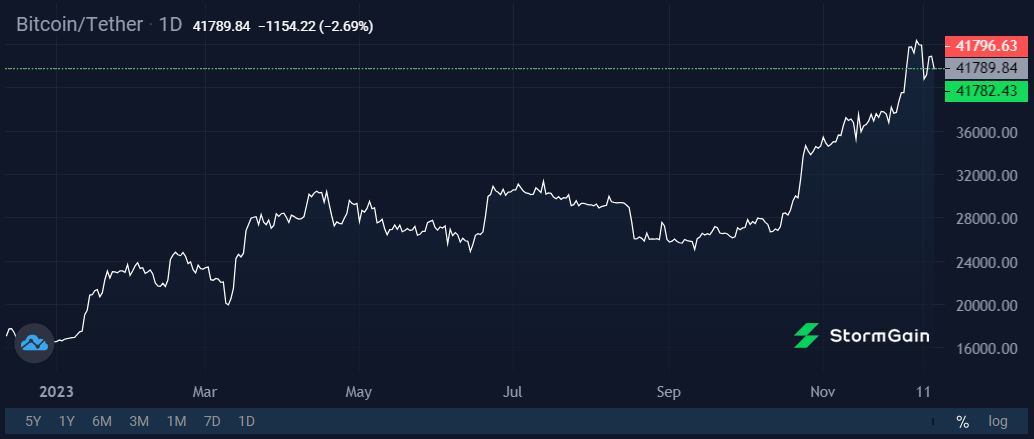

Allegedly, the coins only appeared this year due to significant profits. But lawyer David Miller admitted the company's investments in cryptocurrency at trial in 2019, and K33 Research showed a high correlation of the reserve with Bitcoin's price for several years.

These circumstances explain why USDT received only 2 points out of a possible 5. The cryptocurrency market is booming again, with Tether's capitalisation reaching a record $90 billion. However, as the market becomes more institutionalised and the regulatory framework improves, more questions will be asked.

StormGain Analytical Group

(platform for trading, exchanging and storing cryptocurrency)

Tags

Try our Bitcoin Cloud Miner and get additional crypto rewards based on your trading volume. It's immediately available upon registration.

Try our Bitcoin Cloud Miner and get additional crypto rewards based on your trading volume. It's immediately available upon registration.