How to trade cryptocurrency: key points and tips

The cryptocurrency market is relatively new, and most people know nothing about it. Not so for traders, most of whom added cryptocurrency to their portfolio right away. Why? They saw another opportunity to earn money.

So, how many people trade crypto and get piles of money every day?

A few words about crypto

The first digital asset, Bitcoin, was founded in 2009. Different projects then gave the world more and more alternatives, such as Ethereum, Litecoin, Ripple, Bitcoin Cash and others. According to Coinmarketcap, there are more than 2,000 cryptocurrencies. Active traders are spoiled for choice.

However, less active or new altcoins may have limited trading opportunities as they provide fewer buyers when it's time to sell. Traders want to be sure of their success, so they only focus on some of the leading cryptocurrencies.

How traders define the value of different projects

Crypto coins are generated by computational alchemy, also known as mining, that requires a lot of processing power to produce new coins. The higher the hashrate is for each chain, the more transactions the chain can process. This gives rise to greater demand and value.

What is cryptocurrency trading?

Trading is an extremely complicated activity. It's not just about money and mathematics but also about stress, information processing, fast decisions and cool, collected actions. Warren Buffet, George Soros and Steven A. Cohen all build capital today because they understand how the market reacts to different facts. Therefore, they understand trading.

Michael Novogratz is one of the most successful cryptocurrency traders. He made his fortune on Bitcoin, Ethereum and different ICOs. How? He understood cryptocurrency trading. In 2013, he remarked that a trader could invest in Bitcoin, come back a few years later, and see their investment greatly increased.

He was right because, at that time, Bitcoin was trading at a price of around $200 per coin. In 2017, it had reached $20,000. Even now, it's much higher than $200. The profitability of Novogratz's cryptocurrency investments turned out to be incredibly high.

So what does trading look like?

The main concept is almost identical to the stock or currency market. You buy/sell one asset for another, believing that the crypto you purchase will increase in value.

Cryptocurrency trading is about earning money via a Contract for Difference (CFD) trading account or simply buying and selling different coins via an exchange.

A CFD is a derivative that allows traders to profit on cryptocurrency index changes without taking any ownership of the related cryptos. You may set a "long" (buy) position if you think the cryptocurrency will grow in value and a "short" (sell) position if you think its value will drop. You have to create a deposit to begin trading.

Working with an exchange means that you first have to buy crypto on this platform, create an account, verify it and open the position. As usual, you must store your assets on the exchange wallet.

How does crypto trading work?

If you want to earn as much as possible, you must know this. We can provide the theory and explain someone's experience, but you'll only see the full picture through practice.

Firstly, learn some main principles:

- Cryptocurrency trading is similar to real market trading, but it isn't a fraction of a regular stock exchange.

- It's a 24-hour market.

- The crypto market is especially volatile.

Secondly, you must understand the standard way of working with crypto exchanges:

- Traders send their existing coins to an account on an exchange or use a platform to buy crypto.

- They observe the prices of other assets available on the exchange.

- They select their desired trade.

- Traders then place buy/sell orders.

- The platform finds a seller/buyer to match orders.

- The exchange completes the transaction.

An exchange platform charges a fee for every trade. It's usually around 0.1%, which is high. Why? Because daily trade volume is over $55 billion. The 'lucky' ones built significant capital doing this.

There's one last fundamental thing to understand: traders don't just use their maths skills. Experienced traders know that such an enormous market needs more to earn money. Therefore, they use many different programmes to choose the right asset for the right time. This may involve software to help analyse the market.

Financial engineering is the use of innovative technologies to analyse more statistics in a shorter time. It helps invest in the best fields or currencies.

How to begin trading cryptocurrency

You may be an experienced stock market trader or a newbie who doesn't know how to start trading cryptocurrencies. Real stock market traders have only one advantage: they know technical analysis, so they don't need to learn trading fundamentals.

Even though you're full of motivation and want to see the algorithm for using an exchange, you aren't ready yet. You first need to learn vocabulary to gain an understanding of how to trade cryptocurrency.

Main terms in cryptocurrency trading.

Name | Definition |

Spread | The gap between two indices for buying and selling an asset. |

Lot | A set of coins used to specify the optimal size for trades. The set may consist of small amounts of the cryptocurrency (e.g., 0.01 BTC). The full lot can be tiny (e.g., 1 LTC). However, some altcoins are traded in huge lots (e.g., 10,000 DOGE). |

Leverage | The opportunity to gain a large amount of crypto without paying the full price upfront. Be careful with leverage because it can both enhance your profit or increase losses. |

Margin | The most important fraction of leveraged positions. It describes the initial deposit you set up to place an order. It's expressed as a percentage of the full position. |

Pip | A unit for price movement increments. For instance, a move from $200 to $201 is a pip. Nevertheless, the size of a pip can change in different cryptocurrencies, from a fraction of a cent to $100. |

How to buy and trade cryptocurrency

You're almost ready to start earning money. But if you want to get something, you have to give something. This rule applies to crypto trading, too. You should send fiat money (or crypto from your wallet) to the exchange.

- Create an account on an exchange.

- Verify it.

- If your budget consists of fiat currency, you need to create a payment channel.

- Verify your identity (if necessary). Usually, exchanges ask for this information because of anti-money-laundering (AML) policies. The other reason is security: they combat trading bots.

- Deposit funds.

So how do you trade cryptocurrency?

Now, try to answer the question: how do you trade cryptocurrency? People will ask it every time the conversation turns to trading. So, short-term or long-term?

Short-term trading is about buying an asset to sell soon after. Usually, beginners think that it's after a few minutes or hours. This can be anything from seconds to a few months. You may buy a specific crypto because you think its value will grow shortly.

Pros

The main benefit is an excellent chance to make a high profit in a very (even extremely) short period of time. Why? Because the cryptocurrency index may triple overnight or within several hours. The fiat currency market can't provide such opportunities because prices usually only change about 1% during a day.

You can always find a buyer or a seller. People often turn to short-term trading with big projects such as Monero, Ethereum or Dash. These cryptocurrencies have significant demand, so you won't have to wait for each trade.

Cons

Volatility is the biggest problem in the crypto world. If you perform short-term trades, you'll need to spend a lot of time analysing the market before trading. Because of that, you could lose all your money in just one second.

You must have a good grip on your psychological condition. Short-term trading means that you can't always win.

Long-term trading is about HODLing. You may not know this word if you're new to trading.

HODL means 'hold on for dear life.' It's not in the dictionary but describes the whole long-term trading market's belief that, even if there's enormous volatility, the index will rise over the long term.

Pros

First, you don't have to make a significant technical analysis with complex trading charts. The recipe is straightforward: you buy and wait. Check the price once a day and sell crypto at the most appropriate time.

Second, you don't need a big budget. You can buy small amounts and let them grow over a few years. Many people bought Bitcoin for $0.35 and forgot about it. In 5 years, they had a profit of over 60,000x their initial investment.

Cons

You may lose a good chance for short-term trading. Sometimes, prices rise very quickly, only to fall over a few days. However, if you have enough time and knowledge, you can combine long-term and short-term trading.

With long-term trading, you don't spend much time on market analysis. That's why you may miss some news which could influence the price.

Crypto exchanges

There are many platforms, so choose the one that suits you best. They differ, so do some research. Look for:

- Available currencies (be sure that the crypto you want to trade is supported)

- Leverage (high leverage isn't recommended for newbies, but it's good for a big profit)

- Hedging (provides insurance and reduces the possibility of loss; good for beginners)

- Minimum investment

- Support (you will have some questions, so choose a platform with good staff).

Also, you have to check an exchange's reviews, security issues and history. Don't work with platforms that raise doubts. There are many good exchanges, such as Poloniex, Kraken or Binance. You can choose any and start trading.

Best crypto wallets for trading

When choosing a digital wallet, you should analyse its history and security issues. It defines the reliability of your investments. We analysed the market and completed a list of the best crypto wallets for trading. The final decision was based on security, the number of cryptocurrencies that could be stored and fees.

- Coinbase

- Exodus

- Copay

- Jaxx

- BRD

- Ledger Nano S, Trezor and Keepkey (for long-term trading).

Five Common Crypto Mistakes and How to Avoid Them

Becoming engrossed in the excitement generated by attention-grabbing news headlines is incredibly effortless. Unfortunately, making mistakes when it comes to cryptocurrency investments is very widespread. We've compiled a list of some of the most common mistakes below to help you avoid them.

Buying for the Sake of Low Prices

One common mistake people make when investing in cryptocurrency is buying solely based on low prices. Understanding that low prices do not equate to is crucial. For instance, a cryptocurrency with fewer users might have a low price. Moreover, there are instances where developers abandon a project, and the cryptocurrency's security becomes compromised due to a lack of updates.

Going "all-in"

Another mistake to avoid when investing in cryptocurrency is going "all-in," which means investing all your capital in a single cryptocurrency or a single trade. Some trading platforms may suggest going all-in to maximise profits, but this risky approach could lead to significant losses.

A better approach to cryptocurrency investment is to use only a portion of your investment capital, such as 5%, and spread it across multiple cryptocurrencies or trades to minimise risk. Additionally, it's crucial to maintain an emergency cash fund that's easily accessible and never invested in the market. This fund can act as a safety net in case of unforeseen circumstances, such as market crashes or personal emergencies.

By diversifying your investments and maintaining an emergency cash fund, you can protect your capital and minimise risks while investing in cryptocurrency.

Thinking Crypto Is an Easy Way to Make Money

It's a common misconception that investing in cryptocurrency is an easy way to make money. However, the truth is that making money through trading any financial asset, whether it's stocks, shares, commodities like gold and silver, or cryptocurrency, is a challenging task.

Anyone who claims otherwise is likely trying to deceive you and lead you into making cryptocurrency mistakes. It's important to understand that investing in cryptocurrency involves risks, and it requires a significant amount of research, knowledge, and skills to make profitable investments.

Therefore, it's crucial to approach cryptocurrency investment with a realistic mindset and be prepared to put in the effort to gain the necessary knowledge and skills to succeed in this field.

Forgetting Your Crypto Keyphrase

This can be a critical mistake when it comes to cryptocurrency storage. If you're using a hardware wallet to store your cryptocurrency offline, your keyphrase is the key to your digital assets. Losing or forgetting your keyphrase is akin to misplacing the keys to a bank vault, as it could permanently lose access to your cryptocurrency.

Without the keyphrase, you won't be able to retrieve or transfer your digital assets, and they'll be lost forever. Therefore, keeping your keyphrase safe and secure is crucial, preferably in a physical location that only you can access.

If you forget or misplace your keyphrase, some hardware wallets have a recovery option that allows you to restore your access using a seed phrase. However, this is not always the case, and it's better to be safe than sorry by keeping your keyphrase in a secure location.

Falling for Crypto Scams

Being aware of potential crypto scams is crucial, as falling for them can result in significant financial losses. There are several types of scams in the crypto world, and we outline some of the most common ones below.

Cloud multiplier scams involve fraudsters contacting potential victims via email or text, promising an investment opportunity that doubles or triples their bitcoin if they send it to a specific digital wallet. Viewing free money offers sceptically is essential, as they are often too good to be true.

Pump-and-dump scams involve criminals artificially inflating or deflating the price of small or unknown cryptocurrencies. They promote the currency on social media, wait for the price to increase, sell all their coins, and cause the price to crash, leading to significant losses for investors.

Malicious wallet software is another common scam to watch out for. Dodgy or unknown wallets on Google Play or the App Store can contain malicious code that can steal crypto funds. Sticking to reputable crypto wallets like Ledger, Trezor, Exodus, or MetaMask is best.

Fake coins are another risk in the crypto world. With so many cryptocurrencies available, it can be challenging to distinguish between genuine and fake ones. Investing in fake coins can result in identity theft and significant financial losses. Therefore, conducting thorough research using multiple sources is essential before investing in any new cryptocurrency

How to know when to trade cryptocurrency

Crypto trading is very complicated and risky. Theory alone isn't enough to be successful in this market. Trading is based on analysis, of which there are two main types: technical and fundamental. The first one is about graphs. You have to learn trends, price history and just about everything in figures. The second one is about the news — monitor informational websites about cryptocurrency to learn everything as fast as you can.

Crypto trading signals

It's about technical analysis. Signals are trading ideas or suggestions for actions on the exchange that are generated by professional traders or software. You can find these signals on your own. However, if you lack knowledge, it's better to buy a subscription. You'll lose less if you have expert suggestions.

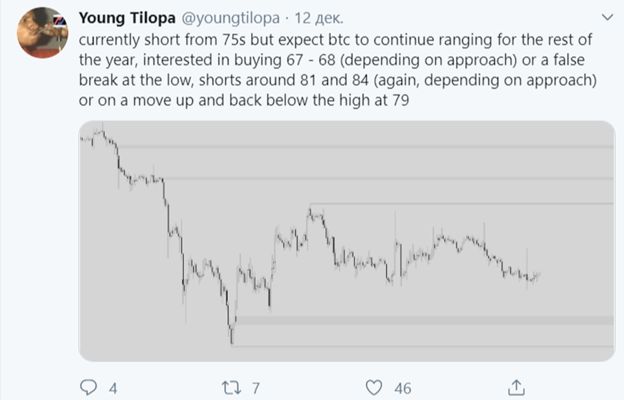

Also, you can follow some popular traders on Twitter.

Be careful. People on Twitter can cheat you to get more profit for themselves. Moreover, if they play on their own, they can lie to their own.

Market analysis

The crypto market runs on supply and demand. Because of decentralisation, it's free from world politics and economics. While there are still many factors that influence this market, prices can change in just one moment due to the following causes:

- Supply

- Capitalisation (the value of all coins)

- Press releases (the media defines almost everything that happens in the financial world, so follow the news)

- Integration (how different payment systems and exchanges work with each cryptocurrency)

- Key events inside the project (updates, security changes, hacks, etc.).

Market analysis is also known as fundamental analysis. It's essential for trading because it defines your success.

How to get started with StormGain

StormGain is one cryptocurrency exchange that lets you start trading in 4 steps:

- Create an account using your e-mail address and password, and verify it.

- Deposit fiat or cryptocurrency.

- Analyse the market.

- Place a trade.

5 golden rules for crypto trading

We can't teach you everything about cryptocurrency trading. Why? Because experience plays a big role. You have to practice to double and triple your capital. It's the first and foremost rule.Fake it 'til you make it.

Next, analyse as much as possible. He who owns the information owns the world. You can't be a good trader without learning everything about the market.

Don't trade over your capital. Remember about real life. If you don't have enough money for food and taxes, you won't have a clear head to make the right decisions while trading.

Understand the cryptocurrency you are buying. Even if your portfolio consists of 30 different coins, you have to know everything about each of them. It's the only way to invest appropriately.

Lastly, remember that it's OK to lose sometimes. You can't always win. If you lose, keep a cool head.

Tags

Try our Bitcoin Cloud Miner and get additional crypto rewards based on your trading volume. It's immediately available upon registration.

Try our Bitcoin Cloud Miner and get additional crypto rewards based on your trading volume. It's immediately available upon registration.