Investors pull out of cryptocurrency funds

Ethereum's Merge was a disappointment both for miners, who lost their most profitable coin, and for institutional investors, who had hedged their bets on a rally following this exceptional event.

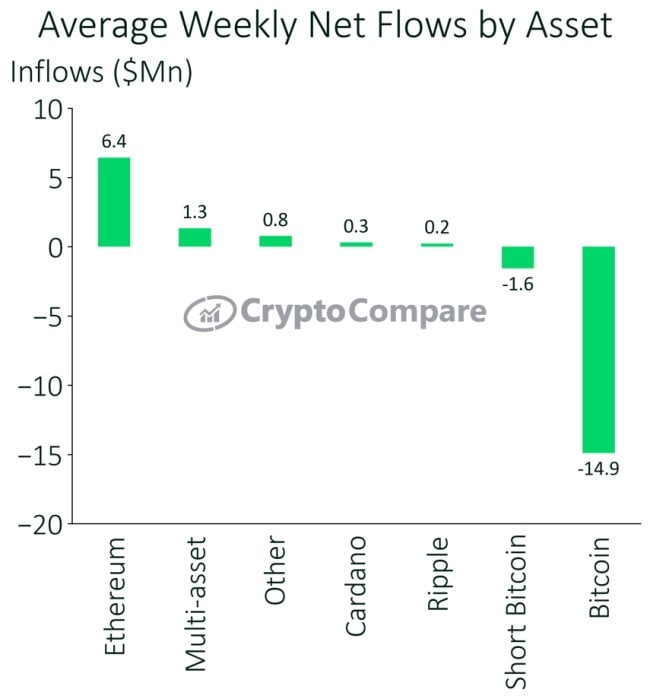

In August, institutional investors withdrew an average of $14.9 million each week from Bitcoin funds and invested $6.4 million in Ethereum.

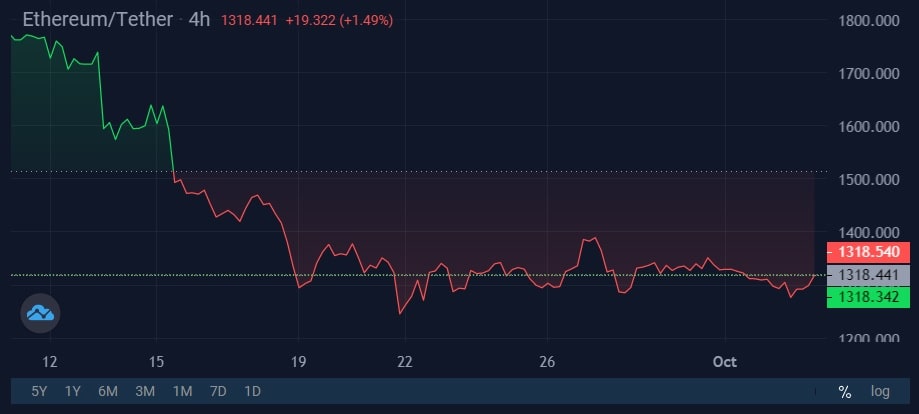

Ethereum's successful transition to a proof-of-stake algorithm may have led to a rally in the right macroeconomic environment, but on its own, it did not solve a number of key issues facing the coin, such as low bandwidth or high fees. In addition, whales were preparing for 'sabotage' by pouring ETH into cryptocurrency exchanges (we wrote about this at the end of August). During the week of the Merge (12-18 September), they sold off 22% of their assets, which put additional downward pressure on the ETH's price.

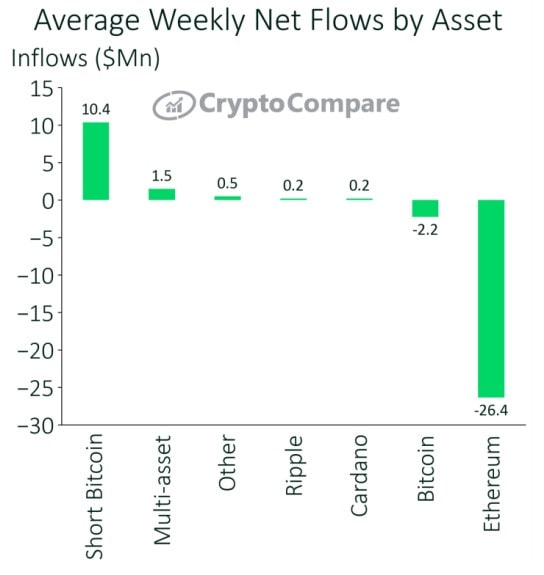

When institutional investors' hopes failed to materialise, they made an exit. And while Bitcoin outflows stopped in September, Ethereum funds saw a substantial exodus of $26.4 million per week on average.

At the same time, there was an increase in short Bitcoin funds (funds which give investors exposure to derivatives that bet against the price of Bitcoin). The average weekly inflow was $10.4 million, led by the ETF from ProShares, which rose by 44% to $98.8 million in one month.

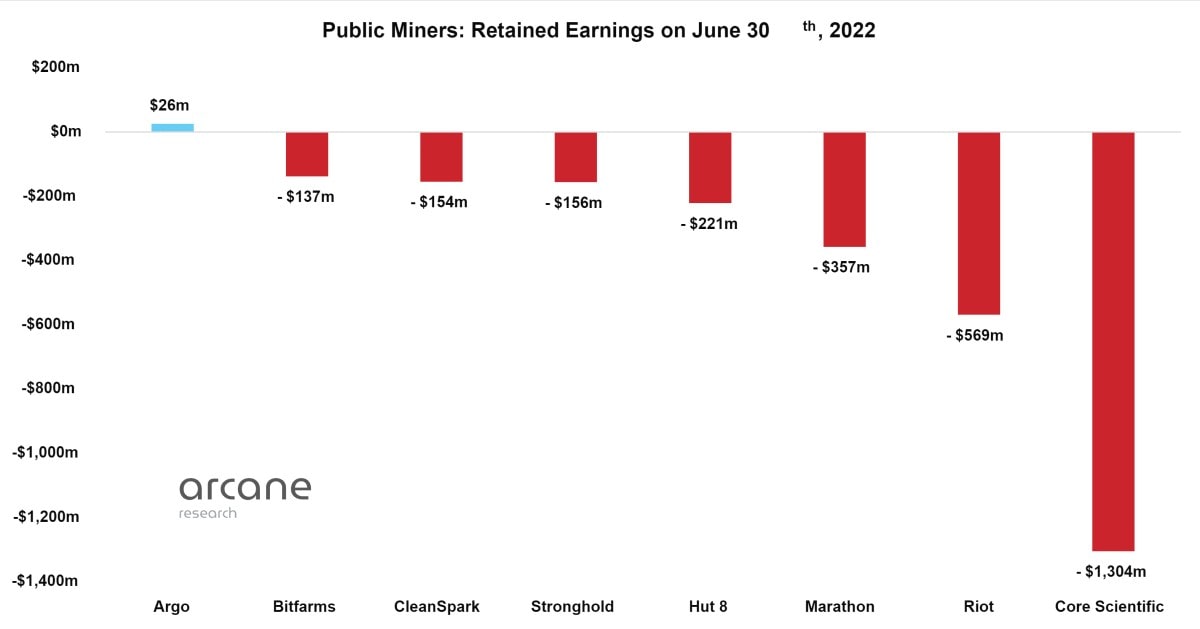

The drop in investment is also affecting public miners, who sold more coins in May, June and July than they produced during that period. The lack of a plan B for a prolonged crisis has left them no choice but to increase market supply and further drive themselves into a corner. The drop in investment attractiveness of publicly traded mining companies is also having a negative impact on the industry, and further sell-offs will continue to put downward pressure on the price of coins.

Institutional investors anticipate that the cryptocurrency market will continue to drop due to the deteriorating macroeconomic environment, with central banks around the world raising interest rates in response to rising inflation and a global recession predicted for 2023 at a 98% probability. This is leading to an outflow of capital from risky assets into US bonds and directly into the US dollar, with its index recently hitting a 20-year high.

StormGain Analytics Team

(cryptocurrency trading, exchange and storage platform)

Tags

Try our Bitcoin Cloud Miner and get additional crypto rewards based on your trading volume. It's immediately available upon registration.

Try our Bitcoin Cloud Miner and get additional crypto rewards based on your trading volume. It's immediately available upon registration.