First date for potential approval of Bitcoin ETFs on 10 January

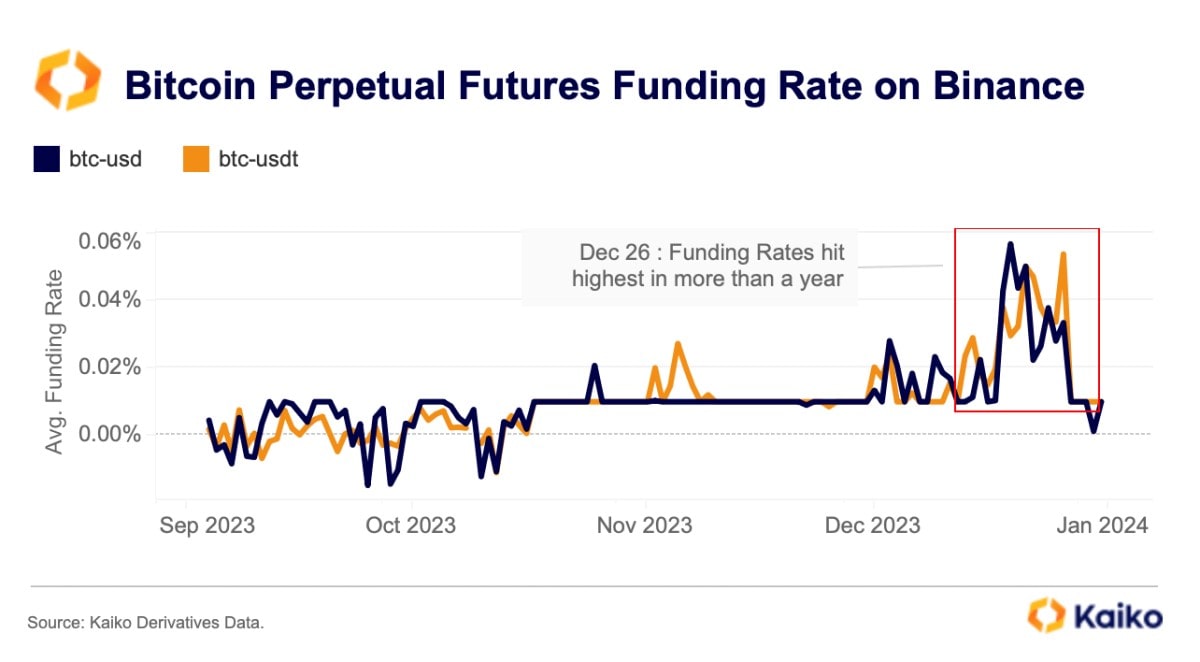

Tension is growing in the crypto market as the final deadline for reviewing applications to launch spot ETFs in the United States approaches. The predominance of bullish leveraged positions in the futures market has led to funding rates increasing to record levels over the past year.

The market heat-up caused increased volatility, while a price drop led to a cascade of marginal positions being liquidated. On 3 January alone, over $0.5 billion worth of bullish positions were closed.

Bitcoin only needed a few days to recover from the wave of sell-offs and overcome the local resistance at $46,000. We warned about the coming increase in volatility in our last article for December.

The excitement was caused by the approaching appearance of spot ETFs that will open broad access to institutional capital for the cryptocurrency. The exchange-traded funds could be approved as soon as 10 January, which is the deadline for the SEC to review the joint application from ARK Invest and 21Shares. If the regulator wants to reject the application, it needs to provide compelling arguments, something that won't be so easy given its loss on Grayscale's appeal last year.

Former SEC Chairman Jay Clayton recently said:

I think approval's inevitable…and I think there's nothing left to decide.

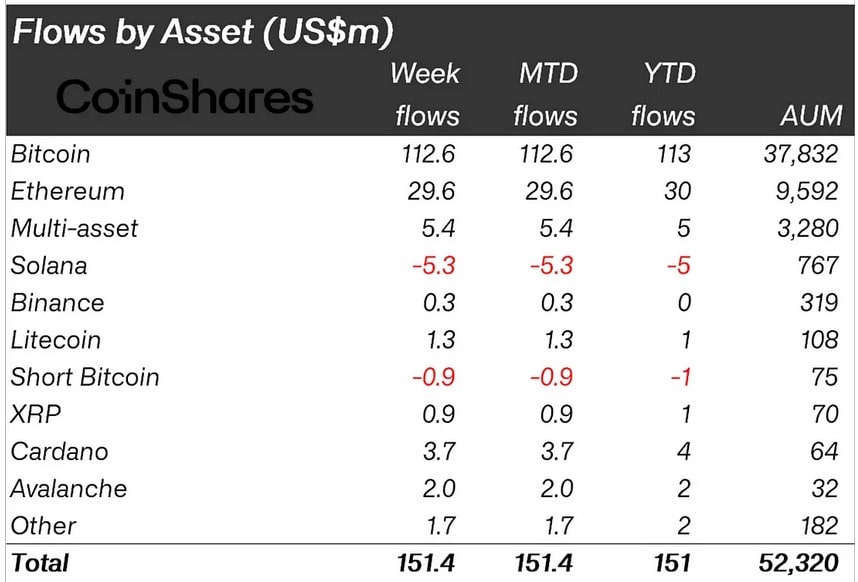

This opinion is shared by institutional investors who invested $151.4 million in crypto in the first week of January, 74% or $112.6 million of which went into Bitcoin funds.

A new warning from the SEC to potential investors hints at the imminent emergence of ETFs:

You may see your favorite athlete, entertainer or social media influencer promoting these kinds of investment opportunities. Although it's tempting, never make a decision to invest based solely on their recommendation.

Despite all the signs that the applications will be approved in 2024, investors should remain cautious. The first important date is 10 January, but it's not the last: The application from ARK/21Shares could be found to contain mistakes, and a rejection from the SEC would set off a new way of turbulence.

The deadline for most applications is in mid-March. That includes the application from the world's largest company in terms of assets under management, BlackRock.

StormGain Analytical Group

(platform for trading, exchanging and storing cryptocurrency)

Tags

Try our Bitcoin Cloud Miner and get additional crypto rewards based on your trading volume. It's immediately available upon registration.

Try our Bitcoin Cloud Miner and get additional crypto rewards based on your trading volume. It's immediately available upon registration.