K33: Ethereum awaits a hot October

After Ethereum switched to a Proof-of-Staking protocol, it ran into pressure from American regulators. According to the SEC, the offer of passive income via staking means the coin should be considered a security. This made it possible for the supervisory authority to come down on cryptocurrency exchanges and financial companies with pre-trial claims that they violated securities law. To resolve the conflict, many of the targets of the legal action closed access to staking and paid huge fines.

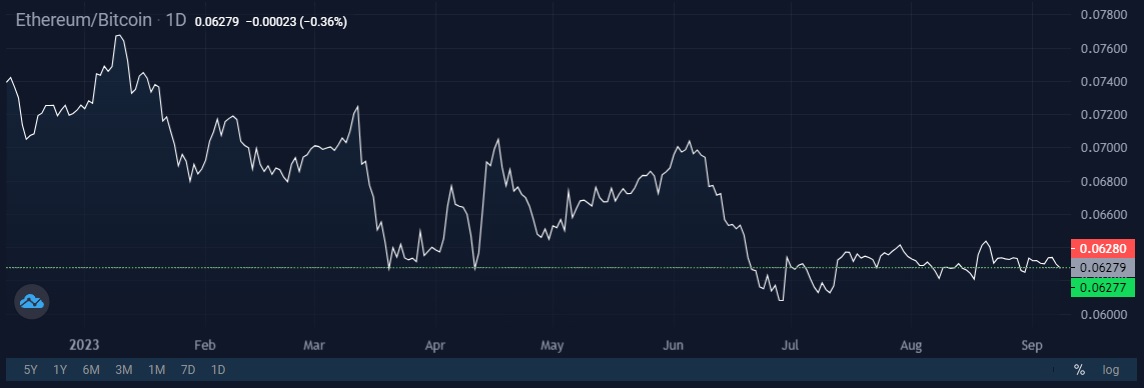

This affected the investment attractiveness of the altcoin, which is why it's 12% behind Bitcoin in 2023.

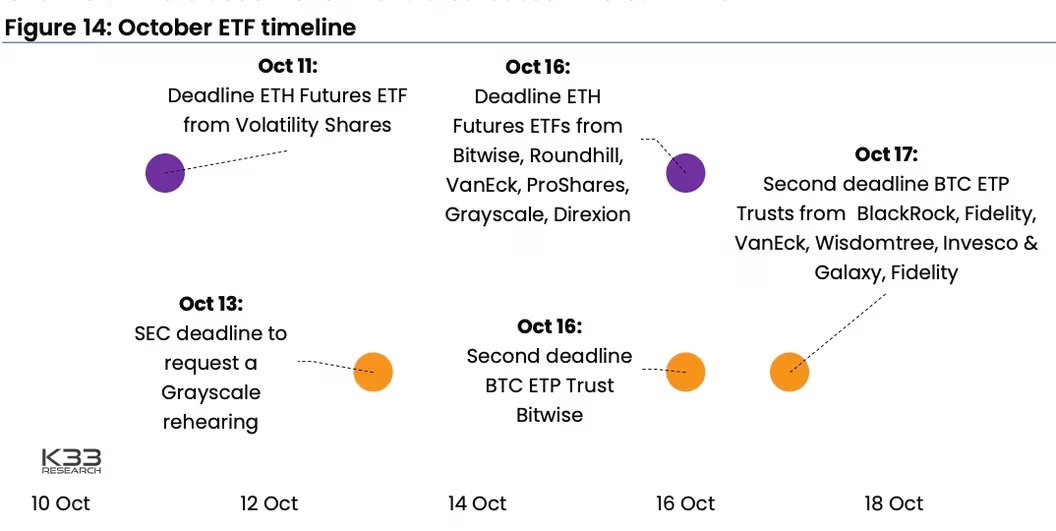

Analytical agency K33 Research suggests that the situation will soon change dramatically since October is the deadline for considering applications to launch ETFs on Ethereum futures.

The event could significantly fuel interest in the altcoin. In 2021, Bitcoin's price surpassed $60,000 based on expectations stemming from the launch of a similar fund for the pioneer cryptocurrency.

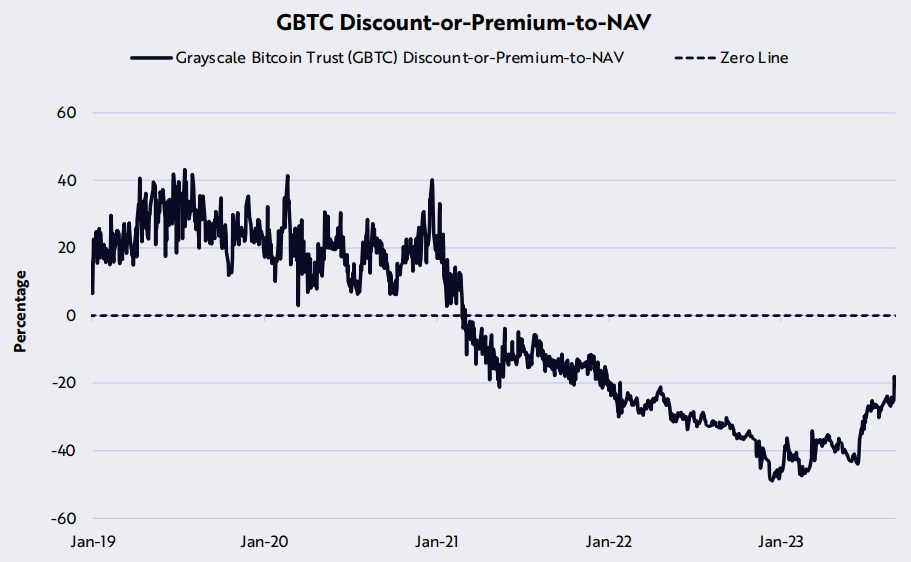

The likelihood of approval is high for several reasons. First, Bitcoin futures ETFs are already operating in the US. Second, in August, the SEC lost a court case over its denial of Grayscale's application to convert a trust fund into a spot Bitcoin ETF. An appeals commission ruled that the refusal was "arbitrary and capricious" since the regulator failed to raise significant arguments (see our article for more info). Now, the SEC must either approve the application to convert the fund or find "ironclad" arguments for rejecting it.

Grayscale shares, which were trading at a significant discount, shot up as market participants assumed the resolution of the conflict was in its favour.

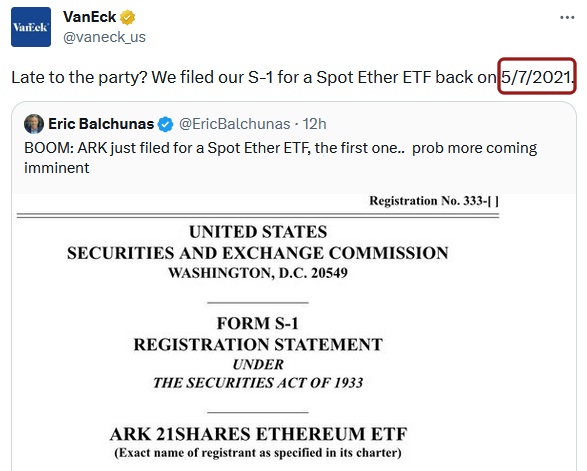

Anticipating a series of victories, investment companies have intensified their applications for spot Ethereum ETFs, too. For example, ARK Invest and 21Shares applied jointly yesterday. Some media felt that this was the first such application of its kind, but VanEck hastened to disappoint them.

The list of applicants will likely soon expand. Grayscale won't mind converting its Ethereum trust fund to spot ETFs. If the SEC accepts the application from ARK Invest and 21Shares, the deadline to consider it will be late May 2024.

All these events could revive interest in Ethereum among institutional investors, who have withdrawn more than $100 million from exchange-traded funds operating around the world over the past 12 months.

StormGain Analytical Group

(platform for trading, exchanging and storing cryptocurrency)

Tags

Try our Bitcoin Cloud Miner and get additional crypto rewards based on your trading volume. It's immediately available upon registration.

Try our Bitcoin Cloud Miner and get additional crypto rewards based on your trading volume. It's immediately available upon registration.