Less than a week to go before the potential approval of spot Ethereum ETFs

On 25 June, SEC Chairman Gary Gensler noted that the registration process for the new ETFs is "going smoothly" and that the approval date depends on the speed at which applicants file amended S-1 forms. Based on the regulator's sudden show of loyalty, Bloomberg analysts have confirmed 2 July as the expected approval date for the new products. Citing anonymous sources, Reuters reports that a consensus has been reached between the receivers and the SEC in negotiations, and only the "finishing touches" remain to be done.

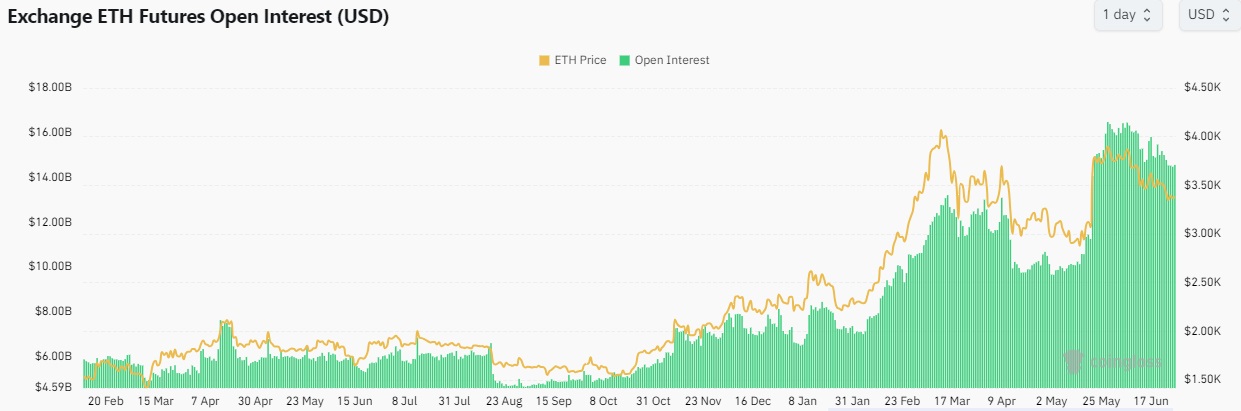

Open interest in Ethereum futures stands at $14.6 billion and is near the record high of $16.5 billion, which was reached on 28 May. At the same time, the financing rate remains in the neutral zone, indicating mixed expectations of the participants.

The emergence of the long-awaited exchange product is certainly a positive factor. Bitwise's IT director, Matt Hougan, expects net inflows of $15 billion to go into the ETFs in the first 18 months.

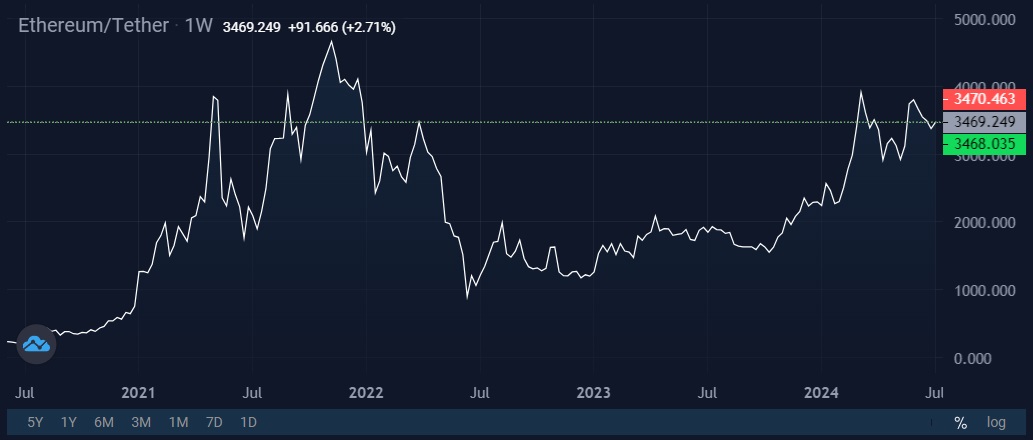

In his analysis, he draws on the experience of Canada and the EU, where the inflow into Bitcoin for similar products is roughly 4 times greater than it is for Ethereum. In other words, while spot Bitcoin ETFs saw total inflows of $26.9 billion in the first quarter, Ethereum is expected to see inflows of $6.7 billion. In this case, Ethereum's price will rise to $4400-5000 in the first three months of the funds' operation.

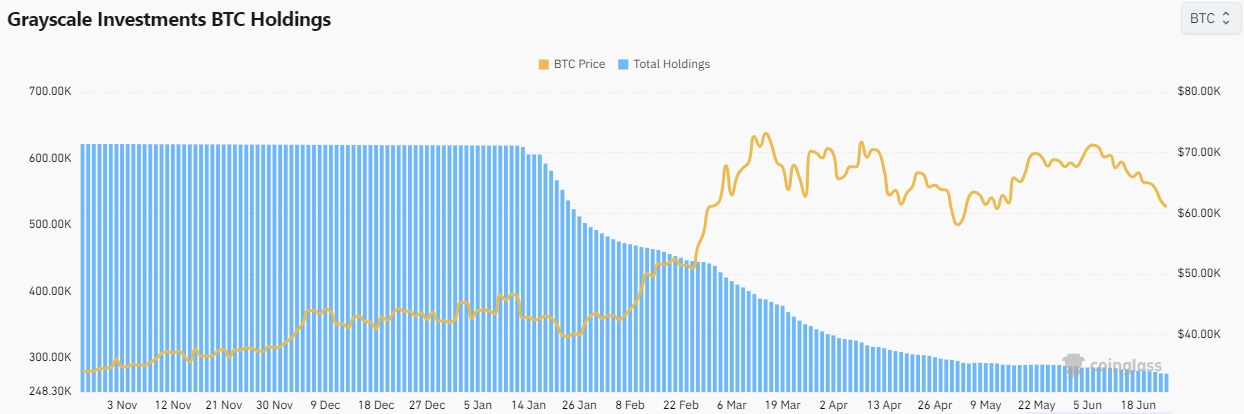

However, Matt Hougan doesn't factor in that the negative impact of the outflow from Grayscale will be stronger this time around. After GBTC's conversion, the fund lost 45.9% of its coins in the first quarter, or 284,000 BTC. Grayscale's ETHE fund holds $10 billion worth of Ethereum. With a similar rate of investor exit, selling pressure would be $4.6 billion, and net inflows would be $2.1 billion, which is six times below what Bitcoin ETFs achieved.

Another reason the altcoin will have a hard time replicating these results is the forced cancellation of staking. The annualised return on blockchain coins is now 3.2%. With restaking, that number exceeds 10%. As investors see it, Ethereum is losing the key advantage it had over Bitcoin: passive income.

That's why the potential demand for new ETFs may be greatly exaggerated, and unlocking the ETHE fund's assets could trigger another correction.

StormGain Analytical Group

(platform for trading, exchanging and storing cryptocurrency)

Tags

Try our Bitcoin Cloud Miner and get additional crypto rewards based on your trading volume. It's immediately available upon registration.

Try our Bitcoin Cloud Miner and get additional crypto rewards based on your trading volume. It's immediately available upon registration.