Long-term Bitcoin holders are locking in profits

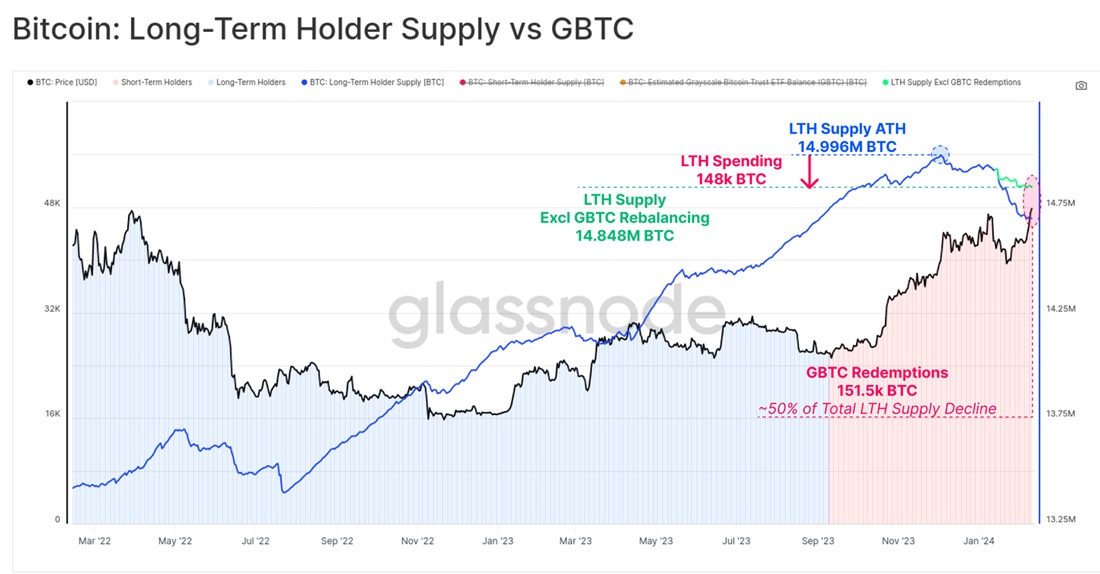

Currently, 87% of the total BTC issued is in the black for its owners. It's traded above $50,000 for less than 3% or 141 days of its history. This raises the temptation of locking in profits. As a result, long-term holders (LTH) have reduced their holdings by 300,000 BTC to 14.7 million BTC.

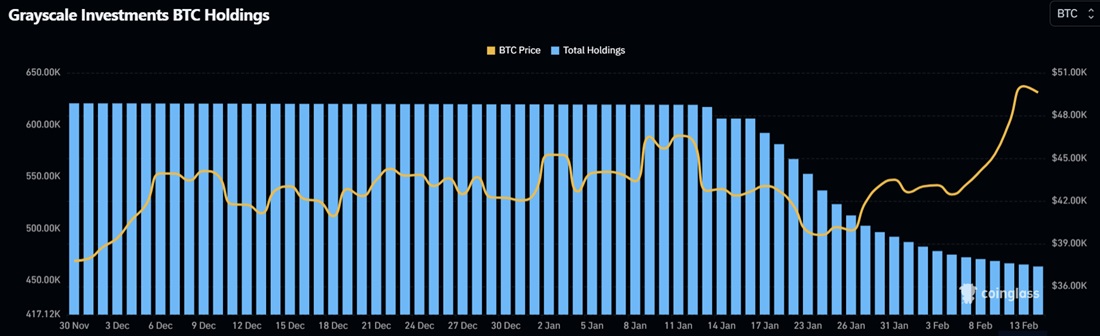

At first glance, it may appear that a sell-off by the most resilient market participants has begun, but that's not the case. Half of the volume has come from the Grayscale fund, which was converted to a spot ETF from a trust fund. The fund's shares were actively bought up last year because of the significant discount of over 40% on the underlying asset. By the time the fund was converted, the discount had levelled off. GBTC is responsible for the sale of 150,000 BTC, totalling $6.3 billion.

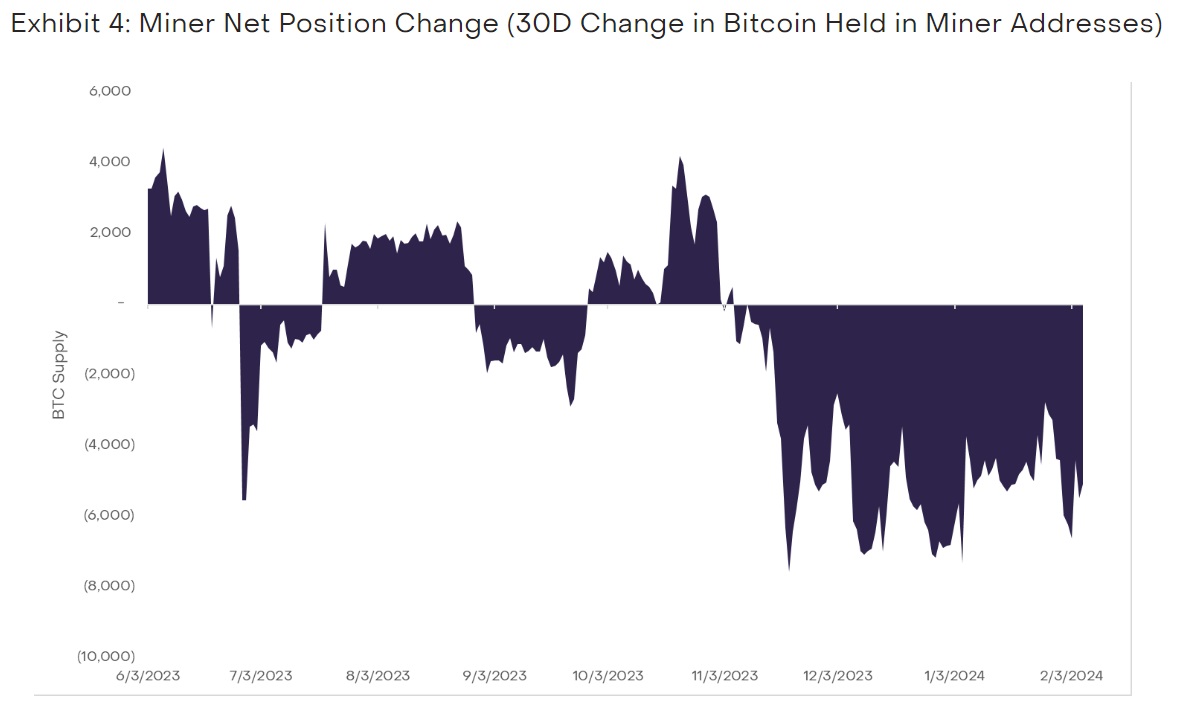

Of the remaining 150,000 BTC under consideration, miners made up the lion's share of the sell-off as they prepare for the halving event in April. The block's mining income will be halved, which, at current prices (and especially in the event of a correction), will put many in a difficult position. They decided to act on the news of the launch of ETFs by massively reducing reserves from 11 January.

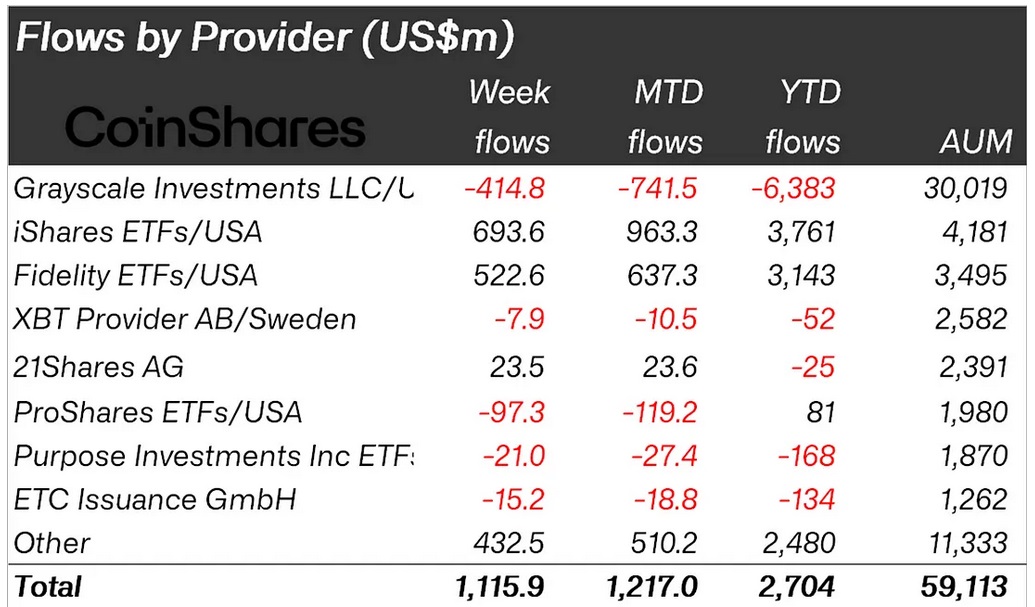

On the other hand, all of that outflow was offset by nine newly created ETFs, with BlackRock at the head. Collectively, they accumulated $10 billion of Bitcoin, which allowed the price to test $50,000 again.

Last week, for example, inflows into these funds totalled $1.5 billion, while outflows from GBTC were $400 million.

It turns out that the main outflow from LTHs came from Grayscale and miners for objective reasons. In terms of how most market participants assess Bitcoin's prospects, they remain purely positive. For example, Skybridge Capital founder Anthony Scaramucci wrote on social media that investors who missed the start of the rally didn't miss the train since Bitcoin's price will quadruple 18 months after its halving event.

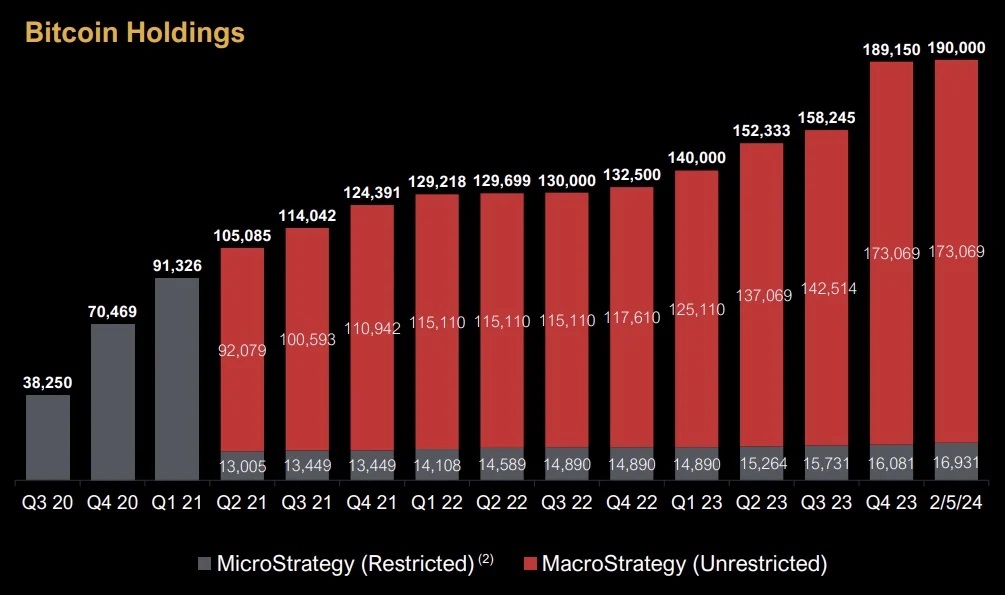

The world's largest publicly traded holder, MicroStrategy, is also keeping a positive outlook and building up its Bitcoin reserves every quarter. It currently holds 190,000 BTC or nearly $10 billion.

StormGain Analytical Group

(platform for trading, exchanging and storing cryptocurrency)

Tags

Try our Bitcoin Cloud Miner and get additional crypto rewards based on your trading volume. It's immediately available upon registration.

Try our Bitcoin Cloud Miner and get additional crypto rewards based on your trading volume. It's immediately available upon registration.