Mastering trading order types: Stop Limit, Limit and Stop orders.

Most successful traders believe that many unprofitable trades, lost money and dashed hopes for beginners come from underestimating the risks of trading, as well as the inability to stop in time to close unprofitable orders. These theories are widely described in the majority of books devoted to the basics of trading. If you're looking for reading material to learn from, make sure to check out our blog post on the best technical analysis books.

Is there a solution to this problem, or do traders need a lot of learning and practice to cope? In fact, dealing with these issues is pretty easy, especially if you use a feature that beginners often ignore: the Stop Limit order. In this article, we'll explore the question "What is a Stop Limit order?", explore different types of orders in trading, learn "How does a Stop Limit order work?" and "What's the difference between a Limit order and a Stop order?" and "What is a stop-limit order example?", as well as the key differences between order types.

What is a Stop Limit order?

Before discussing the difference between stop limit and limit order, let's consider the definition of stop-limit order types in trading.

A Stop Limit order is a limit (pending) order to buy or sell when a specified price is reached, an action that is referred to as a stop. This type of order helps to protect traders against money losses or to lock in profits when the price of a cryptocurrency suddenly rises or falls.

With Stop Limit orders, traders get maximum control over their trades. That makes them useful for both buying and selling cryptocurrencies.

Stop Limit orders are also helpful in reducing risk for long-term investors and short-sellers. They control both the timing of an order's placement and the minimum/maximum prices at which cryptocurrencies can be bought and sold. This is especially useful in volatile markets since prices can fluctuate rapidly or when traders can't constantly monitor their trades.

How a Stop Limit order works

For traders, Stop Limit orders provide more control over their trades by setting minimum or maximum order prices. A trader can do this by setting two prices: a stop price and a limit price. Basically, a Stop Limit combines two order types:

- A Stop order, which triggers a market order to buy or sell cryptocurrency as soon as it reaches a certain price (the stop price)

- A Limit order, which buys or sells a cryptocurrency at a certain price (or better).

If a cryptocurrency's price reaches the stop price, the Limit order is triggered, and an attempt is automatically made to buy or sell cryptocurrency at the limit price or better.

Placing a Stop Limit order on StormGain

Now that we've got the trading order types explained, let's discover "what is a stop-limit order example?"

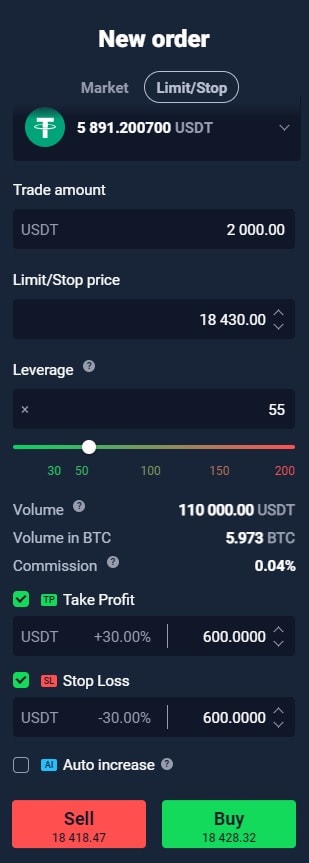

Here's how you set a Stop Limit order on StormGain. Before you start trading, you need to register on the platform. After that, deposit fiat money or cryptocurrency or switch to a free demo account. Once you choose a cryptocurrency pair to trade — let's say Bitcoin, for example — specify an order type on the right part of the screen. If you haven't bought cryptocurrency yet, please read our blog on how to buy Bitcoin with a credit card.

To place a Stop Limit order on StormGain, choose the Limit/Stop order tab. This is where you can specify the limit or a stop price in the Limit/Stop data field. Select the leverage you wish to trade with, then set a price to lock in profits by filling in the Take Profit field. Traders can protect their positions by setting a Stop Loss level in the following field.

Limit orders vs Stop orders

Now, let's consider the difference between a stop limit and a limit order.

Buy and Sell Limit orders allow traders to open a trade at their own price instead of defaulting to the current market price. A Buy Limit order makes it possible to specify the exact price at which you want to buy a cryptocurrency. This price is usually the estimated entry point.

A Buy Limit order comes with several important considerations. With a Buy Limit order, StormGain will buy the cryptocurrency at the specified price or a lower one if it occurs on the market. A Limit order is not guaranteed to be filled; if the market never reaches the specified price level, it won't be executed.

A Stop order means to buy or sell a cryptocurrency at the market price once a certain stop price is reached. A Stop order used when selling is called a Sell Stop order. It differs significantly from a Limit order because it includes a stop price, which then triggers a market order.

In the case of a Sell Stop order, the trader specifies a stop price to sell. If a cryptocurrency's market price hits the stop price, a market sell order is triggered. Unlike Limit orders, Stop orders can include some slippage because there is usually a margin difference between the stop price and the subsequent market price execution.

Buy Limit vs Buy Stop orders

The key difference between Buy Limit and Buy Stop orders lies in the type of order. A Buy Limit order will execute at or below the limit price, while a Buy Stop order is filled above the current market price at the next available market price once the Buy Stop price is triggered. Buy Stop orders are generally used to close a short position on a cryptocurrency.

Sell Limit vs Sell Stop orders

In general, Limit orders allow traders to specify a price, while Stop orders include a specific price to trigger the trade. A Sell Limit order will execute at or below the limit price, while a Sell Stop order is filled below the current market price at the next available price once the Sell Stop price is triggered. Sell Stop trading orders are generally used to close a buy position on a cryptocurrency.

The key difference between Stop Limit, Limit and Stop orders

Inexperienced traders are sometimes confused about what order types do. To fully grasp the difference between buy limit and buy stop and limit orders, here's a short description of these terms:

- A Stop Limit order allows a trader to place a pending (limit) order to close a trade (buy or sell) if a critical or desired price is reached. It can be used to protect against losses or to lock in profits at a certain level.

- A Limit order allows a trader to execute an order (buy or sell) if the desired price is reached.

- A Stop order allows a trader to place a Stop Loss or Take Profit market order once a certain price is reached.

Conclusion

When comparing types of trading orders, it's vital to emphasise that Stop Limit orders are one of the most useful trader tools on the cryptocurrency market. They allow traders to significantly reduce risks or lock in profits without having to monitor the price 24 hours a day. Although this order type makes trading easier, you can't rely only on Stop Limit orders alone. To trade successfully, you have to keep studying, find an approach that works, create a strategy and observe to continue gaining priceless experience.

Tags

Try our Bitcoin Cloud Miner and get additional crypto rewards based on your trading volume. It's immediately available upon registration.

Try our Bitcoin Cloud Miner and get additional crypto rewards based on your trading volume. It's immediately available upon registration.

FAQ

What are the types of orders?

There are different trading order types available, each serving a specific purpose:

- The Stop Limit order involves a pending order to buy or sell when a specified price is reached, known as a stop. This order is beneficial for protecting traders against losses or securing profits during sudden price fluctuations in the cryptocurrency market.

- The Limit order empowers traders to execute a buy or sell order when the desired price is achieved.

- The Stop order enables traders to set a Stop Loss or Take Profit market order when a particular price level is reached. These orders offer traders a range of options for managing their positions effectively in the cryptocurrency market.

Which order type is best?

Stop Limit orders are highly valuable tools for traders in the cryptocurrency market. They enable traders to minimise the risk of trading or secure profits without the need for constant price monitoring throughout the day.

Why is it important to use stop orders to protect against losses?

Using stop orders is crucial for safeguarding against losses as they automatically execute a market order to sell an asset when its price hits a predetermined level. This assists investors in constraining potential losses and managing risk. This risk management tool holds great importance in unpredictable markets where prices fluctuate rapidly, enabling investors to establish a threshold at which they are prepared to exit a trade to avert further losses. Stop orders play a significant role in maintaining discipline in trading strategies and can be particularly beneficial during unforeseen market fluctuations.

Can I modify or cancel an order after it's been placed?

Yes, it is possible to modify or cancel a Stop Limit order after it has been placed.

A Stop Limit order is a type of pending order that combines a Stop order and a Limit order. This order allows traders to establish a stop price that triggers a market order and a limit price that specifies the maximum or minimum price for the trade execution. When the cryptocurrency's price reaches the stop price, the Limit order is activated. Traders have the flexibility to adjust the stop price, limit price, or cancel the order before it is executed, enabling them to manage trades effectively and adapt to market conditions.