Mining vs Trading vs Investing: which one to choose in 2024?

Technologies open vast opportunities for earning money on cryptocurrency. Market participants can be roughly divided into traders and miners, which leaves many investors having to choose between mining vs crypto trading vs investing to figure out how to make a profit. Regardless of how much money you want to invest in cryptocurrencies, you'll inevitably face this question.

There are two ways to invest and make money on cryptocurrencies: trading and mining. In this article, we give a detailed answer about whether crypto mining or trading is better in 2024. We'll also discuss crypto investing in detail and compare trading vs crypto mining vs investing. In addition to that, we will conduct a risk assessment, evaluate how much time needs to be devoted to either one and provide arguments to protect each investment method.

What is crypto mining?

Mining is a way to make money on a cryptocurrency by solving a complex code that requires dedicated computer equipment. When the first Bitcoins appeared, mining coins was incredibly easy. Only a few people knew about the existence of the cryptocurrency, so the early miners were able to get new coins quickly and easily. As interest in Bitcoin grew, the mining process became more complicated.

When buying mining equipment, it's essential to buy it at the right time and the best price. For example, the cryptocurrency market is currently booming, so speculators are significantly increasing the cost of equipment because demand exceeds supply. Equipment purchased at a regular price will see about a 50% return on investment within 6-12 months. If market sentiment is favourable, it's possible to see a 100% ROI. Since mining equipment can always be resold, the main risk, in this case, is the time spent mining.

To earn through mining, you need to have the minimum skills required for selecting PC components and configuring the software. Assembling a GPU (video card) mining farm doesn't differ from assembling one for a PC. A GPU mining farm is the best investment because you won't be tied to a particular cryptocurrency, such as Bitcoin. You can switch between any cryptocurrency supporting GPU mining, e.g., Ethereum, Ethereum Classic, Zcash, Monero and more. Note: be sure to read our blog post on what the best cryptocurrency to mine in 2020 is.

Bitcoin mining requires specialised equipment that costs significantly more than GPU equipment. Before the 'mining era', GPUs and powerful PCs were enough to mine Bitcoin and other crypto assets. Due to crypto's increased complexity, however, ASIC (application-specific integrated circuit) mining chips are now used for Bitcoin mining. When comparing Bitcoin mining vs trading, the trading advantage is that you don't need to spend any money on expensive equipment to get started.

To correctly track the relevance of ASIC mining and get a rough estimate of its return, you need to analyse new chips released on the market, their product features and many other nuances. The minimum investment in ASIC mining is significantly higher than what's required for GPU mining. Today, independent Bitcoin mining is unprofitable. It doesn't provide a return on investment, so users prefer to combine their efforts by uniting in mining pools. If you wonder if Bitcoin mining is profitable, please read our blog.

In addition to equipment costs, electricity is another of the most critical resources. The cheaper it is, the faster you can get a return on your investment. The countries with the lowest electricity prices are the most attractive for cryptocurrency mining. Always consider mining profitability in terms of electricity costs before buying equipment.

A step-by-step guide to starting mining:

- Equipment purchase

- Equipment connection and adjustment

- Software setup

- Independent operation or use of a pool

- System performance maintenance and process adjustments.

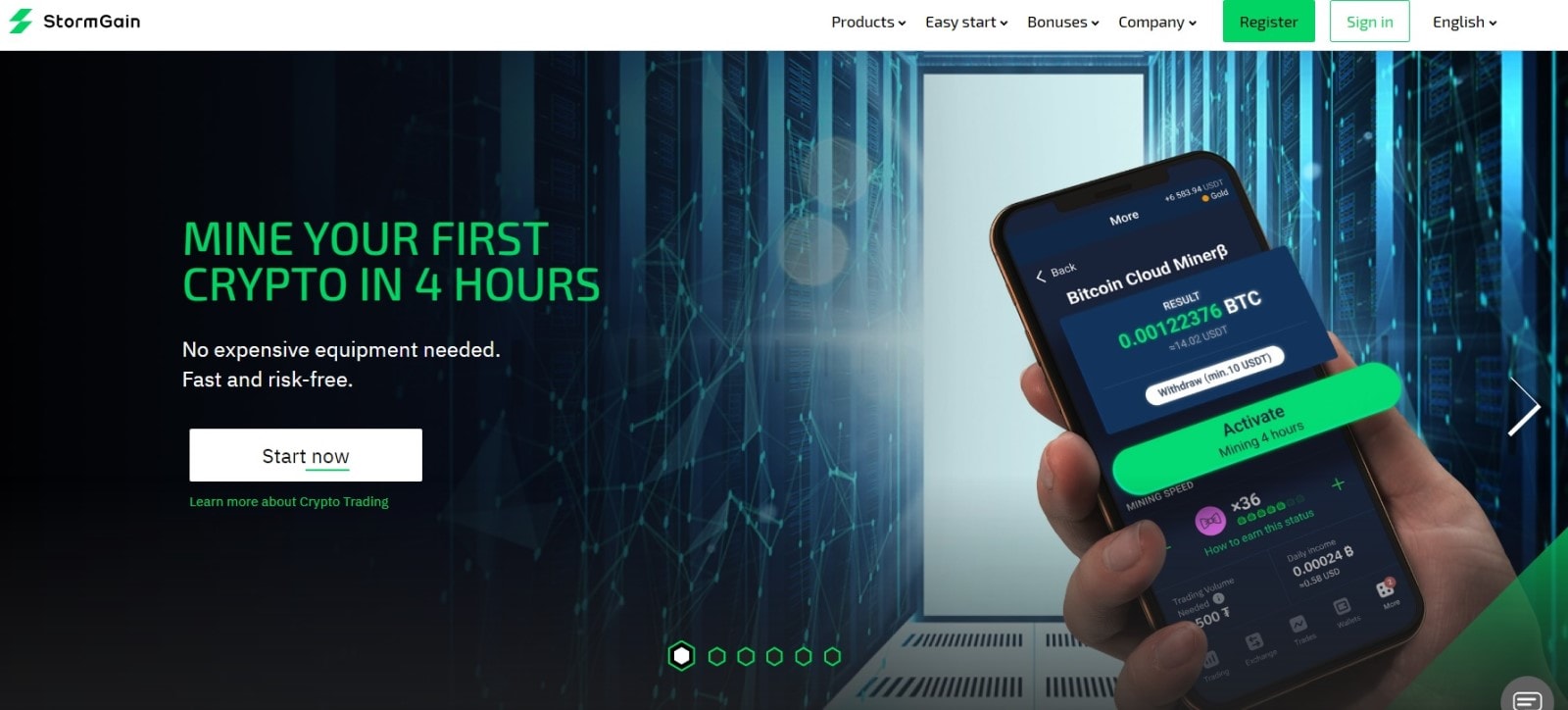

The StormGain cryptocurrency exchange has launched a cloud mining service that offers a unique tool for Bitcoin mining. The entirely free cloud mining service allows you to mine Bitcoin on your mobile phone. Just download the StormGain mobile app and register an account to control a Bitcoin mining rig remotely. The profit from cloud mining is comparable to solo mining, with the notable exception that you don't need to configure the equipment yourself.

Miners have to track the cryptocurrency market to switch farms to more relevant and profitable coins. Of course, no one will prevent you from mining a particular crypto if you're confident in its future growth. Mining isn't easy, and you'll have to continually learn new terms, consider trends and keep an eye on crypto market events.

Mining pros and cons

Pros:

- Lowest risks

- Ability to withdraw profits daily

- Complete control of investment

Cons:

- Requires knowledge of computer hardware

- Requires experience in configuring and maintaining PC components

- Must constantly monitor equipment

- Must always keep track of the cryptocurrency market

- Low but steady profit

Is crypto mining profitable?

In 2020, mining is still profitable, as new coins and new cryptocurrency market trends are constantly emerging. For instance, the decentralised financial (DeFi) app market gave a massive boost to Ethereum mining in 2020. The growing frequency and volume of cryptocurrency transactions in the Ethereum network have a positive impact on the miner's profit. Each miner is rewarded for their work and resources invested. Potentially, the more you invest in mining, the higher your future profits will be.

How much can you earn from mining?

Mining vs trading profits are relatively small and begin at 60-100% per year, but the risks are minimal. You can exchange cryptocurrency for fiat currency at any time, protecting yourself from exchange rate fluctuations. At the same time, you may lose by selling cheaper than you bought (but that's another issue) and doing so increases risks. If you purchased all your equipment from scratch, then after you see a return on your initial investment, your further investments will only be in electricity.

The skills acquired by a miner in the course of market analysis and finding the best price to sell mined crypto allow them to understand trading better. Trade is one stage of crypto mining. The increased complexity of cryptocurrency mining leads to a decrease in profitability. Having acquired the necessary skills, miners often become traders.

What is cryptocurrency trading?

Cryptocurrency trading is a way to make money by buying and selling cryptocurrency. Crypto traders perform trades on the exchange and earn income from rate fluctuations. The cryptocurrency is purchased at a low price (on a dump or light decline) and sold when the value increases.

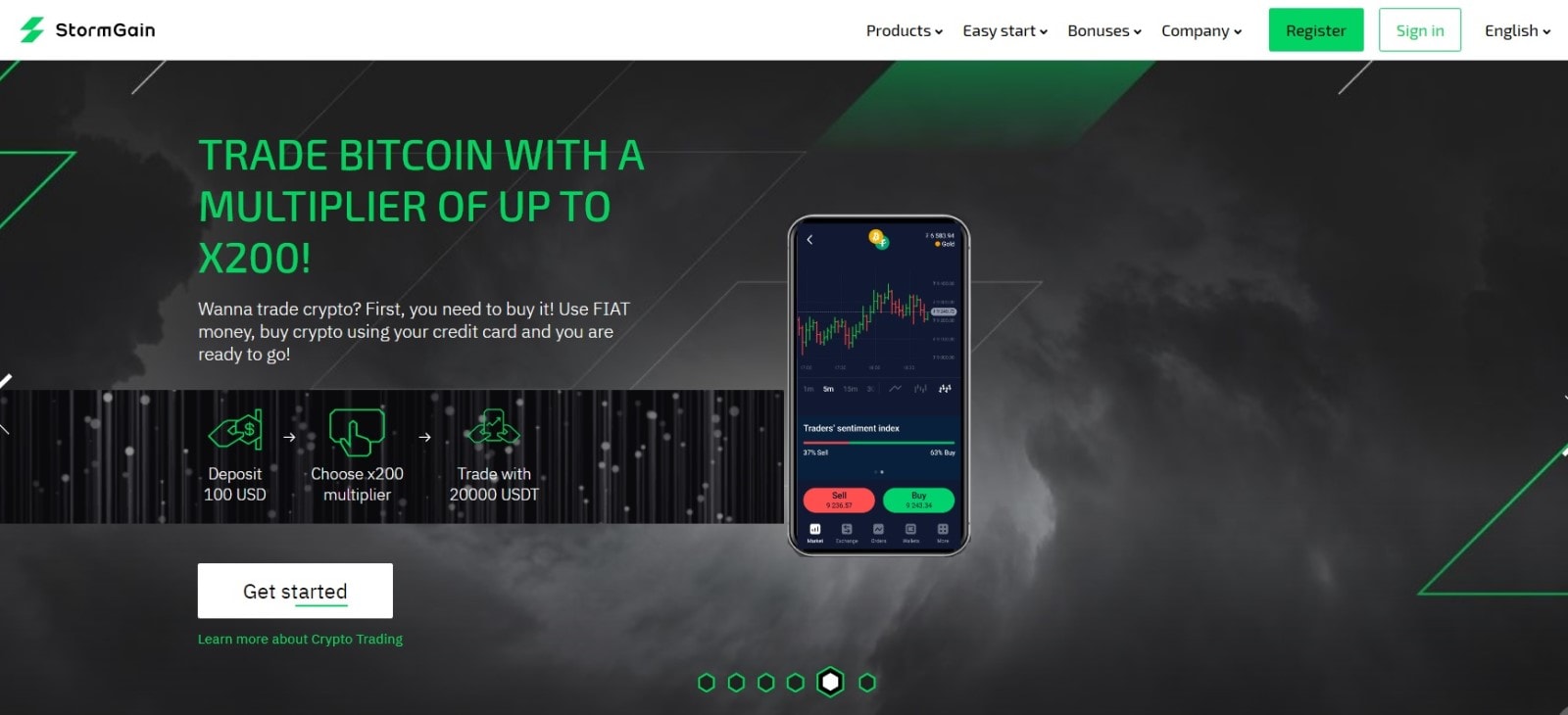

To start trading, one should choose a reliable cryptocurrency exchange. We advise beginning with StormGain, a margin-trading cryptocurrency exchange with a friendly user interface, quality support and top-tier security. Trading volume, liquidity and the number of supported pairs are important factors in choosing a cryptocurrency exchange. It's also necessary to choose a liquid trading pair. Please read about the top traded cryptocurrencies in our blog.

After depositing funds to your account, develop a profitable trading strategy. The main advantage of trading vs mining is working with several cryptocurrencies at once and the opportunity to earn more profit than by simply investing. Keep in mind that trading involves a lot of risks. Controlling emotions and proper money management are the keys to future success.

It's essential to define the trading concept between buying cryptocurrencies on the exchanges and margin trading. If you buy and sell a cryptocurrency, then, in this case, the highest risk is to stay with the cheap cryptocurrency that loses its value, but you can hope that the rate will grow over time. This happens eventually, but sometimes, you need to wait more than one year for it to occur. For example, you can take a look at the Ethereum chart below. Those who bought at the beginning of 2018 are halfway from their buy-in price in 2020.

Getting crypto at the lowest price possible when purchasing is critical. The profit, in this case, is tough to calculate. Before investing in crypto, a trader must analyse and understand which of the hundreds of available cryptocurrencies will show maximum growth. That's a very complicated process and requires time to study the project's whitepaper and its development activity and to acquire fundamental and technical analysis skills.

The highest risks are associated with margin trading cryptocurrencies. If your position is the opposite of the market movement, there is an increased risk of losing money. As with regular or leveraged trading, the choice of a convenient and secure exchange is crucial. Terms, trading fees, leverage and trading tools differ from exchange to exchange. In addition to chart analysis trading tools such as Moving Averages, RSI (Relative Strength Index) and other technical analysis tools, StormGain provides the highest available leverage on the market of up to 200x.

A step-by-step guide to starting cryptocurrency trading:

- Choose an exchange or a broker and open an account.

- Develop a profitable trading strategy.

- Fund your account.

- Make your first trades.

- Track the cryptocurrency exchange and make profitable trades.

Volatility allows traders to make a profit. From a trading perspective, pairs with the highest volatility and liquidity are of most interest. For a trader, there's no difference between selling or buying an asset. The most important thing is that an asset frequently fluctuates, which provides profit from the rate change. Regardless of the trading type and strategy, becoming a successful and profitable trader means mastering emotions and learning to manage capital properly. These skills make up 90% of the trading success formula, where 10% is allocated to fundamental and technical analysis.

Trading pros and cons

Pros:

- High return

- A simple phone/tablet or laptop is enough to start trading

- Quick deposit and withdrawal from an exchange

Cons:

- Requires emotional control and money management skills

- Medium to high risk of loss; may lead to a complete loss of your investment

- Must have a profitable trading strategy

- Hard to calculate potential profit

How much can you earn from crypto trading?

It's hard to give a clear answer because there are so many factors to consider. The potential profit can be very high, and on a good day, a trader can make up to 100% of their trading balance. On the other hand, if they make the wrong decisions, there's a significant risk that they lose money.

If you have the desire and ability to analyse the market and want to improve your trading skills, you could potentially see profits of 500-1000% every year. Everything depends on the buy-in price, trade position (long/short), the trader's mentality and proper management of financial risks.

Crypto mining vs trading: which is better?

There's no exact answer to the cryptocurrency mining vs trading dilemma. Each investor has to answer this question for themselves. Mining is the foundation for sustainable network operation, software development and improvement of mining algorithms, which leads to the evolution of the entire cryptocurrency industry. Before you start mining, consider the cost of electricity, equipment and the time it will take to see a return on your investment. Many variables in this equation affect mining profitability, but when everything works out right, the investment pays off.

Competition in the mining industry is high, and large mining farms force solo miners to unite in pools to gain profit. Trading has a significantly lower entry threshold than mining, and one can start trading with $100. By gradually gaining experience and skills, a trader can increase their trading balance. The ability to handle a small deposit in the same way as a large one is the key to success. Being an excellent theoretical trader doesn't mean anything. The only way to become a real trader is by experiencing victories and defeats. Potential risks in trading are significantly higher than in mining. Still, proper money management, a profitable strategy and emotional control will help achieve high, stable profits.

What is cryptocurrency investing?

Our mining vs trading crypto guide would be incomplete without us mentioning the topic of crypto investments. What is it? How much to invest in crypto per month? What is the difference between crypto trading vs crypto mining vs investing? Let's find out.

Investing is a strategy that focuses on the long-term goal of purchasing stocks or other financial instruments that yield returns over an extended period. This technique requires patience because the investors must hold these stocks for multiple years or even decades. Moreover, owning the company's stocks for an extended period enables investors to receive benefits such as dividends, bonuses, buybacks, stock splits, etc. Thus, investors are ready to face the market's highs and lows because they believe in the long-term prospects of investing.

Investing involves conducting fundamental research on various aspects like price-to-earnings ratio, management history, etc., to identify potential investment targets.

Furthermore, investing aims to build a portfolio comprising different stocks and instruments that can increase in value over time. Additionally, investors should avoid frequently selling their holdings. Ideally, they should sell only during an emergency or when the stock reaches its target. However, investors must monitor their stock investments as they are volatile, and any changes or news can sometimes have a long-term impact on such stocks.

What is the difference between crypto trading vs crypto mining vs investing? Before we find it out, let's highlight the main advantages and disadvantages of investing.

Investing pros and cons

Investing in cryptocurrencies has pros and cons, which should be weighed carefully before making investment decisions. Here are some of the potential advantages and drawbacks of crypto investing:

Pros:

- High Potential Returns. Cryptocurrencies have shown promise for providing significant returns on investment, with early investors experiencing significant gains.

- Decentralisation. Cryptocurrencies operate on decentralised networks, reducing government and financial institutions' control. This can provide a sense of financial independence to investors.

- 24/7 Market. Unlike traditional stock markets, cryptocurrency markets operate 24/7, allowing trading anytime and providing flexibility for investors.

- Innovation and Technology. Blockchain technology, the underlying technology of many cryptocurrencies, is considered innovative and has applications beyond digital currencies. It has the potential to revolutionise various industries.

- Global Accessibility. Cryptocurrencies can be accessed and traded by anyone with an internet connection, providing financial access to people who may be excluded from traditional banking systems.

Cons:

- Volatility. Cryptocurrency prices can be highly volatile, leading to significant price fluctuations in short periods. This volatility can result in both substantial gains and losses.

- Regulatory Uncertainty. Many governments are still figuring out how to regulate cryptocurrencies. Regulatory changes or interventions can impact the value and use of cryptocurrencies.

- Security Concerns. Cryptocurrencies are susceptible to hacking and fraud, which raises concerns about the security of holding and trading them.

- Lack of Consumer Protections. Unlike traditional bank accounts or investments, crypto is not insured or protected by government agencies. If you lose access to your wallet or get hacked, there is generally no recourse.

- Limited Adoption. Despite growing interest, cryptocurrencies have yet to be widely accepted as a means of payment. Limited acceptance can hinder their mainstream adoption and use in daily transactions.

How much can you earn from crypto investing?

The earnings potential of investing in cryptocurrency can vary greatly, depending on several factors. These include the invested amount, the chosen cryptocurrencies, market conditions, and individual risk tolerance. Some investors have experienced significant gains over a short period, resulting in substantial profits. However, it's crucial to note that the crypto market is highly volatile and can lead to significant losses.

A long-term approach, coupled with a keen awareness of market trends and developments, is often necessary to succeed in cryptocurrency investing.

Crypto mining vs trading vs investing: which is better?

The choice between crypto mining vs trading vs investing depends on individual preferences, skills, risk tolerance, and financial goals. Each approach has its benefits and challenges. Let's take a closer look:

Crypto Mining:

Advantages | Disadvantages |

Opportunity for Passive Income Mining can provide a steady source of cryptocurrency as passive income. | High Initial Costs Setting up a mining rig can be expensive, requiring investment in hardware, electricity, and cooling systems. |

Supports Blockchain Networks Miners play a vital role in securing and validating transactions on blockchain networks. | Technical Complexity Mining involves technical challenges, and staying competitive may require constant upgrades. |

Potential for Long-Term Gains If the value of the mined cryptocurrency increases over time, miners can benefit from capital appreciation. | Environmental Impact Some mining processes consume a significant amount of energy, raising environmental sustainability concerns. |

Crypto Trading:

Advantages | Disadvantages |

Potential for Short-Term Gains Traders can profit from short-term price fluctuations by buying and selling cryptocurrencies. | High Risk Crypto markets are known for their volatility, and trading involves a high level of risk. |

Flexibility Trading allows for more active involvement and quick decision-making in response to market changes. | Requires Skill and Time Successful trading demands knowledge, analytical skills, and time spent monitoring markets. |

Diverse Strategies Traders can employ various strategies, such as day trading, swing trading, or trend following. | Emotional Stress The emotional aspect of trading, such as fear and greed, can impact decision-making. |

Crypto Investing:

Advantages | Disadvantages |

Long-Term Growth Potential Investing in cryptocurrencies with strong fundamentals may result in long-term capital appreciation. | Market Volatility Even long-term investors are subject to market volatility, which can lead to significant fluctuations in portfolio value. |

Lower Time Commitment Investing is generally less time-intensive compared to active trading. | Lack of Regulation Cryptocurrency markets are less regulated, which may pose risks for investors. |

Diversification Cryptocurrencies can be part of a diversified investment portfolio. | Limited Income Generation Unlike mining, investing may not generate regular income streams. |

The 'best' option from crypto mining vs trading vs investing depends on your goals, risk tolerance, and preferences. Mining, trading, and investing can coexist in a diversified approach. Some may prefer the active involvement of trading, while others may opt for the passive income potential of mining or the long-term growth strategy of investing. It's essential to research each option thoroughly, understand associated risks, and align your choice with your financial objectives.

Conclusion

When comparing crypto mining vs trading, we can conclude that trading allows you to earn here and now without relying on chance. However, it does require knowledge and skills. At the same time, mining brings you in contact with a completely different level of market participants: the people who build a cryptocurrency network. In this regard, it depends more on chance than trading. Mining also requires a more substantial investment than crypto trading.

If you want to constantly earn profit, gain knowledge and experience in working with computer hardware, aren't afraid of noise and want to minimise your investment risks, then mining is for you. If you want to buy cryptocurrency, go ahead and buy it. You don't have to bother with mining because you'll have to pay for electricity and equipment maintenance while also searching for a profitable cryptocurrency to mine. This time can be spent on something else.

If you like taking risks for the sake of high profits and are prepared to lose some or all of your investment (that's how you need to mentally prepare yourself before trading), then welcome to the world of trading. By margin-trading cryptocurrency, you can make 100% profit a day (the level of mining income) and 500-1000% within six months or even earlier. We wish you luck and hope you earn big!

Tags

Try our Bitcoin Cloud Miner and get additional crypto rewards based on your trading volume. It's immediately available upon registration.

Try our Bitcoin Cloud Miner and get additional crypto rewards based on your trading volume. It's immediately available upon registration.

FAQ

What is the difference between crypto mining vs crypto trading?

When it comes to crypto, crypto mining vs trading are two distinct activities with different risks and rewards. Let's explore the differences between the two.

- Trading vs Mining Profit Potential. Crypto mining can be profitable if executed correctly, but the profit potential is limited. The problem's difficulty, the hardware's hash rate, and the crypto's market price can impact profitability. In contrast, crypto trading has unlimited profit potential, but traders must predict market trends.

- Crypto Mining vs Trading Risks. Both mining and trading crypto involve risks. Mining requires a significant upfront investment in hardware and is affected by changes in difficulty and market prices. Trading involves market volatility and capital loss.

- Trading vs Mining Skills and Knowledge. Mining requires technical knowledge of hardware, software, and blockchain technology. Trading requires knowledge of market analysis and trading strategies.

- Crypto Mining vs Trading Equipment and Costs. Mining requires specialised hardware and consumes significant electricity, producing high equipment and electricity costs. Trading requires no specialised equipment, but traders must pay attention to trading fees charged by exchanges.

What is the difference between crypto mining vs investing?

One of the key differences in crypto mining vs investing is that crypto mining involves validating transactions on a blockchain network to earn new coins, requiring hardware and energy. Crypto investing is buying and holding cryptocurrencies for potential long-term growth without actively participating in transaction validation.

What is the difference between crypto investing vs. trading?

The fact that differentiates crypto investing vs. trading is that investing involves owning financial assets and typically involves a long-term commitment with minimal risk. On the other hand, trading is a form of speculation on financial markets without possessing those assets. It usually carries a greater risk than investing and is often done with a short-term mindset.

What is more difficult: trading, investing or mining?

Trading is generally considered more difficult due to its active and dynamic nature, requiring continuous market analysis and quick decision-making. Mining and investing involve their own challenges but are often less demanding in terms of constant attention and decision agility.