Is Bitcoin Mining Profitable in 2024?

As the crypto market evolves, one question remains constant: Is Bitcoin mining still a profitable venture? With 2024 underway, it's time to examine whether the landscape has shifted and if mining is still lucrative. In this article, we dissect the current state of Bitcoin mining and uncover whether it still holds promise. Is Bitcoin mining profitable today? Let's find out.

I do think Bitcoin is the first [encrypted money] that has the potential to do something like change the world. — Peter Thiel, co-founder of PayPal.

What is Bitcoin mining today?

Bitcoin mining is the process of verifying Bitcoin transactions and adding them to the blocks of the blockchain. This is how the Bitcoin network keeps running. Miners solve specific mathematical problems on their mining equipment to mine a block. The first miner to solve a problem gets a reward that consists of all commissions for the transactions added to the block and a fixed block reward. That block reward is the only way to create new Bitcoins.

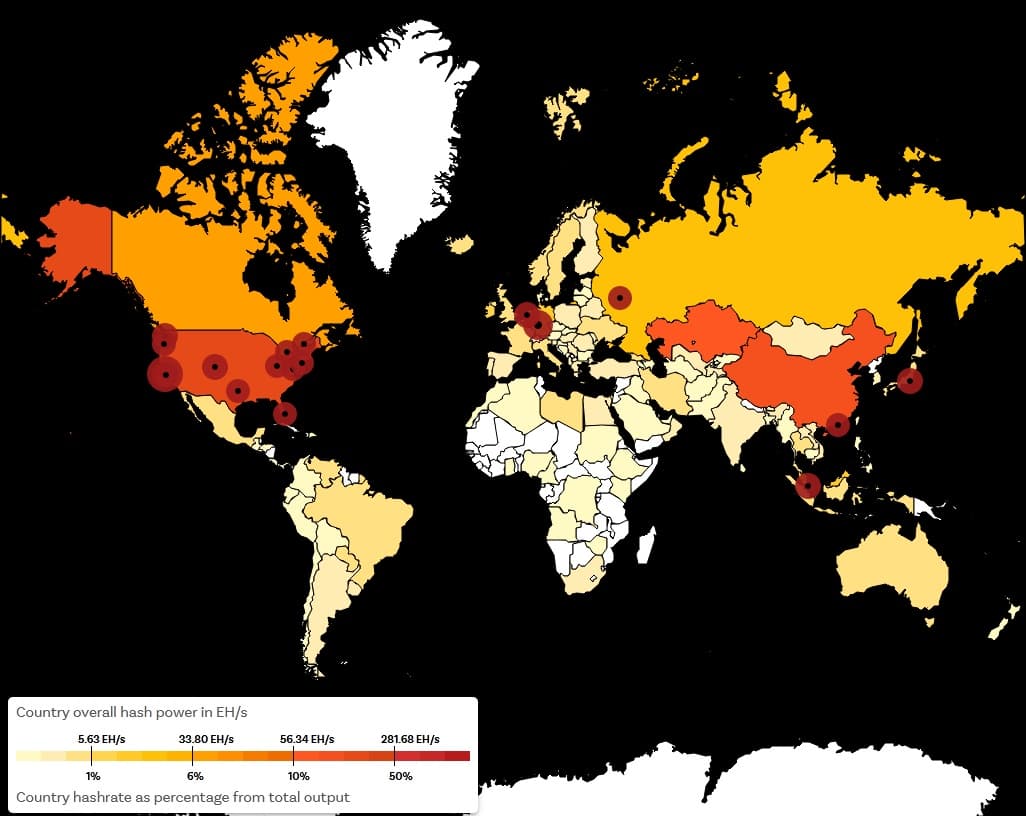

Despite the fact that the bulk of mining capacity is currently concentrated in the hands of larger mining operations with access to cheap electricity, the Bitcoin mining business can still be profitable for individual miners, as well.

Bitcoin mining stats (as of 14/03/2024)

Consensus algorithm | Proof-of-work |

Hashing algorithm | SHA-256 |

Hashrate | 600.46 Ehash/s |

Difficulty | 79.35 T |

Block confirmation time | ~9 min |

Total Bitcoin mined | 19,653,737 BTC |

Max supply | 21,000,000 BTC |

Reward per block | 6.25 BTC |

Next block reward halving | around 20 April 2024 |

Is Bitcoin mining still profitable?

Whether Bitcoin mining is profitable depends on individual circumstances and requires careful consideration of all relevant factors. The key factors that affect the profitability of Bitcoin mining are these:

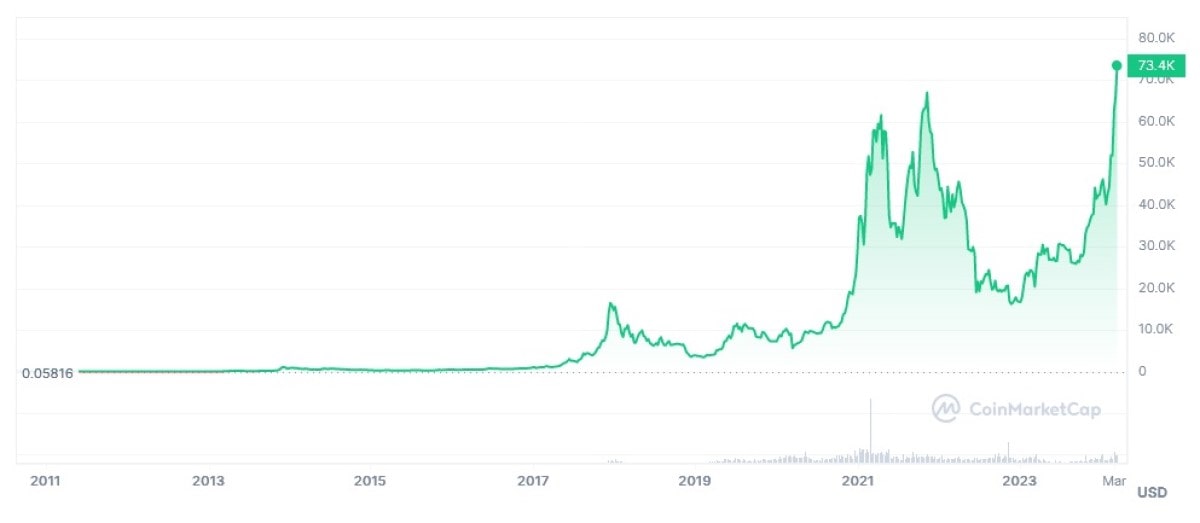

- Bitcoin price. The price of Bitcoin directly impacts mining profitability. When the price is high, miners earn more revenue for each block they successfully mine.

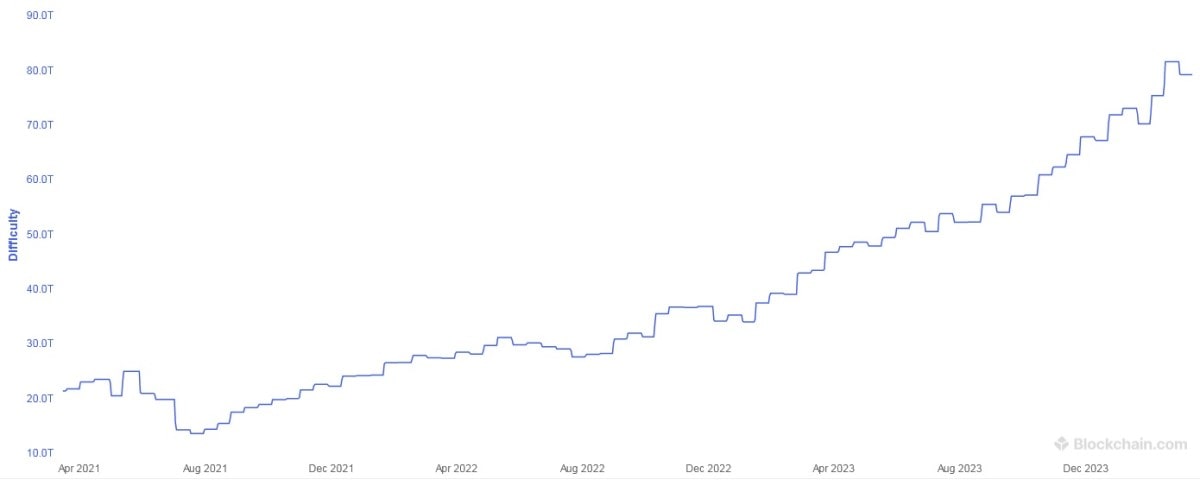

- Mining difficulty. Bitcoin's mining difficulty adjusts approximately every two weeks to ensure that blocks are mined at a consistent rate. A higher mining difficulty means that miners need more computational power to solve the complex mathematical problems required to mine a block, which decreases profitability.

- Electricity costs. Mining Bitcoin requires significant electricity consumption, so the cost of electricity plays a crucial role in profitability. Miners operating in regions with lower electricity costs have a considerable competitive advantage.

- Hardware costs and efficiency. The cost and efficiency of mining hardware, such as ASIC (Application-Specific Integrated Circuit) miners, impact profitability. More efficient hardware has better hashing power to electricity consumption ratios.

- Block reward halving. Bitcoin's block reward halves approximately every four years. This event reduces the number of new Bitcoins miners receive for each block mined, which, of course, has a direct impact on profitability.

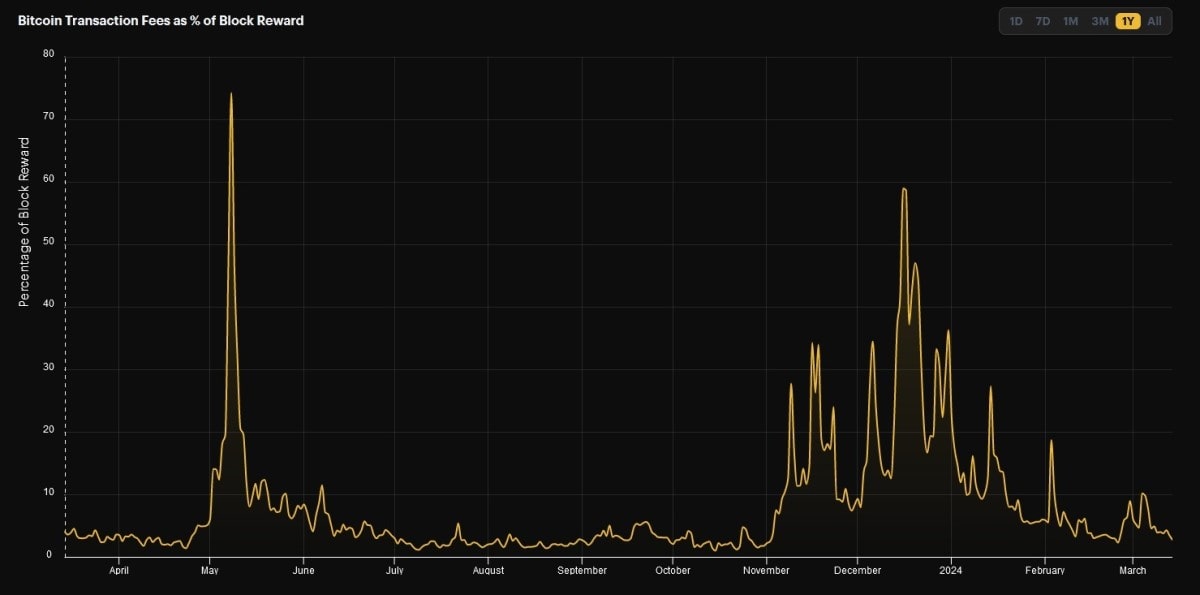

- Transaction fees. Miners also earn transaction fees in addition to block rewards. The higher the transaction fees are, the more profitable mining becomes. Transaction fees are usually a few per cent of the total block reward, but in some cases, they can be as high as a few tens of per cent.

Bitcoin mining difficulty today

The difficulty of the Bitcoin network is a relative measure of how difficult it is to mine a new block compared to the minimum possible difficulty of mining a block.

As the overall hashrate of the Bitcoin network increases, so does the speed for mining new blocks. To prevent this from happening, the difficulty of Bitcoin mining changes every time the total computational power of the mining equipment changes. For every 2016 blocks, the difficulty of the Bitcoin network is recalculated so that the time for generating a new block at the current total mining power is 10 minutes. Since the average generation time for one block is about 10 minutes, the difficulty is recalculated approximately every two weeks. Over the past three years, the difficulty has increased more than 3.5 times. At the time of writing, it's 79.351 trillion.

Of course, the higher the difficulty, the lower the chance for an individual miner to be the first to solve the required mathematical problem and receive a block reward. That is why miners nowadays prefer to unite in mining pools, which allow them to mine blocks through joint efforts and share the received block reward among participants.

How profitable is Bitcoin mining?

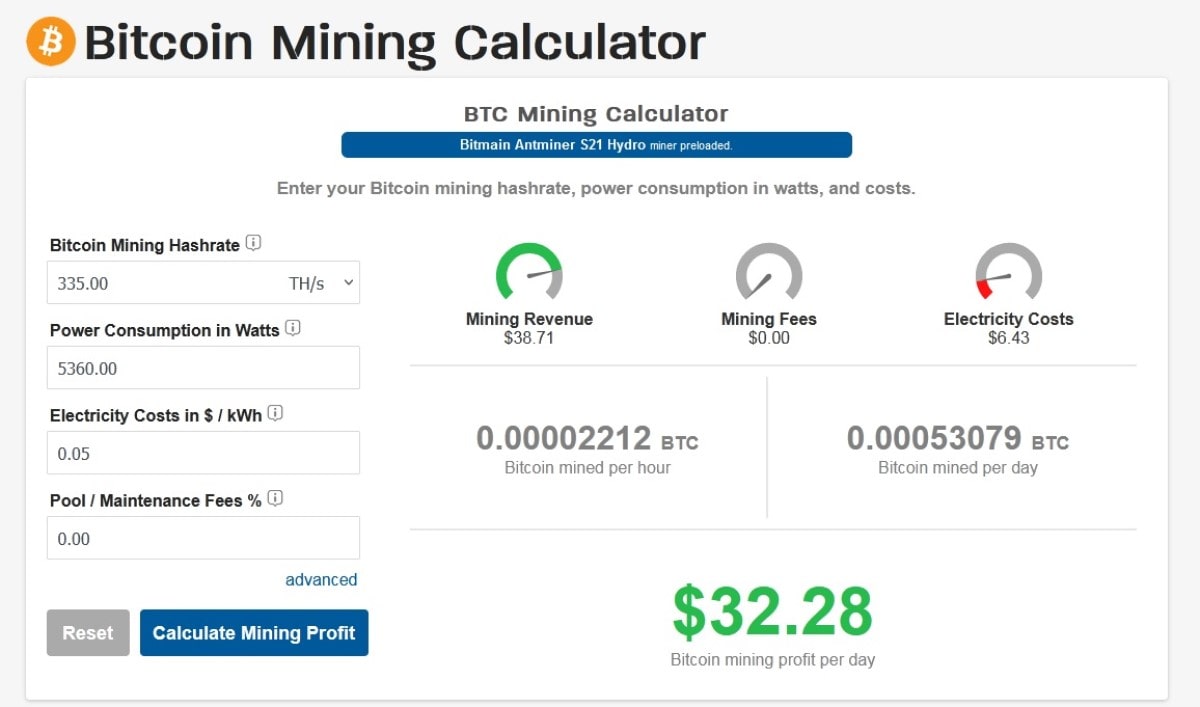

To calculate how profitable Bitcoin mining will be in your specific case, you can use an online mining calculator, such as www.coinwarz.com, www.cryptocompare.com or www.minerstat.com. Enter your equipment's mining hashrate and power consumption, as well as the electricity price and commission of the mining pool you have chosen. Keep in mind that electricity prices can vary depending on the time of day and other factors. Don't forget about the associated costs, such as the cost to cool mining equipment.

Note that mining difficulty is likely to grow, so if the calculator's settings allow, try simulating the increase in difficulty and its impact on profitability. Calculate the breakeven price of Bitcoin in your case and consider your possible actions if the actual price falls below that price level.

Don't forget about taxes, either. Study the laws of your country regarding taxation of cryptocurrency mining and take them into account when deciding whether to invest in mining.

Ways to mine Bitcoin today

Mining hardware has evolved considerably in just a few years. Miners quickly moved from using PCs for CPU mining to more efficient GPU mining. By the summer of 2010, the popularity and price of Bitcoin had grown so much that its mining began to bring some real money, albeit not much. Mining became commercial, which means that competition could not but lead to a technological race. Unlike CPUs, GPUs are optimised to perform many simple mathematical operations in parallel, which is way more efficient for mining.

However, by 2011, some miners began to switch to more energy-efficient devices for mining: Field-Programmable Gate Arrays, or FPGAs. The FPGA mining devices were quite expensive but much more compact, stable and efficient than GPU farms. And yet, video cards remained the most popular mining solution because they were affordable.

The next important step in the evolution of mining devices was the transition to the use of Application-Specific Integrated Circuits (ASICs). ASICs are highly specialised computer chips that can perform only the one task for which they were designed. As such, equipment was created whose sole purpose was to mine Bitcoins. Designing and producing these devices is a long and very expensive process. For this reason, they appeared only after mining became a large and profitable business. Since they first appeared on the market in 2013, ASIC performance has constantly improved.

In sum, the following hardware options for Bitcoin mining are currently available:

- CPU

- GPU

- FPGA

- ASIC

Is CPU mining profitable in 2024?

CPU mining was the first and the most inefficient way to mine Bitcoins. Bitcoin miners moved pretty quickly to GPU mining and then to even more efficient hardware types, so CPU mining has been completely obsolete and unprofitable for a long time.

Is GPU mining still profitable?

GPU mining was the main Bitcoin mining method until the advent of ASIC miners in 2013, when it started to be replaced rapidly. Currently, this method of mining Bitcoin is uncompetitive and unprofitable.

FPGA mining in 2024

The FPGA miners that appeared back in 2011 never gained much popularity. At first, they were too expensive compared to GPU miners, and the emergence of ASICs made them obsolete.

ASIC mining in 2024

ASIC mining is currently the most advanced Bitcoin mining technology available. Nowadays, the Bitcoin mining industry is more competitive than ever before, so ASIC manufacturers continue to innovate, producing more powerful and energy-efficient mining hardware.

Is Bitcoin mining profitable again?

Yes, it is… if you have an efficient ASIC miner and access to cheap electricity. The approaching block reward halving will certainly intensify competition among miners even further and force them to improve the efficiency of their mining ventures. The ongoing bull run in the Bitcoin market, however, will partially mitigate the effects of the halving.

In any case, if you decide to get into Bitcoin mining, you first need to conduct a thorough cost-benefit analysis to determine whether Bitcoin mining will be profitable in your particular circumstances.

Bitcoin cloud mining

If you don't have enough money or time to invest in a full-fledged mining farm, you can consider cloud mining. Cloud mining allows individuals to rent hash power from companies that operate large-scale mining farms. With cloud mining, users don't need to purchase or maintain hardware themselves, as everything is managed by the cloud mining provider. However, cloud mining contracts usually come with fees and may not be as profitable as mining directly, especially considering the potential for scams in the cloud mining industry. Even if the company is a legit cloud mining services provider, the rented equipment often does not have enough time to return the invested funds due to the growing difficulty of mining.

What is StormGain Bitcoin mining?

If you want to try Bitcoin mining but are worried about the required investments and the associated inconveniences, there is an alternative way. Enter the realm of cloud mining — a solution provided by the StormGain cryptocurrency trading platform. This service offers a swift and cost-free means of delving into Bitcoin mining. To use StormGain's Bitcoin cloud mining service, simply register on the platform, navigate to the miner page, and click on the 'Activate' button. You can repeat this process every four hours.

Tags

Try our Bitcoin Cloud Miner and get additional crypto rewards based on your trading volume. It's immediately available upon registration.

Try our Bitcoin Cloud Miner and get additional crypto rewards based on your trading volume. It's immediately available upon registration.