Outflow from ETFs leads to a crypto market correction

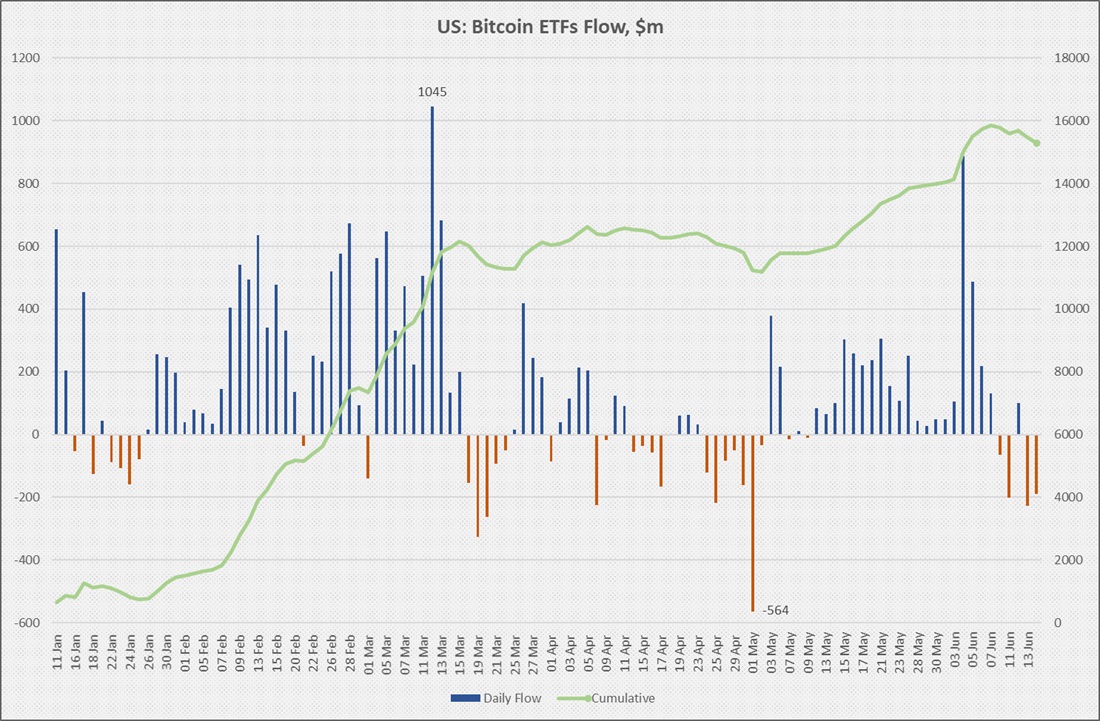

Last week, altcoins' market capitalisation shrunk by 3.5% to $1.07 trillion, while Bitcoin's fell by 4.4% to $1.31 trillion. The primary negative factor was a $581 million outflow from US Bitcoin ETFs in that time.

Grayscale's GBTC showed the worst result among all ETFs, losing a total of $274.3 million. The loss of investments is linked to the fund's conversion from a trust fund to a spot ETF, as well as its high management fee of 1.5%. This time, however, the total outflow from Fidelity and Ark Invest exceeded Grayscale's.

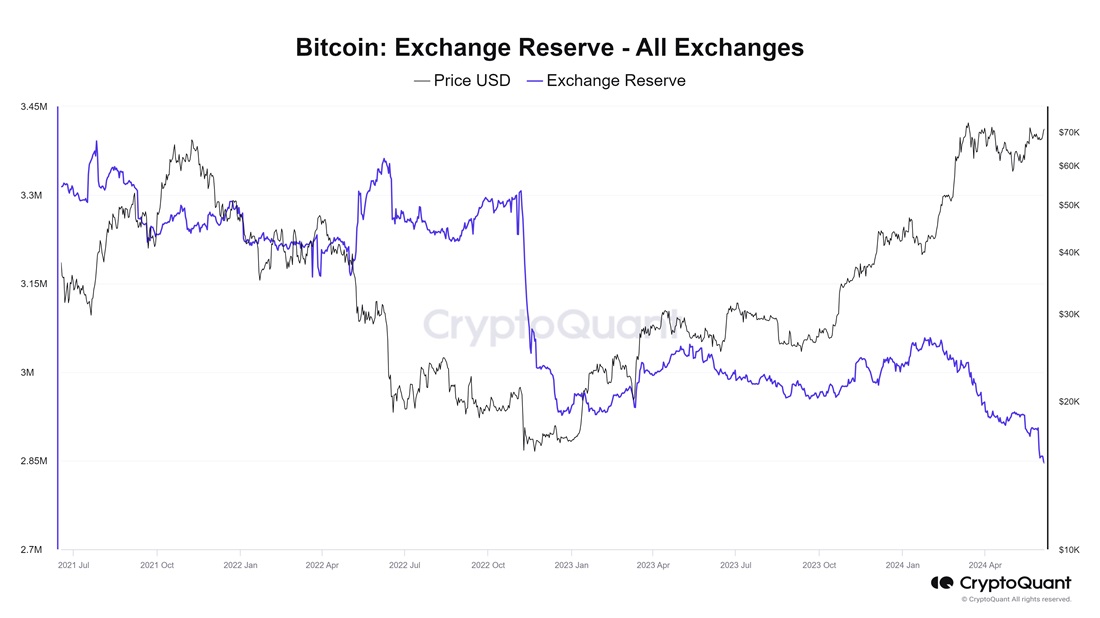

In their latest note to investors, analysts from JPMorgan announced that the impact of the inflow into spot ETFs is overvalued. In their opinion, the lion's share of the indicator is due to the flow of funds from cryptocurrency exchanges and not significant external demand. The net inflow into Bitcoin ETFs since the beginning of the year amounted to 262,000 BTC. In that time, crypto exchanges lost $190,000 BTC.

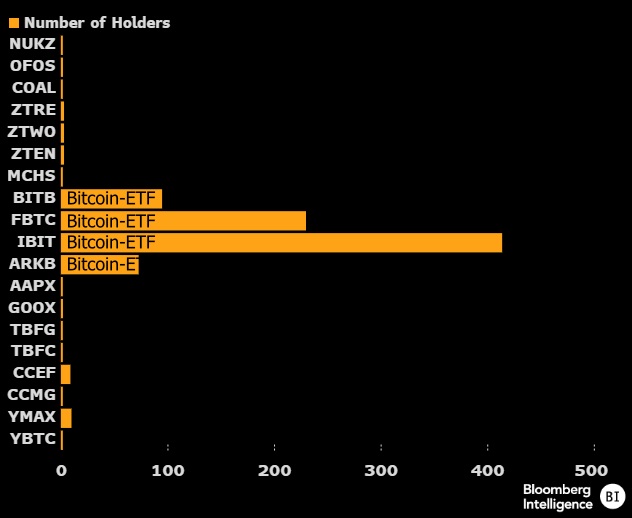

However, this comparison is too superficial and doesn't account for institutional investors' record interest in new ETFs. According to the 13F filings from companies with AUM of over $100 million, their combined interest reached $3.5 billion or 29% of total inflows in Q1 2024 alone. The total number of such participants was 414, which is an order of magnitude higher than the interest in other funds launched this year.

Now, we're seeing a prolonged consolidation, which is largely due to the desire of short-term holders (coins without movement for less than six months) to fix profits. This explains the outflow from FBTC and ARKB last week.

The nearest support level is $62,400, the price that short-term holders (STH) reach.

Among macro factors, the Federal Reserve's revision of its plans to lower its key interest rate has a restraining effect. If FOMC committee members had previously planned three cuts in 2024 (starting in the summer), now, only one cut is expected. Economists believe that the rate change will not occur until September 2024.

StormGain Analytical Group

(platform for trading, exchanging and storing cryptocurrency)

Tags

Try our Bitcoin Cloud Miner and get additional crypto rewards based on your trading volume. It's immediately available upon registration.

Try our Bitcoin Cloud Miner and get additional crypto rewards based on your trading volume. It's immediately available upon registration.