Bitcoin under pressure: Miners, Mt.Gox and the US government

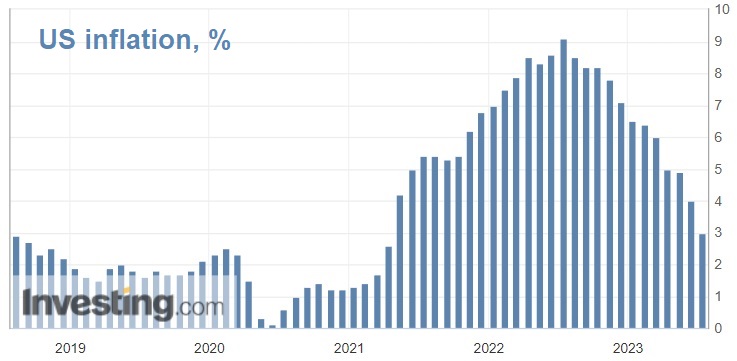

Yesterday, most financial instruments rose against the US dollar amid new inflation data predicting that the Fed will soon pass on raising interest rates and change its monetary policy stance. Price growth in the US has reached the central bank's target level of between 2.0% and 2.5%.

Bitcoin continued to trade in the range, though it was curbed by some negative factors.

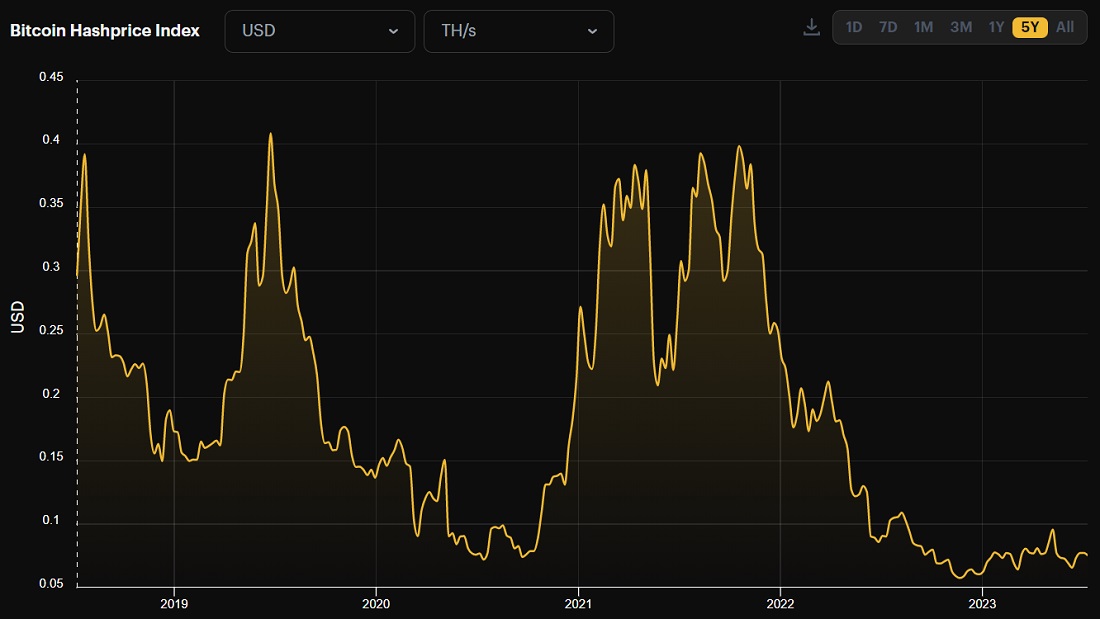

Because of the mining difficulty, the daily mining profit lingers near the all-time low of $0.05 per terahash of capacity. The indicator is currently $0.07, though it reached $0.40 in Autumn 2021.

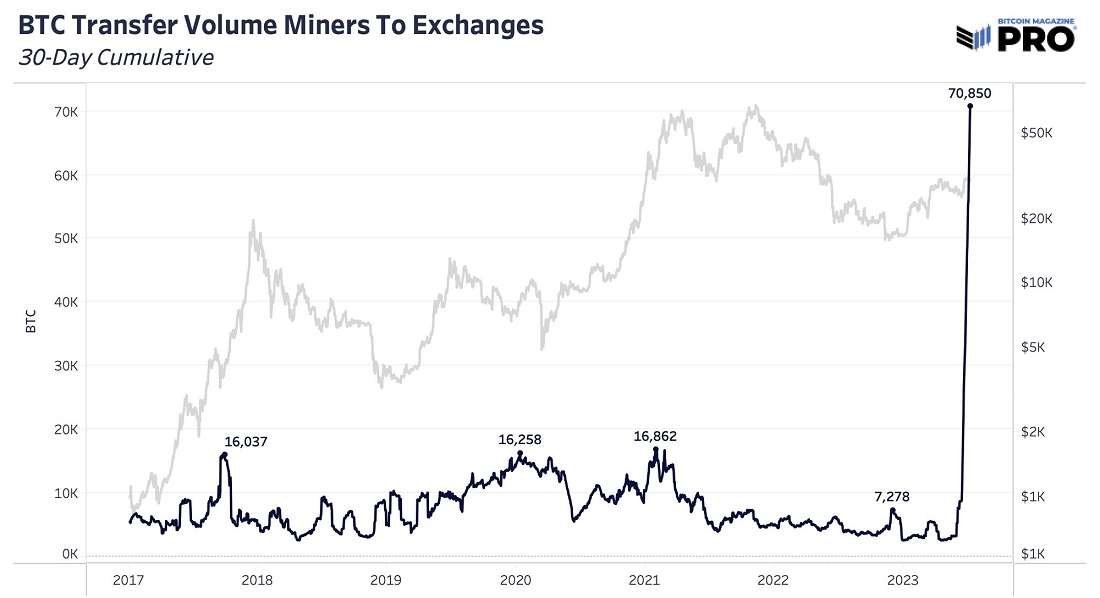

Low profitability and concerns about the price dropping again are pushing miners to sell freshly mined coins and accumulated reserves. According to Bitcoin Magazine, miners have moved a six-year high volume of BTC stock to exchanges.

The upcoming payouts to the clients of the bankrupted Mt.Gox are another restraining factor on BTC's price. The amounts are due to be paid by the end of October. Mt.Gox has kept around 135,900 BTC in its account, which amounts to a whopping $4.8 billion at current prices.

Some analysts don't think this sum may significantly affect the market, but they still highlight the event's unique nature and possible price pressure from speculation based on the news.

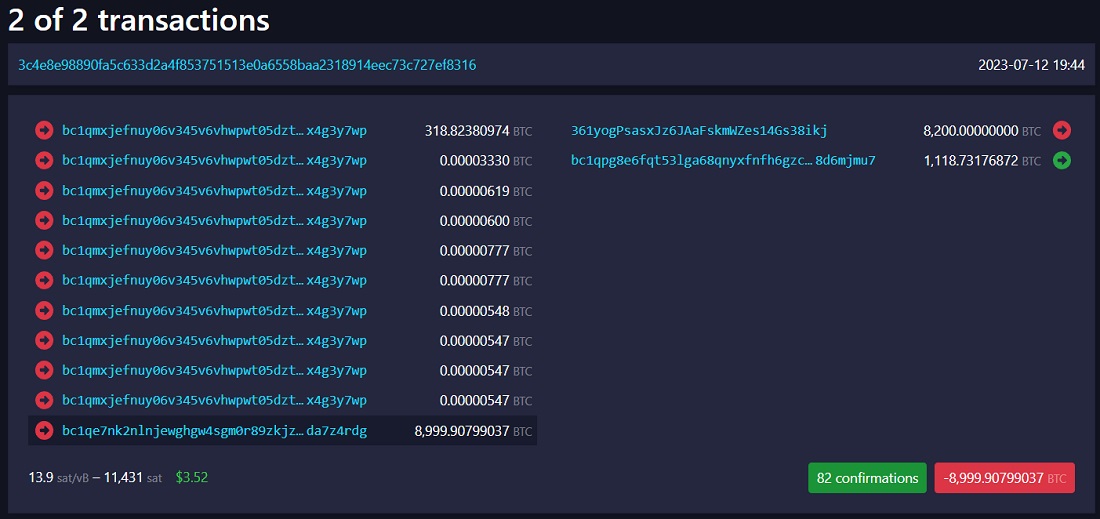

The same can be applied to the latest news on Bitcoin being moved from the US government's accounts. Reportedly, they were credited to the exchange's account to then be sold. Three transactions were conducted that totalled $300 million.

The abovementioned factors are raining on Bitcoin's parade but can't create long-term price pressure.

- Miners' reserves are exhausted, with daily mining amounts reaching 900 BTC, creating $800 million of pressure.

- According to data, the US government is selling off over 10,000 BTC a quarter, the equivalent of 3,000 BTC or $90 million a month.

- Mt.Gox will pay out $4.8 billion, but the payouts can be done in cryptocurrency upon request. That means that not all of the 135,900 BTC will end up on exchanges to be converted into fiat or stablecoins.

Bitcoin's daily trading amount exceeds $12 billion. And the market can easily handle the abovementioned transactions if they're not performed all at once.

StormGain Analytical Group

(platform for trading, exchanging and storing cryptocurrency)

Tags

Try our Bitcoin Cloud Miner and get additional crypto rewards based on your trading volume. It's immediately available upon registration.

Try our Bitcoin Cloud Miner and get additional crypto rewards based on your trading volume. It's immediately available upon registration.