Mining companies' arms race gains pace

Despite the poor financial situation and the need to sell off reserves at the lowest prices in 2022, major mining companies are once again competing to increase capacity. Even companies going through bankruptcy proceedings joined the race.

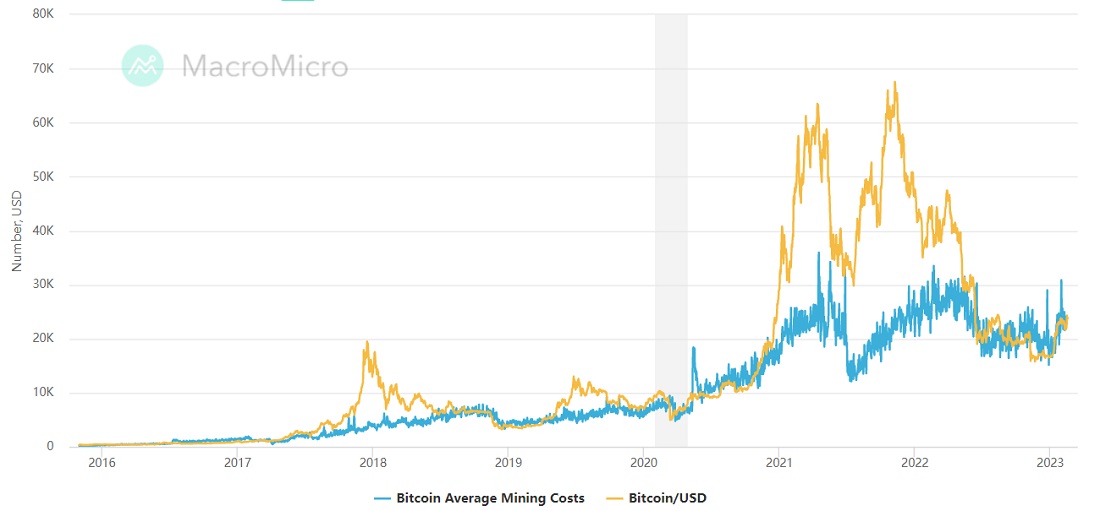

Last year dealt a serious blow to miners' financial health. Public companies, which have been increasing their capacity through loans and investment, were hurt the most. In the summer, the average cost of Bitcoin mining fell below the market price. The largest gap came in November when the cost was estimated at $23,000, while Bitcoin dropped to $16,000.

A lack of funds to support operating costs has forced mining companies to sell off Bitcoin reserves. Many had to turn to refinancing their loans. The industry leader in computing power, Core Scientific, has initiated Chapter 11 bankruptcy proceedings.

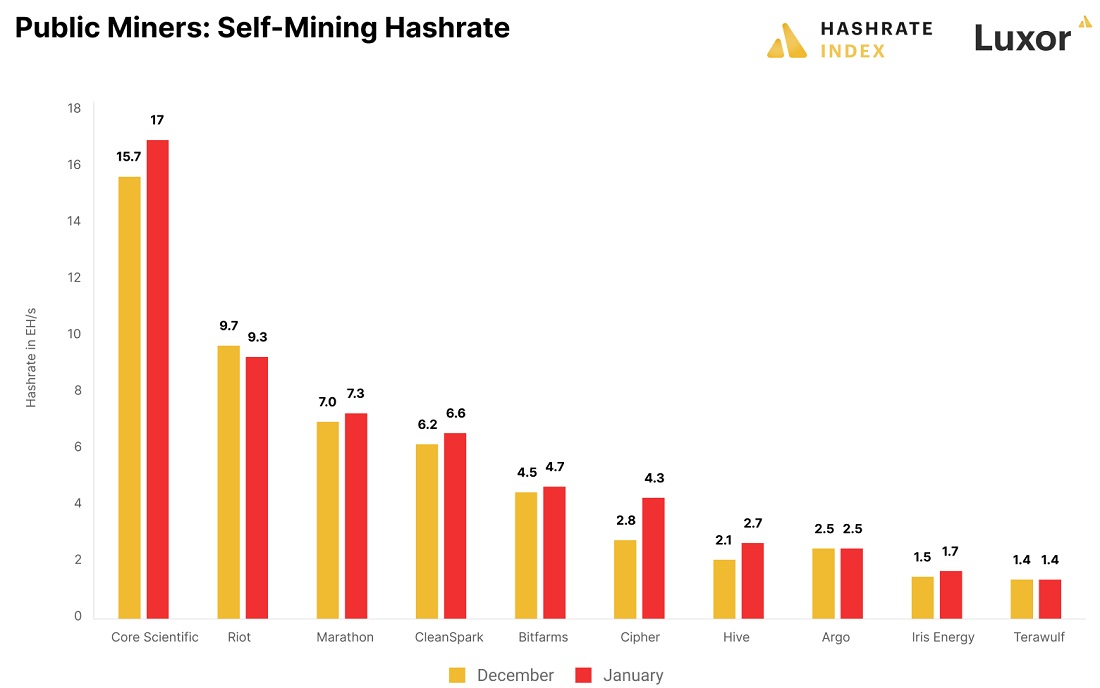

The situation would seem to have cooled miners' enthusiasm, but competition is heating up with new intensity. Almost all public miners have expanded their ASIC fleets, and even Core increased capacity by 1.3 EH/s in January compared to December.

Iris Energy is another shining example of this. In November, the company shut down some equipment because it defaulted on a loan due to the inability to generate sufficient cash flow to service its debt. This week, however, it announced the purchase of additional ASICs from Bitmain, which will increase its own (non-rental) performance from 2.0 EH/s to 5.5 EH/s.

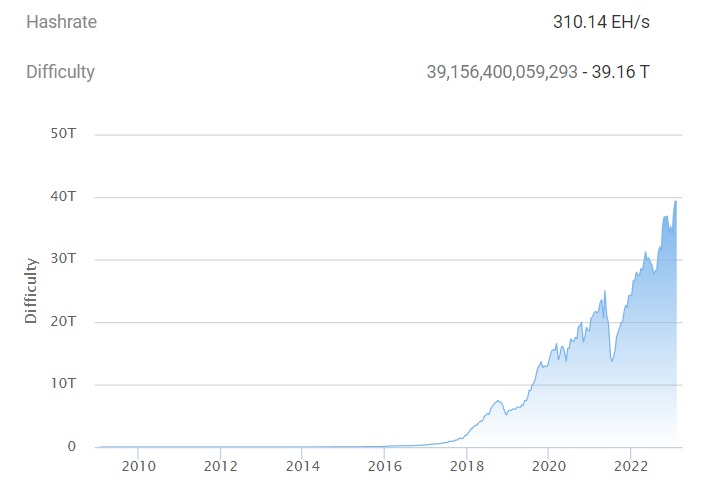

The desire to increase market share at all costs is driving hashrates up, despite challenging circumstances for the industry. Since January 2022, the network's capacity and computational complexity have jumped by 61%.

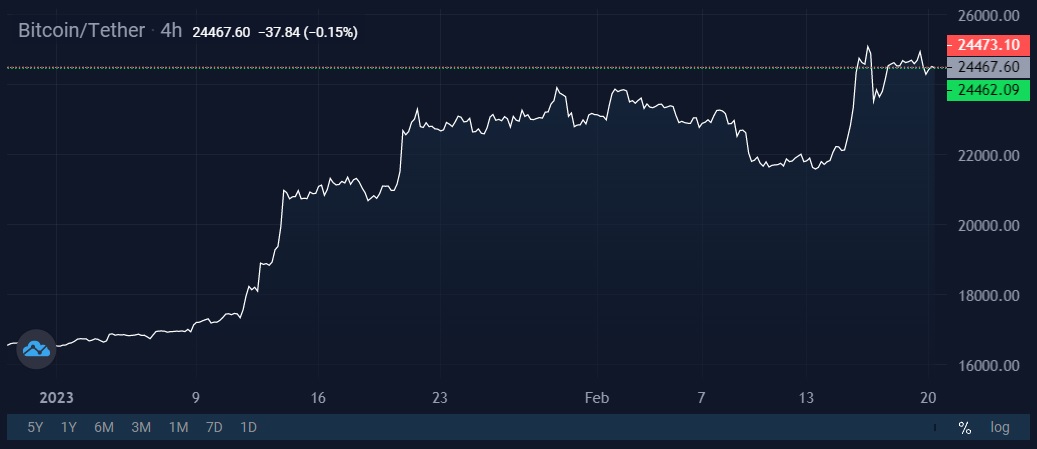

Now, Bitcoin is testing the $25,000 level. One analyst at B. Riley calculates that Core Scientific generates the cash flow needed to service its debt at this cost and that bankruptcy proceedings are no longer necessary.

If 2022 has failed to stop public mining companies from expanding, then even a small rise in Bitcoin this year will boost them.

StormGain Analytical Group

(platform for trading, exchanging and storing cryptocurrency)

Tags

Try our Bitcoin Cloud Miner and get additional crypto rewards based on your trading volume. It's immediately available upon registration.

Try our Bitcoin Cloud Miner and get additional crypto rewards based on your trading volume. It's immediately available upon registration.