Reasons for Litecoin's rise

Litecoin has shown the best growth among the top 20 coins for the last two days. In addition to the cryptocurrency being significantly oversold, this is also due to its higher usability compared to Bitcoin and to the threat looming over stablecoins and PoS coins.

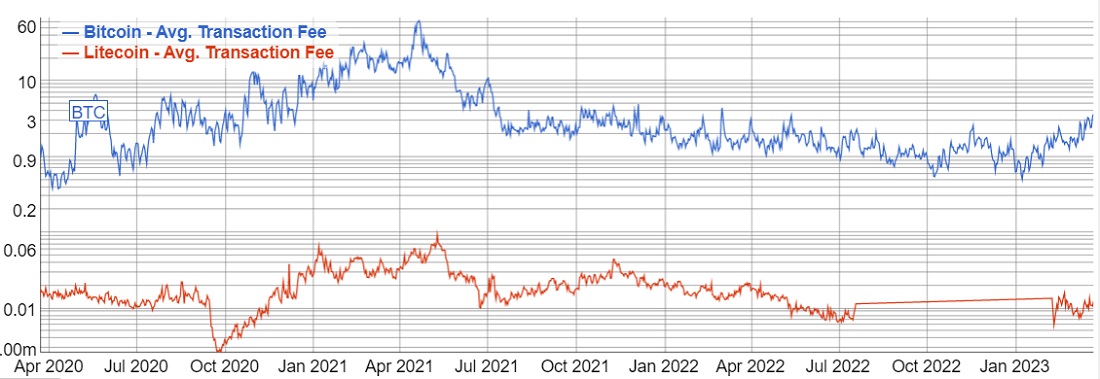

Litecoin resembles its big brother in that it relies on miners' work, its total supply is limited, and there are regular reductions in the reward per block. The altcoin was created to conduct much quicker transactions with lower fees. For example, the average fee on the Bitcoin network is now $3.70, while it's just $0.01 on Litecoin.

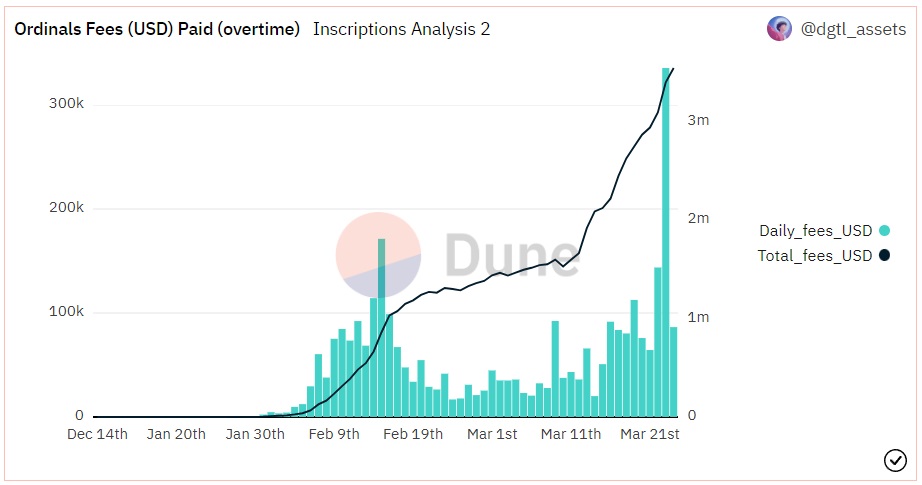

In 2023, interest in Bitcoin is on the rise again, with the increase in commissions mainly due to the emergence of the Ordinals protocol and the ability to transfer digital objects (similar to NFTs). The massive mint of Ordinals led to a sharp growth in the average block size and higher fees. Miners were happy with the innovation, receiving $3.5 million in extra income in two short months.

Ordinals were also introduced on Litecoin in February, but interest in them was naturally lower, so their implementation had no noticeable impact on commission values.

When it comes to Litecoin's place in the overall ranking of cryptocurrencies by capitalisation, its drop from 2nd place to 13th is due to the emergence of stablecoins and smart contract networks. Bitcoin retained its leadership thanks to its role as a store of value. However, the top spot by transactions was overtaken by smarter competitors that provide the opportunity for passive income from staking. This prevented LTC from getting the most out of the 2020-2021 rally.

Ironically, the increased interest in Litecoin in 2023 could be caused by US regulators' actions against PoS coins and some large stablecoin issuers. SEC pre-enforcement notices are already underway against Tether and Binance, and PoS coins could be recognised as securities. Attacks by regulators led to the Kraken cryptocurrency exchange's recent rescission of staking services. Just recently, Coinbase removed Algorand from its list of coins for passive income. If the risks bear out, investment interest from coins such as Ethereum, Cardano and Solana could shift towards Litecoin.

A halving event expected to take place in August may be an additional growth driver. The block mining reward will drop from 12.5 LTC to 6.25 LTC. The deflationary mechanism, coupled with the limit on the total number of coins, ensures that the circulating supply is reduced and causes the price to rise. This contrasts strongly with the Fed's monetary policy, which has returned to printing dollars to prevent a banking crisis.

StormGain Analytical Group

(platform for trading, exchanging and storing cryptocurrency)

Tags

Try our Bitcoin Cloud Miner and get additional crypto rewards based on your trading volume. It's immediately available upon registration.

Try our Bitcoin Cloud Miner and get additional crypto rewards based on your trading volume. It's immediately available upon registration.