Miners' record profits aren't a reason to buy their stocks

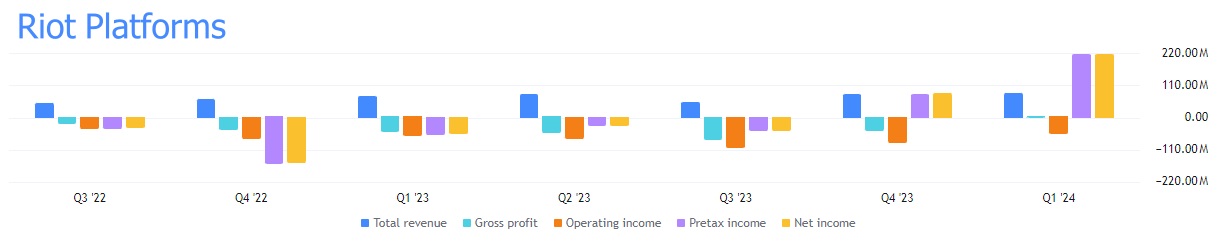

Q1 2024 was phenomenal in terms of many publicly traded miners' profitability. Riot Platforms put up a record-high net profit of $211.8 million, with 249% growth compared to the previous quarter.

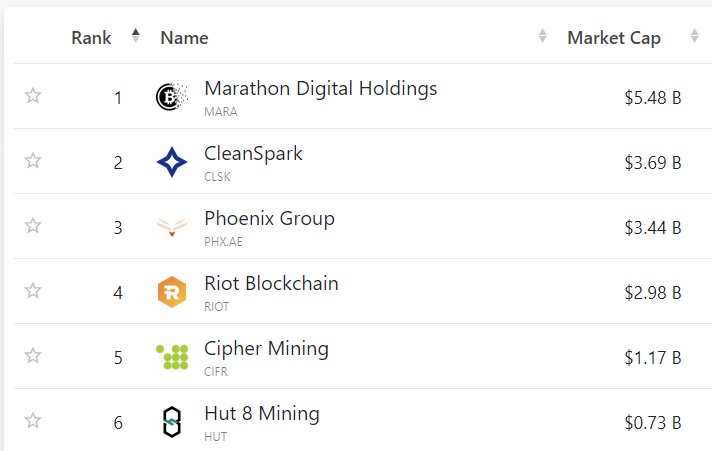

Marathon Digital, which rose to number one in terms of capacity among publicly traded miners last year, was officially included in the S&P SmallCap 600 index yesterday. This index tracks companies with a market capitalisation between $1 billion and $7 billion. Marathon became the first among its peers to receive this honour. Its capitalisation reached $5.5 billion, while net profit in Q1 2024 was around $200 million.

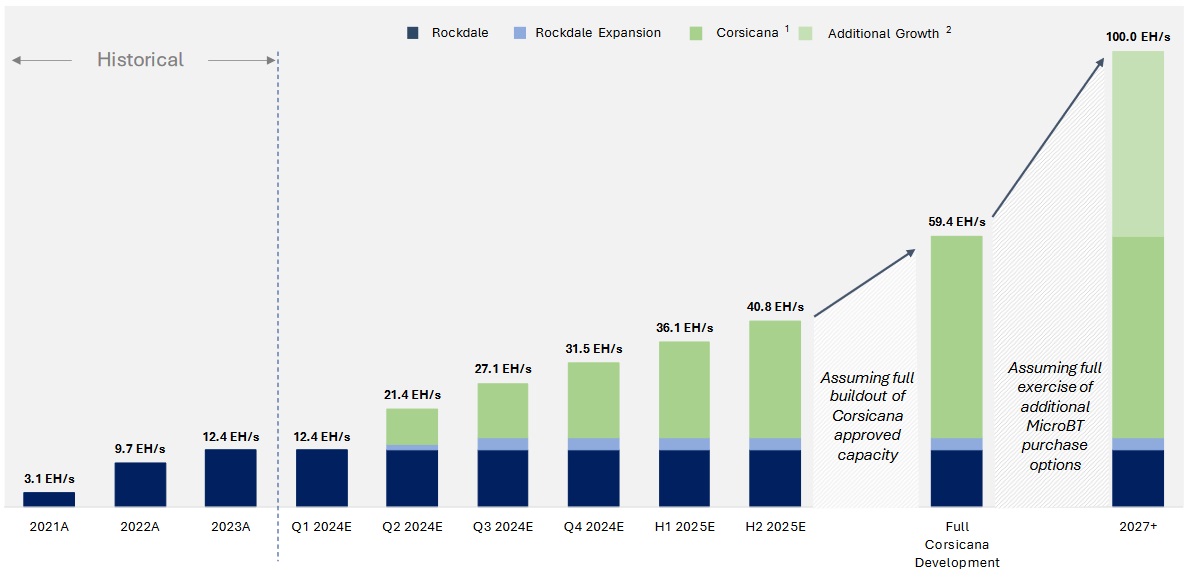

At the same time, the pace of the arms race remains high, and competition is becoming tougher. Riot plans to nearly treble its computing power this year to 31.5 EH/s and to reach 100 EH/s by 2027.

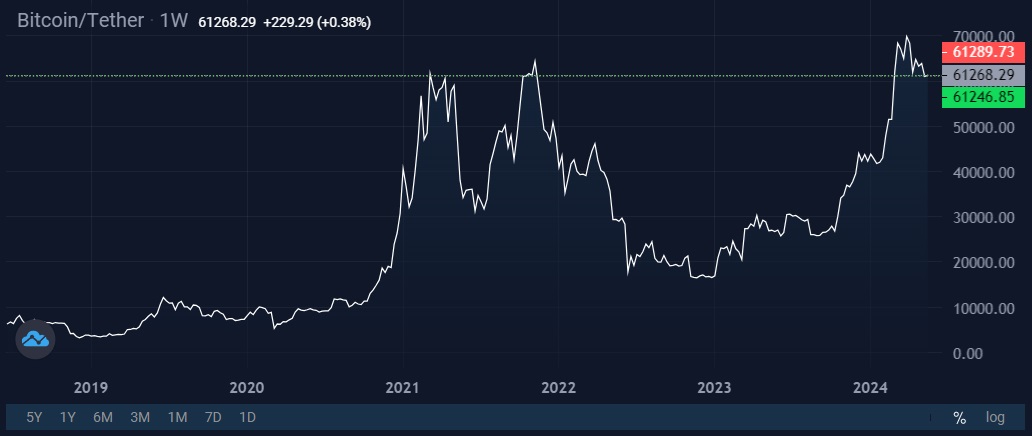

Firstly, miners' optimism is associated with Bitcoin's movement. Most of them are baking in an increase for BTC's value to $100,000-$150,000 in their forecast calculations for the next two years.

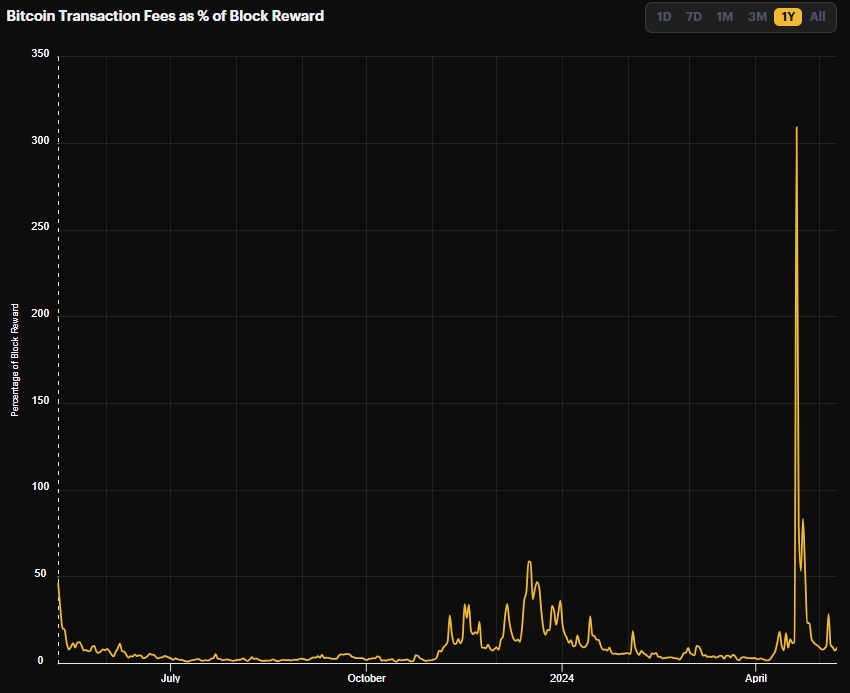

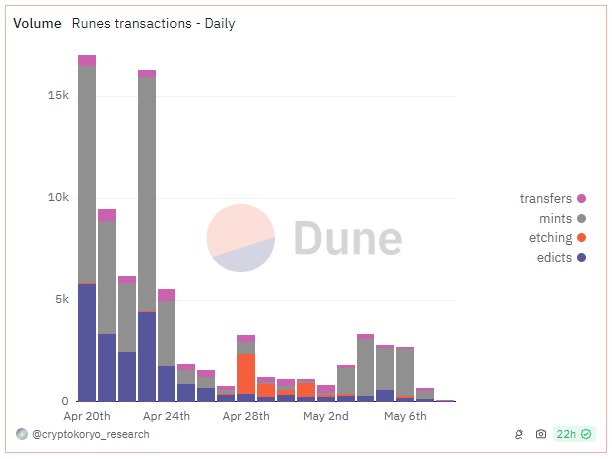

Secondly, miners are pinning high hopes on the network, seeing the spread of by-products, such as ordinals and runes, whose hype in April led to an explosive increase in commission payments. On the day of halving, the income from filling blocks was over three times higher than the income from mining the currency, setting a new all-time record.

After the halving, however, the price stalled, and interest in quasi-tokens faded. Network fees have returned to minimum levels, depriving miners of a promising source of income.

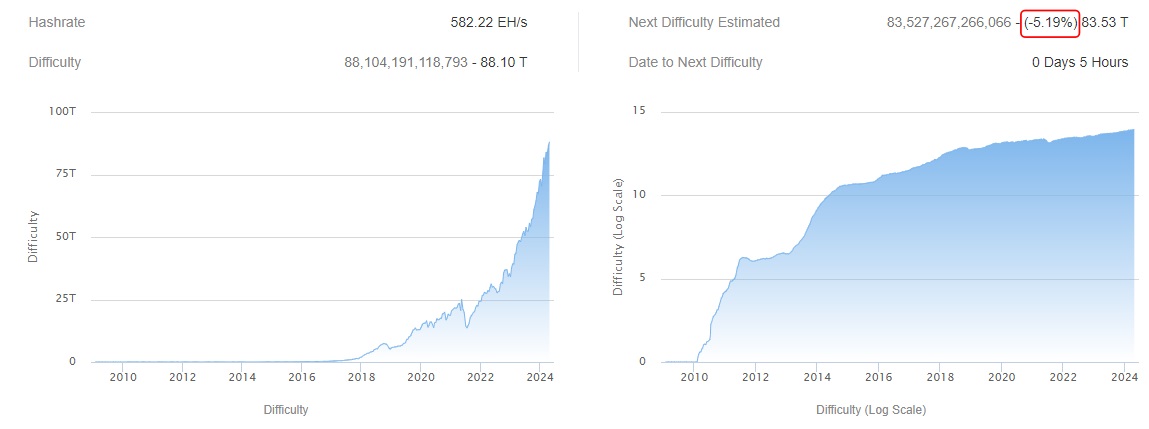

Halving deprived miners of half of the income received for mining a block. Since the new reality was too harsh for some miners, some equipment was turned off. The network hashrate decreased from a record-high 691 EH/s to the current level of 582 EH/s.

The reduction in overall computing power will lead to the highest adjustment in difficulty since December 2022, with a decline of approximately 5.2% today.

Q1 2024 was successful for miners primarily due to the emergence of spot ETFs, which caused Bitcoin's price to rise by 66% during the reporting period. However, Q2 may become a trying period due to the significant decline in revenues.

Mining companies are now reporting record profits, and their stocks are soaring on the news. Nevertheless, now is not the best time to invest in the crypto-mining industry.

StormGain Analytical Group

(platform for trading, exchanging and storing cryptocurrency)

Tags

Try our Bitcoin Cloud Miner and get additional crypto rewards based on your trading volume. It's immediately available upon registration.

Try our Bitcoin Cloud Miner and get additional crypto rewards based on your trading volume. It's immediately available upon registration.