Pump & Dump? XRP (Ripple) is up 39% in March

Bitcoin is up 23% in March, with Ethereum up 10%. But these are small gains compared to Ripple's XRP 39% prize surge. This is due to the rumours filtering through that Ripple will soon win the lawsuit initiated by the SEC and the potential pumping of the token.

The lawsuit against Ripple was initiated in 2020. The regulator has taken legal action against the company for raising more than $1.3 billion through an unregistered, ongoing digital asset securities offering. Ripple insists that XRP is exactly the same commodity as Bitcoin.

In March, company representatives and a number of cryptopreneurs reported that Ripple is expected to win. BTSE CEO Henry Liu shared on social media that Ripple and the SEC have possibly agreed to a settlement. The date of the court ruling remains unknown.

A wave of optimistic reports led to XRP's surge in March.

And open interest in futures is at semi-annual highs, hitting $730 million on March 30.

That said, investors should be aware of the following points when investing in XRP. Firstly, it is a centralized product, and 100 billion tokens were created at launch. Ripple denies that it has ever been an issuer of securities in connection with distributions of XRP, as the token founders took 80 billion XRP and gave it to Ripple, and one of them later became the CEO of Ripple Labs.

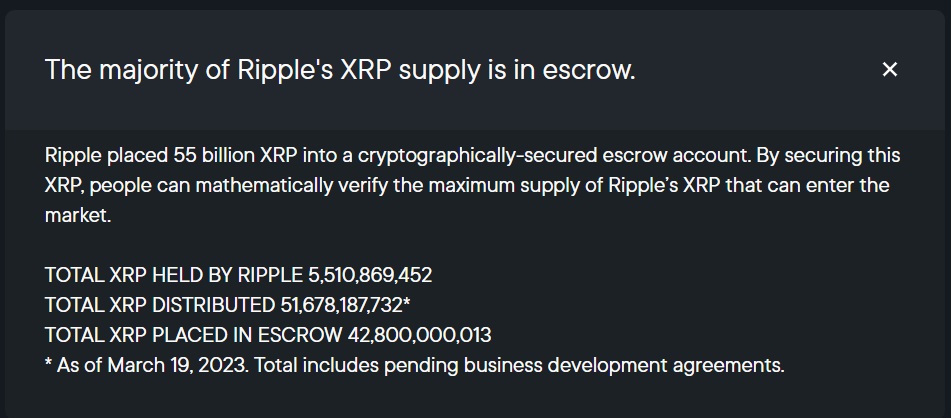

Secondly, about 43 billion XRP (43% of the total issue) is held in escrow and the company can spend up to 1 billion XRP (~$0.5 billion at current prices) a month to grow the business.

Thirdly, XRP cannot be called a cryptocurrency in the full sense of the word. CEO Brad Garlinghouse calls Ripple a payment system for cross-border transactions between financial institutions. The network uses distributed ledger technology, and the list of recommended validators is published by Ripple itself.

The March surge could be a result of price pumping and the desire of the big players to dump some coins at high prices. A potential victory over the SEC is a good pretext. XRP is a far cry from Bitcoin in its architecture, and it was not designated as a commodity in the CFTC's claim against Binance. The two regulators may share a similar view of XRP, in which case Ripple's chances of having the token recognized as a commodity are limited.

StormGain Analytical Group

(platform for trading, exchanging and storing cryptocurrency)

Tags

Try our Bitcoin Cloud Miner and get additional crypto rewards based on your trading volume. It's immediately available upon registration.

Try our Bitcoin Cloud Miner and get additional crypto rewards based on your trading volume. It's immediately available upon registration.