The CFTC could deliver a fatal blow to Binance

On March 27, the Commodity Futures Trading Commission (CFTC) sued Binance, accusing the cryptocurrency exchange of violating several laws. It is accused of conducting unregistered futures transactions and commodity options, evading KYC/AML policies (serving U.S. customers to circumnavigate restrictions), illegal operations (transactions with Hamas, recognized as a terrorist organization by several countries), and market manipulation.

The scope of the charges suggests that Binance will have difficulty reaching a pre-trial settlement with the Commission with just a warning and a fine. Adam Cochran believes that the CFTC is capable of burying the cryptocurrency. Even in the case of a pre-trial settlement, it would be fined billions of dollars and banned from trading in the United States. If the company and Changpeng Zhao (CZ) are found guilty by the court, most financial institutions globally will stop working with the cryptocurrency exchange. And it would also allow U.S. law enforcement to request information about all their accounts and transactions, potentially leading to even more serious consequences.

Adam Cochran also points out that, unlike the SEC, the CFTC doesn't mess around. So this is a lot more serious than the SEC litigation against Ripple, Kraken, or Coinbase.

In Monday's news, BNB slumped 7%, and a number of analysts predict a free fall of the coin to the $200 mark if the conflict escalates.

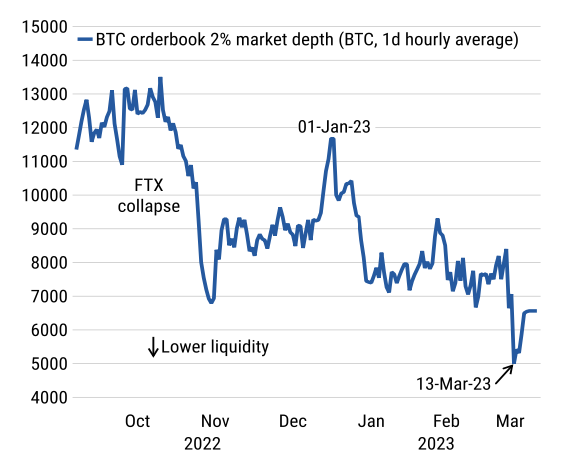

This could cause a wide range of instruments to collapse, and Bitcoin would face a decline in liquidity. The CFTC cites the example of internal chats and correspondence, where CZ asks the team to ensure that a top client does not connect using an American IP address. At that time, this trader alone was responsible for 12% of the total trading volume.

Disconnecting U.S. investors would affect liquidity in Binance, and may make the market more susceptible to manipulation. Bitcoin has already sunk lower than it did during the FTX crash.

There is an interesting aspect of the CFTC claim that cannot be ignored. To press charges on its own behalf, the Commission recognises BTC, ETH, LTC, USDT and BUSD as commodities. This goes against the position of the SEC, which calls these coins securities (except for BTC).

The different perspectives on cryptocurrency and the tug-of-war by regulators once again points to the regulatory gaps and the challenges that hinder innovation.

StormGain Analytics Group

(an all-in-one cryptocurrency platform)

Tags

Try our Bitcoin Cloud Miner and get additional crypto rewards based on your trading volume. It's immediately available upon registration.

Try our Bitcoin Cloud Miner and get additional crypto rewards based on your trading volume. It's immediately available upon registration.