The risks of staking the fastest-growing stablecoin in history

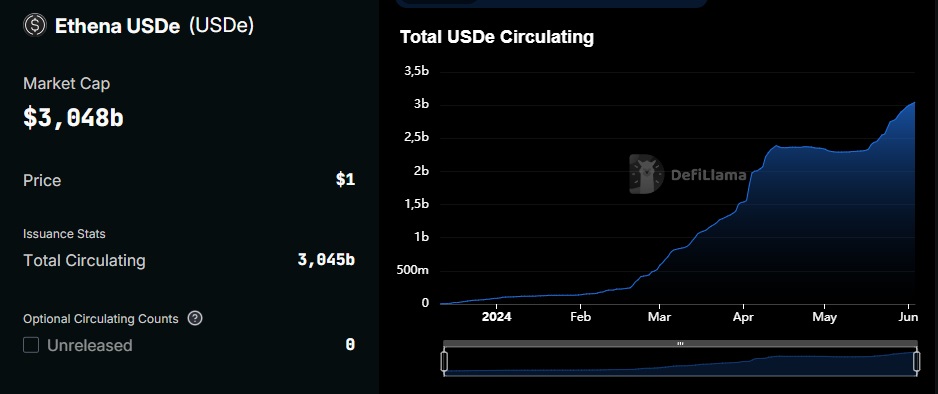

The market capitalisation of the new algorithmic stablecoin USDe has grown from $5 million to $3 billion — a 600-fold increase — in six months. In terms of pace, it overtook the Hong Kong FDUSD, which initially secured zero commissions in Binance, and the infamous UST from the Terra project (LUNA). Some users are sounding the alarm just because of the similarities between USDe and UST.

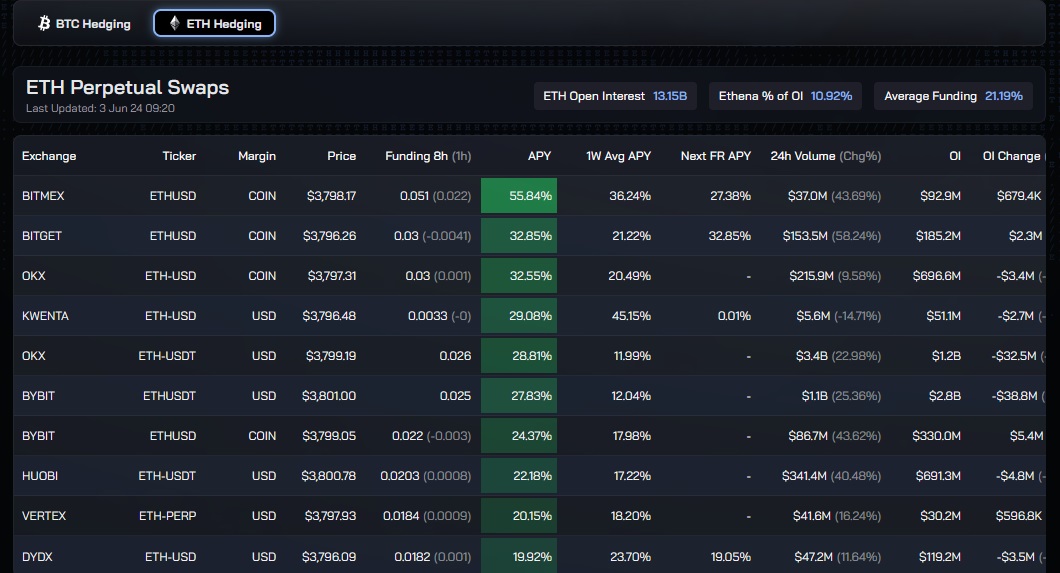

Apart from the lack of provision for reserves (excluding the nominal compensation fund), the similarity of the projects lies in the high staking fees. For UST, the fee is 20% annualised. For USDe, that number is over 35% on some platforms.

Here's how it works. A user deposits Ethereum, Bitcoin, USDT or LST tokens (e.g. LIDO) and receives USDe in return. The user can then lock this stablecoin in a smart contract to get the above-mentioned yield.

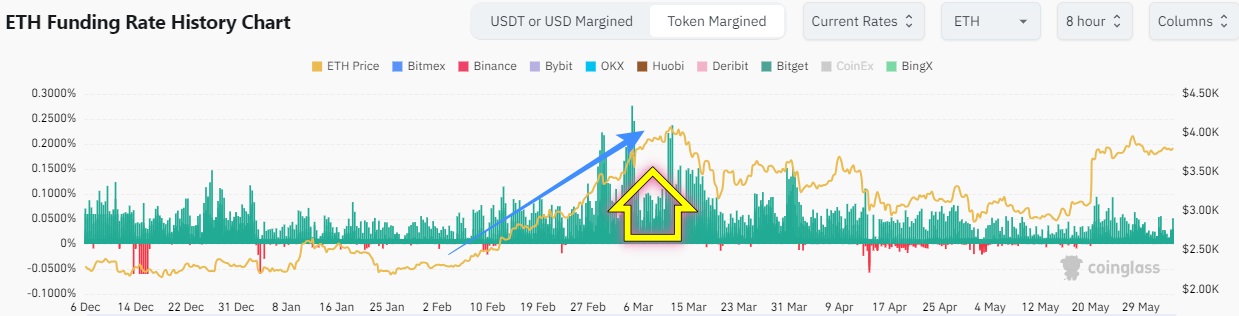

Rewards are generated by staking coins that were originally deposited and from arbitrage transactions conducted by the platform when 1 ETH is bought on the spot market and 1 ETH is opened for sale on the futures market. The net position turns out to be neutral, but when buyers prevail (in a bullish phase), a premium is paid to sellers, which is called the funding rate.

Accordingly, the more intensely the price and optimism rise, the higher the preponderance of buyers is and the bigger the reward is.

The market is currently booming, and USDe is attracting users with high yields. So, why is the project being compared to the collapsed UST, which had a capitalisation of $20 billion at its peak?

The reason is the algorithmic nature and lack of rigid scripts for all cases. USDe's sustainability is based on the appeal of staking due to high yields. However, it will only remain stable when prices are rising. Once we move into a bearish phase, short arbitrage positions will become unprofitable. If users start getting rid of USDe en masse, the balancing mechanism could fail, the stablecoin exchange rate would sag, and panic would end its history.

However, Ethena founder Guy Young believes this is nothing to worry about.

If necessary, we will change our strategy to generate income in a bear market.

The second Achilles' heel is the high dependence on platforms where collateral assets are held. On 15 April, Ethena Labs reported $1.3 billion sitting in Copper, $1.1 billion in Ceffu and $0.5 billion in Cobo. A successful hacker attack on any of them would risk USDe's collapse for holders.

These are the two most negative scenarios that may not materialise at all. At the same time, as its capitalisation increases, yields will still decline, even under favourable conditions, which will naturally reduce the project's appeal and limit its growth. For example, the yield from Ethereum staking falls due to the increase of locked ETH. The yield from arbitrage falls when an equilibrium between buyers and sellers is achieved.

StormGain Analytical Group

(platform for trading, exchanging and storing cryptocurrency)

Tags

Try our Bitcoin Cloud Miner and get additional crypto rewards based on your trading volume. It's immediately available upon registration.

Try our Bitcoin Cloud Miner and get additional crypto rewards based on your trading volume. It's immediately available upon registration.