SEC: We approved ETFs, not Bitcoin

The first application for a spot ETF submitted to the SEC was from the Winklevoss twins back in 2013. It was rejected in 2017. Despite the time that's passed, the regulator's views on the nature of digital assets haven't changed in the slightest. Here's the statement that accompanied yesterday's approval of ETFs (the full text of the statement):

…bitcoin is primarily a speculative, volatile asset that's also used for illicit activity including ransomware, money laundering, sanction evasion and terrorist financing. While we approved the listing and trading of certain spot bitcoin ETP shares today, we did not approve or endorse bitcoin.

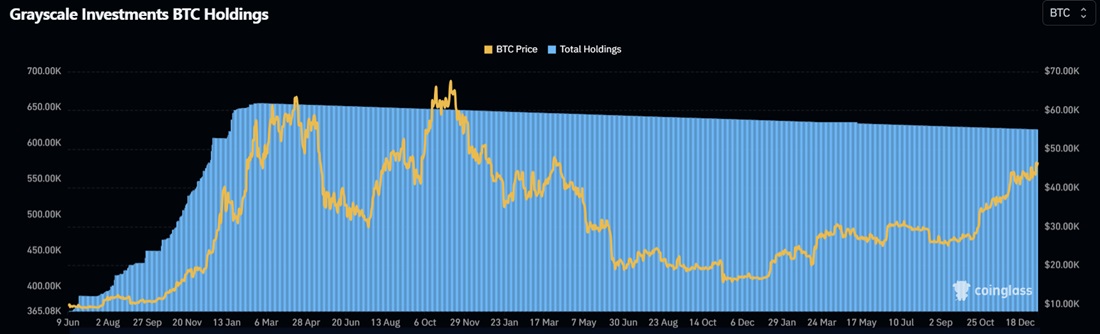

The statement's overall message boils down to this: the SEC would have continued to block the emergence of the investment product if it hadn't been for the judges' particular interpretation of securities law. However, continued rejection would be impossible given the court's ruling in Grayscale's favour in a case about converting its trust fund into a spot ETF.

The interpretation of the cryptocurrency's status is of great interest to investors. The SEC still refers to Bitcoin alone as a commodity, while "the vast majority of crypto assets are investment contracts (i.e., securities)".

In other words, hopes that spot ETFs for Ethereum and other cryptocurrencies will soon emerge are baseless. However, some media outlets attribute Ethereum's surge over the last 24 hours to this very hope.

It'll take time to assess the real effect the launch of the spot Bitcoin ETF has had. The funds will take about a week to be listed on exchanges, and figures on investment volumes will start coming in in about a month.

Currently, 11 ETFs have been approved, including ones from BlackRock and Fidelity, each of which manages over $10 trillion in assets.

For an idea of potential capital inflows, the US saw $1.2 trillion invested in various ETFs over the past two years. Even if a tenth of that is redirected into Bitcoin, it would create powerful price momentum. Many analysts compare the expected outcome of the emergence of these Bitcoin ETFs with the gold ETFs launched in 2004. In seven years, the price grew four-fold, with over $100 billion being held in gold ETFs.

The majority of estimates think that Bitcoin will hit an all-time high as early as this year.

StormGain Analytical Group

(platform for trading, exchanging and storing cryptocurrency)

Tags

Try our Bitcoin Cloud Miner and get additional crypto rewards based on your trading volume. It's immediately available upon registration.

Try our Bitcoin Cloud Miner and get additional crypto rewards based on your trading volume. It's immediately available upon registration.