Open interest in Bitcoin on the CME sets new highs

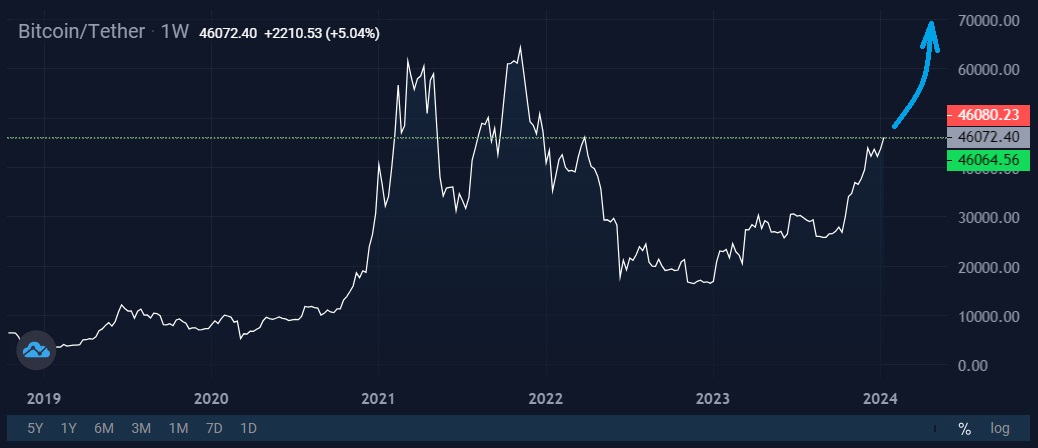

Today is the deadline for approval of ARK Invest and 21Shares' joint application to create a spot Bitcoin ETF. Investment interest in this event is so strong that the total volume of open Bitcoin futures contracts on the Chicago Mercantile Exchange (CME) broke the high previously set in 2021. That figure is now $6.3 billion.

The likelihood of spot ETFs being approved in 2024 has increased dramatically following the SEC's loss on an appeal brought by Grayscale. The regulator banned the conversion of a trust fund into a spot fund, and the court ruled that the SEC's decision was "arbitrary and capricious". The appeal period for that decision expired last October, so it was only a matter of time before spot ETFs were approved.

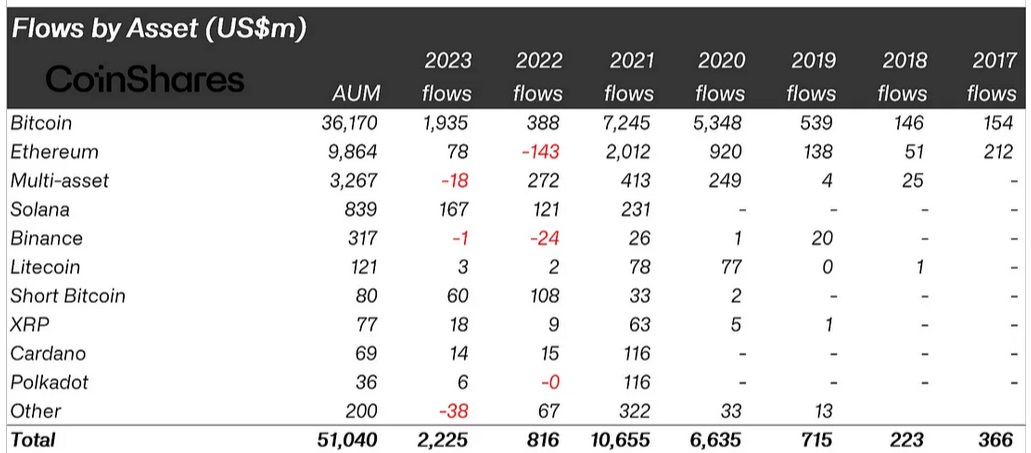

Since week 40 (early October), inflows into existing crypto funds with Bitcoin worldwide have exceeded $1.6 billion. This compares to a modest $388 million for 2022.

Galaxy Digital estimates ETFs will raise $14 billion in the first year. Standard Chartered (SC) claims that this amount will reach between $50 billion and $100 billion. Such an impressive influx of funds will inevitably lead to an increase in Bitcoin's price. SC estimates that the price will rise to $100,000 by the end of the year.

Therefore, speculation around the launch of ETFs is causing increased volatility and unwanted excesses. For example, in the early morning hours of 10 January, the SEC's X (former Twitter) account was hacked, and a post about ETFs being approved appeared. Bitcoin reacted to the news by rising to $48,000. However, within an hour, it rolled back after a denial was published.

K33 Research warns that Bitcoin might even decline after the long-awaited ETFs are approved. The fact is that 43% of the $2.7 billion in CME futures contracts are held by futures ETFs, which will face significant outflows in favour of spot ETFs due to higher costs. The large-scale closing of positions will put pressure on the price until capital flows into new ETFs.

Whales who prefer to dump reserves on big positive news may also add some pressure. All of this promises increased volatility when spot ETFs are approved, but the long-term outlook remains positive.

StormGain Analytical Group

(platform for trading, exchanging and storing cryptocurrency)

Tags

Try our Bitcoin Cloud Miner and get additional crypto rewards based on your trading volume. It's immediately available upon registration.

Try our Bitcoin Cloud Miner and get additional crypto rewards based on your trading volume. It's immediately available upon registration.