Another shake-up in the stablecoin market

The stable coin market continues to experience fever due to the failure of some projects. Last week aUSD was compromised, and this week HUSD, the cryptocurrency exchange token Huobi, lost its link to the US dollar. Amid a tough macroeconomic environment, falling cryptocurrency market capitalisation and the bankruptcy of a few cryptocurrency funds, users are trying to identify the most wealthy stablecoin to save money.

aUSD, the Acala Network's stablecoin, is used in the decentralised finance sector (DeFi) interconnect applications and is based on the Polkadot blockchain. aUSD is a decentralised algorithmic stablecoin with redundant collateral. In other words, to get 1 aUSD, the user must lock $1.5 in another cryptocurrency. If the frozen coins fall in value, a forced reverse conversion takes place. This maintains the necessary reserve to ensure that the stablecoin is tied to the US dollar.

On 14 August, the hacker managed to mint $1.2 billion without using reserves. The Acala team quickly discovered the problem and put the network into maintenance mode. This allowed the attacker's addresses to be identified and the stolen funds to be frozen, but also temporarily halted all online transactions. But users were left confused, as the speed of response doesn't correlate well with the notion of decentralisation and the team's claims of "resistance to censorship".

As a result of the attack and the declining credibility of the project, the amount of blocked funds in Acala halved to 191 aUSD in a few days and continues to decline. The stablecoin's value hasn't recovered yet.

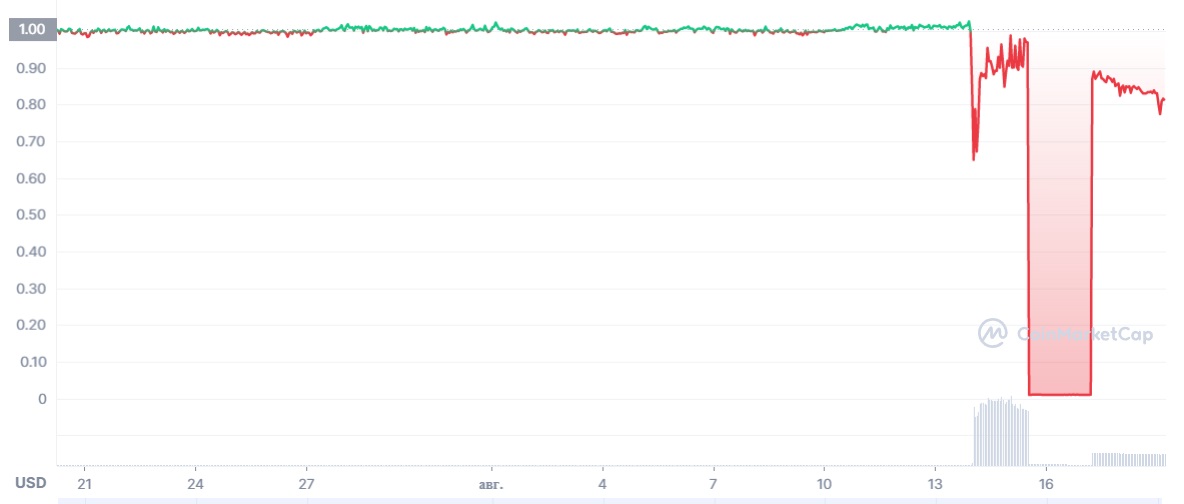

HUSD, the Huobi cryptocurrency exchange stablecoin, lost its link to USD on 17 August. Before the 2021 ban on cryptocurrency transactions, Huobi was the largest operator in China. The company has since suffered a series of setbacks, revenues have declined significantly and FTX has even delisted HUSD.

Unlike aUSD, the HUSD stablecoin relies on a reserve in fiat currency. For example, in 2021, Stable Universal issuer reported that each token was backed by $1 in a bank account. However, according to Coingecko, there are currently 81.4 million coins in circulation with a capitalisation of $79.1 million. And with the HUSD price falling to 85 cents on 18 August, Huobi admitted it had a liquidity problem and began looking for a solution.

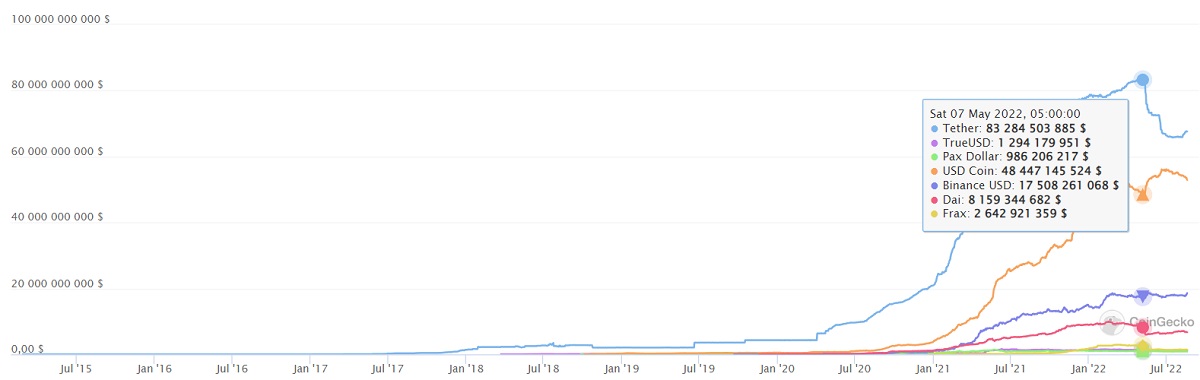

Amid ongoing problems with stablecoin, the reserves of Tether, the market leader, were once again questioned. As 1/5 are undisclosed commercial liabilities, the USDT coin lost 22% of its capitalisation after the UST (LUNA) collapse.

Tether recently announced that instead of Moore Cayman, based in the Cayman Islands, BDO Italia, Europe's largest accounting firm, will soon be certifying reserves. Reporting will be provided on a monthly basis and the share of commercial liabilities in reserves will be reduced to 1/10th.

Increased transparency of the major stablecoin will add to users' confidence in the company's trustworthiness in these challenging times. In two weeks, Tether's capitalisation grew by 2.7%.

StormGain analytics team

(a platform to trade, exchange and store cryptocurrency)

Tags

Try our Bitcoin Cloud Miner and get additional crypto rewards based on your trading volume. It's immediately available upon registration.

Try our Bitcoin Cloud Miner and get additional crypto rewards based on your trading volume. It's immediately available upon registration.