Short-term Bitcoin holders are locking in profit

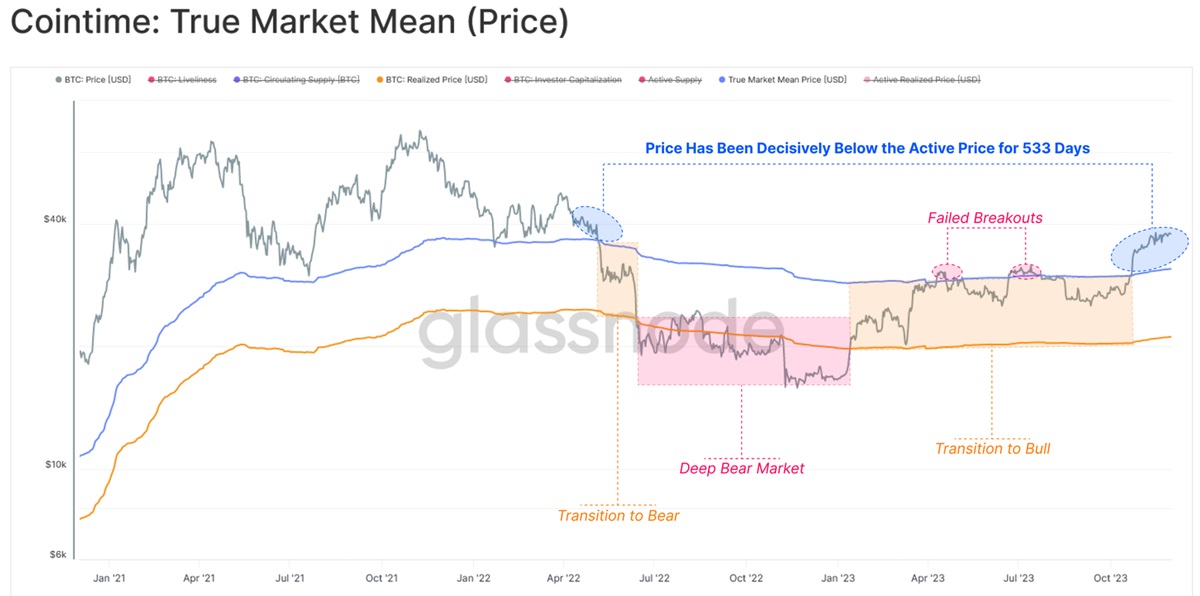

Autumn marked the transition from a bear to a bull market. After 533 days, Bitcoin crossed the threshold of the actual mid-market price (the updated realised price model from analyst agency Glassnode).

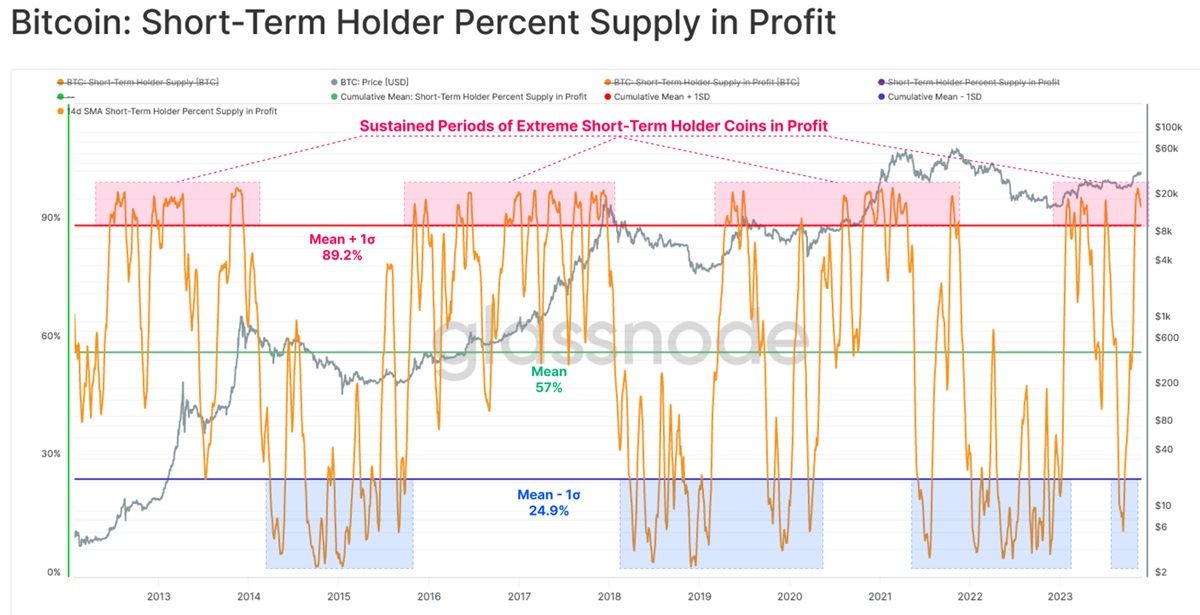

Over 95% of short-term holders (STH), mostly traders and retail investors, turned out to be in the black.

This group typically experiences abrupt mood swings. As seen in the chart above, when "critical mass" is reached (i.e., the index surpasses the 90% threshold), a market correction often follows. This is STH striving to lock profit or negatively react to the correction.

Derivative traders have lost over $300 million in bullish positions in the past 24 hours. This was primarily due to a sharp price decline that triggered Stop Loss orders and received an additional boost for an even greater correction.

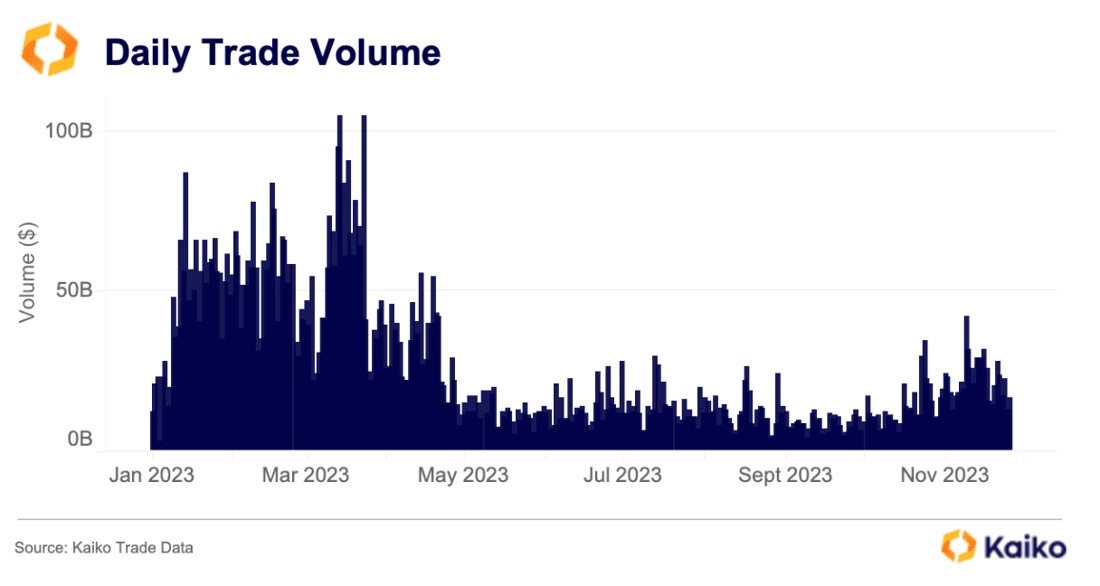

Initially, the sale could've been triggered by a whale or a major market maker. We have repeatedly warned about this risk since the market depth and trading volumes are far from even this year's highs, and traders have significantly increased leveraged buying. Combined, these factors create a favourable environment for market manipulation.

Bitcoin's price has surged 2.5-fold to $42,000 in 2023, leading many market participants to think that a technical correction is possible.

Additionally, negative sentiment has been fuelled in recent days by talk of the SEC possibly refusing to approve spot ETFs. John Reed Stark, a former SEC official, hints:

…For Gensler to approve spot ETFs would be a capitulation, contrary to his conduct and enforcement practices.

Fuel was added to the fire after the investment giant BlackRock made an adjustment to its spot ETF application. In it, the firm describes the negative impact on the value of Bitcoin if the SEC deems the ETF to be a security. This wording didn't exist in previous versions. It seems that it appeared after BlackRock met with the SEC.

StormGain Analytical Group

(platform for trading, exchanging and storing cryptocurrency)

Tags

Try our Bitcoin Cloud Miner and get additional crypto rewards based on your trading volume. It's immediately available upon registration.

Try our Bitcoin Cloud Miner and get additional crypto rewards based on your trading volume. It's immediately available upon registration.